Summary:

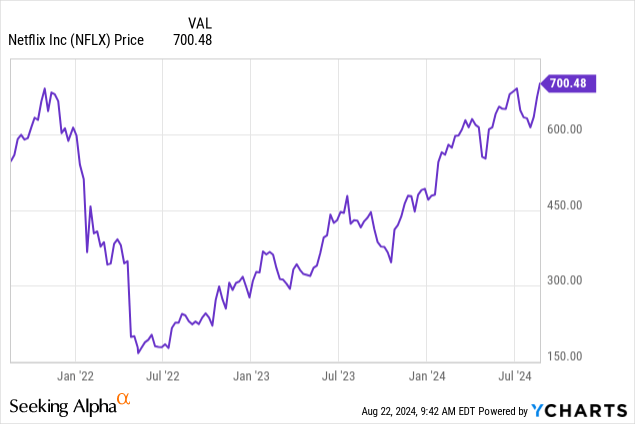

- Netflix stock is up nearly 70% over the past year, amid stronger-than-expected growth.

- The company is finding success with its ad-supported membership plan as a new growth driver.

- We see room to stay bullish on the stock.

bymuratdeniz

It’s been a long ride for Netflix (NASDAQ:NFLX) investors, as the stock finally made a new all-time high for the first time since late 2021. A lot has changed for the streaming giant, notably introducing an ad-supported membership tier that has successfully re-energized growth and earnings momentum.

We highlighted these themes the last time we covered Netflix, setting a $700 price target. While we don’t expect a repeat of the near 70% rally Netflix shares delivered over the past year, there are several reasons to stay bullish on the stock. Ultimately, the company is well-positioned to keep growing and generate positive shareholder returns. Here’s why.

An Excellent Start to 2024

It’s been about one month since Netflix reported second-quarter results that beat expectations. Q2 EPS of $4.88 marked a 48% increase from the $3.29 result in the prior year quarter, coming in $0.14 ahead of the consensus estimate. Revenue growth of 17% this quarter was the strongest in three years.

The story has been a resurgence of global paid subscribers over the past year, including 8.05 million net paid additions in Q2. That figure includes viewers choosing the ad-supported tier, which the company notes now accounts for over 45% of all sign-ups in markets where the option is available. Ad tier memberships grew 34% sequentially, highlighting the appeal to a broader audience attracted to the low base pricing.

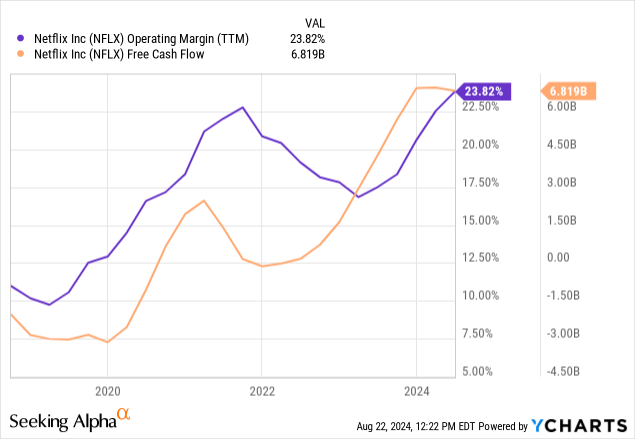

What’s important here is that the strategy is translating into higher profitability. The Q2 operating margin at 27.2% is up from $22.3% in Q2 2023 while free cash flow over the trailing twelve months at $6.8 billion compared to $4.2 billion last year.

The trends have been good enough for management to hike full-year guidance. Netflix now expects 2024 revenue growth of 14% to 15%, up from a prior 13% to 14% forecasts. Similarly, the company now sees the full-year operating margin reaching 26% compared to 25% previously and well ahead of the 20.3% result in 2023.

An Advertising Juggernaut

Maybe the biggest update from Netflix was its latest announcement citing the results from its second annual “Upfront negotiations“, an industry event to secure advertising on upcoming programming. The company noted it received a 150% increase in upfront ad sales commitments over 2023.

Advertising clients are seeing value in partnering with Netflix on not only high-profile properties like “Squid Game” and “Bridgerton”, but also the opportunities to be featured in new live events like “WWE Raw” professional wrestling and Netflix’s first NFL broadcast later this year. Netflix is expanding on its ad-tech technology with more features for marketers to gauge impressions and execute campaigns across various channels.

For investors, Netflix’s newfound advertising prowess has major implications for the company’s growth potential.

What we’re seeing is an ongoing diversification of the company’s business, moving beyond quarterly results that are simply tied to subscriber growth. From the nominal per-member ad-tier pricing, Netflix now has the potential to leverage that viewership into significantly higher advertising revenue over time.

There is also an aspect that is making Netflix’s cash flow and earnings less volatile or higher quality over time, with advertising commitments representing a steadier form of revenue compared to the more uncertain quarterly membership additions.

This dynamic helps explain why Netflix plans to stop announcing regular membership figures into 2025, as the metric becomes less relevant.

Keep in mind that the company remains in the early stages of rolling out the ad tier globally. This means the growth runway can extend for the next several years, capturing rising advertising rates as the marketplace matures. The company’s entry into areas like sports and gaming is largely untapped and will likely play a bigger role going forward.

What’s Next for Netflix?

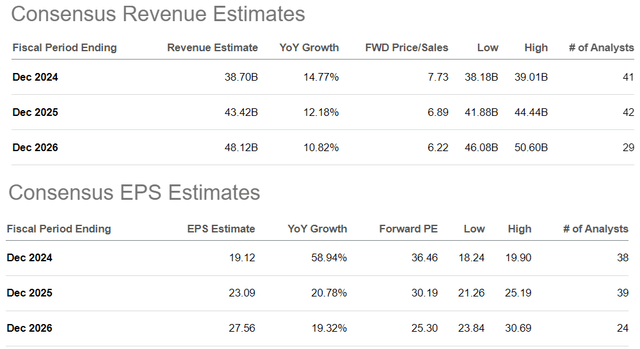

The bullish case for Netflix stock is that the company can keep executing its profitable growth strategy and ultimately outperform expectations. According to consensus, the company is expected to post an average revenue growth rate of around 12% for the next two years, which could prove to be conservative given the expanding number of monetization streams.

A lot of attention is on the ad tier, but the regular plans likely still have an upside in pricing, particularly thinking about high-growth emerging markets where a large number of users will still prefer the no-ads experience.

Investors can look forward to the premier of flagship series like Squid Game season 2 or even the final chapter of Stranger Things as boosting engagement into 2025 and beyond.

In terms of valuation, Netflix trading at 36 times its 2024 EPS estimate or 30 times the 2025 forecast as a 1-year forward P/E ratio isn’t necessarily a bargain, but it can be justified given the company’s current operating and financial momentum. If net paid additions remain strong, there’s a good chance EPS can evolve above the baseline estimates.

Seeking Alpha

Stay Bullish on Netflix

We rate Netflix as a buy with a price target of $840 representing a 36x multiple on the current consensus 2025 EPS. The 20% upside from here essentially maintains the stock’s current earnings premium into next year, with room for the market to reward Netflix based on its more diversified growth profile and higher-quality earnings.

Covering some of the risks, weaker-than-expected results would introduce a new round of volatility into the stock. There is a sense that Netflix would be resilient to shifting macro conditions, but a deterioration of the global economy would pressure growth and force a reassessment of the earnings strength. Monitoring points over the next several quarters include the operating margin and free cash flow trends.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NFLX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein represents the personal opinions and views of Dan Victor only and is intended for informational and/or educational purposes. It should not be construed as a specific recommendation or solicitation to buy or sell any security or follow any particular investment strategy. Please consult with your financial advisor before making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.