Summary:

- Netflix is well positioned for accelerated top-line growth and margin expansion with live events like the two NFL games on Christmas Day and the Paul Vs. Tyson fight.

- These live events may have the ability to pull forward growth in NFLX’s ad-supported tier, leading to a faster ramp up of monetization.

- Regular live events like WWE have the ability to bring in a dedicated cohort of viewers as well as advertisers in a target-rich market.

Dimitri Otis/DigitalVision via Getty Images

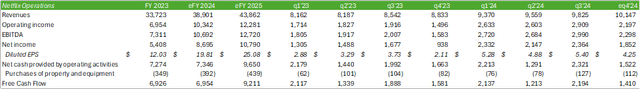

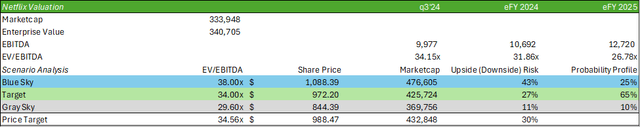

Netflix (NASDAQ:NFLX) experienced a strong q3’24 with 15% top-line growth paired with a significant improvement to its operating margin, reaching 30% in the quarter. With q4’24 being a major, pivotal quarter for the firm, I have reason to believe that Netflix’s operational growth is far from over. With the two NFL games streaming on Christmas Day, the Jake Paul Vs. Mike Tyson match streaming on November 15, 2024, and the installment of weekly WWE matches beginning in the first week of January 2025, Netflix is positioned to expand its live entertainment offerings, and in turn, may accelerate the growth of its ad-supported tiers. I am upgrading my rating to a STRONG BUY rating for NFLX shares with a price target of $988/share at 34.56x eFY25 EV/EBITDA.

Netflix Operations

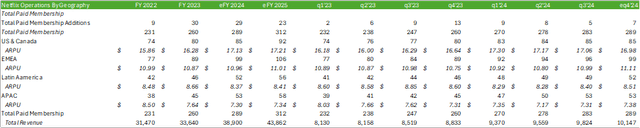

Netflix experienced a strong q3’24 with 15% top-line growth and a 2% improvement to the operating margin driven by growing paid membership across all regions net of LATAM. Management noted in their q3’24 call that LATAM would have reported paid membership growth if the reporting period extended by a single day. Netflix added 5.07mm net adds at the end of the reporting period, with ending period membership growing to 283mm viewers.

The largest growth regions for paid subscribers were APAC, up 24% and EMEA, up 15%. Despite the user growth, average revenue per member declined by -4% in APAC and -5% in LATAM, which are likely driven by users transitioning to lower ad-supported tiers. Management suggested that 50% of net new signups were in Netflix’s ad-supported tier, further suggesting that the lower-cost tier is moving in the right direction for monetization. Ad-supported membership improved significantly in q3’24, growing by 30% sequentially.

As for monetization, management is expecting the ad-supported tier to be one of the major growth drivers going forward and anticipates it to reach critical scale in 2025. Once at this level, I believe Netflix will have the bandwidth to field advertising revenue to bring the lower-cost ad-supported tiers to margin parity; however, finding content balance may take a year or two before this is achieved. Given this factor, Netflix’s margins may remain stagnant in eFY25 as more viewers sign up for the lower-cost ad-supported tiers before margin accretion is achieved. With q3’24’s 30% sequential growth rate and the challenging macroeconomic environment for low-to-mid-band earners, I have reason to believe that Netflix will experience strong tailwinds for its ad-supported tier going into eFY25.

Reviewing TKO Group Holdings’ (TKO) 10-k report issued in February 2024, the annual global sports sponsorship revenue is estimated to increase from $67b in 2022 to $87b in 2025. According to TKO’s q2’24 earnings report, WWE contributed $38.5mm in sponsorship revenue for 1h24. Though this will not likely translate 1:1 for Netflix in terms of advertising revenue generated from the content, I believe that it can provide some insights into the growth potential for this specific segment.

In addition to this, Netflix has some major catalysts for new adds coming up towards the end of 2024. This includes the two NFL games on Christmas Day, the live Jake Paul Vs. Mike Tyson fight, and the installment of WWE. WWE has an average weekly viewership of 1.7mm. Though there will likely be some overlap between WWE viewers and Netflix subscribers, the weekly show will likely add a very dedicated user base to the mix and create a strong tailwind for potential advertising revenue.

Depending on the success of the two NFL games streaming on Christmas Day, Netflix may be in line to continue down this route for more professional sports streaming on the platform. NFL games are notorious for advertising spend. Accordingly, the NFL’s TV partners generated $4.5b during the 2023 season. According to Sportico, the two 2023 Christmas Day games were the 5th and 6th most viewed games of the season with 29.5mm and 29mm viewers, respectively. Given that the metrics presented were on the back of a declining linear TV viewership, there is the possibility that Netflix can garnish a stronger level of viewership during the 2024 games.

Netflix Financial Position

Modeling out eq4’24 financials, I’m forecasting net adds of 6.57mm with total revenue coming in at $10,147mm. In UCAN, I’m forecasting similar user growth paired with average revenue per user moderating. Outside of UCAN, I’m expecting average revenue per user to improve with growth in user acquisition.

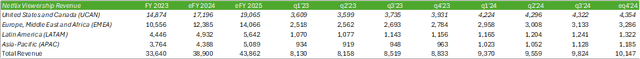

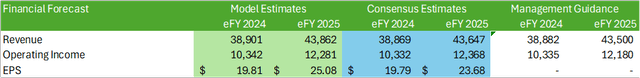

I’m raising my forecast for eFY24 to $38.9b in revenue, with eFY25 revenue coming in at $43.86b. My EPS forecast is coming in slightly above consensus estimates at $19.81/share with eFY25 coming in towards the top end of the range at $25.08/share. My eFY25 forecast is based on higher growth potential across all regions, with advertising spend growing as the ad-tier scales.

Risks Related To Netflix

Bull Case

Netflix is navigating into new revenue streams with more live events while scaling its ad-supported tiers. These features are likely to be more impactful to revenue than margins in the near-term; however, Netflix may realize scale faster than anticipated as it adds more live events to the streaming service. I’m anticipating these features to bring in new net adds to all tiers, especially when considering the dedication of the WWE viewers. Though marketing spend is oftentimes reduced during challenging economic environments, the transition from linear to SVOD will likely create certain tailwinds for Netflix.

Bear Case

Netflix may face margin headwinds as it transitions a portion of its business to ad-supported revenue, which may result in a dispersion between ad-tier subscribers and monetization. The overlap between NFL and WWE subscribers may be greater than I anticipate, leading to fewer net adds in eq4’24 and eFY25, which may result in lower-than-expected revenue generation.

Valuation & Shareholder Value

Netflix currently trades at 34.15x TTM EV/EBITDA, the midpoint of its trading range in the last year. Given the substantial growth potential with live events and its growing ad-supported tiers, I have reason to believe that Netflix’s growth is far from over. Based on my EBITDA growth forecast through eFY25 and its historical trading range, I am upgrading my rating to a STRONG BUY rating for NFLX shares with a price target of $988 at 34.56x eFY25 EV/EBITDA.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.