Summary:

- Netflix reported strong Q4 earnings, causing the stock to surge 8% after hours.

- There is high investor confidence in NFLX, evident from its valuation. The company’s simple and transparent business model is a key factor in this confidence.

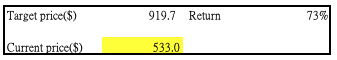

- Sensitivity analysis indicates a positive risk/reward profile. (72% upside/33% downside).

- The stock rating for Netflix has been upgraded from hold to buy. This decision reflects the undervaluation of the company’s potential despite concerns about competition from AI-generated content.

metamorworks/iStock via Getty Images

Netflix’s Strong Q4 Earnings and Stock Surge

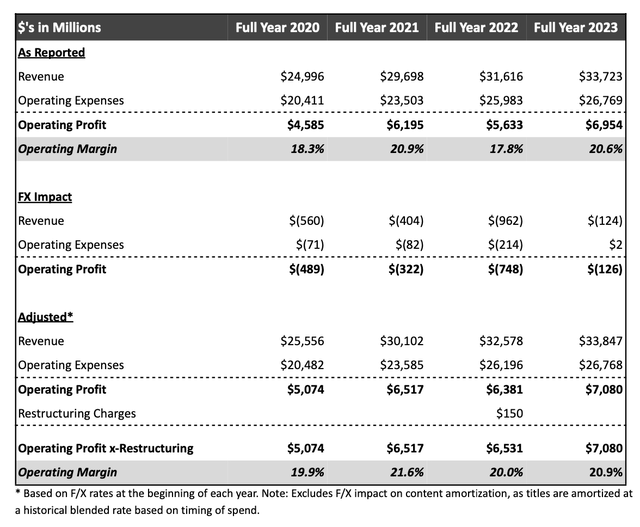

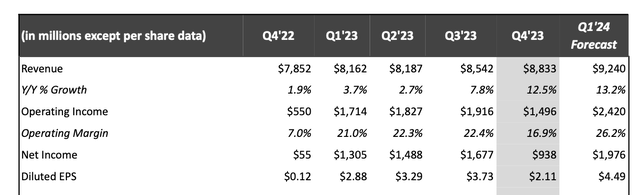

Netflix (NASDAQ:NFLX) reported strong fourth-quarter earnings on January 23rd, causing the stock to jump up 8% after hours. The company raised its full-year 2024 operating margin forecast from 22-23% to 24%, thanks to the weakening US dollar and financial performance that exceeded expectations.

Upgraded Rating: From Hold to Buy

We are upgrading our rating on Netflix from hold to buy, as we believe the current stock price undervalues the company’s potential. Our previous conservative outlook was based on concerns about competition from AI-generated content. However, it seems Netflix has not yet been negatively impacted, as it remains dominant in long-form video streaming. While AI-generated content poses a risk worth monitoring, excluding, Netflix has a solid position in the long-form video market, which continues to grow globally. The company keeps increasing its market share by expanding into new geographies and offering freemium plans. We believe there is still room for stock price growth from current levels.

Investor Confidence and Valuation

Investors have high confidence in management, as shown by the company’s valuation. This is common with businesses that have simple, transparent models. Let’s walk through a valuation exercise to illustrate why we’re fans of using discounted cash flow models.

In the Q4 earnings report, the company cited a $600 billion total addressable market, with its current 5% market share and less than 10% of TV viewing time.

It’s a $600B+ opportunity revenue market across pay TV, film, games and branded advertising – and today Netflix accounts for only roughly 5% of that addressable market. And our share of TV viewing is still less than 10% in every country.

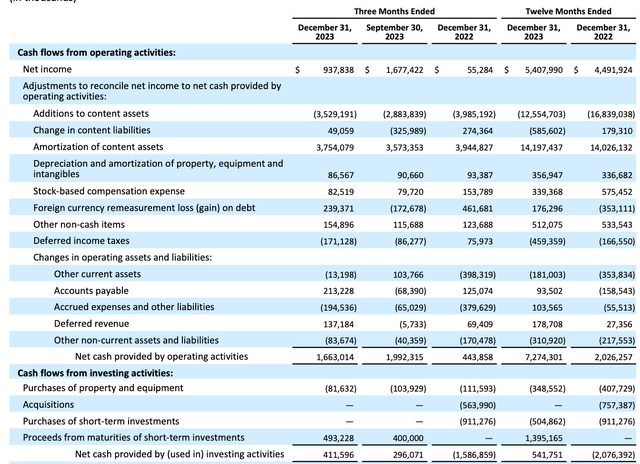

It also raised its full-year 2024 operating margin guidance to 24% and provided a 26% margin target for Q1 2024. Given that its 2023 operating margin of 20.9% aligns closely with the 20.7% free cash flow margin, it’s reasonable to assume a 25% long-term free cash flow margin.

Fair Value Estimate Based on DCF Model

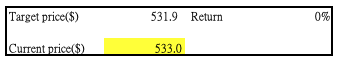

From there, we can make projections on revenue growth and margins to estimate future free cash flows. Applying an appropriate discount rate (7.2%) gives us a valuation that suggests the stock may be fairly valued at current levels. Plugging management’s projections into a discounted cash flow model, we arrive at a fair value estimate of around $532 per share. This aligns well with the market valuation after the earnings release.

DCF valuation (LEL)

This framework provides a data-driven approach to valuing this simple, transparent business model. We find discounted cash flow models valuable for assessing companies like this and determining if the stock price offers an attractive risk/reward profile.

Investment Strategy: Long-term View

For companies like Netflix, whose stock price closely tracks the latest data, it’s best not to trade every quarter. There can be a lot of volatility around earnings announcements. We find it more prudent to take a long-term view and hold through any near-term noise.

This reduces the risk of buying or selling on what could be temporary swings, rather than fundamental value shifts. While each earnings report provides helpful updated inputs, no single quarter makes or breaks the long-term investment case. As long as Netflix continues executing its growth plan and expanding its addressable market, we believe the stock has room to appreciate over a multi-year horizon.

Sensitivity Analysis and Future Outlook

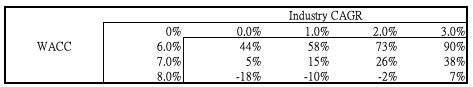

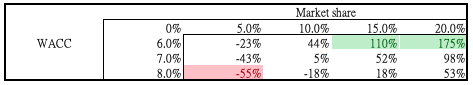

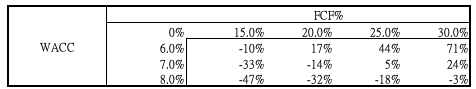

The real opportunity with Netflix lies in predicting its long-term financial metrics that aren’t yet reflected in the numbers. Let’s walk through a sensitivity analysis to see how different assumptions impact the valuation.

Factors like the discount rate, free cash flow, terminal growth rate, industry growth, and market share have uneven impacts on the valuation, as expected. We’ll look at each one sequentially, considering how conservative the base assumptions are and what evidence supports potential upside or downside adjustments.

Industry Growth

The 0% industry growth rate seems overly conservative, given the Fed’s 2% inflation target. Bumping the industry CAGR to at least 2% is more reasonable and would increase the valuation by 26% above today’s price.

LEL

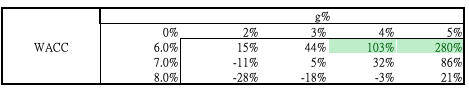

Terminal Growth

For the terminal growth rate, most investors use 3% to reflect a 1% premium over inflation for companies with pricing power. Netflix has demonstrated strong pricing power with its diverse global customer base. This also gives it a foundation to build bargaining power with advertisers over time, although its 260 million subscriber base is still much smaller than competitors like YouTube today. Given Netflix’s dominant position in long-form video and current profitable model, it’s reasonable to believe it can expand its user base and advertiser bargaining power in the future. So 3% seems appropriate given our belief in its pricing power.

LEL

Market Share

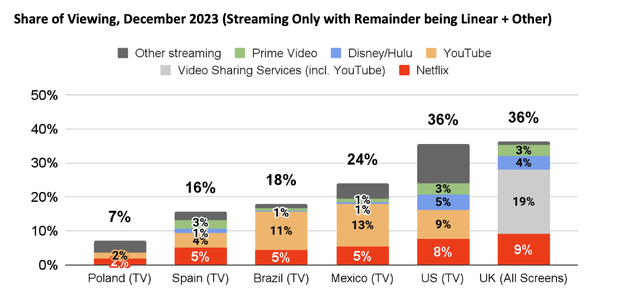

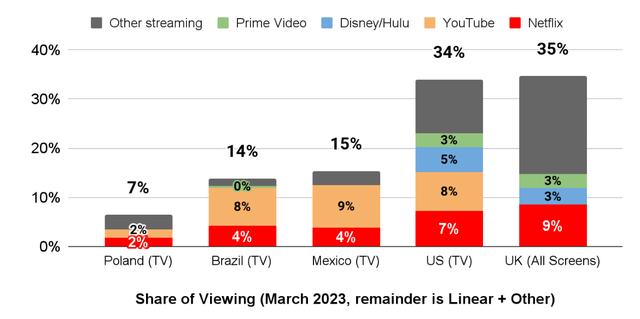

Looking at market share, Netflix currently has 5% of the total market and under 10% of viewing time.

It grew share about 1% from Q1 2023, helped by streaming continuing to take share from linear TV.

While penetration is rising in the relatively mature US market, Netflix has much more room to grow in emerging markets like Mexico and Brazil where penetration remains in the teens and twenties. Growing from 5% today to 10% in 10 years implies only a 5.9% CAGR according to our model, which seems reasonable given the outlook for teen growth in 2024. Using a 15% long-term share would increase the valuation by 52%.

LEL

Free Cash Flow Margin

Lastly, our 25% free cash flow margin assumption is supported by the 24% operating margin guidance for 2024 and the 26% target for Q1 2024.

There is a risk that expanding the lower-margin advertising business could reduce the overall margin. Dropping the assumption to 20%, in line with the last 3 years, would cut the valuation by 14%. And if advertising drags the margin below 20%, we’d need to model something like 15% given the 20% margin without ads historically. That downside scenario could produce a 33% stock drop from here.

LEL

This analysis gives us good visibility based on what we know today. Despite 33% downside risk, the potential 73% upside from modest industry growth and market share assumptions provides an attractive risk/reward profile.

LEL

Buyback

The recently completed $6 billion buyback, about 3% of the current market cap, provides an extra 4% of potential upside as well.

Competition Risk: AI-Generated Content

In our previous article, we noted that generative AI poses a potential competitive threat to Netflix by lowering content production costs for creators. Let’s look at an example to illustrate just how much cheaper AI-generated content (AIGC) could be.

With subscription services like Adobe Express ($9.99/month), Canva Pro ($14.99/month), or AIGC Koreado AI Pro (RMB599/quarter), creators can now produce animation videos within days. The “Bebefinn” example shows that AI-generated content can get 5.1 billion views in 18 months. This can translated to a $30*18/5.1 billion=$0.00000011 per view.

Compared to Netflix’s Red Notice at 230 million views for a $200 million budget, or ~$1 per view. Though the exact Bebefinn operating costs aren’t public, it’s reasonable to assume they are a fraction of a Netflix-produced movie.

Netflix tried using AI to create the animated short film “The Dog and the Boy.” But after announcing it on Twitter, Netflix Japan faced massive backlash and the discussion went viral, garnering over 3,000 replies and 7,000 quote tweets.

While we’ve seen more AIGC being used for short and mid-form videos on platforms like YouTube and TikTok, there are no major AIGC competitors yet in long-form video. There are a few likely reasons:

- Technical complexity – Producing long-form videos like movies or multi-episode shows is more complex than short clips. It involves more storylines, character development, and visual effects that pose huge challenges for current AI capabilities.

- Creative control – Directors and writers usually have stricter creative control over long-form projects. AI still can’t fully replace human creativity and nuance here.

- Experimentation and risk – Short videos have lower production costs, making them better suited for experimenting with new AI tech. Long-form projects are far costlier and riskier, so AI experimentation is less feasible.

While Netflix hasn’t faced real AIGC competition yet, this remains a major risk factor to monitor over time as the technology evolves. For now, human creativity, complexity, and control seem to give Netflix an edge in long-form storytelling. But AIGC’s rapid progress in other video formats reminds us disruption can happen quickly once technical barriers are overcome.

Conclusion

We are upgrading Netflix from a hold to a buy rating, as we believe the current valuation reflects an overly pessimistic view of the competitive landscape, especially regarding disruption from AI-generated content (AIGC).

There is no doubt that AIGC poses a potential long-term threat to Netflix’s business model and cost structure. We have seen rapid advancements in using AI to produce short-form video content at very low cost for platforms like TikTok and YouTube. However, we view the risk of near-term AIGC disruption in long-form video as uncertain.

Make no mistake, AIGC merits close monitoring as the technology evolves. But for now, we do not see evidence that Netflix’s competitive moat in long-form video is facing imminent disruption. Excluding the hard-to-predict AIGC factor, Netflix appears well-positioned to continue gaining share in the fast-growing global streaming market.

Its core advantages in content, creative relationships, and consumer experience look durable. Geographic expansion, penetration of underserved markets like India, and flexible freemium plans should further solidify its market position. Considering these positives, we see Netflix stock as attractively valued for long-term investors. We expect the risk/reward calculus to shift even further in Netflix’s favor as it continues executing well against its growth roadmap.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.