Summary:

- Netflix has started a battle with its customers, showing its plan to maximize profits.

- The company is in a much more competitive industry and we expect pushback from customers to be extreme.

- The company’s growth has already slowed down and we expect it to struggle to earn profits to justify its valuation.

Wachiwit

Netflix (NASDAQ:NFLX) has seen its share price more than double from its prior market capitalization to a current value of more than $160 billion. Despite that recovery, in our view the company’s business is heavily overvalued, as it hasn’t realized the impact of changing market conditions. As a result, we expect Netflix will struggle to justify its long-term valuation.

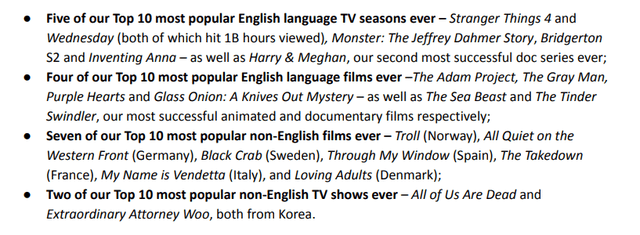

Netflix Password Sharing

Netflix has been focused on handling a stagnant customer base. One way the company is looking to do that is minimize account sharing. The company recently announced a plan to prevent password sharing by forcing users to log in with their home network every 31-days in a now deleted FAQ. On social media platforms, the reaction was quick.

TikTok

Netflix Social Media Reaction – TikTok

Netflix’s core problem is that they’re no longer the only game in town. In fact, they have one of the smaller established libraries and they’re spending a massive amount to try and fix that. They also have one of the higher prices in the industry. On top of those things, they have the least diversification in their business portfolio.

That means they need to be doing everything they can to stop customers from switching at a time when other services are clearly being more enticing. The above comments show that they’re not doing that.

Netflix Earnings

Netflix has continued to struggle to switch its earnings to future growth in the business.

Netflix Earnings – Netflix Press Release

The company watched its revenue decrease 1% QoQ but it technically managed to keep YoY growth at just under 2%. The company’s operating income was just over $500 million and its operating margin remained low as well keeping net income at mere $10s of millions. That’s for a company that needs billions per quarter to justify its valuation.

The company’s share count has struggled to decrease. QoQ it increased by 1.3 million shares, which represents another loss of several hundred $ million. The company’s FCF barely annualized at a billion $ post share dilution, indicating how the company doesn’t have a path to increase its FCF long-term.

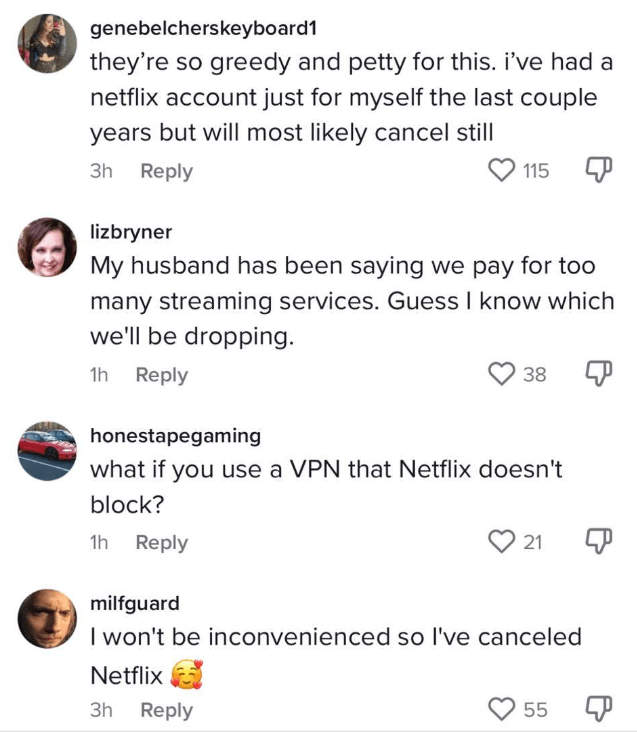

Netflix Content Marketing Struggles

Netflix continues to talk about raw numbers for marketing is content, but continues to face a recurrent problem.

Netflix Content Marketing – Netflix Investor Presentation

Netflix has continued to set new records for show popularity. The company is spending $10s of billions to attempt to produce record breaking content especially in non-US markets. The company’s content has done well, but the downside here is that it hasn’t been reflected in the company’s numbers as it’s struggled to get new subscribers.

To us, the risk here is clear. The numbers appear to indicate that Netflix’s record popularity is no longer attracting new customers. Sure plenty of existing customers might be watching shows, but those interested in the company’s new content aren’t signing up. That’s a risk for future success.

Netflix Forecast

The company’s forecast for future returns remains incredibly dismal.

For the 1Q 2023, the company is forecasting just under $8.2 billion in revenue, or an increase of just under 4% YoY. However, margins are expected to decrease substantially YoY decreasing the company’s operating income by roughly 20%. The company remains one where net income is a small fraction of that which would be required to justify its valuation.

It’s worth noting here that the company hasn’t adjusted its forecast at all by expected impacts of actions such as the above household decision, which we think could be a strong negative. The company hasn’t provided a guidance for its streaming memberships, which performed well YoY in the most recent quarter, but stagnated for the year before that.

Our View

Netflix is in a complex position. The company is struggling to earn the cash flow to justify its valuation. The company is struggling to grow with net income remaining all of the place and revenue for the company struggling to match inflation rates. More importantly, with the company using ads and household restrictions to restrict customers it’s angering its existing base.

In an expensive inflationary environment customers are looking between multiple options now to see which they can do without, and for many with split households (i.e. military families) canceling Netflix might be more appealing than purchasing a second subscription. We expect Netflix’s bottom line to continue to struggle which will hurt its valuation.

Thesis Risk

The largest risk to our thesis is, as Netflix has said, its competitors are losing money, and they won’t want to lose money forever. There will eventually be increased consolidation in the industry and the company could be well positioned to survive. That could enable it to raise prices and profits substantially going forward.

Conclusion

Netflix has been around for a while now. It’s no longer acceptable to have solid top-line numbers that don’t trickle to the bottom-line. Investors are beginning to put more pressure on the company to change how it operates. At the same time, that period is coinciding with a rapid increase in competition along with an overall tough market environment.

The company is spending $10s of billions in content and it only has streaming to earn that back, versus peers who have other business lines like theater sales they can use to earn back money. From the company’s subscriber numbers it seems like continued platform hits are now the minimum, it’s no longer driving growth. With increased prices etc. antagonizing customers, we expect the company to struggle and recommend against investing.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.