Summary:

- Netflix stock currently has a forward price to cash flow multiple of almost 48x, which is 423% above the sector median.

- If Netflix truly wants to reduce churn and generate recurring subscription- and advertising- revenue, simply offering a cheaper plan is not enough.

- Competitors possess powerful bundling advantages, but Netflix’s potential in this space should not be underestimated.

Wachiwit

Since bottoming in May 2022 amid subscriber loss concerns, Netflix (NASDAQ:NFLX) shares have rallied by almost 180%. This has investors asking whether the bull run can continue? Gone are the days when investors assigned a valuation to Netflix based on subscriber growth and the streaming giant continued to deliver solid revenue growth year after year. The streaming industry is witnessing intensifying competition, resulting in slowing revenue growth. It is fair to say that the slowdown in subscription revenue growth has already been priced into the stock. The market is now focused on profits and free cash flow instead. Investors are keen to observe whether the evolvement towards an ad-based business model can lead to stronger profitability and free cash flow generation. Netflix’s growth prospects through the advertising avenue are indeed promising, and a bundling strategy can further strengthen the bull case. Nexus Research has a ‘buy’ rating on the stock.

Netflix remains the king of content, enabling it to boast a subscriber base of over 232 million in Q1 2023. However, its rich content library has not necessarily translated into enviable pricing power. While competitors have been raising prices, a few months ago Netflix actually cut prices in numerous regions to stay competitive and retain/add subscribers. The bears saw this as a confirmation of the fact that the streaming business model is flawed given the ease with which subscribers can cancel subscriptions and hop from one streamer to another depending on which new (or even old) shows they want to watch. This is indeed concerning for investors.

Amid slowing subscriber growth and doubts around the competitiveness of streaming business models, last year Netflix evolved its business model towards incorporating an ad-based monetization strategy.

Can Netflix succeed at advertising?

Last November, Netflix had launched an ad-supported subscription tier in some countries for $6.99/month. While advertising is a high-margin business that can boost Netflix’s profitability over the longer run, it is also a competitive industry where incumbents are strongly positioned to leverage troves of data on its users. Data is king in the advertising industry, as this is what allows ad-based platforms to target users with relevant advertisements, conducive to higher conversion rates. This raises the question; can Netflix succeed at targeted advertising?

Upon the introduction of the ad-based tier, the streaming giant stated:

“To help advertisers reach the right audience — and ensure our ads are more relevant for consumers — we’ll offer broad targeting capabilities by country and genre (e.g. action, drama, romance, sci-fi).”

Factors like ‘genre’ do hold targeting potency, as advertisers seek to build impressions of their products/ services while the audiences are consuming content related to what these merchants have to offer. On the last earnings call, Netflix executives emphasized that they will be working on improving their targeting capabilities. Obvious targeting factors would include specifications like age, gender, and time of day.

However, if Netflix truly wants to become a force to be reckoned with in the advertising industry, it will not only need to step up its data collection efforts, but also offer advanced conversion tools like ‘Buy/ Shop now’ buttons, or at least a ‘Save for later’ option.

For instance, the largest advertising platform in the world, Google, offers multiple services that grant it a treasure of data. Moreover, ad-targeting on YouTube is primarily informed by users’ Google search histories, enabling advertisers to be confident that their ads are being served to people that are at least somewhat interested, not just based on the content genre of the video they are watching, but also other activities. Therefore, as it stands, advertisers are likely getting more valuable ad solutions through Google than Netflix. This gives Netflix investors a reason to tame their ad-based revenue expectations, at least over the near-term while the streaming giant builds out its advertising business.

On the other side of the coin is the user experience. In May 2023, Netflix revealed that its ad-supported plan had garnered 5 million global monthly active users, signaling that there is certainly appetite for such hybrid subscription plans.

More importantly, this ad-based tier is also proving to be lucrative for Netflix, as in the Q1 2023 earnings release, they disclosed that:

“We are pleased with the current performance and trajectory of our per-member advertising economics. In the US for instance, our ads plan already has a total ARM (subscription + ads) greater than our standard plan.”

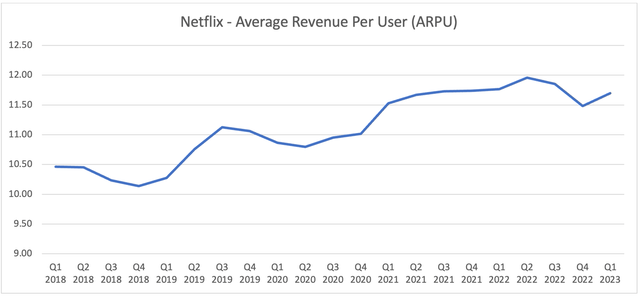

For context, the standard plan is $15.49 per month, while the ad-based plan is $6.99. This means that they are generating more than $8.50 of advertising revenue per ad-based user, and that’s on top of the subscription fee. And Netflix has only gotten started. As the streaming giant becomes increasingly able to offer more targeted advertising solutions, the revenue prospects should get even better. Hence, the growth in Netflix’s ARPU should accelerate thanks to growing advertising revenue.

Data compiled from Company filings

Nonetheless, investors are now more focused on profitability/ free cash flow than top-line revenue growth. Hence, the question is, will the lucrative ad-revenue flow down optimally to the bottom line? A notable amount of Netflix’s content library is still composed of third-party licensed shows/movies. Consequently, Netflix needs to pay extra to third-party content providers to be able to show ads in their content, and some content isn’t even available in the ad-based tier due to licensing issues. The exact cost implications with third-party content providers remains unknown, but we did get insights into executives’ margin expectations for the advertising avenue on the last earnings call amid interaction with an analyst:

Jessica Reif Ehrlich (analyst)

And then I just wanted to clarify something, Spence, I think you said, this is a 50% margin. I mean, typically, advertising could be as high as 80% or 85% margins. Is that — do you expect to build up to that or do you think it’s really just a 50%-plus business?

Spence Neumann (CFO)

Well, I put plus in there. So I said at least 50% and it was really just to highlight the fact that we are still in startup mode of this business and so leaning a little conservative. But, yes, our expectations over time is that it would be meaningfully over 50%, but I don’t want to give a specific number yet.

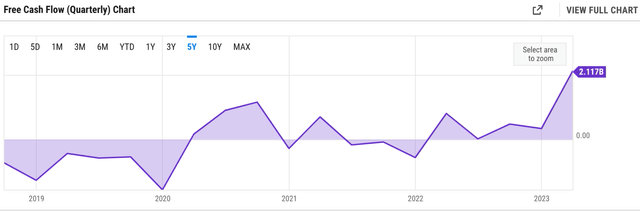

Advertising margins should improve as the proportion of original content on Netflix grows, as this eliminates third-party cost implications, allowing more ad dollars to flow to the bottom line. Producing their own content is indeed capital-intensive, but a strong advantage Netflix has over its competitors is its solid stream of free cash flow. On a trailing twelve-month basis, Netflix generated nearly $3 billion in free cash flow. Comparatively, competitor Disney generated $1.4 billion. This enables Netflix to spend more on original content and subsequently continue attracting subscribers.

Can advertising really reduce churn?

Investors are also observing whether the cheaper ad-supported plan can help reduce the churn rate for Netflix. The bulls want to see ad-based subscribers continue to roll over their subscriptions as the $6.99 fee should be less costly to maintain membership on a monthly basis. However, this could be more easily said than done.

Currently, ad-based subscriptions include 4-5 minutes of ads per hour, which appear in the form of 15-30 seconds, non-skippable ads playing pre-roll and mid-roll. Paying $6.99 per month while also having to sit through non-skippable ads is displeasing, which undermines Netflix’s ability to reduce churn. Though keep in mind that Netflix is still experimenting with how they deliver ads, and the ad experience should evolve overtime to stay competitive. In the meanwhile, people may still continue to unsubscribe/ re-subscribe infrequently depending on shows/ movies they want to watch that month.

Consider that competitor YouTube is completely free with a mix of skippable and non-skippable ads. Furthermore, with the rise of generative AI, YouTube creators are likely to be able to easily create high-quality content that potentially competes more commensurately with Netflix’s content. Hence, this alternative entertainment avenue may indeed undermine Netflix’s ability keep subscribers rolling over on a monthly basis.

If Netflix truly wants to reduce churn and generate recurring subscription/ advertising revenue, offering a cheaper plan is not enough. Netflix should instead focus on a bundling strategy.

Bundling strategy for platform loyalty/ recurring revenue

Streamers are increasingly adopting a bundling strategy (combining their video streaming service with other services) to try and induce consumer loyalty to their video streaming platforms in the form of longer-term commitments. In its 10k report, Netflix states:

“We have agreements with various cable, satellite and telecommunications operators to make our service available through the TV set-top boxes of these service providers, some of which compete directly with us or have investments in competing streaming content providers…In many instances, our agreements also include provisions by which the partner bills consumers directly for the Netflix service or otherwise offers services or products in connection with offering our service.”

An example of such partnerships includes an agreement with Comcast, one of the largest cable providers in the United States. Through this partnership, Netflix is integrated into Comcast’s X1 set-top box platform, allowing Xfinity X1 customers to access and stream Netflix content seamlessly alongside their traditional cable channels.

Furthermore, Comcast is also one of the largest Internet Service Providers (ISPs) in the United States. The collaboration with Netflix also involves a direct interconnection between Netflix’s servers and Comcast’s network, allowing for a more direct and efficient delivery of Netflix’s content to Comcast subscribers. This helps reduce congestion and improve streaming performance for Comcast users accessing Netflix. Note that this is just one example, and Netflix has similar partnerships with other cable providers and ISPs.

Netflix has also secured partnerships with various mobile operators. One such example would be the partnership with T-Mobile, a major mobile network operator in the United States. Under the partnership, T-Mobile subscribers who meet certain eligibility criteria can receive Netflix’s Standard plan as part of their T-Mobile subscription at no additional cost. This collaboration allows T-Mobile customers to access and enjoy Netflix’s streaming service directly through their mobile devices.

The marketing partnerships with mobile operators are vital to ensure accessibility and high-quality viewing experience through mobile devices, particularly in regions where content consumption through mobile devices is becoming increasingly prevalent.

These bundling partnerships are crucial to stay relevant in the increasingly crowded streaming space. However, several of these cable/ISP providers are offering their own streaming services that compete directly with Netflix, undermining the partnership strategy. Furthermore, mobile operators and cable/ISP providers don’t exclusively partner with Netflix, as they tend to offer numerous other streaming services as part of their bundled packages. Not all customers of the third-party partners may necessarily activate a Netflix subscription via the bundle, undermining Netflix’s ability to generate recurring revenue from these deals.

Netflix is also competing against other tech giants which benefit from wider-reaching platforms/ installed bases. These companies tend to offer multiple services that they bundle together with their streaming services, positioning them better to induce users to keep rolling over their packaged subscriptions on a monthly basis, as well as enabling them to collect a lot more data on their users for targeted advertising.

We already touched upon YouTube’s advertising advantage over Netflix, given Google’s access to users’ Google Search histories, Google Maps activities, etc. Google also bundles its YouTube Premium offering (ad-free version) with its other products, namely through the Pixel Pass, giving subscribers access to the Pixel smartphone upgrades along with other services too.

Amazon is another force to be reckoned with, as Amazon Prime members that seek to receive fast/free delivery benefits also gain access to its streaming service, Prime Video, as well as other Amazon services such as convenient grocery shopping. Given the multitude of Amazon’s services, it has become a beast at collecting user data, enabling powerful targeted advertising across the platform outside of Prime Video. This gives Amazon a significant advantage over Netflix.

Apple is another tech behemoth that enjoys an installed base of over 2 billion active devices. Not only is its streaming service, Apple TV+, pre-installed on its suite of hardware products, but it also bundles this service with other services like Apple Music and Apple Arcade, as part of the Apple One subscription offering. Note that Apple also has a growing advertising business, and is strongly positioned to collect data on its users through its multitude of services for targeted advertising.

Therefore, these tech giants are better positioned than Netflix to not only induce long-term subscriptions for a stream of recurring revenue, but also possess superior targeted advertising potential, better enabling them to attract advertisers.

In an effort to keep users knotted to their Netflix subscriptions, the streaming giant has been offering games alongside its shows/movies. While this is a start to expand its platform offerings, not all users will be interested in gaming. Hence, Netflix has a long way to go in terms of bundling its popular video-on-demand service with other appealing services to offer a stickier subscription offering that is difficult for users to sporadically abandon.

In fact, aside from the tech giants mentioned above, other video-on-demand competitors are also cleverly bundling their streaming services with third-party services to widen their reach and advance their ability to generate recurring revenue. More specifically, Paramount Global partnered with Walmart last year to offer the ad-supported tier of its streaming service, Paramount+, for free as part of Walmart+ subscriptions (Walmart’s version of Amazon Prime with various shopping benefits).

This is a competitive partnership as it keeps Paramount+ top of mind for loyal Walmart shoppers, especially given that the deal is exclusive (Walmart can’t offer other streaming services simultaneously). Walmart reportedly pays Paramount Global $2-3 per subscriber that activates the Paramount+ service. Moreover, while the granular details of the deal are unknown in terms of consumer data sharing, such a partnership does potentially open the door to Paramount Global gaining insights into consumer spending habits, conducive to better targeted advertising.

Therefore, in order to become a force to be reckoned with in the advertising industry, Netflix needs to lock in third-party partnerships similar to the Walmart+/ Paramount+ deal. This would not only help induce longer-term Netflix subscriptions, but also grant them access to insightful third-party data on its audiences for better targeted advertising, boosting advertising revenue prospects to the delight of Netflix shareholders.

Given that Netflix remains the most popular streaming service with the largest subscriber base of over 232 million, it should be able to win even more powerful partnership deals with companies across industries, conducive to being able to offer alluring subscription bundles to its users. Nexus Research expects Netflix to strike various commercial partnerships going forward to boost both subscription and advertising revenue, fostering the bull case for the stock.

Is Netflix stock worth buying?

Solid cash flow is vital in the streaming industry to subdue debt-financed content production. Netflix has been free cash flow positive since Q1 2022, offering a strong competitive advantage.

Though Netflix will need to prove it can deliver positive free cash flow on a sustainable basis, to be able to incrementally finance original content production, as well as other potential ventures to expand the Netflix platform for richer subscription offerings.

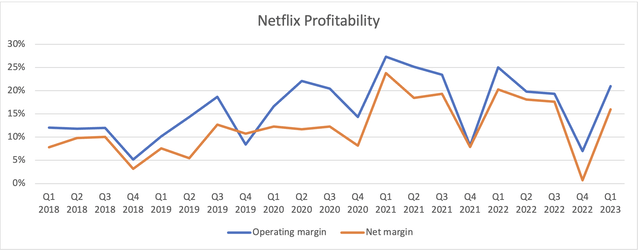

While Netflix is profitable, margins can waver amid fluctuations in production costs, content licensing renewals, and management’s judgment on the rate at which existing content should be amortized.

data compiled from company filings

Amid the expansion into advertising, investors could witness even more fluctuations in profit margins going forward, given the economically-sensitive nature of the advertising industry.

According to Seeking Alpha data, Netflix stock currently has a forward price to cash flow multiple of almost 48x, which is 423% above the sector median. The forward PE (GAAP) multiple is currently over 39x, 112.35% above the sector median. Netflix stock is indeed richly valued.

Though Nexus Research believes this is a stock worth holding given its promising growth potential through the advertising avenue and commercial partnership prospects. This should drive both subscription and advertising revenue growth. While the production of original content will require substantial cash flow, the growing proportion of original content in its library will translate to a larger portion of ad dollars flowing to the bottom line to boost profitability, and in turn cash flow.

Nexus Research has a ‘buy’ rating on the stock, but is mindful of the rich valuation. Hence, a dollar cost-averaging strategy is recommended to build a position in the stock over time in case the stock dips.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.