Summary:

- Netflix reports strong Q4 earnings, pleasing investors and gaining 10% in stock value.

- The company has successfully executed a plan to increase monetization and revenues, leading to positive cash flow generation.

- Netflix expects to improve margins and achieve over 13% YoY growth in Q1 2024, with a focus on flexible pricing and ad revenue.

Giuliano Benzin

Thesis Summary

Netflix (NASDAQ:NFLX) has reported Q4 earnings, pleasing investors and gaining 10% after the announcement.

The company has had a strong quarter and a strong year while also guiding for an even better Q12024.

Over the last year, the company has executed a thought out plan to increase monetization and also revenues, which has clearly paid off.

Though the company could seem expensive, a not that ambitious DCF model shows there’s still over 25% upside.

Q4 Earnings

Netflix just announced its Q4 earnings, showing great subscriber growth and positive cash flow generation.

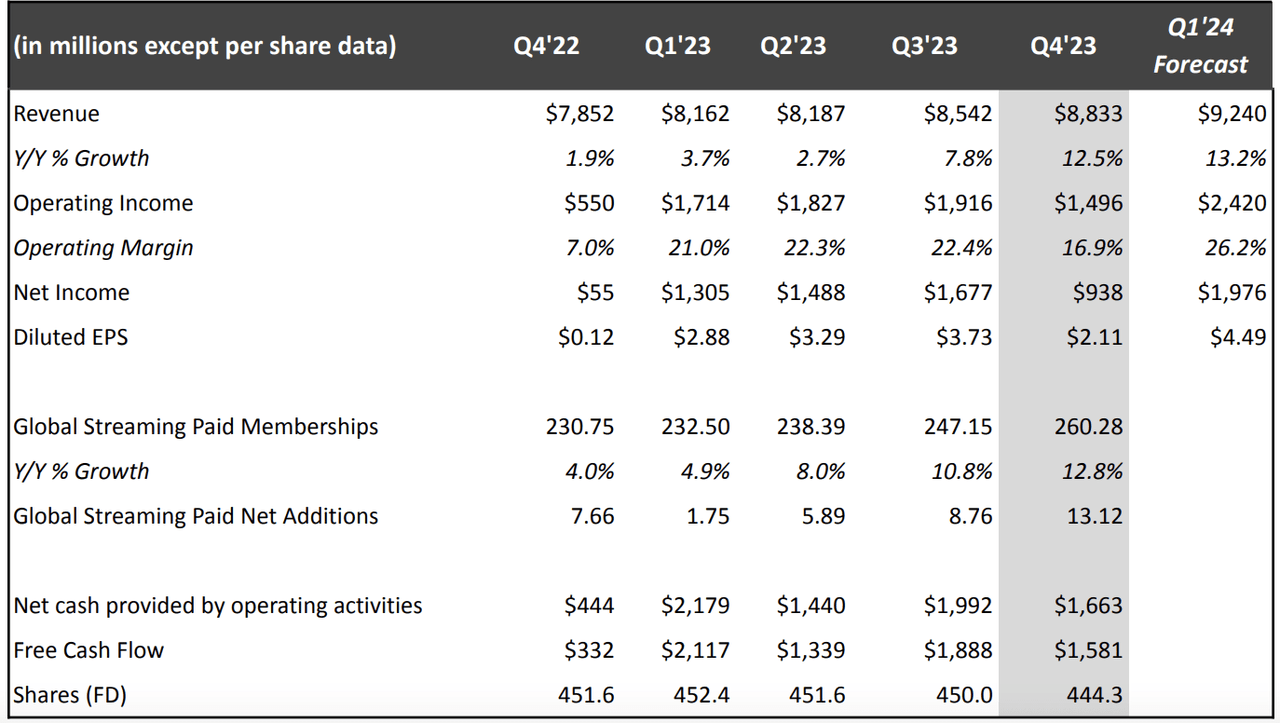

Netflix Financials (Investor Letter)

As we can see, revenue grew 12% YoY, showing a great improvement over the previous three quarters. Operating income, however, did come in lower than expected, with an operating margin of only 16.9%.

Meanwhile, perhaps one of the best takeaways has been the healthy growth in global subscribers at 12.8%.

Overall, while the company has done well to keep growing and remain earnings positive, I am a bit concerned about the lower margin.

Let’s dig into this:

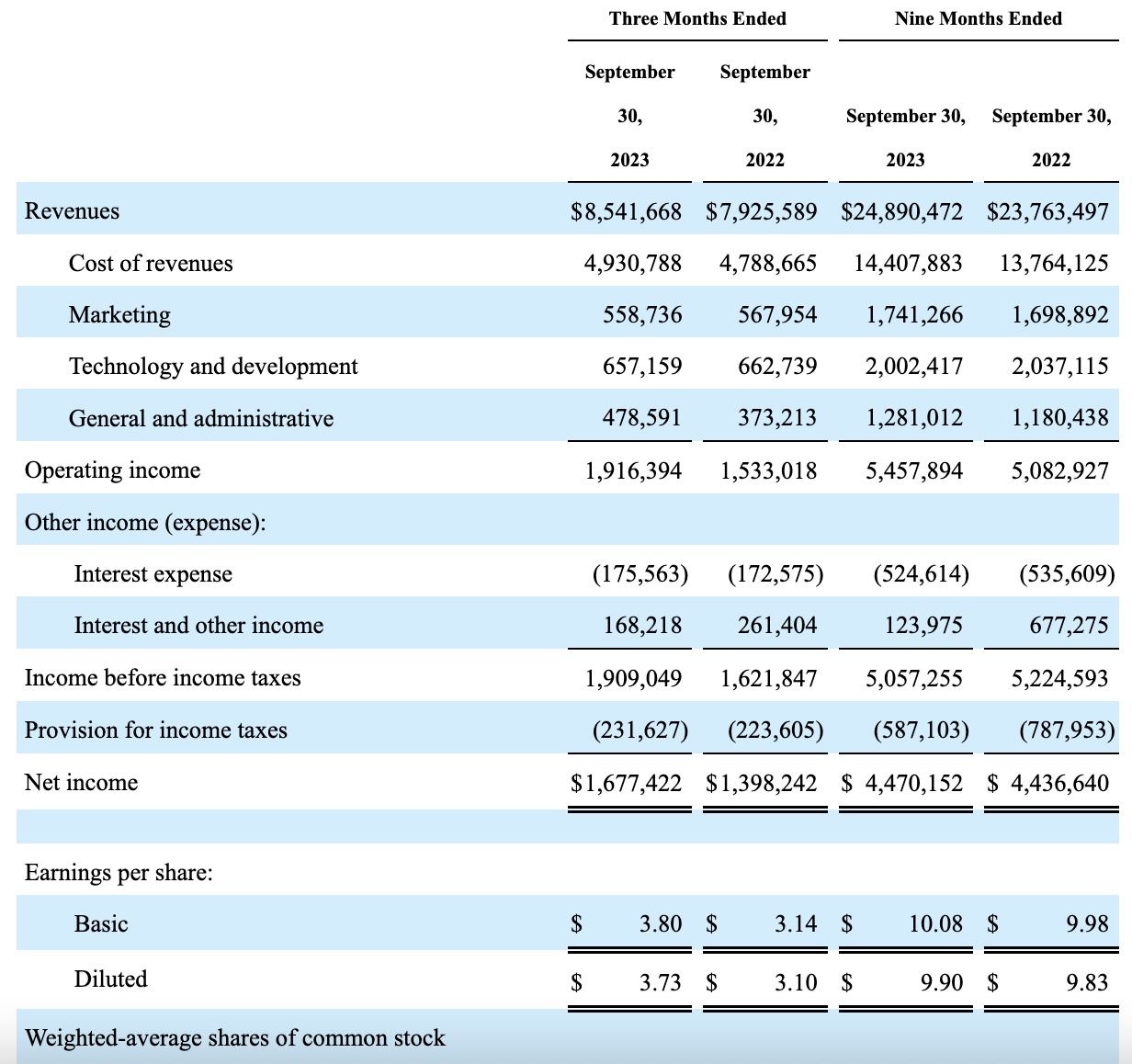

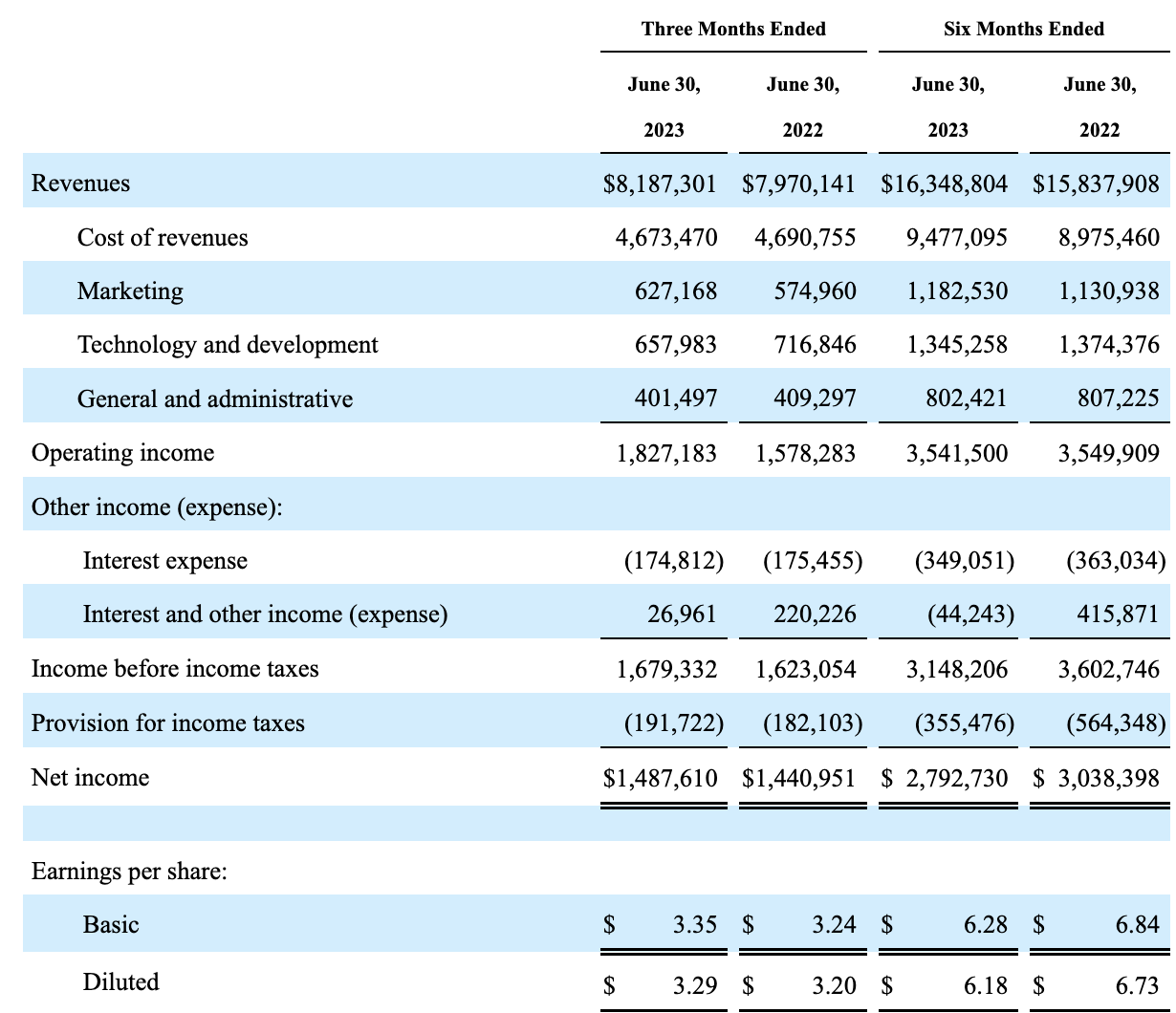

Netflix Q4 Income statement (10Q) Netflix Q3 Income statement (10Q)

Above we can see the results, first for the latest quarter, and then for June.

While revenues increased by almost $400 million, this was offset by higher costs of revenues, (mostly attributable to amortization of content assets) around $300 million, and G&A costs. Interestingly, though, marketing costs actually decreased in the quarter. We also had higher provisions for taxes, which reduced EPS.

However, if we focus on the outlook for the next quarter, it seems like the company expects margins and growth to improve.

The company is guiding 26.2% operating margin, and over 13% YoY growth. How exactly will they achieve this?

Insights From The Earnings Call

On the issue of monetization, the company outlined a three-pronged approach to increasing it.

-

Pricing: Using flexible pricing and also increasing pricing appropriately as the value offering increases.

-

Ad revenue: Ad memberships increased 70% QoQ

-

Sharing: Cracking down on password sharing while facilitating sharing at a smaller cost.

Perhaps one of the biggest levers Netflix can pull now is ad spending. Netflix now offers a free ad tier, though this is not the default tier.

So we’re focused on the long-term revenue potential here. We’re very optimistic about it. It’s a huge opportunity, $180 billion of ad spend ex-China and Russia, $25 billion alone on Connected TV. We know ad dollars follow engagement. We’ve got the most engaged audience. So we believe we’re well positioned to capture some of that ad spend that shifts from linear to streaming.

Source: Earnings Call

“Ad dollars follow engagement”. That is perhaps one of the most important factors here, and it is true that Netflix has a very engaged audience. This is a $180 billion market Netflix can grow into and monetize.

In terms of sharing and pricing, 2023 was a year when Netflix focused on transitioning to what the company calls paid sharing. Moving forward, the company will focus on how and when to increase pricing.

Those changes went well (paid sharing), better than we forecasted. And we’ll continue to then monitor other countries and try and assess when we’ve delivered enough additional entertainment value, we look at engagement retention acquisition as a signal is there. so that we can go back to members and ask them to pay a bit more to keep that positive flywheel going. And we can invest in more great film series and games for those members. So the summary statement might be back to business as usual.

Source: Earnings Call

And moving back to potential revenue opportunities, Netflix is making a stand in the mobile game segment. Back in November, the company announced it would be offering the Grand Theft Auto Trilogy.

We were in the top mobile game downloads for several weeks, which shows it was not only big for us, but big numbers for mobile gaming in general. And beyond any specific title, we’ve tripled game engagement over the last year. So that’s a solid growth trajectory for us. Games, it’s a huge opportunity, $140 billion in consumer spend, ex-China and Russia. And we believe we can build games as strong components, and other content categories to deliver entertainment value to our subscribers.

Source: Earnings Call

$140 billion untapped potential. Netflix is doing very well to increase value through licensing.

Yesterday, we also got news that WWE would be streaming on Netflix. While this was mentioned in the earnings call, not a lot of details were disclosed.

With that said, it seems like Netflix is going to expand into licensing, while staying true to its original model of creating great original content.

So we do not plan to change our strategy or the mix. It’s always going to be that kind of blend of first window, second window and deep catalog. We think that formula works best to entertain the world.

Source: Earnings Call

My Two Cents

The way I see it, Netflix has done a stellar job of monetizing the value it provides.

This has come in the form of optimizing subscriptions through flexible pricing and ad monetization.

The great thing here is that Netflix is giving consumers a choice, which is always good in my opinion. The company has managed to roll out its ad tier, which opens it up to a huge market, without upsetting its current clientele.

Meanwhile, it has managed to crack down on password sharing and even increase its prices without too much disruption.

A year ago, investors were faced with the question: Does Netflix have the power to increase prices/serve ads without upsetting customers?

So far, the answer has been a resounding yes. Perhaps it is the years of unique original programming, but the company has a sticky and engaged audience.

Now, it’s a matter of walking the thin line between adding value and monetizing it. Yes, price increases are never welcome by consumers, but consumers are discerning. There is a lot of choice out there, but perhaps not that much quality. Premium price for better quality is something consumers can accept.

Valuation

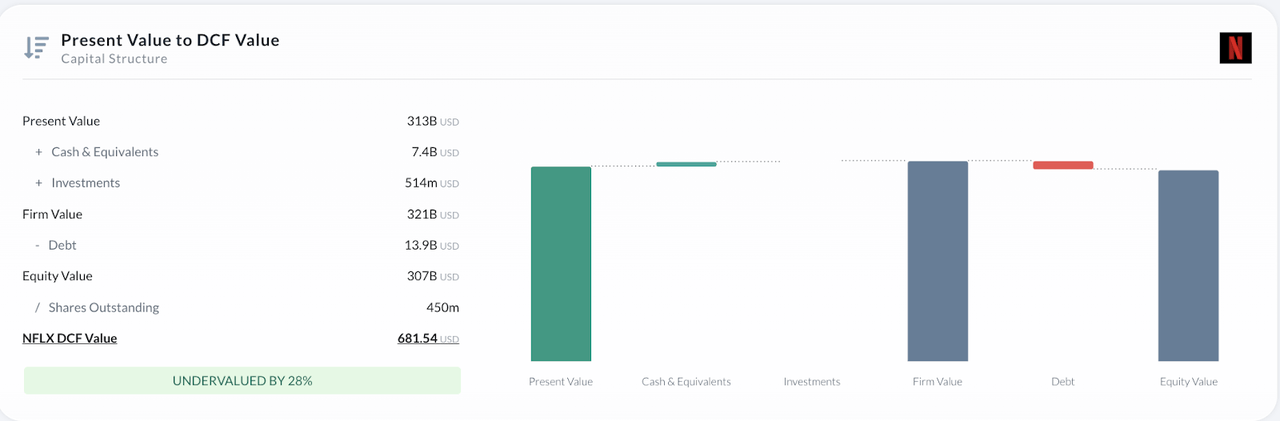

Though Netflix could seem expensive at first glance, if we take into account the current projections for growth and margins, we can actually find value in a DCF analysis.

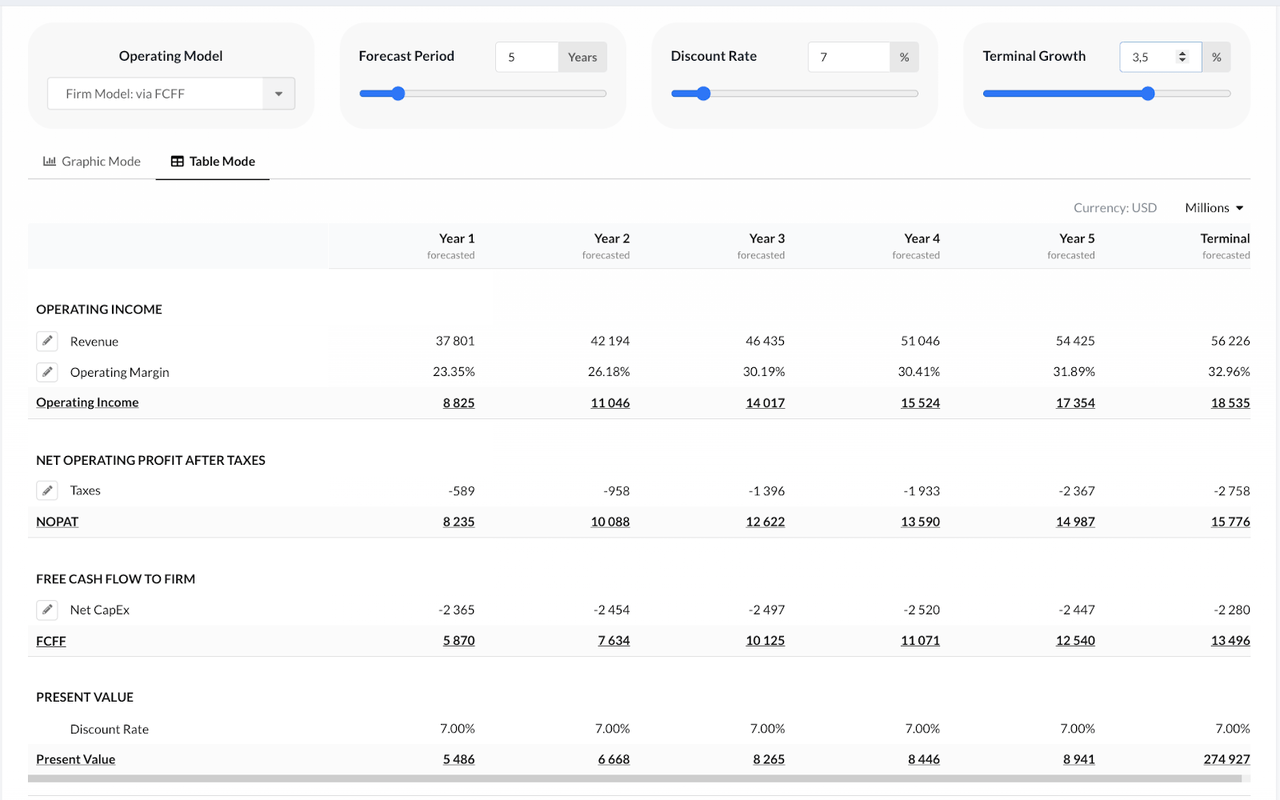

Above we can see my forecast for the next five years. The revenue tracks the consensus analyst estimates you can see on SA.

We then forecast an operating margin that keeps growing until around 33%. Bear in mind, Netflix is projecting a 26% margin already for next quarter. I think there’s a lot of room for this to be even higher.

We then apply a 7% discount, terminal growth of 3.5% and achieve a price through a FCFF model.

This yields a target price of $681.54, which implies a 25% undervaluation from today’s opening price.

Takeaway

Netflix has struggled in the past to be profitable and grow. The competition is intense, no doubt, but the company has executed very well in the last year. All of the new monetization strategies and revenue streams have paid off. Ultimately, there’s a big slice of the pie here, and Netflix just sat down at the table.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This is a high-risk/high-reward opportunity, which is exactly what I look for in my YOLO portfolio.

Join the Pragmatic Investor today to get insight into stocks with high return potential.

You will also get:

– Weekly Macro newsletter

– Access to the End of The World and YOLO portfolios

– Trade Ideas

– Weekly Video