Summary:

- Netflix experienced one of the sharpest declines during the recent bear market, declining by a staggering 75% from peak to trough.

- Remarkably, “investors” chased the stock as it peaked around $700, but many would not touch it as shares crashed to $170.

- Despite surging by over 100% off its lows, Netflix’s stock has considerable upside.

- Netflix has significant growth prospects and substantial earnings potential.

- The dynamic of a higher earnings multiple combined with better-than-anticipated profitability should enable its share price to appreciate substantially long-term.

simpson33

The last time I discussed Netflix (NASDAQ:NFLX) in a public article, I wrote about “buying the bottom” as the stock was ready to rebound from its bear market low. Incredibly, Netflix had cratered by a staggering 75% from its $700 inflated tech bubble top to an ultra-depressed low of just around $170 in early and mid-2022. Moreover, the stock traded in the exceptional $170-200 buy-in range for several months before surging in H2 2022 and 2023.

However, despite Netflix’s 115% rally from its lows, the stock remains inexpensive relative to its solid growth prospects and outstanding profitability potential. Furthermore, Netflix offers the best content globally while providing it on the world’s most trusted streaming platform. The company should continue growing revenues and EPS at double-digit speed for several (5-10) years, and Netflix’s share price should appreciate considerably as the company advances in the coming years.

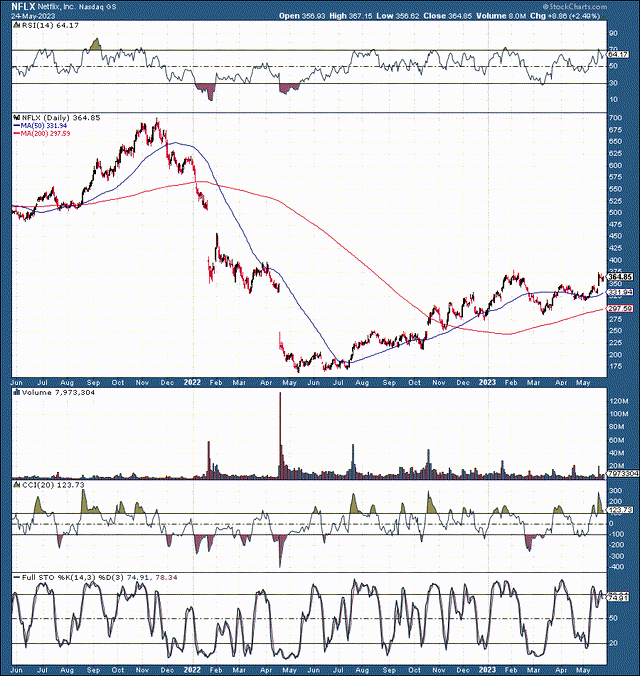

Technically – Netflix Should Go Much Higher

One of the factors that amazed me during Netflix’s recent fall from grace and subsequent recovery was that so many market participants chased the stock as it swelled into a bubble in 2021 at around $700 and then wouldn’t touch it with a ten-foot pole when it cratered below $175. Regardless, we witnessed an excellent buying opportunity in the $170-200 range, and I released several bullish articles on the stock as I picked up shares on the cheap during the bear market lows for Netflix.

Technically, we saw a capitulation-style bottoming process as the stock fell off a cliff in April and May last year. Then there was a constructive consolidation phase before the stock surged in July. The rest, as they say, is history. Nevertheless, despite the stock’s 115% rebound from its low, Netflix remains in a constructive long-term trend that should take the stock price much higher. We witnessed the 50-day MA moving above its 200-day MA.

Moreover, the steady RSI, CCI, and full stochastic suggest that the stock will likely continue appreciating. The stock has already filled the gap to around $350 and should fill the next gap to about $500 soon. Therefore, we see a positive long-term trend in the technical image, and the technicals could strengthen as we advance.

Netflix – Remains The Content King

While I’m not an acclaimed movie critic, I know what I’m talking about (in my view) regarding films and series. I scour the internet, continuously looking for something acceptable to watch. Have you seen some of the garbage they (the movie studios) offer today? It’s not some, but mostly junk, not worth watching. Nevertheless, if I had to watch just one platform, it would be Netflix, and here’s why:

Netflix offers the most diversified content – Many people may disagree with me, but Netflix offers the best and most diversified content. I know there’s no live sports or news, but Netflix is not here for that. If you want to watch the news, tune in to CNN or Fox. For sports, try the NFL Network or ESPN. However, if you want to be entertained, click that red Netflix button on your remote, sit back, relax, and let Netflix do the rest. You’re good, enjoy!

Also, just because Netflix isn’t big into the news or sports now doesn’t mean the company won’t explore such business opportunities down the line. After all, there was a time Netflix wasn’t big into streaming, advertising, or running ads on its platform, winning countless awards, or anything else that the company does now.

Everybody works with Netflix

It’s remarkable, but so many series and movies I watch on Netflix are shot by or in collaboration with major studios like Warner Bros., Columbia, and more. One reason is that companies with massive debts run many “traditional” studios. Therefore, they are welcome to work with a cash-flush company like Netflix when they can. However, it’s much more than that, as money is not the only factor in the equation. Netflix has the complete package, and people, even rival studios, want to be a part of something special, and Netflix offers the way.

International Content is Best on Netflix

Netflix doesn’t only collaborate with U.S. studios. The company has exposure worldwide. Netflix is a visionary company that envisioned going global much faster and better than the rest. Netflix has TV shows, series, and films worldwide, as the company has a global audience. Other companies like Warner Bros., Disney, and the like missed this opportunity to capitalize on going global. Now, Netflix has the trust of the global audience, while many do not. Therefore, Netflix should continue expanding globally much more efficiently than its competition.

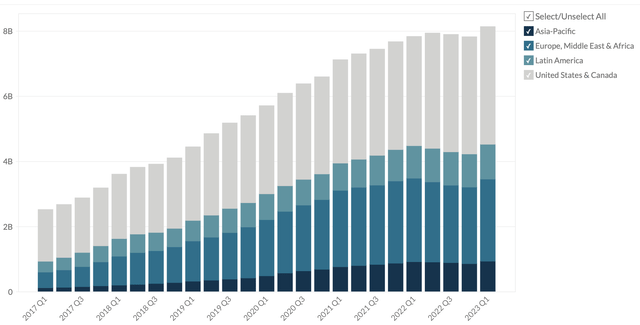

Netflix – Revenue by Region

Revenue by region (businessquant.com)

Netflix’s U.S. and Canada segment revenues were roughly $3.61 billion last quarter, accounting for about 44% of total revenues when broken down by region. Therefore, more and more revenues come from different regions and places worldwide. The company’s Europe, Middle East, and Africa segments delivered $2.52 billion in revenues last quarter, and the world is a massive place.

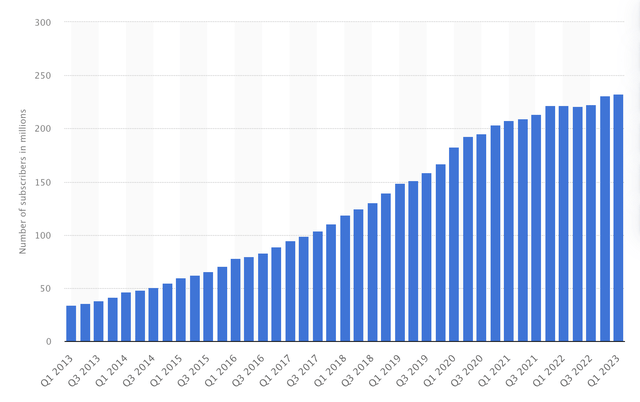

Netflix – Subscriber Count to Keep Growing

Subscriber count (Statista.com)

Netflix clocked in 232.5 million subscribers at the end of Q1. This figure is about a 5% YoY increase in subscribers, which is remarkable, provided the global economy is going through a transitory slowdown. Also, I’d like to go back to last year when we heard that Netflix’s subscriber growth was over and all the other nonsense that brought the company’s stock down to its knees around the same time last year. Despite various headwinds, Netflix can continue growing and should provide better than anticipated growth in the future.

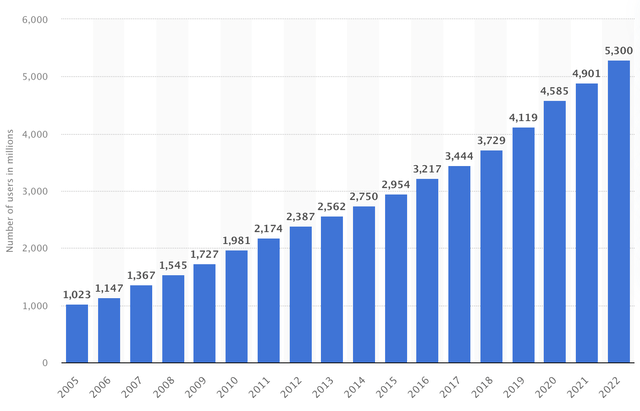

Global Internet Users

Global internet users (Statista.com)

As of 2022, there are roughly 5.3 billion internet users globally. Moreover, the global population continues to expand perpetually, and technological advancements should continue providing room for the worldwide internet population to prosper in future years. Therefore, Netflix’s 232 million subscribers account for 4.4% of its applicable market, suggesting the company has substantial growth opportunities as we advance.

Valuation – Netflix to Become Increasingly Profitable

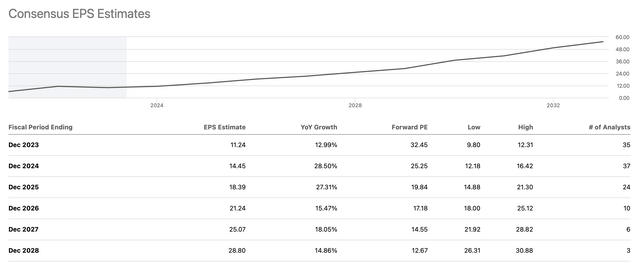

EPS estimates (SeekingAlpha.com )

Netflix’s consensus EPS estimates are $11.24 this year and $14.45 in 2024. Therefore, Netflix’s EPS growth is not faltering but is merely taking a break. Moreover, Netflix could surprise higher, and my EPS is approximately $16 for next year. Thus, if Netflix provides EPS of $14.45 next year, the stock is trading around a forward P/E ratio of 25, and if the company can secure $16 in EPS, the stock will be closer to a forward P/E ratio of just 22 here. Also, due to the successful introduction of its “ad plan” and other factors, Netflix should continue to grow more profitable in the coming years.

Why I Want to Own Netflix Long term

| The year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| Revenue Bs | $35 | $39.5 | $43.5 | $48 | $52 | $56 | $60 |

| Revenue growth | 11% | 13% | 10% | 10% | 8% | 8% | 7% |

| EPS | $12 | $16 | $20 | $25 | $29 | $33 | $38 |

| EPS growth | 20% | 33% | 25% | 25% | 16% | 14% | 15% |

| Forward P/E | 22 | 25 | 28 | 29 | 28 | 27 | 26 |

| Stock price | $360 | $500 | $700 | $840 | $920 | $1023 | $1130 |

Source: The Financial Prophet

Netflix’s remarkable revenue growth and EPS growth prospects should enable its multiple to expand in the coming years. Instead of a 22-forward P/E ratio, Netflix could trade at a forward P/E ratio closer to 30. The company’s P/E ratio may expand beyond 30, but to keep estimates relatively modest, I kept my projections to a forward P/E ratio of 29 and below. We see that Netflix’s earnings and share price should expand sharply as we advance, making Netflix one of the top buy-and-hold stocks for the next decade.

Risks to Netflix

Despite my bullish outlook, there are several risk factors to consider before investing in Netflix. Increased competition, growth issues, inflation, global conflicts, an economic slowdown, and other factors could negatively impact the company’s growth and share price as we advance. Therefore, one should consider these risks and others carefully before committing capital to an investment in Netflix.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NFLX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!