Summary:

- Netflix’s advanced AI-driven content strategy prioritizes high-quality, personalized content, boosting user engagement and willingness to pay, setting the company up for continued growth.

- Despite a high forward P/E ratio, Netflix’s superior growth prospects justify the premium valuation, making it an attractive investment ahead of earnings.

- The platform’s ruthless content pruning, removing underperforming shows, ensures a higher proportion of engaging content, enhancing user satisfaction and retention.

- Netflix’s main competition is from social media platforms like TikTok and Instagram, but its unique content strategy helps it maintain and grow viewer engagement.

Michael Vi

Co-Authored By Noah Cox and Brock Heilig.

Investment Thesis

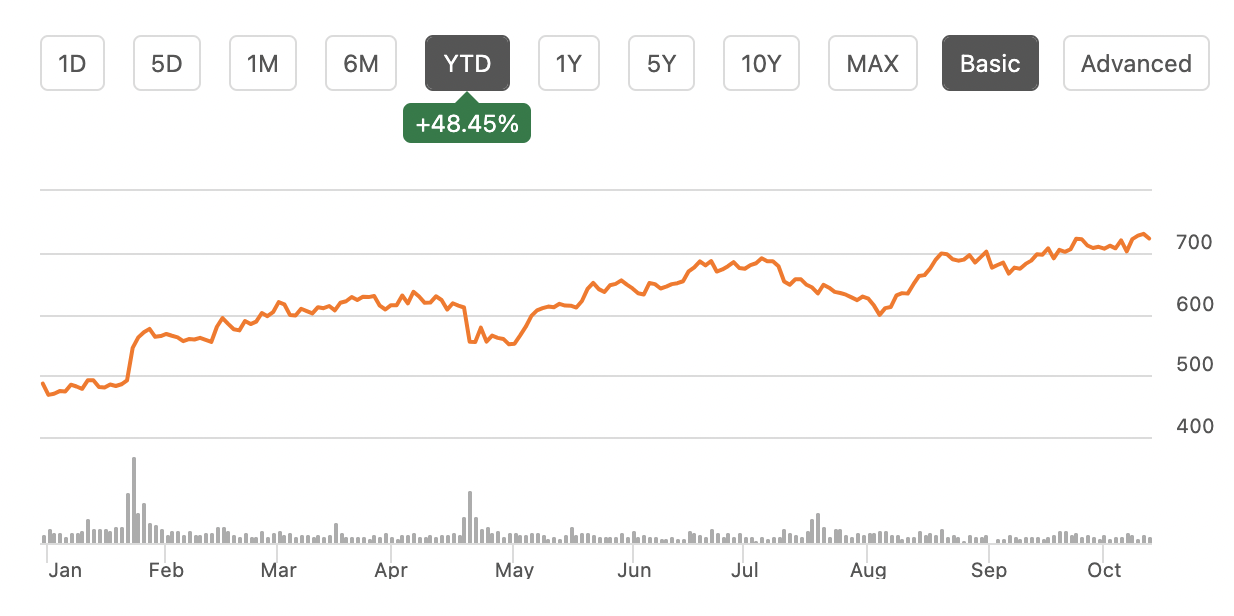

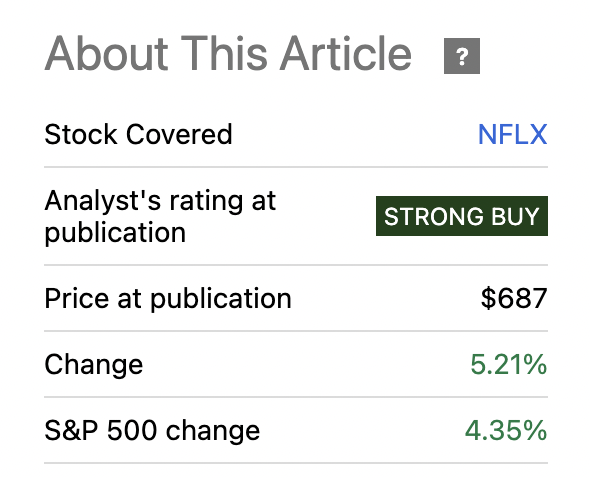

Netflix (NASDAQ:NFLX) shares are up over 5% since I last wrote about them in July. Year to date, shares are up 48.45%.

NFLX YTD Performance (Seeking Alpha)

However, despite all of their growth and strong operating performance, Netflix is honing in on a very unique problem: the company now has too much content on its platform (overwhelming some users).

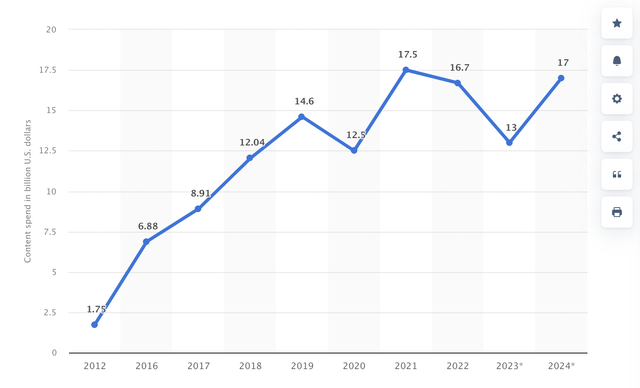

Netflix has spent over one hundred billion dollars over the last decade on content production for original TV shows & movies that air exclusively on the platform (with this year shaping up to be over $17 billion in content spending alone).

Netflix Content Spend (Statista)

The benefit of this is their content slate is that it’s one of the best in the industry (both based on user feedback and based on the streaming service continuing to win more Emmys than most other streaming services).

The struggle now is that they have to keep content carousels on the platform stocked full of new content to keep subscribers engaged (this is actually a complaint some users have explicitly expressed in some online forums).

What makes Netflix so successful is not the abundance of content, but the right content that appeals to each individual user. More individualized content that caters to each user means they watch more movies, they watch more TV shows and they have a higher willingness to pay for Netflix subscriptions (which Netflix continues to raise the prices on).

To help cater to each person’s area of interest, Netflix is now using advanced AI models paired with a disciplined content prioritization schedule to get rid of content that isn’t performing. While AI is not new for the streaming giant, this strategic content prioritization is. I think this is going to power the next leg up for the tech giant.

With this, I think shares continue to be a strong buy, especially heading into earnings this next week.

Why I’m Doing Follow-Up Coverage

Netflix continues to perform well, and have outpaced the market since the last time I wrote on them in July.

NFLX Performance (Seeking Alpha)

I’m honing in on their strategic content pruning because I do think that the company’s careful prioritization of content is a bit contrary to what you would expect from a traditional platform. Normally, you would just expect a good streaming platform to need an abundance of content and users would be able to find the content they’re looking for.

Management commented on their engagement growth on the last call. Not only do I think their content management is more unique, but it seems to be working:

Look, I think I talked about this a bit on the last call as well, but competition for entertainment is super intense and we compete for every second of view time we get. So beyond that, kind of the competitive intensity that’s always been out there, we also anticipated some headwinds in our engagement because of paid sharing. Remember, we’re taking folks who were watching Netflix and not paying-off the service. So we thought our engagement would go down…

…but looking at that same segment again, that segment’s engagement is actually not just steady, but up year-on-year. So we’re very excited about that. I think it’s a very healthy sign of engagement growth. And even with all of that, so beating down the headwinds of that and beating down competition, we’re still about 10% of TV time in every country we operate in. So still lots of room to grow, but very pleased with our engagement, but not fully satisfied -Q2 Call.

Netflix is starting to learn better than the users themselves what TV shows they like, and they are giving users new content to watch exactly when it’s needed and based on what their interests are.

It’s why they have been able to up engagement metrics even as the world of digital content has gotten so crowded (Q2 Call). In the second half of 2023, users watched a total of 90 billion hours of content on the streaming giants website. This number jumped to 94 billion hours by the first half of 2024.

For many tech giants, content is king. But ironically, less is more here.

I’m doing follow-up coverage to show how these little improvements in content are going a long way in helping the company compound. The purpose of this writeup is to show how this is setting them up well going into earnings.

Disciplined AI Content Strategy

What’s interesting about Netflix’s AI strategy is just how intricate the system is. It isn’t as simple as just suggesting new movies or TV shows based on what the consumer has already watched. There is a whole lot more that goes into it.

Netflix’s latest AI content model is multifaceted. The model assesses a portfolio of metrics, from whether you finished watching a specific show or movie to how quickly you watched the episodes of a series. They even look at users with similar content taste to see what movies and shows they’re watching and then making a best guess to see if you’d watch the same content as well.

Interestingly, Netflix even uses auto-generated thumbnails to appeal to the viewer.

Netflix AI works perfectly by examining thousands of video frames and capturing the one frame that is most appealing to the viewer—the thumbnail. Next, this thumbnail is displayed on the movie recommendation list, increasing the likelihood of people clicking on the movie or show.

This is the ultimate form personalized promotion. Thumbnails that appeal to each user makes content more appealing to each user’s content likes and tastes.

This next part is key: Netflix also monitors the success of each piece of content, and it disposes of the ones that aren’t performing well. The platform is in the process of getting rid of more than 100 movies and TV shows in this month alone.

Now that we know this, the strategy comes together. Netflix is using their proprietary AI model to filter out which shows are underperforming, and pushing their best content to the top so users can watch more of it and stay more engaged with the platform.

Q3 Preview

For earnings expected on the 17th after the bell, current consensus estimates are for EPS to come in at $5.11, according to a panel of 33 analysts. Revenue, meanwhile, is listed at $9.76 billion, which represents 14.31% YoY growth. EPS is projected to grow by 37.06% YoY.

Going into the upcoming earnings conference call, I’ll personally be looking for more information on how Netflix is optimizing its content strategy. Any additional details they can provide on how they’re being methodical with their content prioritization will likely make me even more bullish than I am today. I really see this content strategy as a unique selling point of their content platform.

In past conference calls, Netflix founder Reid Hastings has noted that Netflix’s biggest competitors aren’t even other streaming services like Paramount+ and HBO Max.

Instead, Hastings says it’s other social media platforms like Instagram, YouTube and TikTok that Netflix is competing with the most.

The cool part about Netflix as a platform is that they have a much greater level of control over their content suite than other social media giants (this is because platforms like Meta largely let users post whatever they want).

Netflix only posts approved content to their platform (the shows and movies they approve of). The result is that they have a much stronger control over the content they feed users.

For a company like Netflix, the number of high quality shows or movies on your platform is not the winning edge (most streaming platforms have high quality content now). It’s the proportion of high quality content that’s on these platforms that is key. Data backs this up as well. According to Reelgood:

…subscribers of the major streaming platforms currently have access to 36,674 TV shows and movies across the nine most extensive streaming services. However, based on their IMDb viewer scores, only 46% of that content is considered quality or high-quality offerings.

Netflix can win on content by having a higher proportion of their content deemed ‘high quality’ by users. Based on engagement hours, it looks like they already are winning.

Valuation

For all the value investors out there, I want to be clear: Netflix shares are obviously expensive from a traditional valuation standpoint, especially on a forward price-to-earnings basis. This is by no means a value play.

To me however, this makes complete sense. The company is set up for phenomenal growth over the next few years, and I think it’s easy to see why.

AI is helping increase the attractiveness of the content on their platform so consumers spend more time on the platform.

I think the forward price-to-earnings ratio for the streaming giant actually makes sense, and if anything, I think it’s actually undervalued.

The company trades at roughly 37.71 times the Non-GAAP (FWD) earnings. While this is a massive premium to the sector median of 13.50, I think it’s important for consumers and investors to understand that the company is significantly better than the sector median. Growth shows this.

In essence, investors are paying a 179.55% premium on the sector median P/E ratio with this forward P/E of 37.71, but that allows us to invest in a company whose earnings-per-share growth on a forward basis is set to come in a 318.70% above the sector median. So in the end, you’re paying a 179% valuation premium to access 318.7% better growth.

With this in mind, I think the company should trade at roughly a 200% premium to the sector median forward P/E ratio, which would represent about 11.7% upside.

Risks

As I previously mentioned, Hastings has noted historically that social media platforms are the streaming giant’s biggest competition.

One of the few struggles Netflix is having is making sure the eyeballs of the consumers are honed in on their platform, instead of on short-form content that is found on apps like Instagram and TikTok. It’s clear that consumer attention spans are dropping (one study shows that they have dropped by 25% from 2000 to 2015).

Netflix has to fight against this given most of their content is long-form content (greater than 10 minutes long).

Other social media platforms like Meta (META) are also implementing new AI features, which means the same AI core technology that Netflix is using to keep consumers is also driving consumers to take in more content on platforms such as Meta.

They’re clearly in the middle of a war for eyeballs. But frankly, I’m not concerned about this.

I think it’s clear that distraction headwinds are growing, but Netflix is powering through them (based on the Q2 call quote I mentioned before and the number of hours spent by users watching content on the platform).

Adding to this the proposed ban of TikTok in the United States, and this could allow Netflix to capitalize in a huge way. TikTok is one of their biggest short form competitors. Less distractions means more users watching more Netflix.

Bottom Line

Netflix has a fantastic system that is pruning content so their platform can be even more consumer-focused and centered around specific content desires. Their in-house AI models are catering to each individual consumer in a way that is just now uniquely possible. I’m really optimistic about this.

Netflix gets its consumers to watch more content by suggesting movies and TV shows that best fit their interests. This is a fantastic strategy that I think will become even more evident after this earnings report.

With this, I think shares continue to be a strong buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.