Summary:

- Netflix’s global distribution system has been key to its success, with popular shows like Squid Game gaining popularity worldwide.

- The company’s international expansion has been significant, with membership and revenue growth in APAC, EMEA, and LATAM.

- Forward-looking investors should monitor upcoming releases such as Netflix Slam, 3 Body Problem and WWE’s Raw.

Marvin Samuel Tolentino Pineda

Introduction

Per my November article, Netflix management showed confidence in the business by choosing to buy back six million shares in 3Q23. The 2023 10-K shows buybacks continued in 4Q23 as another 5.5 million shares were repurchased. My thesis is that Netflix (NASDAQ:NFLX) shines with global distribution.

Global Distribution

Co-CEO Ted Sarandos spoke about Netflix’s global distribution at the December 2023 UBS Global TMT Conference. The fictional Addams Family originated in cartoons in The New Yorker in the late 1930s. Wednesday is a Netflix series about part of the family and per Sarandos, it became popular in countries like Korea and Japan thanks to Netflix’s global distribution. Squid Game was a Korean story which became popular all over the world thanks to Netflix. The global DNA at Netflix enables them to make the right decision for each market locally. Per Sarandos, one reason Netflix is able to have a decentralized view is because they don’t have 100 years’ experience managing the business from California (emphasis added):

And I think it’s probably more of a DNA thing of the American studios. So most of them have run their international businesses from Southern California. And there are some on the ground folks, but most of the decision-making is made in Southern California. I really pride myself on what we’ve been able to do in terms of putting decision-making in territory. Nobody in Los Angeles or Los Gatos would have made Squid Game.

Rather than getting into bidding wars for matches from legacy sports leagues entrenched in specific geographies, Netflix is in the business of global sports adjacent storytelling. The drama of sports is universal and the global Netflix distribution system is the perfect mechanism for getting this out to global audiences. Sarandos spoke about this at the UBS Global TMT Conference, discussing the Netflix Cup, Formula One and Beckham (emphasis added):

But we look at that and say what people really care about is these – like in sports, of course, they want to see the match. But between the matches, there’s an unbelievable wealth of stories. And we’ve done so great in terms – and again, back to [the] virtuous cycle. The PGA for full swing. PGA has been around for a long time. Right after the Full Swing came on Netflix, the attendance of the PGA matches all went up. The viewing of the championship went up by 3.5% – sorry 30% in the U.S. So enormous lift in viewers.

A November 2023 Time article talks about the fact that successful distribution begets more successful distribution. Korea’s Squid Game has prompted Netflix to invest more heavily in international expansion (emphasis added):

Today, 60% of Netflix’s global audience has watched Korean content, while 70% of its viewers are outside the U.S. “The ambition was to break the language barrier and really connect the global audience together,” says Kim. “Squid Game just really proved that.” Now Netflix is also investing in films in markets like Thailand, Indonesia, and Taiwan in the firm belief that the next Squid Game could come from anywhere.

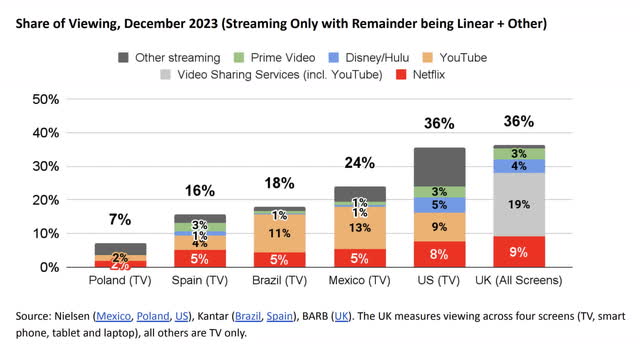

The past success we’ve seen from Netflix with respect to global distribution is unique and there is still plenty of room for growth. Per Netflix’s 4Q23 letter, streaming as a percentage of viewing is just 7% in Poland, 16% in Spain, 18% in Brazil and 24% in Mexico. The opportunity for Netflix in these markets is substantial:

Streaming viewing (4Q23 letter)

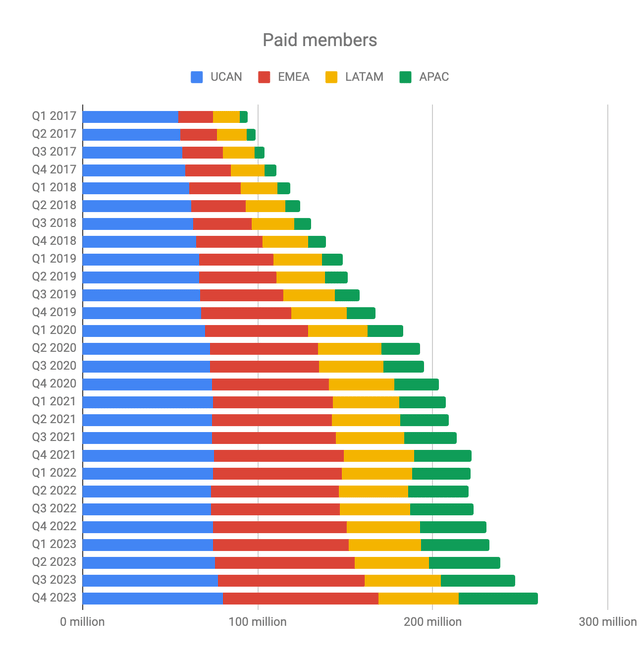

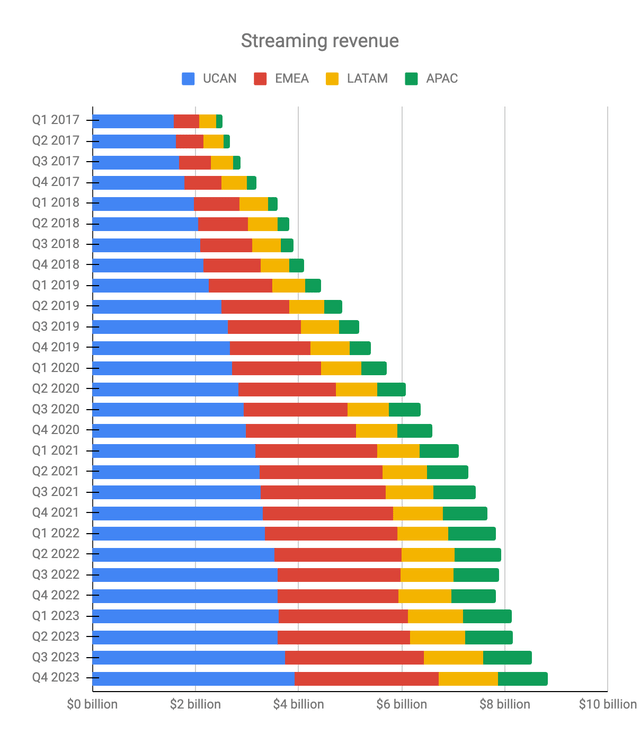

Thanks to a unique global distribution system, membership and revenue have flourished worldwide. APAC has been the fastest growing region in recent years. In 4Q18, 10.6 million or 7.6% of the total 139 million Netflix members were from APAC and $277 million or 6.8% of the $4.1 billion total revenue came from the region. Five years later in 4Q23, membership in the region more than quadrupled to 45 million for a CAGR of 33.5% while revenue rose to $963 million for a 28.3% CAGR. These 4Q23 regional numbers climbed to 17% and 10.9% of the 260 million and $8.8 billion totals, respectively.

There were 37.8 million EMEA members in 4Q18 and this more than doubled to 88.8 million in 4Q23 for a 5-year CAGR of 18.8%. The region saw revenue climb from $1,097 million in 4Q18 up to $2,784 million in 4Q23 for a 5-year CAGR of 20.5%. Also noteworthy is the fact that EMEA revenue increased to nearly 32% of the total by 4Q23.

LATAM had a 5-year membership CAGR of 12% as the count grew from 26.1 million in 4Q18 up to 46 million in 4Q23. Revenue for the region had a 5-year CAGR of 15.3% as it climbed from $567 million in 4Q18 up to $1,156 million in 4Q23. Per the 2023 10-K, this region punches well above its weight with respect to members and revenue relative to full-time employees (emphasis added):

As of December 31, 2023, we had approximately 13,000 full-time employees. Of these, approximately 9,000 (69%) were located in the United States and Canada, 2,000 (15%) in Europe, Middle East, and Africa, 500 (4%) in Latin America and 1,500 (12%) in Asia-Pacific.

UCAN has always been the biggest revenue market. It was surpassed by EMEA in membership during the 3Q22 period. UCAN has 5-year membership and revenue CAGRs of 4.4% and 12.7%, respectively.

Here is a visual of the membership and revenue growth that has come about because of Netflix’s global distribution:

Paid members (Author’s spreadsheet)

Streaming revenue (Author’s spreadsheet)

A January 25 daily update interview/podcast from Ben Thompson helps us understand Netflix’s global strategy through the words of co-CEO Greg Peters. Per his comments, Netflix has leverage such that if they make their recommendations algorithms better for one country then they’re better for all the countries where they have distribution. Netflix has a history of opening the world up to local producers:

Well, if you look at what we’ve done globally, there’s a bunch of things that I would say where we’ve invested in stuff where a local producer – let’s say like Casa de Papel or Money Heist, it was originally on a Spanish broadcast, had pretty modest success there and then we pick it up and we can make it a global show.

Liberty Media (LSXMA) announced their $4.4 billion purchase of Formula One in 2016. Peters implies that if they knew what Driver to Survive was, they would have acquired Formula One or Liberty. In other words, they look at sports differently now that they’ve seen what their global distribution system did with Drive to Survive:

It turns out there’s not many of those opportunities to acquire a fully-fledged sport out there. They’re not sitting on the trees for you to pluck. So I think the biggest lesson we learned is like, “Wow, this is a powerful content category for us, we should do more of them.” You might’ve noticed that we’re doing it in every major sports category that exists, and our members love it. And then, I think with WWE, we’re working to try and figure out, “Okay, how do we step a little bit in that direction and figure out how can we make this more powerful?” And you should fully expect that you’ll get a Drive to Survive-like shoulder content around WWE as well and we hope that that’s massively successful and helps us grow the sport, grow viewership, and everyone will be happy.

Looking at FlixPatrol, Amazon (AMZN) doesn’t have the type of LATAM distribution we see from Netflix and we can conjecture that MercadoLibre (MELI) is part of the reason for this. Per Peters, the value of content is in the eye of the beholder and what is lean-in content to one viewer may be lean-out content to another. He points out that Netflix has had more success than Amazon with respect to global content (emphasis added):

When you get to Amazon, they spent a lot of money on content, and I think it’s been their lack of capability in the space has been clear, and so I think when they’re moving more into sports and things like that, I think it’s actually a smart move for them because it de-risks the creative execution component of things. You talked about marketing versus what role is the content playing? I think for them it’s much more marketing really at the end of the day, and so that’s a smart move for them.

YouTube (GOOG) (GOOGL) is a unique beast and they’re in a totally different space from Netflix. Peters notes how YouTube didn’t have global success with Cobra Kai:

YouTube is a different beast entirely, although I’ll note that it plays a different role in the consumer’s mind and I often think that there’s four things you got to put together and they all have to work together – it’s the content class and the content that works for certain members, it’s the actual user experience that’s right for that content to make that connection happen, it’s a business model that fits around it and is appropriate for that and maximizes the value of that, and it’s a brand which tells consumers around the world that that’s what you go do. YouTube has done that, and has done it incredibly well, but in a totally different space. That’s why when they do Cobra Kai, it doesn’t work for them, and then we pick it up, and it’s a hit.

Valuation

Here is what Netflix says in the 4Q23 letter regarding their growth opportunity (emphasis added):

If we continue to execute well and drive continuous improvement – with a better slate, easier discovery and more fandom – while establishing ourselves in new areas like advertising and games, we believe we have a lot more room to grow. It’s a $600B+ opportunity revenue market across pay TV, film, games and branded advertising – and today Netflix accounts for only roughly 5% of that addressable market. And our share of TV viewing is still less than 10% in every country.

Per the 4Q23 letter, double digit revenue growth is expected for 2024 above the 2023 level of $33,723 million. Additionally, the operating margin is expected to rise to 24%. If we use 12-13% for “double digit” revenue growth then 2024 revenue could be close to $38 billion. Applying a margin of 24% gives us hypothetical operating income of a little more than $9 billion.

Per my August 2019 article, HBO had an operating margin of about 34% from 2015 to 2017. I don’t know if Netflix can get up to this level but I do believe they can go higher than the projected 2024 level of 24%.

If interest rates start going down then I don’t think it is unreasonable to value Netflix at 25-30x my projected 2024 operating income figure of $9 billion such that the range is $225-$270 billion.

Per the 2023 10-K, there are 432,759,584 shares outstanding as of December 31. Multiplying by the January 26 share price of $570.42 gives us a market cap of $247 billion. The market cap is inside my valuation range so I think the stock is a hold for long-term investors.

Forward-looking Investors

Tennis content can benefit immensely from Netflix’s global distribution system and forward-looking investors should keep tabs on the Netflix Slam which is taking place on March 3.

Netflix’s 3 Body Problem should do well with Netflix’s global distribution system and it comes out March 21. A Hollywood Reporter article reveals the global considerations going into it. Liu Cixin wrote the books which were released in China in 2008. Years later they were translated to English and released in the US. Game of Thrones showrunners David Benioff and Dan Weiss brought Alexander Woo on board to help adapt the books among other things:

To help adapt the books – and to properly incorporate the novel’s Chinese pedigree – the duo brought aboard a third showrunner, Alexander Woo, who was also a writer-producer on a hit HBO genre drama adapted from a series of books (True Blood). “One thing that really attracted me as someone who’s Chinese American, as opposed to Chinese from China, is that I’m the child of immigrants, and this is kind of an immigrant story,” Woo says. “The aliens are looking for a safer place to live, and the people who live there don’t want them.”

3 Body Problem will be a global story with scenes in the UK, China, Panama and the US. Forward-looking investors need to keep tabs on the success of this series in March:

One of the biggest creative shifts is that 3BP is now a global story (the first season is mainly set in the U.K., with sequences in China, Panama and the United States) and stars an international cast (including Eiza González, Rosalind Chao, Alex Sharp and Jovan Adepo).

Per the above material from the January 25 daily update interview/podcast with Ben Thompson and co-CEO Greg Peters, Netflix will be the new home of WWE’s Raw. Forward-looking investors should monitor the way Netflix integrates WWE content into their ecosystem. The global reach from Netflix is very appealing to content creators and it was emphasized in the announcement (emphasis added):

“This deal is transformative,” said Mark Shapiro, TKO President and COO. “It marries the can’t-miss WWE product with Netflix’s extraordinary global reach and locks in significant and predictable economics for many years. Our partnership fundamentally alters and strengthens the media landscape, dramatically expands the reach of WWE, and brings weekly live appointment viewing to Netflix.”

Per Fortune, WWE’s Raw has 1,600 episodes and it has been a key part of linear television since 1993. Times are changing and forward-looking investors should analyze the shifts as viewers turn to Netflix for new episodes:

This will be a shift for fans, who will have to subscribe to Netflix to catch the weekly program. That’s on top of the Peacock subscription they need to watch WWE paid live events. (WWE’s “Smackdown,” which currently airs on Fox, will move to NBC next year. WWE’s “NXT” will move from USA Network to the CW.) For fans outside of the U.S., things will be a little easier. Netflix will air “Raw,” “Smackdown,” “NXT” and PLE events like Wrestlemania, which could indicate the company’s interest in taking those over when the Peacock deal expires in March of 2026.

I think forward-looking investors will soon see that the WWE deal provides 52 weeks of soap opera entertainment which will keep viewer engagement at high levels. Co-CEO Peters explained the specifics to Ben Thompson:

What we believe is that there’s a real opportunity for growing the fan base for this set of content globally. We think it’s been under-distributed, we think it’s been under-leveraged. There’s good signs that there’s fans out there, but we think we can grow that. We think about it as the inverse to Drive to Survive to F1. We could actually grow the international audience in a way that is material. We’ve organized the deal so that it’s a big long-term deal. In other words, there’s a little bit of risk insulation into the renting concerns that you mentioned before.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX, AAPL, AMZN, DIS, GOOG, GOOGL, LBRDK, PARA, WBD, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.