Summary:

- Netflix, Inc. Q2 2023 results were mixed as revenues and ARM came in soft, but new subscribers and profits came in better than expected.

- Management is more confident about the company’s financial outlook as a result of improved monetization opportunities.

- Paid sharing, phasing out of the basic ad-free plan, and the ad-supported tier also bring incremental revenue opportunities for 2H23 and 2024.

- Netflix continues to be in a leadership position in the streaming industry despite the rising competition and new entrants in the industry.

- I think the valuation of Netflix is fair at the moment, with my 1-year price target implying just a 5% upside from current levels.

Wachiwit

Netflix, Inc.’s (NASDAQ:NFLX) Q2 2023 was a mixed bag as new subscribers and profit beat, while revenues and average revenue per membership was soft.

That said, management is more confident about its financial outlook, as the improved free cash flow position offers the opportunity for more share repurchases while the launch of paid sharing in most countries offers the opportunity for revenues to reaccelerate.

In addition, Netflix showed this quarter that the company continues to gain share in the streaming industry, which is filled with growing competitors and new entrants as it continues to invest in content and technology.

I have also written other Netflix articles, which can be found here.

Q2 2023

In 2Q23, Netflix added 5.9 million subscribers, which was way more than the 2.3 million new additions expected by the market. EMEA added 2.4 million subscribers, UCAN added 1.2 million subscribers, LatAm added 1.2 million subscribers and APAC added 1.1 million subscribers.

However, revenue grew 3% from the prior year to $8.2 billion, one percentage point lower than what market was expecting, but in line with own guidance.

Operating profit came in at $1.8 billion, beating market expectations by 15%. This was beat in operating profit relative to revenue came as a result of the timing of the content spend as well as improved management of expenses, and slower headcount growth.

Likewise, EPS beat consensus by 15%, as a result of the operating profit beat. Free cash flows for 2Q23 were also strong at $1.3 billion, higher than the market consensus of $567 million as a result of the reasons mentioned above about the timing of the content spend.

Guidance

The main goal for Netflix is to accelerate revenue growth, improve operating margin and grow free cash flows. With the launch of paid sharing more broadly, Netflix is now more confident about its own financial outlook. It is more confident about its revenue growth acceleration in the second half of 2023. This is because of expectation of improved monetization as a result of its paid sharing launch and expanding of the initiative to nearly all remaining countries, as well as the growth in its ads plan.

In terms of guidance, Netflix’s 3Q23 revenues were expected to be $8.5 billion, two percentage points lower than consensus expectations while operating profit is expected to be $1.9 billion, two percentage points above consensus expectations. In 3Q23, the company expects a similar level of net additions to subscribers by about 5.9 million, less than the faster subscriber growth that the market expects. It expects operating profit margin to come in between 18% to 20%.

Management expects to deliver $5 billion in free cash flows for 2023 as of the 2Q23 quarter, up from the prior expectation of $3.5 billion of free cash flows for the full year of 2023. This is because of the strikes of actors and writers, which will result in content spend being cut down. As a result, Netflix ironically will have more cash than it previously expected as a result of these strikes.

I make the assumption of content spend of about $15 billion and $18 billion in 2023 and 2024, which translates to about $5 billion and $6 billion of free cash flows generated in 2023 and 2024 respectively. The lower content spend in 2023 as a result of the timing of these strikes are expected to be pushed back, in my views and assumptions, to 2024, thus slightly lowering 2024’s free cash flow estimates.

In addition, with a larger free cash flow expectation, Netflix stated in their shareholder letter that they plan to increase their stock repurchasing activity in the second half of 2023. In 2Q23, Netflix bought back 1.8 million shares, and it has $3.4 billion remaining capacity in its $5 billion share buyback authorization.

The building of paid sharing and ad tier

One of the biggest disappointments in the 2Q23 quarter was the 1% decline in average revenue per memberships, or ARM, ex-FX and the commentary for this to be flat or slightly down in the third quarter. The reason for the softer than expected ARM was a result of limited price increases in the past year leading up to paid sharing launch, the timing of paid sharing net additions which came in later in the quarter, and the higher mix of subscriptions from lower ARM countries.

Paid sharing was also rolled out in more than 100 countries in May, which accounts for more than 80% of Netflix’s revenues, and the enforcement of this will come in phases. Revenues for each region exceeded re-launch and the signups also exceeded cancellations. In particular, Netflix stated that cancel reaction for these countries were low and that they are seeing a “healthy conversion” of borrower households into full paying memberships as well as its uptake in its extra member feature. For the remaining countries that does not have paid sharing yet, they will be rolled out in the coming weeks, with room to increase prices in 2024.

The ads plan membership has also nearly doubled since the first quarter of 2023 and its reach continues to grow. However, there is still a rather small membership base so the current revenue from ads is not material. The company expects that the ad plan will enable a unique proposition to offer consumers a lower price point and continue to work hard to scale the business after eight months since its launch. It continues to see advertising as one of its potential multi-billion-dollar incremental revenue stream.

There’s also another room for revenue growth opportunity in the near-term as Netflix also confirmed that it will be phasing out its Basic ad-free plan for new and rejoining members in both the US and the UK.

This was also what happened in Canada in the 2Q23 quarter as the company phased out of the Basic ad-free plan in Canada during the period.

After the change, Netflix will offer a $6.99 per month ad-supported tier, the $15.49 per month standard plan, and the $19.99 per month premium plan.

With the cancellation of the Basic ad-free plan, the paid sharing and ad tier roll out, I think that creates a solid revenue opportunity in the teens range in 2024, which will be supported by subscriptions and ARM growth.

Streaming industry

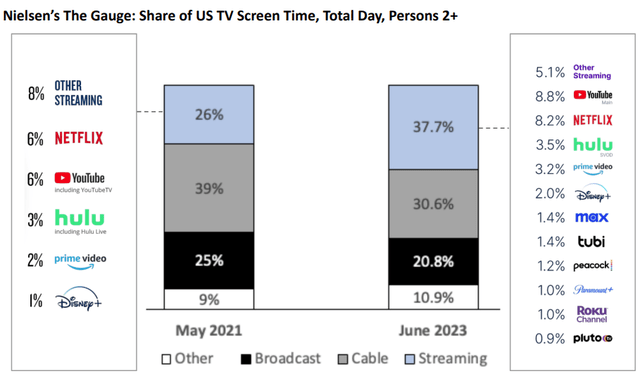

While the streaming industry is taking up market share, it remains intensely competitive today.

In fact, we see Netflix continuing strong execution to compete and grow market share even with so many new entrants in the space. In order to lead the space, Netflix needs to improve and build on its technology, produce the best content with the best creators and continue to improve the user experience for consumers.

Streaming market share (Netflix)

With competition from so many large and established players, consumers today have plenty of choices and that is the main reason that Netflix is unable to rest on its laurels. Competition does not just come from traditional entertainment companies like Disney (DIS), Paramount (PARA), but also big tech players like Apple (AAPL), Alphabet (GOOG) and Amazon (AMZN).

Netflix will continue to need to invest in its business, spend on content to churn out the best entertainment for its users in a way better than its competitors.

Valuation

Netflix is trading at 28x 2024 P/E. While there was a slight selloff post earnings, the stock is up more than 40% year to date and more than 130% since its lows in 2022. In my opinion, the risk reward opportunity for Netflix, Inc. stock is not great at the moment and the valuation of the company is likely somewhat fair.

I assume a 30x 2024 P/E on my 2024 EPS estimate of Netflix to derive my 1-year price target for Netflix.

My 1-year price target for Netflix is $448, implying a potential return of 5% from the current stock levels.

Conclusion

Netflix’s quarter came in rather mixed. Subscribers and profits came in better than expected by revenues and ARM came in softer than expected.

The stronger free cash flow generation allows the management team to accelerate stock repurchase activity in the second half of the year.

In addition, phasing out of the Basic ad-free plan, launch of the paid sharing in most countries and growth in the new ad tier, this brings incremental revenue opportunities in the second half of 2023 and in 2024.

The streaming industry is certainly more competitive than it was years ago, but Netflix remains at the top of the industry in the leadership position after years of investment in its technology and content.

I think that the valuation of Netflix is fair at the moment.

My 1-year price target for Netflix is $448, implying a potential return of 5% from the current stock levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, as well as access to The Barbell Portfolio.

The Barbell Portfolio has outperformed the S&P 500 by 97% in the past year through owning high conviction growth, value and contrarian stocks.

Apart from focusing on bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join us for the 2-week free trial to get access to The Barbell Portfolio today!