Summary:

- Netflix’s 3Q24 results exceeded expectations, but the stock’s 66% YTD rise and 34x 2025E P/E suggest limited upside; recommend taking profits.

- Ad-tier subscriber growth has stagnated, and content restrictions and lack of offline downloads hinder its appeal, questioning optimistic growth assumptions.

- Consensus expects ad revenue to reach $4bn by 2025, but decelerating ad-supported subs growth and premium content strategy raise doubts.

- The bullish outlook hinges on accelerated ad-tier growth, higher ARPU in international markets, and more hit content in ad-supported tiers.

ISvyatkovsky/iStock via Getty Images

Netflix (NASDAQ:NFLX)(NEOE:NFLX:CA) reported 3Q24 results in which 5.07mn net member add was above the sell-side consensus of 4.54mn, roughly in line with the buy-side consensus of 5mn. Management guided Q4, and operating income was higher than consensus, while FY25 revenue and operating margin were roughly in line.

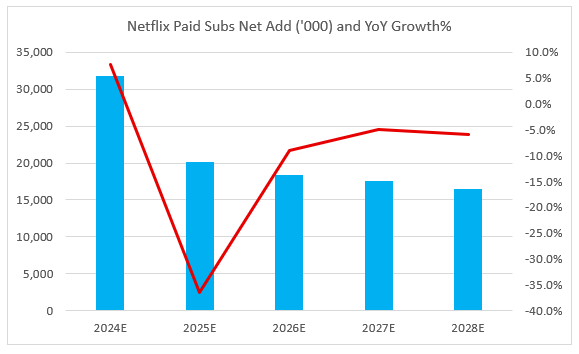

Although the subscriber net adds decelerated following the password sharing crackdown, the market continues to place a high premium on NFLX’s growth prospect due to the upcoming slate of notable content, such as the Squid Game Season 2, that will likely be supportive of incremental sequential paid subscriber growth, and more importantly, the growing prospect of advertising revenue becoming a meaningful revenue driver in the medium term due to the growth of the ad-tier members.

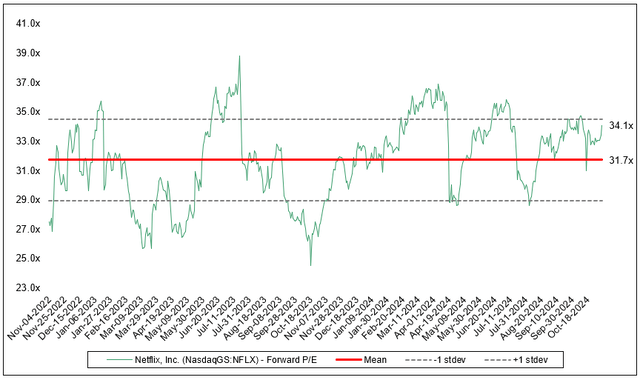

With the stock up 66% YTD and trading at 34x 2025E consensus P/E, we feel that a lot of growth expectations are built in. We note that the current valuation of 34x P/E is close to 1 standard deviation of the two-year average, and the share price may have limited upside from this point on, given that the forward valuation has been trading at a fairly tight range between 29x and 35x over the period.

As such, we recommend investors take some profit off the table to wait for a better entry point, as the Street may be overly optimistic about the ad subscriber and revenue growth outlook.

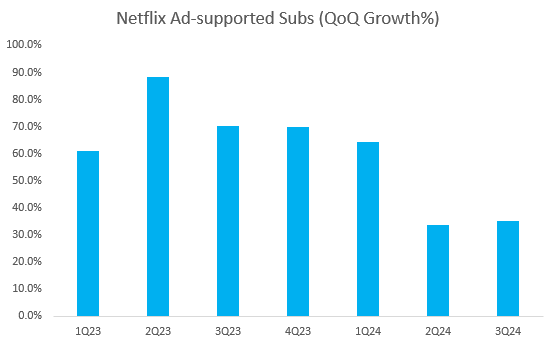

On the ad-tier subscriber side, while the consolidated sequential growth of 35% seems to be impressive, the growth rate has been largely stagnant over the past two quarters and decelerated significantly from a year ago.

Company Report, Astrada Advisors

Although the ad-supported tier is expected to launch in Canada in Q4, we do not expect this to move the needle significantly. We note that Canada has roughly 6.7mn Netflix subs, per World Population Review, and it is unlikely that most of the subs shift to the ad-supported tier to meaningfully drive the metrics in this region.

Consensus is forecasting an accelerated ad-supported tier subscriber growth of 25% CAGR between 2025 and 2028 from sub 20% growth in 2024E. We find it difficult to achieve for two key reasons:

First, the ad-supported tier has content restrictions due to the licensing agreement, greatly limiting what users can watch, thereby disrupting the viewer experience.

Second, this tier does not offer offline content download, a function that is considered essential for many users who want to consume the content on the go.

For the consensus to expect 25% subscriber growth, CAGR would imply that there is a large addressable market for casual viewing of Netflix content with added restrictions. While this may be applicable in the UCAN market, the decelerated sequential growth raises questions on the total addressable market and whether the ex-UCAN market could support the current accelerated growth assumptions.

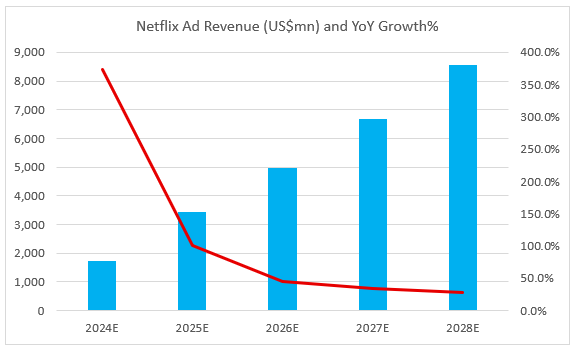

With ad-supported tier growth appearing optimistic, we believe the current ad revenue assumption is also optimistic.

Per eMarketer, NFLX ad revenue is expected to reach $1bn this year. When factoring in the revenue potential from other ad-supported countries such as Australia, Brazil, Germany, France, Italy, Japan, Mexico, and South Korea, the consensus expects NFLX’s global ad revenue to be between $1.5bn and $2.0bn.

Company Report, Astrada Advisors

For 2025E, NFLX expects ad revenue to double, bringing this number to $4bn at most.

With the decelerating growth of ad-supported subs, we can assume that most of the growth was driven by international rather than the UCAN region.

Given that NFLX has a two-tier strategy of selling premium content at higher CPM and longer tail content through demand side platforms, we question the revenue growth impact from this strategy given that the majority of the premium content is likely to be available to the paid subscribers and that the long-tail content may not see material demand.

With paid subs growth expected to continue to decline in the coming years, we would avoid NFLX for now, given the current valuation premium.

Company Report, Astrada Advisors

We would be more bullish on NFLX if the following scenario plays out:

First, the ad-supported tier shifts to acceleration mode, with growth across all new international and UCAN regions.

Second, there is higher ARPU growth in the other international markets, which continue to lag behind the US in terms of pricing.

Finally, more hit content in the pipeline and allocating the hit content into the ad-supported tiers to drive subs growth.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.