Summary:

- I called the bottom in Netflix stock last year, even as the financial media and Wall Street analysts were pessimistic. It demonstrates that investors must use independent thinking.

- NFLX was extremely battered in 2022, so the massive recovery shouldn’t be surprising. It has significantly outperformed the S&P 500 since its bottom.

- Netflix is consolidating its market leadership as peers rein in spending to focus on profitability. Moreover, it’s gaining momentum with its new ad-supported strategy.

- NFLX remains reasonably priced at an FY25 EBITDA multiple of less than 19x. Its long-term price action suggests momentum investors could return next to push it higher.

Wachiwit

My last update on Netflix, Inc. (NASDAQ:NFLX) was nearly a year ago, in mid-July 2022. So, I thought providing a progress report on how my upgrade has fared since then would be opportune.

Netflix investors should recall how somber buying sentiments in NFLX were back then. I even highlighted that the Wall Street consensus rating moved to a Hold, as analysts feared the worst was still over the horizon. The financial media fed investors’ pessimism with downcast headlines that caught their eye.

Analysts were also wrong-footed at the worst possible moments, just as NFLX formed its long-term bottom. However, astute long-term dip buyers ignored these projections, as they likely assessed that NFLX was punished too harshly and probably close to peak pessimism. At that point, those who needed/wanted to bail out had likely left.

With that in mind, NFLX has significantly outperformed the S&P 500 (SPX) (SPY), up nearly 180% from its May 2022 lows through its recent June highs. As such, I believe it should be clear why investors must develop independent thinking and not get caught up with excess optimism and pessimism. In extreme scenarios, the market could take investors for a ride, taking them by surprise by forming the ultimate turning point when most thought it was going to continue in the same direction.

Netflix, the subscription video-on-demand or SVOD leader, is breathing new life into its market leadership, just as its peers rein in spending to focus on profitability. Moreover, Netflix is already ahead of its peers as it’s free cash flow or FCF profitable in its SVOD business. It can still afford to spend $17B on content while leveraging its new ad-supported strategy to drive revenue and subscriber growth.

Therefore, the strength of Netflix’s dual-pronged strategy has lifted its ability to gain more share against its legacy peers as they face a secular decline in their TV business. While Netflix is considered a fledgling player in the ad scene, it’s not taking a stroll in the park.

According to recent reports, Netflix could end its partnership with Microsoft (MSFT) and build its ad tech to further its innovative capabilities. In addition, the company is also moving fast to “enhance its advertising capabilities to generate more revenue from its ad campaigns.” As such, management has demonstrated that it’s learning the ropes of playing the ad game very quickly, leveraging its massive user data to improve its targeting and attract more advertisers to its platform.

As such, it does seem that Netflix is taking the game to the legacy players, building on the strengths of its FCF profitable SVOD business, and gaining momentum in the ad business.

Hence, I’m not surprised that the market has rewarded NFLX investors with a massive recovery that well-eclipsed my wildest expectations over the past year. That said, should investors who missed riding the bandwagon over the past year jump on the NFLX opportunity now?

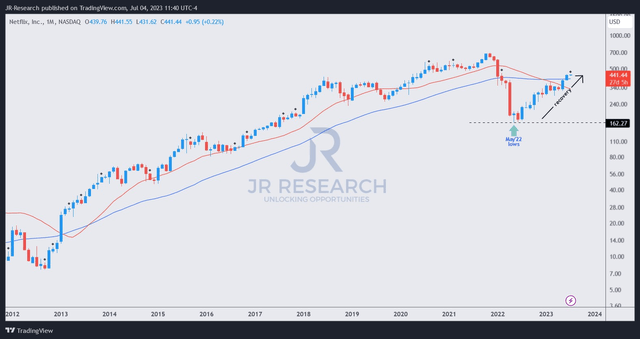

NFLX price chart (weekly) (TradingView)

NFLX has regained its long-term uptrend as of June 2023, a remarkable turnaround from the battering that sent it down to its May 2022 lows, a nearly five-year low back then.

However, that also set up an astute bear trap or false downside breakdown, allowing dip buyers to return with confidence. With NFLX regaining its long-term uptrend bias, I assessed that momentum investors could follow through next, which is pivotal to helping NFLX potentially re-test its all-time highs set in late 2021.

The question is whether NFLX’s valuation is still reasonable for investors to take a position here? NFLX’s forward EBITDA multiple is no longer cheap at 26.5x. However, due to its scale, the company is likely still in the earlier stages of gaining operating leverage.

Moreover, given the uncertainties over its ad-supported strategy, I assessed that its FY25 EBITDA multiple of 18.5x doesn’t seem to have been priced in its ad-supported opportunities fully at the current levels. Therefore, investors are likely still assessing its potential, discounting its execution risks.

As such, while NFLX is no longer cheap, its price action and valuation remain favorable for investors to add exposure, anticipating momentum investors to join in subsequently.

Rating: Maintain Buy.

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!