Summary:

- Netflix had a solid first quarter with revenue of $9.37 billion and an increase in paid members.

- The company’s focus on generating advertising revenue has been successful, with ad membership growing by 65% in Q1.

- Despite positive performance, NFLX stock has become pricey and a movement toward opacity, leading to a downgrade to a ‘hold’ rating.

Giuliano Benzin

When it comes to streaming, probably no company is as well-known as pure play streaming giant Netflix (NASDAQ:NFLX). The company offers the largest single streaming service on the planet and, despite fears to the contrary, it has, over the years, defied expectations and achieved rather remarkable growth. Some of this has even come at a time when the market was fearful that the streaming markets were saturated. And it’s all a testament to good management, good branding, and high-quality content.

For a long while, I was skeptical about the company as an investment opportunity. This was because of how pricey shares were and because I was worried that the lack of non-streaming sources of revenue and cash flow would result in other players coming into the streaming space outspending it to build more robust services with massive libraries of content to support them. While shares have remained pricey, the latter fear proved to be wrong, at least up to this point, as other streaming services have aimed to cut costs by reducing content spending, and as growth achieved by Netflix has accelerated.

Ultimately, this led me to upgrade the stock from a ‘hold’ to a ‘buy’. That occurred back in October of last year. And since then, shares have shot up 50.9% while the S&P 500 is up 16%. And since my last ‘buy’ article on the company in January of this year, shares are up 13.5% compared to the 2.5% rise seen by the broader market. Unfortunately, all good things must come to an end, though. And based on results just released covering the first quarter of 2024, I believe it’s appropriate to downgrade the firm to a ‘hold’. Believe it or not, this has less to do with the actual results posted by management and more to do with how pricey the stock has become. But in addition to that, another development occurred during the quarter that flashes warning signs to me.

A solid quarter

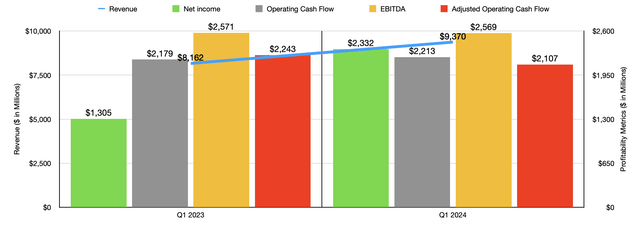

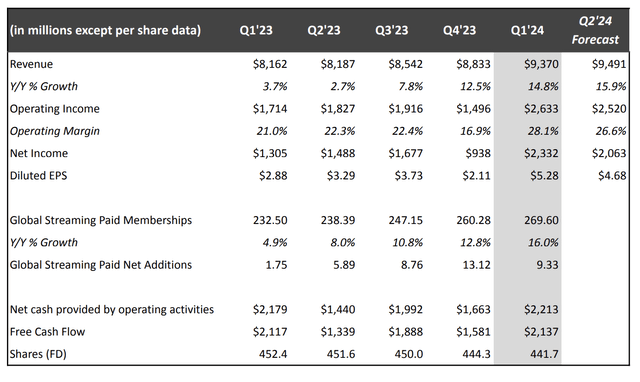

Fundamentally speaking, Netflix had a really solid quarter. Revenue, for instance, came in at $9.37 billion. This represents an increase of 14.8% compared to the $8.16 billion generated in the first quarter of 2023. In addition to this, it’s $90 million higher than what analysts anticipated, and it’s $130 million above what management had forecasted. While the company has started generating revenue from advertising, the bulk of its growth seems to have come from a rise in the number of users on the platform. The number of paid members totaled 269.60 million during the first quarter of 2024. That’s up 9.32 million, or 3.6%, from what was seen one quarter earlier, and it happened to be 37.10 million, or 16%, higher than the 232.50 million that the company reported for the first quarter of 2023.

Those who follow the company closely might recall that management has been focusing more on generating advertising revenue. Not long ago, the company even launched a version of the membership that includes advertisements. So far, that seems to be working out quite well. Ads membership grew by 65% in the first quarter of the year compared to what it was in the final quarter of 2023. That was after rising 70% from the third quarter to the fourth quarter. According to management, over 40% of all signups in its ads markets came from its ads plan.

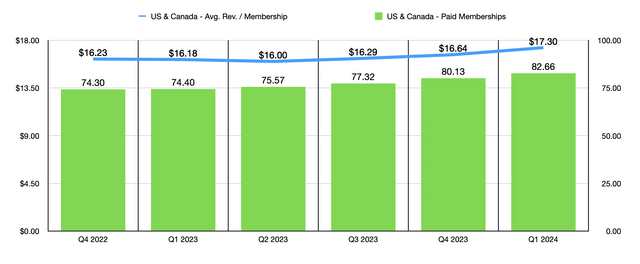

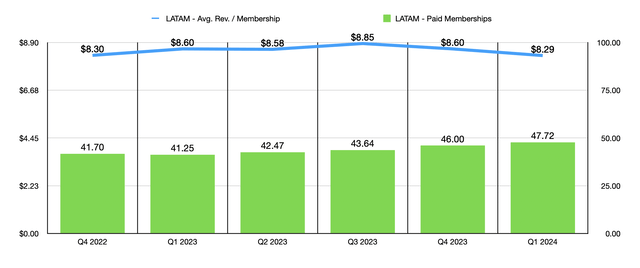

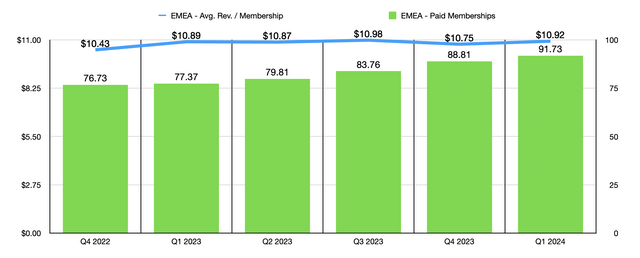

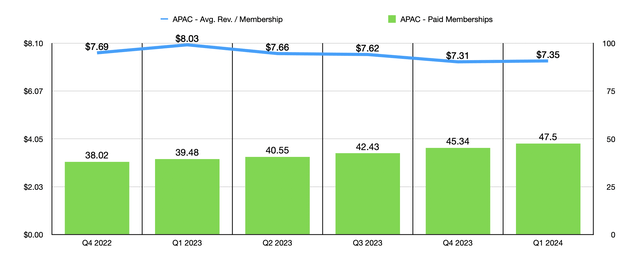

Geographically speaking, growth in subscriber count was achieved across the board. In the US and Canada region, the company achieved 82.66 million paid members during the quarter. That’s up from the 80.13 million reported for the third quarter, and it compares favorably to the 74.40 million reported one year ago. In the EMEA (Europe, Middle East, and Africa region, the subscriber count was 91.73 million. That’s up from the 88.81 million reported in the fourth quarter of last year, and it compares nicely to the 77.37 million reported the same time last year. In the Latin America region, the company boasted 47.72 million subscribers. That’s up from 46 million one quarter earlier and up from the 41.25 million reported one year ago. And lastly, in the Asia Pacific region, the 47.50 million paid members beat out the 45.34 million reported only three months earlier, and it beat out the 39.48 million reported one year ago.

As much as I would like to say that revenue per membership increased, that was not the case in all regions. As you can see in the chart above, the company saw a drop in average revenue per membership from $8.60 in the final quarter of last year to $8.29 the first quarter of this year when it comes to the Latin America region. But in all other regions, the company posted respectable growth. Most notably, in the US and Canada, average revenue per member totaled $17.30. That’s up 4% in just three months, and it’s up 6.9% year over year. While this may not sound like much, when you apply this increase to the number of paid members that the business had across the US and Canada in the first quarter of the year, it works out to an additional $1.11 billion in revenue.

On the bottom line, the picture was largely positive. Earnings per share of $5.28 dwarfed the $2.88 per share reported one year ago. It was also $0.76 per share greater than what analysts anticipated. Plus, it was $0.79 per share, or $356 million, higher than what management had forecasted. To be fair, not all of this is because of a growth in revenue and cost-cutting. The company did benefit from a $131 million non-cash unrealized gain involving foreign currency remove measurements on its euro denominated debt. But even without this, the bottom line came in better than expected. Other profitability metrics were not as impressive. Operating cash flow inched up only slightly from $2.18 billion to $2.21 billion. But if we adjust for changes in working capital, we get a decline from $2.24 billion to $2.11 billion. Meanwhile, EBITDA for the company fell by $2 million, though it still rounds out to $2.57 billion at the end of the day.

It’s also worth noting that the company came out with some rather rosy guidance for the second quarter of the year. If all goes according to plan, revenue in the second quarter should be around $9.49 billion. Analysts were anticipating $9.28 billion. Earnings per share, meanwhile, is expected to come in at around $4.68. That compares favorably to the $4.54 per share that analysts had been forecasting for the second quarter of the year. This shows that management is doing well, not only from a revenue perspective, but also when it comes to profitability.

Given how solid the quarter happened to be, you might be surprised that I’m downgrading the stock. But it really boils down to two reasons. First and foremost, shares have gotten quite pricey. As I mentioned near the start of this article, shares are up, excluding the after-hours share price decline of 5%, 50.9% since I first turned from neutral to bullish on the company last year. If we use results from 2023, the stock is trading at 34 times the price to adjusted operating cash flow multiple. Meanwhile, the EV to EBITDA multiple of the company is a hefty 29.1. I recognize that growth has been attractive as of late. That’s especially true for a company of this size. But I have a difficult time digesting such a lofty multiple. This doesn’t mean that I am pessimistic about the company from an operational standpoint. In fact, there is a lot that investors have to look forward to.

In a turnings release, for instance, management announced a number of interesting points and a change in how they are going to be doing business moving forward. Viewership, for instance, for many of its top shows has been absolutely phenomenal. During the first quarter alone, Fool Me Once, brought in 98.2 million views. There were other big name shows as well. Griselda brought in 66.4 million views, while Avatar: The Last Airbender brought in 63.8 million views. One movie, Society of the Snow, boasts to 98.5 million views, making it the second most popular non-English language movie of all time according to management. Another big win involved Damsel, which saw 123.9 million views. This was followed up by Lift with Kevin Hart at 113 million.

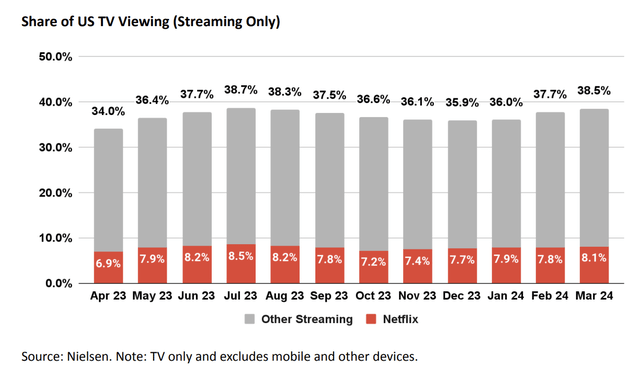

You would think that, with such big viewership numbers, the company would be dominating all video viewing. But you would be underestimating just how large the video viewing space is. According to management, the company’s share of total TV viewing is less than 10% in every country in which it operates. And even when you focus on the US market that the company has such a nice chunk of, it has only 8.1% of all TV viewing, which isn’t even a majority of the streaming market that accounts for a total of 38.5% of all TV viewing in the nation. Outside of content and things like that, it’s also worth noting that the company has been paying down debt and buying back stock. They paid down $400 million worth of senior notes during the first quarter of the year, using cash that was on hand. They also repurchased 3.6 million shares for roughly $2 billion. With 2024 as a whole expected to result in $6 billion worth of free cash flow, which is even after factoring in $17 billion in cash content spending, it’s likely that additional debt reduction will occur, and that more share buybacks will take place. However, given how pricey the stock is, I think the cash could be used for something more than share buybacks.

With this in mind, management did say that they intend to change matters moving forward. In the past, they’re always focused on maintaining gross debt of between $10 billion and $15 billion, with cash balances equal to roughly 2 months of revenue. They haven’t provided any real details, but they did say that they will move away from that, but with the goal of ensuring the existence of a ‘healthy’ balance sheet with ‘ample liquidity’. They did say that they have decided to upsize their revolving credit facility from $1 billion to $3 billion. But I don’t necessarily know if this will raise debt in the long run. If anything, it will create some additional volatility in how much debt exists from quarter to quarter. Management did say that they don’t plan to borrow in order to buy back stock, so that is a positive.

The one other thing that bothers me, besides how pricey shares are, is one of the other changes that management is making. This is that management has decided, effective with the first quarter of 2025, they will no longer be reporting quarterly membership numbers or average revenue per member. Their justification is that, as they start generating strong cash flows and as they start generating revenue from other sources like advertising and different types of memberships, that those are better metrics than the number of paid memberships and average revenue per member. I wholeheartedly disagree. These data points that they are forgoing will create opacity and will make it difficult to notice changes in growth and to potentially point out should the company start to see a decline in membership. I understand the need to come up with additional metrics. But the answer is not to do away with others in favor of new ones. Rather, it is to continue to report the old ones, while adding to them and modifying them as needed.

Takeaway

In the long run, I fully expect that Netflix will do well for itself. But this doesn’t mean that the company makes for a compelling opportunity right now. Shares have seen tremendous upside since I became bullish about the firm. But in all honesty, I view further upside as unlikely, at least relative to what the broader market will achieve. Because of this and because of the change in what the company plans to report starting early next year, I believe that a downgrade to a ‘hold’ rating makes sense.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!