Summary:

- In a game of Show Me The Money: NFLX will win hands down over any other streamers, attributed to its positive operating margin and FCF generation.

- Combined with its three monetization strategies, we reckon the streamer will remain profitable, while moderately growing its subscribers.

- These factors alone prove that NFLX deserves its premium valuations, no matter the potential impact of the recession.

- We shall discuss this further.

Khosrork

The Aggressive Monetization Investment Thesis

Netflix (NASDAQ:NFLX) had proven us wrong indeed, by achieving higher Average Revenue per Membership [ARM] for its ad-supported tier in the US, exceeding the standard plan by FQ1’23. In retrospect, the streamer should have entered the advertising market sooner, despite the earlier cannibalization effect in early November 2022. Read our previous coverage here.

As a result, it was unsurprising that NFLX had been looking to further unlock top and bottom-line growth ahead, by upgrading the ad-supported tier’s video quality from 720p to 1080p, while allowing two concurrent devices ahead. We reckoned this strategy might potentially drive more subscription growth, at a time of password crackdown and rising inflationary pressure.

This was on top of the second initiative, paid sharing, which had also successfully overcome the initial cancel reaction through new account signups later on, as highlighted by the streamer in the FQ1’23 shareholder letter:

For example, in Canada, which we believe is a reliable predictor for the US, our paid membership base is now larger than prior to the launch of paid sharing and revenue growth has accelerated and is now growing faster than in the US. (Netflix)

Thirdly, NFLX also aggressively reduced its prices in different markets, while ramping up its localized marketing and product strategies, in order to expand penetration.

For example, this approach yielded net subscription growth in India by approximately +30% YoY, naturally accelerating the expansion of its FX-neutral revenue by +5 points to 24% in 2022. This was despite the reduction in its local subscription fee at between -20% to -60%. Given that the price impact only comprised less than 5% of the streamer’s global revenue, we concurred with the management that the endeavor had been a successful one.

With minimal incremental expenses, the combination of the three strategies above might trigger optimized monetization rates, further contributing to NFLX’s top and bottom-line expansion and subscription growth from FQ2’23 onwards.

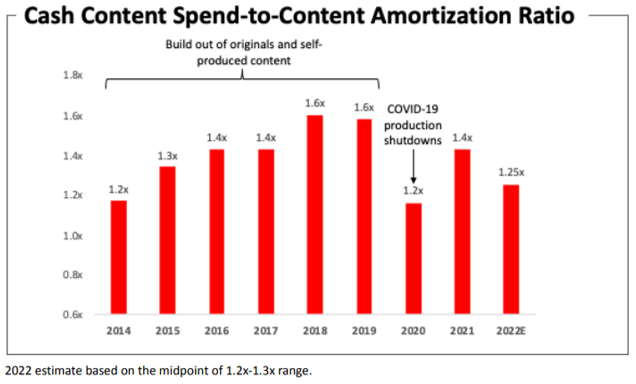

NFLX’s Content Spend To Content Amortization

NFLX

Combined with NFLX’s thoughtful moderation in Content Spend To Content Amortization to 1x in 2023, compared to the 2022 levels of 1.2x and 2019 levels of 1.6x, it was no wonder that the streamer had guided stellar Free Cash Flow [FCF] generation of over $3.5B (+117.3% YoY) for the fiscal year, against the original guidance of $3B.

Based on its current cadence, we may see the streamer record $32.72B (+3.5% YoY) of revenues and 10.6% (+5.5 points YoY) of FCF margins in 2023, demonstrating its excellent profitability indeed.

Assuming that the macroeconomics and top-line expansion improve ahead, we may also expect NFLX to accelerate content spending ahead at approximately $17B in 2024, similar to pre-pandemic levels, or even more depending on the resultant engagement cadence.

This stellar feat naturally stands out amongst its unprofitable streaming peers, such as Disney (NYSE:DIS) with D2C operating margins of -20.7% in FQ1’23, Warner Bros. Discovery’s (NASDAQ:WBD) projection of $1B in D2C profitability only by 2025, and Paramount Global’s (NASDAQ:PARA) peak D2C losses in 2023.

As a result of the improved FCF generation, NFLX also guides increased share purchases ahead, potentially expanding its EPS profitability through reduced share count.

With a minimum cash equivalent of approximately two months of revenue at $5.4B, we may see the management purchase up to $2.4B of shares over the next few quarters, attributed to its expanding balance sheet at $7.82B (+29.2% QoQ and +30.3% YoY) in FQ1’23.

This may translate to a further reduction in NFLX’s share count by -7.42M or -1.6% from the current 452.41M, based on its current share prices of $323.12. Otherwise, by -7.2M or -1.5%, based on its FQ1’23 share repurchases at an average of $333.

This strategy may potentially improve the streamer’s EPS by nearly +2%, further adding to the acceleration of its operating income growth at +8% based on the constant currency basis.

Furthermore, NFLX’s execution thus far has demonstrated its clear focus on balancing profitability and subscription growth, an objective that many of its streaming peers may have lost sight of. This cadence is also apparent in the management’s thoughtful expansion into the advertising market, one that includes multiple rounds of verification to ensure “incremental profit contribution.”

With “95% of viewing parity” and over 50% of profit contribution in the ad-supported tier by FQ1’23, we reckon that the streamer’s strategic plan of offering a lower-priced option has been highly instrumental in achieving both of its goals thus far, as opposed to DIS’ increased standard price plan.

Due to its early success, it may be a matter of time before NFLX records over 80% of profit contribution, as per industry standard, once advertising dollars return as the macroeconomic normalizes by sometime 2025, if not earlier.

This cadence may be significantly aided by the streamer’s choice of adding a “programmatic private marketplace” for advertisers, while improving consumer targeting and Cost Per Mile [CPM] ad network through the expanded advertising tools in partnership with Microsoft (NASDAQ:MSFT).

So, Is NFLX Stock A Buy, Sell, or Hold?

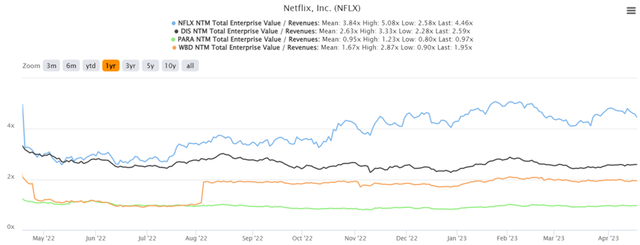

NFLX 1Y EV/Revenue

Due to the abovementioned factors, it makes sense that NFLX is currently trading at an EV/NTM Revenue of 4.46x, at a premium compared to its peers, due to the stellar top/ bottom line expansion and subscription growth to 232.5M (+0.7% QoQ and +4.8% YoY) in FQ1’23.

In addition, based on the market analysts’ FY2024 projected EPS of $14.32 and NTM P/E of 26.57x, we are looking at a moderate price target of $380.48, implying a decent upside potential of 17.7% from current levels.

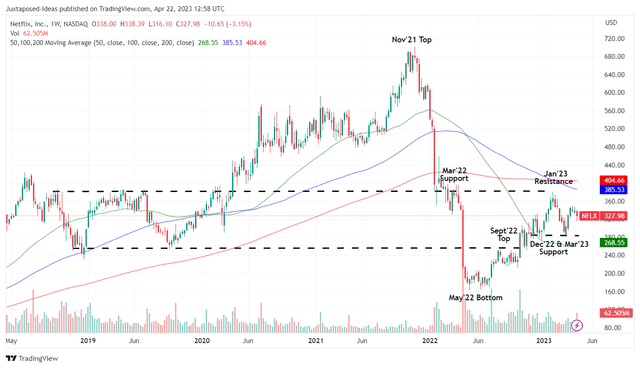

NFLX 5Y Stock Price

However, we prefer to prudently rate the NFLX stock as a Hold here. Interested investors may attempt to wait for further retracements ahead, preferably to its previous December 2022 and March 2023 support levels of $280s for an improved margin of safety. With more rate hikes coming and a likely recession by H2’23, we reckon there are still many excellent chances for adding in the short term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.