Summary:

- Netflix has emerged from a period of immense growth and industry disruption, but that appears to be slowing down.

- The company leads against competition from other streaming platforms like Disney Plus, Peacock, and HBO Max.

- Their shifting focus towards engagement rather than total subscribers reflects the evolving media landscape, where platforms like YouTube and TikTok thrive.

- Current valuation seems to be in excess of growth outlooks, which is not helped by aggressive buybacks, and so long-term returns may not be optimal.

Photoboyko/iStock via Getty Images

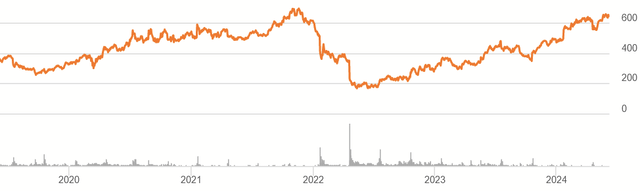

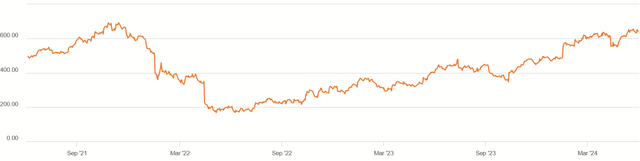

Netflix (NASDAQ:NFLX) pioneered the streaming-service industry. What was a novelty over a decade ago is now the standard for media consumption, thanks in large part to their work. After a long stretch of growth, the company turned positive cash flows a few years ago. In that time, we’ve seen how the market can change its mind about Netflix’s financial ability.

NFLX 5Y Price History (Seeking Alpha)

With a mature company and a newer media environment, it’s worth considering whether or not they will be a leader and trend-setter, as well as if the current price for shares of such a company is right. While I believe Netflix will continue to do well operationally and grow, I do not believe it will be like the past, so I think its current valuation makes it a Hold at best.

Financial History

Founded in 1997 as a rental service by mail, the streaming service we know today did not begin until 2007. This transition grew their subscribers from 7 million then to 269 million today. It’s not surprising, considering there was no other massive library of popular television shows and films quite like this.

I remember first subscribing in 2011 myself. Spotlighted was Tangled, Disney’s (DIS) 2010 adaptation of the Rapunzel story, which I had failed to see in theatres myself. I thus instantly found myself enjoying the convenience that Netflix offered. Of course, Netflix was already thinking ahead and began producing its own programming in 2013, with the launch of House of Cards.

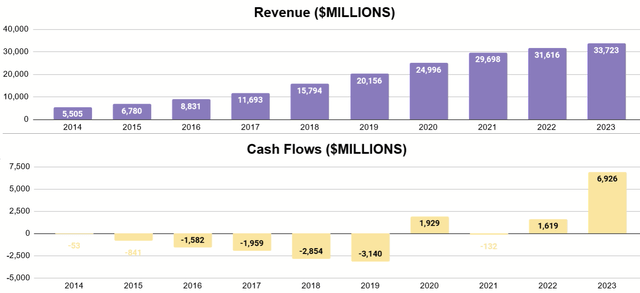

Financial Results (Author’s display of 10K data)

With this model set up, it became a matter of scaling it. Revenues have grown by 6x since 2014. Free cash flow finally turned positive for the first time in 2020 and came just under $7 billion in 2023.

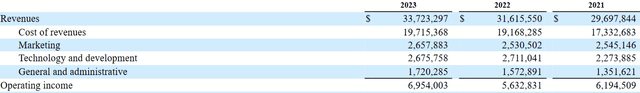

Income Statement (2023 Form 10K)

Nearly all of revenues have come from subscription fees (Form 10K, pg. 21). 44% of streaming revenues in 2023 came from North America, 31.5% from EMEA, 13.1% from Latin America, and 11.3% from Asia. All of these markets have room for further growth, with the latter two having the most potential.

Cost of revenues is the biggest drain, but this relates to everything they need to acquire and produce content. As such, I don’t expect them to be reduced over time.

What this financial history shows is that Netflix is going to have to grow revenues faster than it grows its operating expenses, while keeping capex minimal.

First Quarter Results

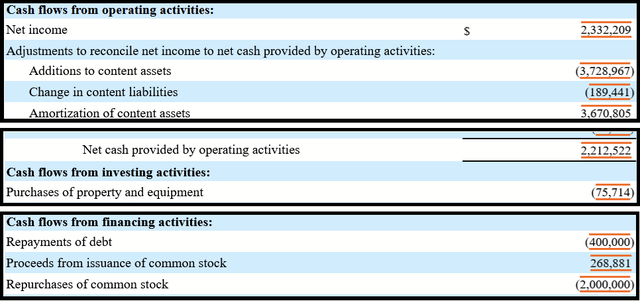

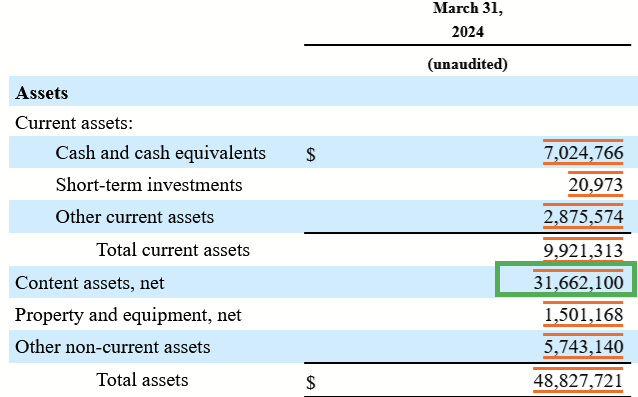

Now, let’s look at Q1. First, I want to focus on these snips of the cash flow statement that I think are instructive.

Cash Flow Statement (Q1 2024 Form 10Q)

Notice that about $3.7 billion was spent on “Additions to content assets,” which basically the licensing fees they pay for IP.

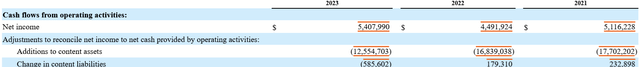

Balance Sheet (Q1 2024 Form 10Q)

Content is the biggest item on their balance sheet, about 65% of total assets. This is why they commit so much cash to it.

Cash Spent on Content (2023 Form 10K)

This is an important item to watch over time, as we can see that cash committed to content shifts by billions over the years.

After that expenditure for Q1, operating cash flows and low capex produced about $2.1 billion in free cash flow, nearly all of which was spent on share repurchases.

Future Outlook

Netflix generates positive free cash flow, but challenges have also crept up. Disney Plus was launched in 2019, Peacock (CMCSA) in 2020, and Max (WBD) in 2021, to name a few of the challengers. It also lacks as vertical of a runway of growth, starting at 269 million subscribers now instead of its initial 7 million. We therefore need to see what growth remains and how Netflix will allocate its capital going forward.

Engagement and Competition

During Q1 earnings, co-CEOs Greg Peters and Ted Sarandos were asked by analysts about their shift in emphasis away from total subscribers. Instead, they were going to focus more on revenues, profits, EPS, free cash flow, and metrics like that, to gauge Netflix’s success. Peters had to say:

But ultimately, we think this is a better approach that reflects the evolution of the business and it more matches and is consistent with how we manage internally to engagement, revenue and profit.

Engagement is the key detail. Sarandos quickly followed up with his own emphasis:

…why we focus on engagement is because we believe it’s the single best indicator of member satisfaction with our offering, and it is a leading indicator for retention and acquisition over time. So happy members watch more, they stick around longer, they tell friends, which all grows engagement, revenue and profit, our North Stars.

I think this is correct, and it’s where they will face a lot of competitive pressure. Folks typically think of Netflix’s competition being the other streaming apps I mentioned: Disney Plus, Peacock, Max, et cetera.

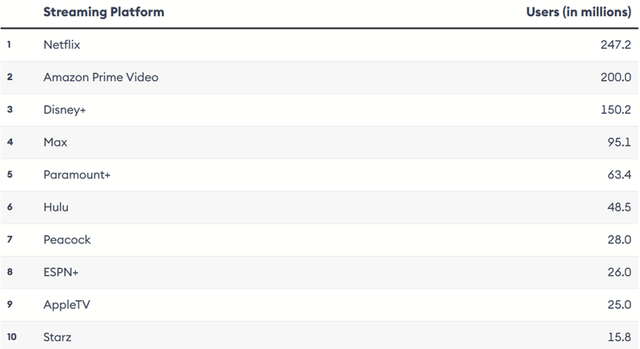

Streaming Services 2024 Subscribers (Forbes.com)

Shown above, Forbes reported that Netflix still leads the other streaming services in total users, and these are by pretty wide margins. I believe this owes to the fact that much of Netflix’s original programming is unique and even daring, whereas established media are largely milking new iterations of the same franchises. Similarly, Netflix is still a great resource to watch classic TV and films that aren’t as trendy and guarded.

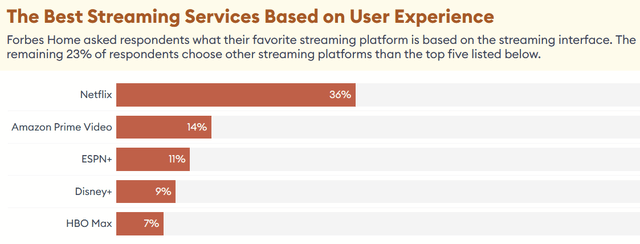

Forbes.com

That same article also mentioned that Netflix holds an even clearer lead in being the best experience for users, something that I think will give their model durability into the future.

Yet, I think that Forbes chart is incomplete, namely concerning other competition to what Netflix does, YouTube (GOOG) being a key example. We might also consider Twitch (AMZN) and TikTok as part of that market. If unique programming is a big part of Netflix’s remaining draw, then I would dare to say that these are their real competitors.

YouTube.com

This is a screenshot from a YouTube search. It shows a very popular documentary about a civilization experiment on a Minecraft server that lasted about two weeks. This video alone is over an hour, essentially a proper film, with over 23 million views. Several players made documentaries of their own point of view, many of which have hundreds of thousands of views.

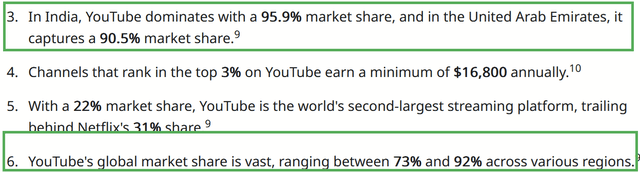

Linearity reported several metrics that show the strong position YouTube has, depending on which market you define. (YouTube is so adaptable that it provides multiple services beyond entertainment streaming.) If we go off of them, YouTube #2 to Netflix as a streamer.

Linearity.io

These data also show YouTube performing very well in international markets where Netflix would hope to grow more. Moreover, in their 2023 Form 10K, they note:

The market for entertainment video is intensely competitive and subject to rapid change. We compete with a broad set of activities for consumers’ leisure time, including other entertainment video providers, such as linear TV, streaming entertainment providers (including those that provide pirated content), video gaming providers and more broadly against other sources of entertainment, like social media, that our members could choose in their moments of free time.

This is the riddle of engagement. How much are people engaging with a platform, and who does it better? Netflix is beating their obvious competitors, but Disney and Warner Bros. do not account for their complete market. Independent creators have autonomy and direct relationships with their audiences. That’s about as engaging as it gets. People share YouTube links with their friends, automatic marketing. This unique material also now enjoys high production value. Even Sarandos noted YouTube as a competitor:

…some of that viewing is directly competitive with us, the same as it is with other media companies who provide content to YouTube by way of example. The art of this has always been finding the right balance of both. So, and also would point out that these platforms have been a way to have new voices emerge, and we’ve got our eye on them as well to try to develop them into the next-generation of great storytellers on Netflix.

I appreciate the opportunistic lens, that YouTube can be a pipeline for Netflix to discover folks, but that’s a tacit admission that creators worth acquiring will be on that platform first.

All of this to say: In addition to having to hold their lead against big media that finally started their own streaming services, Netflix is up against other platforms that have built up their resources to allow creators to fill similar voids of novelty that Netflix typically fills. It’s a tighter space than what Netflix faced 15 years ago.

Evolving Revenue Model

The second part of their shift to other metrics is the inherent weakness that became apparent in just counting total subscribers, as password sharing for free access became an issue. When asked more about this in the call, Peters said:

So rather than thinking beyond sort of specific cohorts or specific numbers, we really think about this more as developing more mechanisms, more effective ways to convert folks who are interacting with us, whether they be borrowers or folks that were members before that are coming back, we call them rejoiners or folks that have never been a Netflix member. So we want to find the right call to action, the right offer, the right nudge at the right time to get them to convert.

…the overall business growth now has extra levers and extra drivers like plan optimization, including things like extra members, ads revenue, pricing into more value, which is important. So those levers are also an increasingly important part of our growth model as well.

It’s an intelligent response, but it does speak to some of the risks of size, that growth is limited by networking effects and friends pooling resources, forcing them to fine-tune their monetization model. Netflix can call this a growth model, but it sounds akin to a return on equity model, similar to what I hear when I listen to insurers and lenders talk about how they select customers.

For that reason, I don’t expect growth like in the past, with huge gains in subscribers accompanied by large expenses in marketing, content acquisition, and capex on their studios. Rather, it’s going to be about delivering a level of quality that loyal users are preserved, as loyal users are natural promoters.

Capital Allocation

To that end, let’s talk about their plans for capital allocation. As I indicated before, the two big cash outflows are content and share repurchases, so this will be where the balance is struck. Sarandos spoke to the content side of it, answering an analyst on whether or not they would actually exceed $17 billion in spending for the year:

Look, independent of the availability of licensed content, you should look at it, I think we’re – we’ve always been very disciplined about the way we invest in the business and how we grow it. And we can get a lot of bang for our buck by spending our money well and producing our shows really well and also by acquiring the right content. And the floodgates have opened a little more on licensing for sure. But again, we’re very focused on the ones that we think will drive the business.

That says to me that they are very picky about what they acquire and how much they pay for it. That’s a good thing. Considering how large their library is, there’s no need to grow it too fast, especially if it doesn’t earn them new or continuing subscribers.

What’s interesting to me, though, is how this “bang for our buck” mentality doesn’t seem to exist for share repurchases. CFO Spence Neumann elaborated:

It’s really quite a modest evolution of our capital allocation strategy to better reflect our investment-grade status…prioritizing profitable growth by reinvesting in our core business, maintaining a healthy balance sheet with ample liquidity and returning excess cash beyond several billion dollars on the balance sheet of minimum cash and anything that we use for selective M&A to return to shareholders through share repurchase… any cash beyond that, we’ll return to shareholders.

It’s consistent with their history of share repurchases since cash flows became positive, all of which seem to occur even when Netflix trades at a high multiple. Currently, the market cap is $276B, for a business that only averages a few billion in free cash flow in recent years. It’s difficult to imagine a mega cap like Netflix is getting a good return on a multiple like that, and it’s something that I believe will weaken long-term returns over time.

Valuation

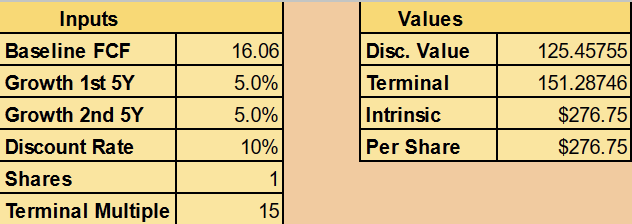

With all of that discussed, let’s do a valuation. I will use a Discounted Cash Flow model, with the following assumptions:

- $16.06 in FCF per share

- 5% average growth the next decade

- Terminal multiple of 15

$16.06 is 2023’s FCF divided by the current number of shares outstanding. I think the whole business could experience about 10% growth per year, uncovering these new revenue models, expanding globally, and maintaining the same relative costs. Yet, expensive buybacks mean that much of this will exit the business and not return to holders (like a dividend would). I suspect this means NFLX will eventually return to a more conservative multiple like 15.

Author’s calculations

With such assumptions, a fair value per share would be about $277. While I’m not worried about failure of the business, and long-term returns could easily be positive, I’m not convinced today’s investors get the best price.

NFLX 3Y Price History (Seeking Alpha)

Moreover, recent years show that such a price can show up, as the market feels moments of doubt and uncertainty about Netflix.

Conclusion

Netflix maintains its dominant role in entertainment media through streaming services. With a big lead over Disney Plus, Peacock, Max, and similar apps, they will have a bright future ahead. Loyal users will provide positive cash flows and have created a viewing culture that incrementally feeds growth.

At this size, however, they are being flanked by the rise of individual content creators, and both CEOs say engagement is the new strategic front. Where mainstream media apps lack this, platforms such as YouTube, Twitch, and TikTok thrive because user-generated content is inherently engaging.

With less growth ahead, the long-term returns are further complicated by capital allocation, with an eye only for buybacks and not dividends. Return on capital for share repurchases seems not to be a consideration at all. While the business itself is fine, price really does matter here, and until there is a better alignment between fundamentals and the business’s appetite for its own shares, NFLX is just a Hold for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.