Summary:

- Netflix stock has risen almost 100% in the past year, outperforming the S&P 500.

- Looking ahead, I do not see a clear force that can drive the stock prices in a definitive direction.

- Positive factors include Netflix’s dominant position in the market, successful initiatives, and subscriber growth.

- Negative factors include competition from other streaming services, high valuation risks, and insider selling activities.

hapabapa

Will NFLX stock keep rising?

Shareholders of Netflix (NASDAQ:NFLX) have enjoyed excellent price performance in the past year (see the next chart below). The price of the stock has climbed almost 100% in the past 1 year, easily surpassing the S&P 500 Index.

However, looking ahead, I see a variety of factors that could limit its stock price from continuing its upward trajectory in the near future. In the remainder of this article, I will detail these factors. Although, before that, I want to clarify that I am not arguing a bearish thesis. My thesis is only that the stock is unlikely to continue its current momentum in the short and intermediate term, given the mix of positive and negative catalysts.

The positives

As such, I will first start with the positives. Despite a challenging operating environment with competition intensification (more on this later), Netflix has remained as the dominant player. Management’s new various initiatives have proven highly successful. Even during the 2023 writer and actor strikes that halted new content creation, Netflix skillfully pivoted to its vast library, maintaining subscriber growth. Membership has enjoyed robust growth (see the next chart below) to nearly 250 million. The company was also able to implement price increases on certain services to further grow its profits.

Although, in my view, NFLX now begins to face a saturated North American market. Netflix has been successfully coping with such saturation with its recent strategies. Notably, Netflix has started a new and ad-supported subscription tier at a lower cost. This strategic move has proven successful and paid off handsomely, attracting a massive 15 million members within a year of launch. By October 2023, that number had surged to a staggering 23 million monthly users. Furthermore, Netflix addressed another revenue leak: password sharing. Recognizing lost income, they implemented a system where subscribers could pay a small monthly fee (as low as $6.99) to add users outside their households. This crackdown on password sharing has also contributed significantly to subscriber growth.

Competition and valuation risks

As just mentioned, my view is that NFLX now begins to face a saturated market, at least in the North American market. The streaming market is crowded with competitors like Disney+, Hulu, and HBO Max. These players are constantly producing new content, making it harder for Netflix to retain and attract subscribers. Thus, Netflix’s recent subscriber gains might be due to one-time effects like the ad tier and password-sharing crackdown. These may not be sustainable sources of long-term growth.

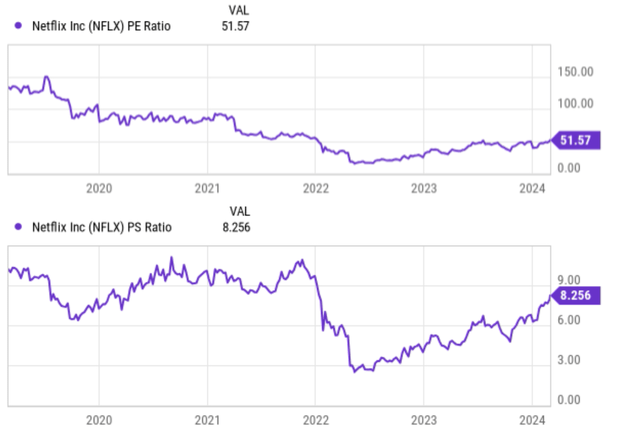

In the meantime, at its current price levels, NFLX also faces sizable valuation risks the way I see it. As seen in the two charts below, the valuation ratios for NFLX, ranging from bottom line metrics like the P/E (price-to-earnings) ratio to top line metrics like P/S ratio, are at elevated levels both in absolute and relative terms. To wit, NFLX’s FY1 P/E currently stands at 36x, a large premium relative to its close peer Disney (which stands at 24x FY1 P/E). In top line metrics, NFLX’s current P/S ratio hovers around 8.1x, almost four times higher than DIS’ 2.3x. Such high valuation multiples suggest the market expects significant future growth to justify the current price. I see good odds for a price correction if Netflix’s future growth doesn’t meet the high expectations baked into its valuation.

Insider’s activities

Another downside risk worth mentioning, or you can view it as a reflection of the downside risks mentioned above, involves its recent insider activities. As you can see from the next chart, the insider transactions surrounding NFLX have been completely dominated by selling activities. To wit, in the past 3 months alone, a total of 51 insider actions were filed and 100% of these actions were selling. These activities accumulated to a total of $155.8M. In the last two weeks of February 2024 alone, both co-CEOs and two of its directors reported a series of selling tractions in a price range between ~$560 and $600.

Admittedly, insider selling does not send a definitive bearish signal as noted in my earlier article,

When it comes to insider activities, usually I pay more attention to buying activities than selling activities. The reason is that selling activities can be triggered by a range of factors irrelevant to business fundamentals (such as divorce or buying a new house). In contrast, insider buying activities usually have only one explanation – the insiders think the stock is undervalued.

Although when insider activities are so one-sided as in the current case of NFLX, it does get my attention. As aforementioned, to my mind, the current insiders’ activities are at least a reflection of the downside risks in the near term.

Other risks and final thoughts

While there are many general risks faced by all streaming services (such as the competition and market saturation risks mentioned above), there are a few areas where Netflix might have unique vulnerabilities. The top one in my mind is its heavy reliance on self-produced content. Unlike some competitors with access to vast back catalogs from established studios (and both DIS and WBD are good examples), Netflix heavily invests in its own original content. If their originals underperform or fail to generate the buzz they need, it could be a bigger blow to Netflix compared to a competitor with a more diverse library.

At the same time, the long-term impact of its ad-tier experiment is yet to be seen in my view. Netflix’s foray into the ad-supported tier is a new venture that has been successful so far. While it’s attracting subscribers thus far, it’s unclear to me how instructive the ads are to its subscribers, how this could impact the existing subscriber base used to an ad-free experience, and also how quickly other competitors follow the same strategy.

All told, as clarified upfront, I am not arguing a bearish thesis here. My thesis is that I see both positive and negative catalysts for NFLX. In the near term, I do not see a clear force that can drive the stock prices in a definitive direction. As such, I believe the stock is unlikely to continue its recent price momentum and conclude with a hold thesis.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.