Summary:

- Netflix’s strategy to crack down on password sharing has resulted in a meaningful increase in subscribers.

- However, this success wasn’t a given, and the bear thesis has shifted from “it won’t work” to “it’s only temporary.”

- While the increase in subscribers may be temporary, the effects of the strategy are not, as they contribute to recurring revenue and strengthen the company’s content investments.

- The bottom line is the company has added excess revenue from this strategy, providing benefits for quarters and years to come.

wutwhanfoto

With Netflix’s (NASDAQ:NFLX) Q3 earnings report showing a significant bump in subscribers, many opinions have emerged about the relevancy and importance of its strategy to crack down on password sharing. The most interesting argument claims this bump is temporary and more or less one-time. However, a subscription-based model doesn’t generally have “one-time” subscriber events; in fact, adding paying subscribers is the apex of this business model. Subscribers, due to so-called “one-time” strategies or otherwise, have a compounding business effect as revenue is impacted positively for years to come, given the same or better churn rate as the prior cohort. While Netflix’s subscriber growth rate won’t be sustained at these levels, it pushes the company into the next level of recurring revenue, increasing its ability to finance content and thus expand its network effect and moat.

The Important Contribution Of Subscribers

Recurring revenue is the pinnacle of most modern companies, especially ones in the software or software-like sector. Subscribers are subscribers whether they are using Adobe (ADBE) software, cybersecurity apps, or entertainment platforms. The bottom line is subscribers in a subscription business model create financial predictability and consistency for a company. One could argue there are more “sticky” subscription products out there, and entertainment and streaming may be one of the weaker subscriber platforms. However, getting a subscriber to pay for something with an agreement for those charges to reoccur is a business-minded victory, regardless.

So when Netflix employs a strategy to force subscribers out of sharing passwords, it matters if the strategy creates a meaningful short-term bump in growth; those subscribers are now on the train like everyone else.

But more than this, the strategy to limit password sharing has shown to be successful by providing a meaningful increase in subscribers. And contrary to the same bearish thesis claiming its just short-term effects, the original intent to drive subscriber growth wasn’t a foregone conclusion. Netflix could’ve seen no traction from the strategy shift and mediocre gains in subscribers or, at worst, a loss of subscribers in protest. But because the success wasn’t a foregone conclusion, the bearish thesis has had to shift the goalposts from “it won’t work” to “it’s just temporary.”

Let me review the “it won’t work” idea first.

Proof Is In The Numbers

First, what was and is the goal of removing password sharing? Well, from management’s perspective, it’s clear: grow revenue via adding subscribers.

…[W]e expect to roll out paid sharing more broadly later in Q1’23…We anticipate that this will result in a very different quarterly paid net adds pattern in 2023, with paid net adds likely to be greater in Q2’23 than in Q1’23…as borrower households begin to activate their own standalone accounts and extra member accounts are added, we expect to see improved overall revenue, which is our goal with all plan and pricing changes.

– Netflix’s Q4 ’22 Earnings Press Release

And this would be in line with what I expect if I were a shareholder, to grow the top line. And to grow the top line with Netflix, adding subscribers must be the primary objective.

So, with that in mind. What have the results been since this went into effect regionally in Q1 and globally in Q2?

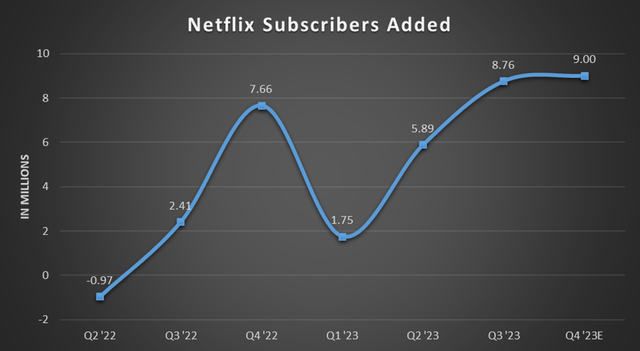

Chart mine, data from Netflix’s Earnings Press Releases

Outside of the seasonal impact generally seen in Q4, Q2 and Q3’s strength in 2023 has been well above the average. With management’s guidance for Q4’s subscriber growth to be similar to Q3’s, the strength of the trend this year appears to continue.

Clearly, with password sharing shifting to paid sharing, there has been a meaningful increase in subscribers. While some may say this is due to additions to its advertising tier, management claims only 30% of sign-ups in 12 countries starting in Q3 accounts for the ad-based subscriber increase. Therefore, even if 90% of all subscriber adds are in those 12 countries, 30% of the increase in Q3 equals 2.36M subscribers. Backing these out equals an increase of 6.4M subscribers, attributed mainly to the paid sharing strategy. This is still vastly more than Q2 ’23’s 5.89M and Q3 ’22’s 2.41M. Thus, the paid sharing strategy has undeniably boosted subscriber numbers – a very early success by my count.

Now, let’s move on to the “it’s just temporary” idea.

So What? It’s Only Temporary

Even if Netflix did manage to add millions more subscribers, reversing a trend of weakening and even negative quarterly growth just a year ago, it’s not sustainable and amounts to a “temporary” increase.

I put temporary in quotes because the number of adds throughout these quarters might be temporarily high in nature, but the effects are not. Netflix will carry forward these subscribers into future quarters and years.

Using my math above to deduce subscriber growth, Q2 and Q3 have provided an additional 10.7M subscribers. Assuming not everyone who joined in the last two quarters joined due to being kicked off their friend’s account, but a good majority were, I’ll take 70% of the 10.7M number for a fair guestimate. This leaves me with 7.5M excess subscribers in the last two quarters due to employing this sharing strategy. With a regional weighted average ARM (average revenue per membership) of $11.69 as of Q3, the company has future excess gains of $263M per quarter from just the past two earnings reports.

And with a weaker content slate expected in Q4 of ’23 than Q4 of ’22, the 9M estimated subscriber adds aren’t going to be driven by the same force management claimed drove its nearly 7.7M subscribers from last holiday quarter. Instead, much of it will be the continued effects of paid sharing. Assuming a lower 60% paid sharing contribution (instead of the 70% for Q2 and Q3) to account for seasonality, 5.4M will join due to getting their own account. This combines for 16.1M subscribers the company wouldn’t otherwise have gained in 2023 without this paid sharing strategy. It amounts to an additional $564.6M in revenue per quarter after Q4 or $2.26B annualized.

This “one-time” strategy bump allowed the company to bring in $2.26B on an annual basis it wouldn’t otherwise have received, and that’s just in the first three quarters of implementing it (I expect a decently long tail to continue). That pays for over 17% of the company’s content spend for 2023 and over 13% of its 2024 estimated content spend of $17B. This isn’t any small amount and allows the company to invest with a higher degree of confidence to maintain its streaming leadership position.

So, while I don’t expect subscriber growth to remain at elevated levels, the added subscribers’ effects are well beyond temporary. Assuming average churn rates – which management says it’s seeing due to the cohort’s time spent watching – the initial $2.26B is a gift that keeps on giving for years to come. In a word: compounding. And every investor I know loves to compound their results, and it’s no different with Netflix’s mission with this strategy.

Moving Forward With The “Temporary” Effects

While bears may say the effects are temporary, the only temporary aspect is the subscriber growth rate. But that doesn’t make the effects temporary; quite literally the opposite actually. In the near term, subscriber growth will be boosted by the paid sharing strategy. But the subscriber growth rate coming back down doesn’t return the revenue those 16M subscribers added. Subscriber growth is carried forward into the financials, and thus, the impact of the “temporary” strategy compounds as their revenue lives on.

Now, does this mean Netflix is set to soar back to the $600s as it once did? In the medium term, I’ve shown my paid subscribers there’s likely to be a continuation of the downtrend a little longer, with potential for a near-term rally in between on the back of this earnings report like we’re seeing now. But over the next year, I expect the stock to take off toward those high $600 highs once again as the company approaches 300M subscribers. I’ll be patient, though, and wait till the stock retraces toward the mid-to-low $300s, following my expectations for the downtrend to finish. I’ll be updating that technical chart analysis for my subscribers as time passes.

The bottom line is the company’s revenue growth will benefit significantly for quarters to come due to this strategy. It’s not just near-sighted to claim a one-time subscriber boost means nothing long-term, but narrow-minded because that’s not how subscriptions work. The added benefit of these subscribers is they are long-time viewers hidden under someone else’s account. This means their viewing habits are those of long-term subscribers; thus, their retention was known but merely hidden on the P&L sheet. Having their own account puts the dollars in the company’s pocket as they “should” have been doing all along. The benefit now is an accelerating revenue growth outlook, taking share from other streamers.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join My Tech Stock Group For More

Do two things to further your tech portfolio. First, click the ‘Follow’ button below next to my name – you’ll instantly get more content from me. Second, step up to being a paid subscriber to get the chart analysis and trade strategy from this article. I also provide four times more content (earnings, best ideas, trades, etc.) each month than what you read for free here. Plus, you’ll get ongoing discussions among intelligent investors and traders in my chat room.