Summary:

- Bridgewater Associates has exited its positions in Netflix near 52-week high prices.

- Insider transactions are also dominated by selling activities.

- I view these activities as a reflection of the unfavorable return potential ahead.

- I expect the impacts from the Hollywood writer strike and competition intensification to be the dominating forces in the near future.

Robert Way

Bridgewater exited near 52-week high

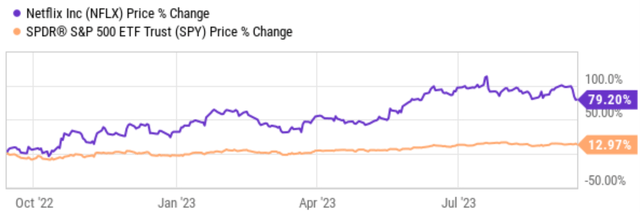

In a disclosure released in mid-August 2023, Bridgewater Associates reported that it has exited its positions in Netflix (NASDAQ:NFLX) amid a strong rally. As seen in the chart below, the stock price reached a 52-week high around the time of the disclosure. At that level, the stock has almost doubled its price compared to the level 1 year ago. In contrast, the broader market has “only” delivered a price return of about 13%.

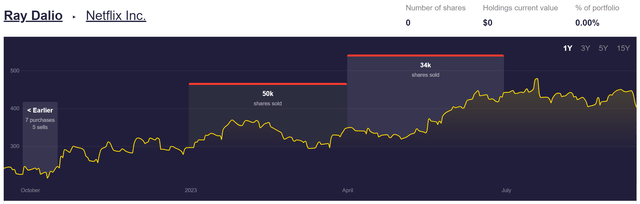

Both Bridgewater Associates and its founder Ray Dalio are well-known for their contrarian investing style. Indeed, the disclosure of Dalio’s holding (see the chart below) also shows that he has been exiting his own NFLX positions recently. To wit, he has sold a total of 84 thousand shares in the past two quarters as the stock prices marched toward the peak level.

If you are an NFLX investor and are hoping for the momentum to continue, this article is to argue for the contrarian move that both Bridgewater Associates and Dalio have taken. The remainder of the article will explain why I see the market’s enthusiasm has gone too extreme and thus has created more downside potential than upside. In particular, I will detail three negative catalysts that I consider as the dominating forces in the near term: the insiders’ selling activities, the impact of the Hollywood writer strike, and the competitive pressure in the streaming space.

Insiders are all selling too

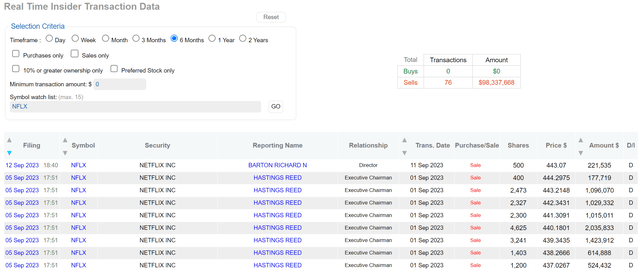

The next chart shows the insider transactions for NFLX in the past 6 months. As you can see, there were a total of 76 insider transactions reported in this period, and all of them were selling activities. These selling activities resulted in a total amount of more than $98M. In September 2023 alone (so far), its executive chairman (Hastings Reed) and a director (Barton Richard) reported a series of selling all in a price range of around $440.

Admittedly, the signal from insider selling is often not as conclusive as insider buying as noted in my earlier article,

When it comes to insider activities, usually I pay more attention to buying activities than selling activities. The reason is that selling activities can be triggered by a range of factors irrelevant to business fundamentals (such as divorce or buying a new house). In contrast, insider buying activities usually have only one explanation – the insiders think the stock is undervalued.

However, when insider transactions are totally dominated by selling as in the current case of NFLX, investors should pay attention. Next, I explain why my view is that these selling activities do signal a fundamental shift in the risk/reward ratio.

Impact from Hollywood Writer Strike

First, I anticipate a considerable negative impact on NFLX from the ongoing Hollywood writer strike. For readers unfamiliar with the strike, this wiki page provides a good recap. The gist is a labor dispute surrounding pay and working conditions. After the Writers Guild of America (“WGA”) and the Alliance of Motion Picture and Television Producers (“AMPTP”) failed to reach common ground, a strike began in early May 2023.

The strike has halted the production of new content in Hollywood and NFLX is not immune. Actually, issues relating to residuals from streaming platforms such as (or in particular) NFLX, are among the most hotly contested disputes. Actors have also joined writers in walking off the job over contract disputes recently. The halted production has caused delays to a number of NFLX’s pipeline projects, including some of its most popular series such as Emily in Paris (Season 4), Stranger Things (Season 5), The Witcher (Season 4), et al.

In addition to these specific projects, the strike is also likely to have a broader and longer-lasting impact on NFLX. For example, it may create reputation damage to Netflix, so it becomes more difficult for NFLX to attract top talent. And it could also cause NFLX to lose MORE market share to other streamers as its new content is delayed or even canceled. As we will see next, it has been already losing market share in recent years as the competition intensifies.

Admittedly, the strike would cause similar issues for NFLX’s peers as well. However, I see a few possible reasons that the strike could be more hurtful for Netflix than, say more than Disney (DIS). First, DIS’ income revenue streams are more diversified. Unlike NFLX, DIS has a number of income streams besides its streaming segment and studio entertainment, ranging from theme parks, to TV media networks, and also to license fees of its characters to a wide range of manufacturers. Having a more diversified income stream could help to smooth the interruptions caused by the strike. Furthermore, NFLX relies more on fresh content. Its business model is based on providing a constant stream of new content to keep subscribers. DIS (and other “traditional” media stocks like HBO Max too), in comparison, has a large library of existing content to draw from, so it can still keep its subscribers entertained even during a strike.

Market share loss and competition intensification

It’s common knowledge that streaming is getting more and more crowded and NFLX has been inevitably ceding market share. However, in my view, the pace is a bit faster, and the picture is a bit more dire for NFLX than most investors recognize. A landmark moment in my view came in Q2 2022, When Walt Disney’s (DIS) total subscriptions surpassed NFLX for the time. In that quarter, NFLX reported a loss of 970k net subscribers and its total subscribers retreated to 220.7 million. In contrast, subscribers for Disney+ reached 221.1 million.

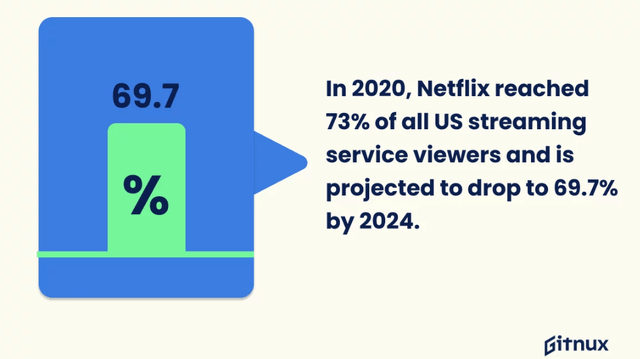

Looking ahead, I see good chances for the pressure to further intensify and NFLX’s market share to further retreat. Other studies point in the same direction. For example, the chart below projects Netflix streaming service viewers (in the U.S.) drop to 69.7% by 2024 from 73% back in 2020. Unsurprisingly, Disney+ enjoys a huge edge over NFLX for a key demographic: parents with young kids. Surveys have shown that 1 out of 5 parents are likely to cancel NFLX and switch to Disney+. As a parent myself, I can totally understand why. Besides Disney+, competition pressure from other streaming services, such as Hulu and Amazon Prime Video, is also intensifying. Take Amazon Prime Video as an example. It reported 117 million subscribers worldwide in 2023. The number is projected to grow to 250 million in 2027.

Other Risks and Final Thoughts

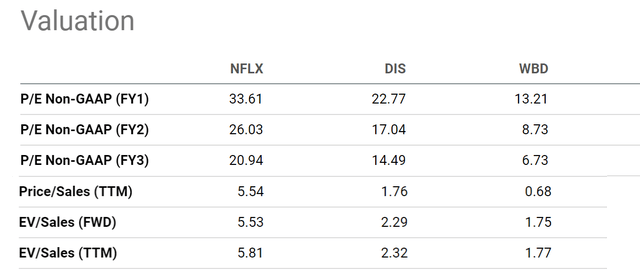

Besides the risks mentioned above, the stock also entails large valuation risks in my view. The stock now trades at an FY1 P/E of 33.6x. As you can see from the chart below, it is at a large premium compared to DIS’ 22.8x PE (by almost 1/3) and more than double that of WBD. NFLX’s valuation premium is even more dramatic in topline metrics. In terms of P/S ratio, NFLX is trading at 5.5x TTM sales, more than 3x higher than DIS and 8x higher than WBD. It is true that NFLX is less leveraged than both peers (a large plus for NFLX), so leveraged-adjusted multiples are more meaningful. As seen, its EV/sales ratio is about 5.8x, still many times above both DIS and WBD’s multiples.

Upside risks. There are a few upside catalysts worth mentioning. The rollout of the new ad-supported service is a top one in my mind. The lower-priced service with ads might gain momentum and boost its customer base. However, other players would quickly follow suit if the strategy were proven to work. Secondly, its efforts to tame abuse of password sharing seem to be a good idea to me also. I am eager to see how effectively its strategies can combat such abuse and boost sales.

All told, I see the headwind at the dominating catalysts in the near term. To recap, these headwinds include the impacts of the Hollywood writer strike and the competition intensification. These headwinds, when combined with the lofty valuation premium, create much more downside potential than upside potential in my view. Recent selling activities from both high-profile investors and insiders are a reflection of such unfavorable return potential, in my view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.