Summary:

- Netflix added 13.1M new subscribers in Q4, outperforming expectations.

- The streaming company achieved double-digit top line growth and saw accelerating subscriber net-adds.

- Netflix’s free cash flow soared 376% YoY. FCF margins are looking very good.

- The streaming company announced a major deal with WWE, entering the live sports entertainment market.

- Shares are expensive, however.

Nanci Santos

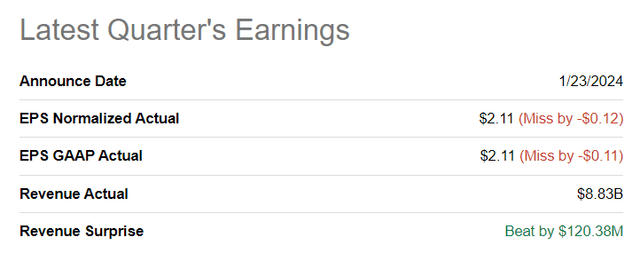

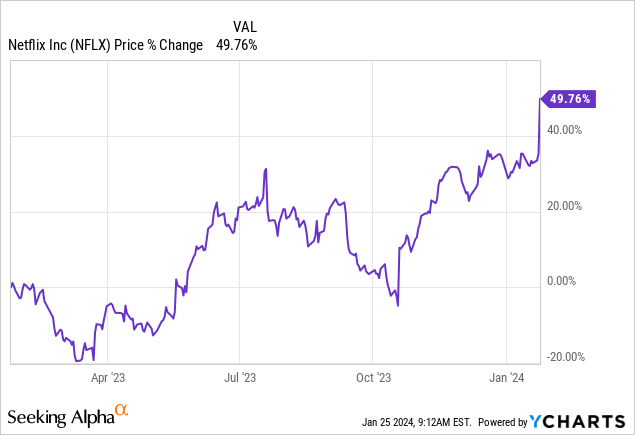

Streaming company Netflix (NASDAQ:NFLX) reported results for its fourth quarter on Tuesday and submitted a blockbuster earnings sheet as the holiday season, typically a strong one for streaming in general, resulted in the addition of 13.1M new subscribers. Netflix missed on earnings, however, but this didn’t deter investors from piling into the streamer’s shares: Netflix was up 11% in response to the earnings report on Wednesday. The streaming company also announced a major deal with wrestling organization WWE which could attract an entirely new audience to the platform in the future. Price increases have also had an effect, resulting in a strong free cash flow upswing for Netflix. I am still not convinced on the valuation, but I acknowledge that Netflix has been able to grow much faster than expected in all key metrics, including subscribers, revenues and free cash flow!

Previous rating

I rated Netflix a sell in October due to the company’s high valuation and crackdown on password sharing that I believed would not lead to subscriber gains in the long run. In the fourth-quarter, however, which is typically a strong quarter for the streaming company due to the inclusion of the holiday period, Netflix widely out-performed expectations with regard to subscribers again, requiring me to face up to reality. I do have reservations about Netflix’s high valuation given its historical valuation, but I am upgrading Netflix to hold nonetheless due to growth in free cash flow and a strong subscriber performance.

A strong holiday quarter

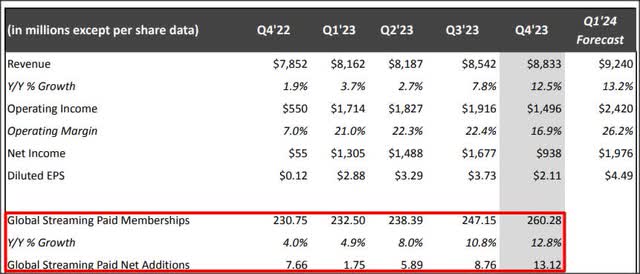

Netflix’s shares soared 11% yesterday as the streaming company crushed subscriber expectations for Q4’23. Earnings were not as great as the subscriber number, but Netflix did beat the average revenue estimate by $120.4M.

Netflix continued to see extraordinary subscriber momentum in the last quarter and, after adding a massive 13.1M new subscribers, ended the fourth-quarter with 260.3M paying customers on its platform. The consensus estimate was for around 9M subscribers, so Netflix did out-perform subscriber estimates by a considerable margin.

The streaming company added a huge 29.5M in new subscribers throughout FY 2023, in part due to Netflix’s announced crackdown on password sharing which forced consumers that shared accounts with non-household members to sign up for their own plans, starting in the second-quarter of FY 2023.

Netflix’s subscriber growth also accelerated nicely in the fourth-quarter, showing 12.8% growth year over year compared to 10.8% in the previous quarter. In the important U.S./Canada market, Netflix gained just 2.81M new subscribers, however, which represents 21% of total net additions. Netflix gained 5.26M subscribers (40% of total) in low-ARM regions Latin America and Asia-Pacific (ARM standing for average revenue per membership), with the remainder coming from Europe. The North American market is by far the most lucrative market for Netflix with an average revenue per membership of $16.64 per quarter which is about 55% higher than the next highest market from an ARM perspective.

Strong growth in FCF, high free cash flow margins

The crackdown on password sharing practices and subscription plan price increases have had a positive effect on subscriber growth in FY 2023… and resulted in a major free cash flow upswing that I previously did not account for. Netflix generated $1.6B in free cash flow from its streaming platform in Q4’23, showing an improvement of 376% year over year. The free cash flow margin has also significantly improved and the Q4’23 margin, on a year over basis, expanded a solid 14 PP.

|

Q4’22 |

Q1’23 |

Q2’23 |

Q3’23 |

Q4’23 |

Growth Y/Y |

|

|

Revenues ($M) |

$7,852 |

$8,162 |

$8,187 |

$8,542 |

$8,833 |

13% |

|

Operating Cash Flow ($M) |

$444 |

$2,179 |

$1,440 |

$1,992 |

$1,663 |

275% |

|

Free Cash Flow ($M) |

$332 |

$2,117 |

$1,339 |

$1,888 |

$1,581 |

376% |

|

FCF Margin |

4% |

26% |

16% |

22% |

18% |

+14 PP |

(Source: Author)

Based on the trends in revenues, subscribers and free cash flow, Netflix’s business is clearly in an up-trend and I see further upside potential for Netflix in FY 2024. Incremental growth could come from:

- Additional price increases for monthly subscription plans

- Continually strong growth in subscribers: I estimate that Netflix could 5-6M of new subscribers, on average, per quarter, which would bring Netflix’s subscriber total at the end of FY 2024 to 280-284M

- Netflix’s core subscriber market in the U.S./Canada is saturated which creates an opportunity for ARPU up-lift in markets outside of North America, especially in Latin America and Asia-Pacific which currently have average revenues per membership of $8.60 and $7.31. Netflix could achieve this through growth in local language library content, as an example.

WWE deal and entry in live sports

Netflix inked a 10-year deal with TKO Group Holdings, Inc., the owner of wrestling competition WWE, which is a milestone agreement for the streaming company. It marks Netflix’s entry into the Live Sports Entertainment market which also creates a new appeal for the Netflix streaming platform. WWE is popular with a younger demographic and gains approximately 17.5 million unique viewers per year.

Starting in FY 2025, World Wrestling Entertainment’s Raw will have Netflix as its exclusive home. While financial details besides the $5B deal price tag have not been disclosed, the deal could add an entirely new customer demographic to the platform and is favorable from an incremental subscriber growth point of view.

Netflix’s valuation

Netflix was highly valued before the Q4’23 earnings report, and it definitely is now. Shares soared 11% on the earnings release, proving that investors loved the report despite the Q4’23 earnings miss.

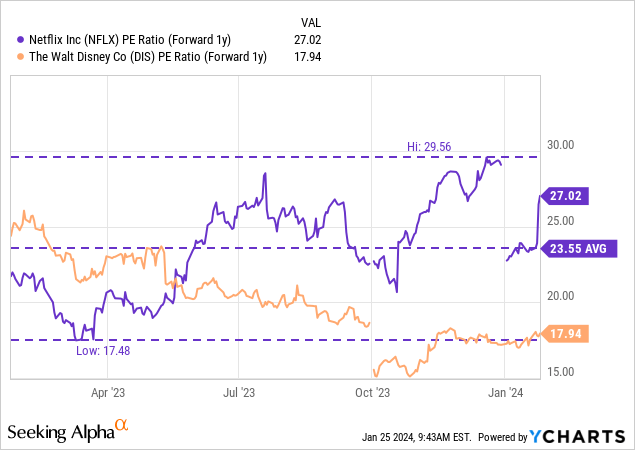

Netflix is expected to grow its EPS 40% this year and 23% next year which is not surprising given the current momentum in subscriber additions. For comparison, Disney (DIS), which also runs a very large, yet loss-making streaming business, is expected to growth its earnings 16% this year and 21% next year. Netflix therefore is decoupling from Disney and Netflix has the advantage of already being profitable.

Disney is more seen as a restructuring play as its continued to rack up streaming losses in its DTC segment. As a result, Netflix’s streaming value appears to be more fully recognized than Disney’s and shares are currently priced at a 27X P/E ratio compared to just 18X for Disney. I personally would be willing to pay ~20X forward earnings for a profitable, fast-growing streaming platform with 20% free cash flow margins, therefore I see Netflix as slightly overvalued. A 25X P/E ratio implies a fair value of ~$500. The average P/E ratio for Netflix is also lower at 24X, indicating that investors are currently more driven by enthusiasm.

Given my personal taste for high-risk, high-reward and undervalued investments, I see more upside revaluation potential for Disney: The Recovery Could Be Epic.

Risks with Netflix

Netflix trades at a high valuation multiplier and there is a risk that even a slight disappointment in subscriber growth in FY 2024 could put the valuation multiplier factor at risk. From a commercial perspective, there is a risk that Netflix will continue to grow more strongly in regions that have a relatively low monetization value, like in Asia-Pacific and Latin America. Monetization, free cash flow margins and subscriber growth figures are measures that I monitor.

Final thoughts

Netflix reported a blockbuster quarter in terms of subscriber additions in Q4’23, but the company’s earnings nonetheless fell short of expectations. The fourth-quarter is historically an outstanding quarter for the streaming platform as customers have excess time during the holiday period which means that Netflix’s subscriber growth will normalize during the first and second-quarter of FY 2024, as it normally does. On the positive side, subscription plan price increases and the crackdown on the password sharing practice had a favorable top line and especially free cash flow (margin) effect. Netflix’s free cash flow has soared in Q4’23, backed by record subscriber growth rates, a trend that I expect to continue in 2024. However, given my concerns about Netflix’s valuation, I can only get myself to rate Netflix a hold at this point.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.