Summary:

- Netflix stock has dropped around 20% since the last coverage, but it is still considered overvalued.

- Analysts expect Netflix to beat EPS estimates for Q3, but weak guidance may lead to further downside in NFLX stock.

- The success of the ad-supported tier and crackdown on password sharing may lead to an increase in subscriber count.

hapabapa

Investment Thesis

Netflix (NASDAQ:NFLX) is going to report Q3 numbers on the 18th of this month after the market closes. I’ll give my thoughts below on the biggest concerns for the company in terms of its outlook going forward. Even after the company has dropped around 20% since I last covered the stock, I believe that it is still overvalued. However, I am upgrading my rating to a Hold as I believe the company on the announcement date may only moderately drop the remainder of the way to my PT as it tends to fluctuate quite a bit.

What happened to Netflix stock since my last coverage

Netflix is down around 20% since my last article where I argued that the growth of the company does not support the valuation, and was priced to perfection, meaning anything the investors won’t like in the upcoming reports will result in the company seeing massive swings in its share price. Even with the company beating Q2 estimates, its weak guidance sent the company down in the next 3 months, and there may be further downside in the making in my view.

NFLX Performance since last article (Seeking Alpha)

NFLX Outlook

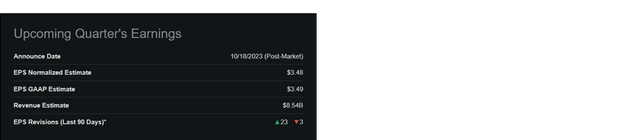

So, analysts are expecting the company to do around $3.49 of EPS, which is around 11% higher than the same quarter last year and with over 20 upward revisions for this quarter also while seeing around 8% growth in revenues y/y. There is a high chance the company will beat EPS estimates once again as it tends to more often than not, especially in the third quarter of the year.

NFLX analyst expectations (Seeking Alpha)

As I mentioned, Q2 was not met with positivity due to the weak guidance. The management is expecting to see average revenue per member or ARM to be flat or slightly down for Q3. This may be met with further negative sentiment, and I would expect a lot of volatility during the trading day of the announcement of 3rd quarter earnings.

I will be looking at how the subscriber growth has developed q/q and y/y as this is one of the biggest factors that will bring the most volatility to the share price. Last quarter, the company beat analysts’ estimates by a huge margin (adds came in at 5.89m against 2m of analysts’ estimates). The company does not give guidance on subscriber growth any longer, but I expect this to improve due to the ad-supported tier.

How’s the Ad-tier Faring?

In the last earnings call, the company mentioned that ads planned membership grew at almost 100% q/q. Ads ARM was performing better than the basic ad-free plan, so no wonder the company is axing the basic tier. The company needs to work harder to get people to subscribe to the ad-supported tier. In the past, the management said it wanted to see ad revenue make up a total of 10% of revenues, which it still has a long way to go as it is still in its infancy. Ad-supported tiers have seen massive success in other streaming platforms and I would expect the company to continue to push its efforts in this category further as Discovery and NBC Universal saw ad-supported tiers to be more lucrative than the ad-free plan.

I wouldn’t be surprised if we see a decent jump in additions to paid subscribers, given that the ad-supported tier has surpassed 10m, although, the company did say that it is not at the scale that it wants to be yet. The CFO Spencer Neumann expects that revenues will continue to accelerate on the count of the continual crackdown efforts of password sharing. I mentioned in my previous article that people did not hesitate to add members to their existing accounts, so I believe we will see a healthy uptick in subscriber count this quarter whether that is from an ad-supported tier or ad-free plan. The success of the password-sharing crackdown led the company unsurprisingly to expand in the most profitable territories, the US and Canada.

To counter that notion of additions, the company is planning on yet another price hike after the actors’ strike ends (will mention later), which we have no deadline for yet, but NFLX is expecting it to come through in a couple of months. This may affect the company’s subscriber count; however, I would expect margins to improve because of this also.

The actors’ and writers’ strikes

This will affect many companies like NFLX negatively. Now with one of the strikes behind us, the actors’ strike remains. The writers are getting a much-needed boost in pay, and bonuses from streaming. This means that writers are now going to get paid a lot more if their content attracts huge viewership numbers on NFLX. I would venture a guess that actors are looking for something much better too and this could potentially affect the company’s performance materially – although, I don’t see this changing in the short run as these contracts will be re-negotiated later on, so I would expect to see the ramifications sometime late next year. As I mentioned the price hikes may bring higher margins, however, once the two strikes are done and contracts are re-negotiated, I could see margins coming down slightly because the contracts will favor higher benefits from writers and actors alike.

Closing Comments

I’m sticking to my PT I made in July of this year, which is around $320 a share, but I am upgrading the company to a hold rating. The selling period in my opinion is over already, so now, even though it is still overvalued, it is not as bad as it was, and the share price could go either way once it reports Q3 results in my opinion. It can easily drop or shoot up over 10% on the announcement day as that is quite the usual thing to do for NFLX.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.