Summary:

- NFLX’s double beat FQ3’24 earnings call and promising FY2025 guidance have underscored why it is likely to remain highly profitable.

- This is despite the stagnant streaming market share growth and decelerating membership net adds, with the advertising segment yet to be a growth driver in 2025.

- With NFLX set to release an exciting Q4 slate aided by the highly sticky membership base, we expect the management to deliver another beat (and potentially, raise) performance.

- Combined with the increasingly rich free cash flow generation and ongoing share retirement, we believe that the stock remains a compelling Buy at every dip.

PM Images

NFLX’s High Profitable Investment Thesis Remains Compelling Upon A Moderate Retracement

We previously covered Netflix, Inc. (NASDAQ:NFLX) (NEOE:NFLX:CA) in July 2024, discussing why we had reiterated our Buy rating upon the pullback observed after the supposed FQ3’24 guidance miss, since the bottom-line expansion continued to imply robust advertising monetization efforts.

With the market trends still promising and NFLX continuing to grow its streaming market share, we maintained our belief that market leaders might never come cheap after all.

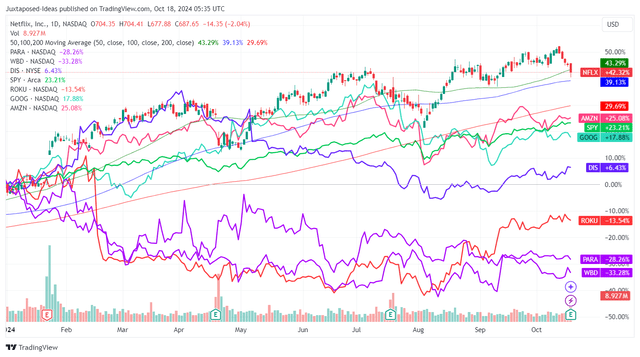

NFLX YTD Stock Price

Trading View

Since then, NFLX has suffered through the painful July/ August 2024 market rotation, with the stock pulling back by -13.3% at its worst, before rapidly recovering by +22% to hit new heights of $730s – with the same trend also observed in its streaming/ media company peers to varying degrees.

Even so, NFLX’s YTD outperformance can not be denied indeed, thanks to its inherent market leadership with 7.9% in streaming share as of September 2024 (inline MoM/ +0.1 points YoY), aside from Google’s YouTube (GOOG).

This development has naturally contributed to NFLX’s double beat FQ3’24 earning results, with revenues of $9.82B (+2.8% QoQ/ +11.8% YoY), expanding operating margins of 29.6% (+2.4 points QoQ/ +7.2 YoY), and richer adj EPS of $5.40 (+10.6% QoQ/ +44.7% YoY).

The acceleration observed in its bottom-lines are highly encouraging indeed, despite the obvious deceleration in its Global Streaming Paid Net Additions by 5.07M by the latest quarter (-3.7% QoQ/ -42.1% YoY), implying its ability to increasingly monetize its offerings.

It is apparent from these numbers that NFLX’s growing advertising membership base by +35% QoQ has been top/ bottom-line accretive thus far, despite the supposedly lower priced ad tier.

This is on top of the UCAN region’s outperformance as the company’s top/ bottom-line driver, with an increased member base at 84.8M (+0.69M QoQ/ +7.48M YoY) and a relatively stable Average Revenue per Membership at $17.06 (inline QoQ/ +4.7% YoY).

If anything, we are likely to see NFLX report another beat and raise performance in the upcoming FQ4’24 quarter, thanks to the exciting slate, including Squid Game S2 (building upon Squid Game S1’s at 262.2M views), the Jake Paul/Mike Tyson fight, and two NFL games on Christmas Day – with it likely to drive further membership engagement.

Readers must also note that the management has offered a promising FY2025 revenue guidance of $43.5B (+12% YoY) and operating margins of 28% (+1 points YoY), with it signaling the company’s ability to consistently deliver profitable growth, despite the deceleration against its 10Y mean of +22.7%/ +44.5%, respectively.

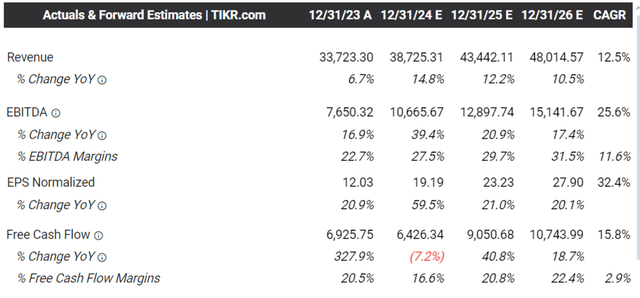

The Consensus Forward Estimates

Tikr Terminal

This development may also be why the consensus have moderately raised their forward estimates, with NFLX expected to generate an accelerated top/ bottom-line growth at a CAGR of +12.5%/ +32.4% through FY2026, compared to the original estimates of +12%/ +28.2%, respectively.

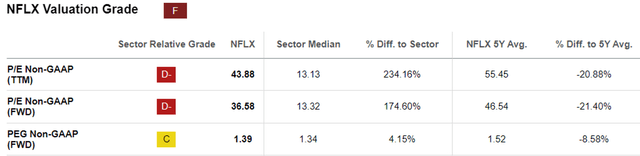

NFLX Valuations

Seeking Alpha

This is also why we believe that NFLX continues to trade reasonably at FWD P/E mean of 36.58x despite the upgrade from its 1Y mean of 31x, given the moderation from the 5Y mean of 46.54x and 10Y mean of 116.35x.

This is attributed to the relatively cheap FWD PEG non-GAAP ratio of 1.39x, compared to the 5Y mean of 1.52x, 10Y mean of 2.61x, and the sector median of 1.34x.

Even when comparing against its market leading Big Tech/ streaming peers, including GOOG at FWD PEG non-GAAP ratio of 1.28x, Amazon Prime (AMZN) at 1.71x, and Disney+ (DIS) at 1.38x, it goes without saying that NFLX remains a compelling Buy at every dip.

So, Is NFLX Stock A Buy, Sell, or Hold?

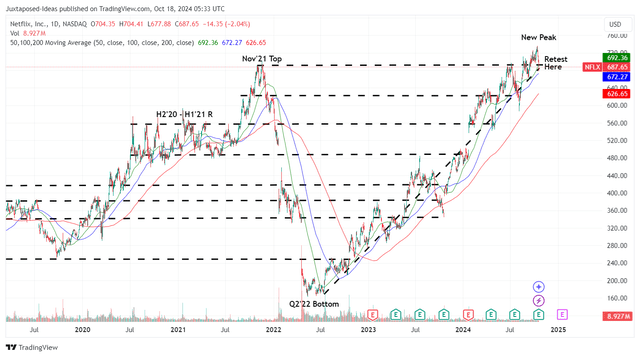

NFLX 5Y Stock Price

Trading View

For now, NFLX’s steady uptrend support since the Q2’22 bottom has been extremely impressive indeed, as the stock continues to run away from its 100/ 200 day moving averages.

For context, we previously offered a fair value estimate of $496, based on the LTM adj EPS of $16.00 ending FQ2’24 (+70.3% sequentially) and the 1Y P/E mean of 31x.

Based on the higher LTM adj EPS of $17.67 ending FQ3’24 (+76.3% sequentially), it is apparent that NFLX has ran away (yet again) from our updated fair value estimates of $547.80.

Despite so, based on the consensus raised FY2026 adj EPS estimates of $27.90, we are looking at an excellent upside potential of +25.7% to our updated long-term price target of $864.90.

While NFLX does not pay out dividends, it remains highly shareholder friendly based on the share retirement by -2.2% over the LTM, as the management puts the increasingly rich LTM Free Cash Flow generation of $7.12B (+26% sequentially) to good use.

As a result of the still robust capital appreciation prospects and its market leading position in the streaming industry, we are reiterating our Buy rating for the NFLX stock.

Risk Warning

For now, the stock market appears to be exuberant as we enter the Q3’24 earnings season, partly attributed to the cooling inflation, healthy labor market, strong discretionary spending (as observed in NFLX’s ability to grow its subscriber base), along with the Fed’s recent outsized pivot by 50 basis points in the recent September 2024 FOMC meeting.

The same has been observed in the increasingly greedy market sentiments, elevated McClellan Volume Summation Index at 1,714.71x compared to neutral levels of 1,000x, and the increasingly higher CBOE Volatility Index at 19.11x compared to the start of the year at 13.20x.

At the same time, NFLX’s market share gains has been mostly stagnant compared to many of its big tech peers, such as YouTube to 10.6% (inline MoM/ +1.6 YoY), Amazon Prime to 3.6% (+0.5 MoM/ inline), and Disney+ to 2.5% (+0.2 points QoQ/ +0.6 YoY).

The same has also been observed in its decelerating Global Streaming Paid Net Additions by the latest quarter, with its next growth opportunities naturally tied to advertising.

However, with NFLX yet to break down its revenues by segment (only by geographical regions), it appears that we may have to contend with slowing growth in the near-term, as hinted by the management – with their ads revenues “not yet a primary growth driver but to be a more meaningful contributor in ’25.”

As a result, while we remain optimistic about its long-term prospects as one of the streaming market leaders, investors may want to temper their near-term expectations indeed, with the stock potentially returning part of its recent gains upon the normalization in market sentiments.

Interested investors may want to wait for the upcoming retracement before adding, preferably at NFLX’s previous support levels of $560s in April 2024 or $620s in August 2024 for an improved margin of safety.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.