Summary:

- Netflix reported a significant earnings increase.

- Revenue and both cash flow measures lag the earnings increase percentage.

- Competitors can monetize established franchises through diverse channels, while NFLX’s reliance on streaming implies continued use of free cash flow for acquisitions.

- Long-term earnings, GAAP cash flow, and free cash flow growth will be constrained by revenue growth.

- Management presents a bright future. But that bright future appears to grow the business in the teens (percentage rate of growth).

JHVEPhoto

Netflix (NASDAQ:NFLX) just announced a pretty good jump in earnings. However, just like the previous article noted, revenue and free cash flow have not followed suit. Eventually, profits can only grow as fast as revenue. Meanwhile, profits that grow faster than cash flow or free cash flow point to allowed but aggressive accounting. It strongly suggests that the depreciation component of the income statement is understated (although there are other possibilities).

A long time ago, back in 2016, I suggested that the “virtuous circle” idea that the company went public with, just was not working as planned. This was going to be an idea, that at current revenue levels, should be “printing money”. Compared to the market value of the stock, that has clearly not been the case.

Now, the company is so large, that management projects revenue growth in the teens. Therefore, the market needs to come to terms with what the long-term earnings growth will be as well.

This is before considering that Netflix is at a competitive disadvantage with both Warner Bros. Discovery (WBD), and Disney (DIS). Both of these companies have many more ways to make money from established franchises that Netflix does not appear to have. It would be hard to make a case for Netflix having anything more than hit series because building a true franchise takes a while. How the competition works out remains to be seen. But both companies (Disney and Warner Bros Discovery) are in the position of being able to break even on streaming while making money on games, clothes, movies, and even amusement parks (for example). Netflix is currently all about streaming, with some games on the way. That should imply that any free cash flow at Netflix will continue to be used for acquisitions to catch up to the models of the competition.

Earnings

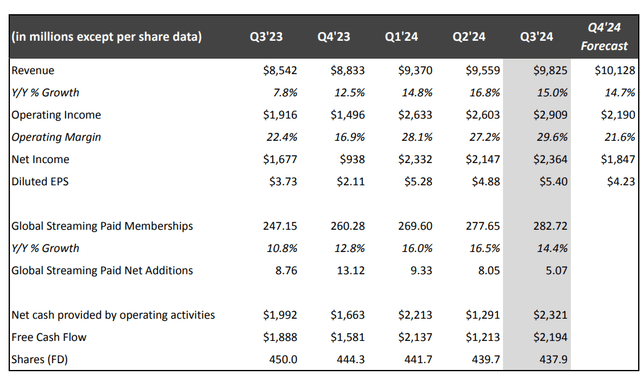

Netflix reported a big jump in earnings as shown below:

Netflix Third Quarter 2024 Operating And Financial Summary (Netflix Third Quarter 2024, Earnings Press Release, October 2024)

The earnings were $5.40 per share, compared with $3.73 per share the year before. But notice that net cash provided by operating activities only grew from $1,992 million to $2321 million. That is only a roughly 16% change in cash flow compared to the third quarter of the previous fiscal year. Worse yet, the last article noted that both free cash flow and the GAAP cash flow were down from the previous year (same quarter). On an annual basis, it is highly unlikely that cash flow growth will come anywhere close to approaching the earnings rate of growth.

More importantly, in the long run, earnings can only grow as fast as revenue because margin expansion is only going to be able to expand a finite amount. There is a similar argument to be made for cash flow growth.

During the conference call, management made a quality argument that should take precedence over “cheaper”. That should mean that cash flow margins are not going to be expanding all that much. The original “virtuous circle” argument may never be realized. It is, in fact, entirely possible that original cash generation ideas about this business may never happen.

There could well be a time period where “everyone grows” as this is a fairly young industry and Netflix is one of the first to be in the industry. However, being the first has not really allowed much in the way of cash generation, as shown above.

Stock Price Reaction

Right now, the stock price reaction appears to be completely divorced from any realistic valuation models that I know of. But then again, Mr. Market can stay irrational longer than I can stay solvent.

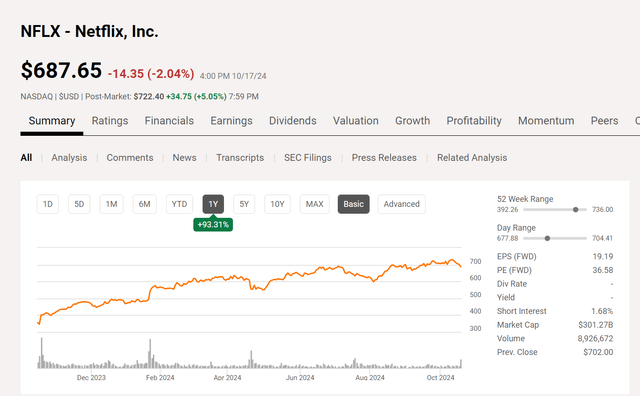

Netflix Common Stock Price History And Key Valuation Measures (Seeking Alpha Website October 17, 2024)

The price-earnings ratio shown above is about triple the projected growth rate (very roughly). That makes this stock a play for my technical friends who are having a lot of fun and raking in profits doing technical analysis.

But for a buy-and-hold investor, this stock is way too expensive given the future projections laid out by management. That is before you consider that this is one of the least diversified companies in the industry and therefore is very likely to use any free cash flow generated for acquisitions to catch up to the diversified models that appear to have a competitive advantage.

Management is projecting free cash flow in the $6 billion range. But that is only 2% of the current market cap. With a revenue projection in the teens, that cash flow growth is unlikely to meet normal market expectations for years to come. This is before the necessity to diversify noted before. Including that necessity could mean there will be no free cash flow for investors for years to come.

How long, profit growth can exceed revenue growth is anyone’s guess. However, with the management argument that quality should have more weight in the decision-making process over cheaper, one could likely argue that any cash flow growth will not exceed revenue growth for long. Both Disney and Warner Bros Discovery have reported a similar level of cash flow for their most recent fiscal years while reporting far less earnings. That may end up being a warning to investors about the earnings here. Both are very likely to grow cash flow much faster because of the diversification.

Summary

All of the above considerations make this stock a strong sell because it is way overpriced for the future prospects. The future prospects may be bright, but they are not bright enough to justify the current price-earnings ratio. There is a further consideration that management should probably choose a far more (but approved) conservative GAAP accounting, as the competition has done.

The market is currently excited about the subscriber growth and the earnings growth. However, the key growth to watch has got to be the GAAP cash flow and free cash flow growth. Sometimes lost in the market enthusiasm for growth and that “pot of gold at the end of a future rainbow” is the fact that any company is in business to make money. But it is just as clear that there is going to be relatively little to no money available to shareholders (especially when compared to the current share price) for some time to come (if ever).

When the market realizes that this company is reaching the maturity stage, there is likely to be a transition from a “story stock” which is what it is priced at right now, to a regular going concern company that is valued like any typical company.

This could mean a price-earnings ratio of approximately 14 in the future. If the stock price stayed where it is now, that likely would mean at least a couple of years of earnings gains before that ratio would be achieved. If the accounting system used more conservative assumptions, leading to an increase in depreciation (which would not change the cash flow reported), then it could take even longer for earnings to justify that stock price.

It is hard to envision any dividend for the foreseeable future, if ever.

Risks

The streaming business is currently in its infancy and the competition is beginning to heat up. There is likely to be a time period when all the competitors can grow market share. This could cause some complacency among Netflix shareholders that the current stock price is “safe”.

However, any growth situation in any industry has an upper limit. Netflix is already large, and the market value is getting larger. This is becoming a specialized situation for those who know how to handle it and know when to walk away.

Too many times, investors under-evaluate investment risk because the stock has gone up and is always going to go up. Therefore, what is the risk? “All I have is gains” is a refrain I have heard too many times until several years or even all the gains disappear. These stocks do adjust to normal levels. So, the question is: “what plans are you making for the day this becomes a going concern company valued like every other company out there?”. Generally, when it happens, multiple years of gains disappear very fast.

There is an old saying that sometimes the bears make money, and sometimes the bulls make money. But the pigs never make money. That saying is beginning to apply to this stock. It is time to leave this stock for very well-trained professionals who know how to handle the situation. My mailbox history has proven more than a few times what happens to investors who own a stock like this one for too long.

The loss of key personnel could materially set back the future plans of this company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor and this is not a recommendation to buy or sell a security. Investors are recommended to read all of the company's filings and press releases as well as do their own research to determine if the company fits their own investment objectives and risk portfolios.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies, related companies, and Neflix in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.