Summary:

- Netflix has provided three catalysts in the last two years, boosting subscriber growth and, subsequently, revenue growth.

- With these catalysts now providing tailwinds, the momentum won’t be sustainable without a more tangible catalyst outside of games and live events.

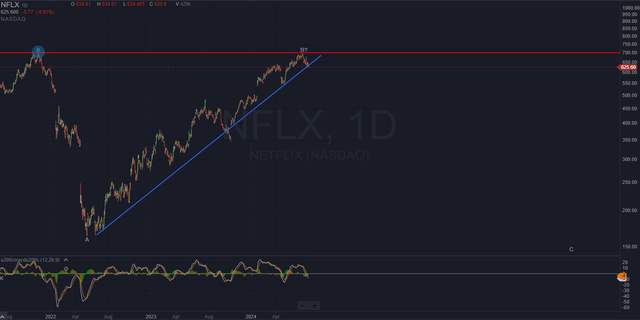

- Considering the cleared deck of catalysts and the chart making a double top while the trend is in danger, Netflix is now, at best, a hold.

bymuratdeniz

In November of 2022, Netflix (NASDAQ:NFLX) launched its ad-supported tier. It was less per month and had the potential to draw in the value-oriented customer, but it required sitting through ads while watching content. Then, in May of 2023, the company implemented its crackdown on password sharing. Instead of giving your friend, sibling, or parents your Netflix password so all of you can stream and split the bill (if they were nice enough), the company made it nigh impossible to have unfettered login access to your account. Now, per last week’s earnings report, the company has finally eliminated its basic plan. Management continues its streak of driving business catalysts to increase subscribers and buoy revenue growth, but have they run out of levers?

Conjuring catalysts to continue driving growth is really what mature companies deal with day in and day out, year in and year out. Many times, the original product has run its course, and innovation – the same innovation that launched the company – is needed to stay relevant and accelerate growth.

For Netflix, it has had to work the streaming angle, as its product (content) isn’t necessarily a naturally innovative area. Making TV shows and movies is what it is. Unless someone invents a new medium to tell stories, this is the realm it has to work in. Therefore, it must resort to catalyzing the business itself. In other words, how does streaming become more profitable and attract new users?

Recent Catalysts

The company has had a flurry of organic catalysts over the last two years, driving growth in subscribers and revenue. These were required if Netflix wanted to dig itself out of the difficult pandemic comps.

Ad Tier

The ad tier was a great way to attract new users because it positioned the company on the same value level as other low-cost streamers and still provided nearly all the content it produced. It was able to grow users at a faster clip than it had seen in years.

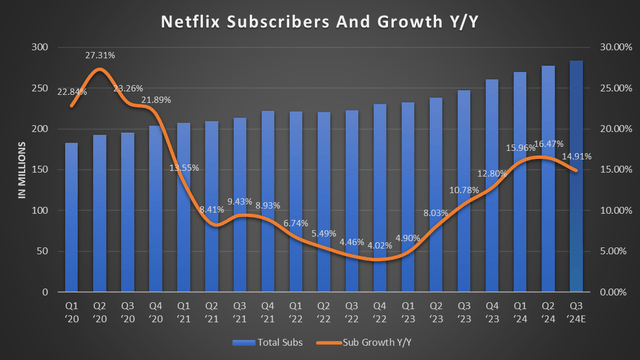

Netflix Subscriber Growth (Data from Statista/Company Filings)

Management had to overcome the pandemic effect, which saw massive user growth to the tune of mid-20 percent year-over-year in 2020, which crashed to nearly 4% in some quarters in 2022. To lift user growth, it needed to make changes. Adding an ad-supported tier would bring in users unwilling to pay double-digit dollars each month to stream non-live TV. And that’s just what it did. User growth accelerated in the quarters after the November 2022 launch. This was catalyst number one.

Password Sharing

It then followed it up by eliminating password sharing in mid-Q2 of 2023. This further accelerated growth, providing acceleration through this most recent earnings report on a year-over-year basis. I wrote an in-depth piece on how this wouldn’t be a one-time bump in revenue and how the strategy has ongoing effects on revenue. Not only did it provide further subscription growth, but it also provided compounding revenue growth since, after all, it’s a subscription service. This was catalyst two.

Eliminating The Basic Plan

Most recently, the company has sought to increase average revenue per membership (ARM) by eliminating the Basic plan.

Now, some might say the Basic plan hasn’t been available since the summer of 2023, which is true (as in you could no longer sign up for it). But anyone already on it has been allowed to continue their subscription. Only now will users be forced to subscribe to a different plan. For $3.50 more, members can upgrade to the Standard plan with HD quality and two concurrent streams, or they can go down to the $7 ad-supported tier, which “offers two streams, better video quality…” than Basic “…and downloads.”

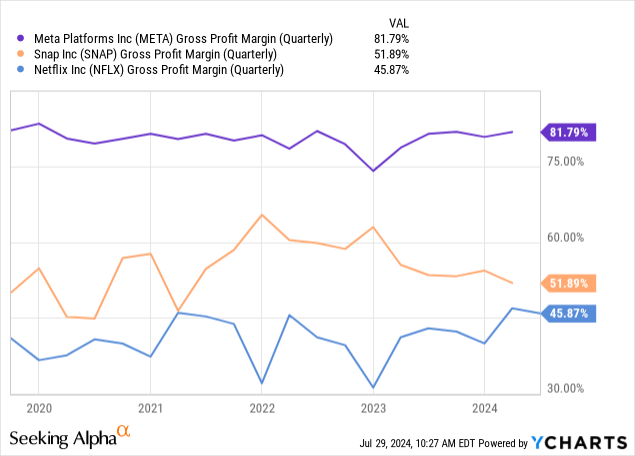

Some might expect this as surely a hit to ARM, as many will likely choose to “downgrade” to the ad-supported tier. But, as many know, the digital advertising market can have very high margins. Meta Platforms (META) sustains around 80% gross margins, while even Snap’s (SNAP) market-trailing performance sometimes sees upwards of 60% margins. With Netflix’s roughly 45% gross margins, ads are a net benefit once inventory and ad tech ramping finish. Advertising will likely meaningfully exceed its company-wide gross margin profile, providing a tailwind, not a headwind.

Management wouldn’t eliminate a tier if it thought users would swarm to a “lower” tier without added benefits to its top line. Management is almost encouraging this move because its ad tier provides much more than the $7 per month fee; it also provides ad revenue, potentially as much as the subscription fee itself, per subscriber. This has turned into the third and final catalyst.

What Catalysts Lie Ahead?

Stocks like catalysts; they provide events that cause movement in the shares. However, without further catalysts on the horizon, the company must rely on the momentum of the catalysts it has created over the past two years, but that won’t be enough.

With many easy levers now pulled, where does Netflix go from here?

The most typical solution is slowly raising subscription prices (something it has done over the years already), pushing ARM and overall revenue growth higher. However, the company can only make so many price increases until subscribers resist, and net subscriber adds flatten or go negative. In the best-case scenario, it’s a slow and tedious process.

This is where Netflix finds itself as a mature company: what product innovation comes next?

Gaming has been a push for a few years now, while live-streaming events and sports have been tested with at least mild success (certain live events have been canceled due to technical issues caused by running out of server and networking resources, like during its Love Is Blind reunions).

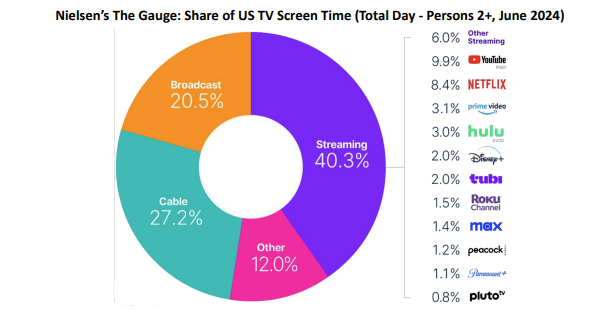

Having said that, if it can capture a larger piece of the market and attract more than just bingers of TV shows and movies, it can grow its market share of TV time.

Netflix’s Q2 ’24 Shareholder Letter

But those initiatives aren’t going to produce revenue or subscriber growth as quickly as the levers it has pulled over the last two years. The catalysts of the last two years shored up its weak areas or places where subscribers were taking advantage of the system. But with those avenues now providing tailwinds instead of headwinds, the company’s strategy must evolve into product innovation. Games and live events could do it, but the company needs to execute better than it has to gain momentum. Moreover, by doing so, it’s entering another arena of many competitors – not dissimilar to its current arena.

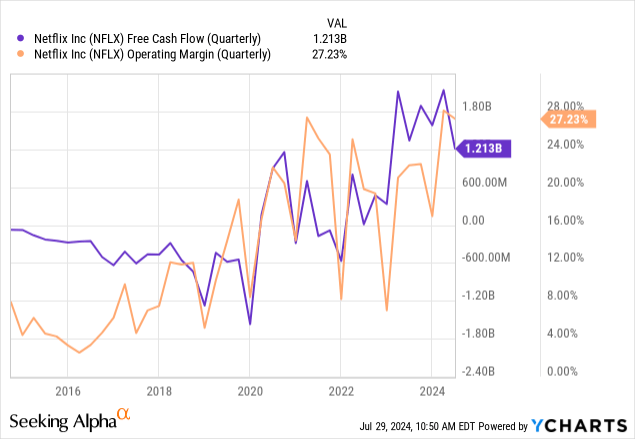

The upside is the company is profitable and sustainable with decent free cash flow at this point in its maturity, providing a consistent backstop to expensive content creation, which it must continue to produce to stay on top.

But the types of strategies left in management’s toolbelt are longer-term and more out of their control. Just because they may have games and live events doesn’t mean subscribers will come pouring in, not like an ad tier to shift the value proposition to consumers or directing households to get their own accounts (or add-on accounts for a cost). Those are immediate, tangible catalysts – which, by the way, could have backfired but didn’t.

Where Does The Stock Go From Here?

At this point, what’s to drive Netflix higher after hitting a double top all-time high on its chart – not to mention the trendline looking in trouble? Management needs to provide a new in-its-control catalyst to push it higher.

Meanwhile, sentiment for bulls looks to be in trouble, and there could be a fairly decent correction in the stock. Due to the clearing of the catalyst deck and nothing appearing on the horizon, combined with the chart’s weakening outlook, sentiment may have peaked.

At best, Netflix is a hold, and at worst, a several hundred-dollar correction could be on its way over the next six to eight months. While management has done well for its business over the last two years, it may have fired its last easy shot.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join The Top AI And Tech Investing Group

Do two things to further your tech portfolio. First, click the ‘Follow’ button below next to my name. Then sign up to be a free member of my investing group Tech Cache. You’ll get more free content from me, no paywall, and no credit card. If you want the trading strategy and technical chart analysis of the article you just read, step up to being a paid subscriber with a two-week free trial and read it immediately.