Summary:

- Netflix shifting focus to telecom partnerships for growth, stable stock performance, visible future trajectory.

- Telecom partnerships offer Netflix a competitive edge and room for expansion, especially in APAC and EMEA regions.

- Competitive advantage over YouTube and Disney, the potential for significant growth with telecom partnerships, and undervalued stock.

MichaelGordon1

Investment Thesis

In January 2024, we upgraded our rating for Netflix (NASDAQ:NFLX) (NEOE:NFLX:CA) to Buy, and the company’s stock has since increased by 13%. The stock of Netflix has just fallen more than 10% from its peak. After looking over the company’s fundamentals and evaluating its growth potential, we discovered that Netflix had completely changed the way it approached business.

It is moving away from aggressively spending on content acquisition in favor of using its user base advantage through partnerships with telecom companies for customer acquisition and retention. As a result, the stock performance is more stable, and the future growth trajectory is more visible. We recommend the company as a Buy even though it is currently trading at a premium valuation because we believe it is supported by a solid growth strategy.

Q2 Earnings Recap

When Netflix mentioned that its telecom strategy was effective in Q2 earnings, we examined it and discovered that the company had a competitive edge and significant room for expansion.

During 2023-2024, with telecom companies like T-Mobile in the US, Vodafone in Spain, Telkom in South Africa, Jio and Vi in India, SK Telecom in South Korea, and Deutsche Telekom in Europe, Netflix has taken steps in collaboration. Telecom companies provide Netflix in their plans at no extra cost to the user. Despite not knowing the specifics of this agreement’s profit sharing, we may infer from Netflix’s financials that there is room for margin expansion.

Netflix claims the relationship adds value to the internet service provider (“ISP”) by assisting in user acquisition, retention, and upselling to higher-tier plans. Furthermore, Netflix offers its Open Connect CDN technology to ISPs to lower transmission costs and enhance the effectiveness of video delivery. For example, Netflix claims that it will save the ISP $1.2 billion in 2020.

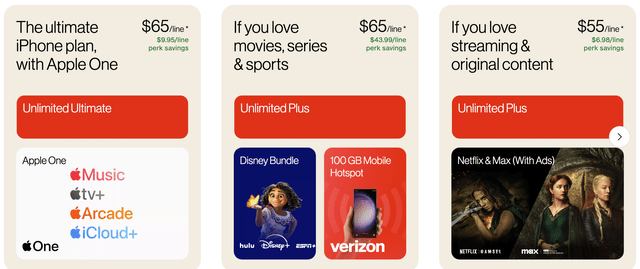

Using this method over the last two years has enabled Netflix to resume its pace in growing its subscriber base. Disney (NYSE:DIS) has attempted to imitate this tactic, but Netflix has had greater success because of its higher subscriber base and watch timeshare, which enable better terms for negotiations. For example, the Disney plan required a $10 (see below chart) additional fee from mobile users as part of Verizon’s collaboration with Disney. In actuality, Disney suffered from this. Disney therefore did not gain as much from the telecom partnership as Netflix did.

T-Mobile Pricing plan (T-Mobile)

In addition, because mobile users typically have varied contract renewal dates, this cooperation strategy ensures a constant 12-month growth in the subscriber base. As a result, investors can see how its user base is growing. The most recent agreement Netflix has is with Vi, an Indian platform that was revealed in June 2024 and has 218 million subscribers. In the future, Netflix may find success with these tactics, since it can now take advantage of its large user base to attract new subscribers and cut down on the amount of money it spends on advertising to expand its own. Thus, Netflix’s stock ought to behave more akin to a defensive player. The company may shift from a content-driven growth engine to a telecom partnership model. This paradigm shift could be significant.

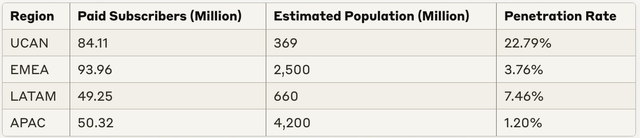

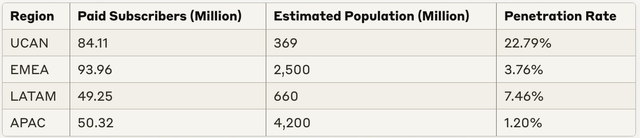

As of right now, Netflix has a 22% penetration rate in UCAN. Other regions continue to be low, particularly APAC and EMEA. One explanation is the region’s comparatively low brand awareness and consumer behavior.

Penetration estimation (From Wiki, Netflix and edited by LEL)

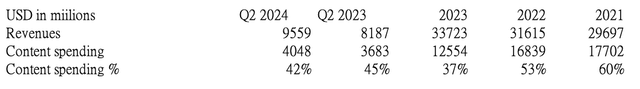

In addition, financials (see below exhibit) indicate that Netflix is already reducing the proportion of content production costs relative to revenue.

Netflix content spend% (From Netflix and edited by LEL)

Competitive Advantage

YouTube

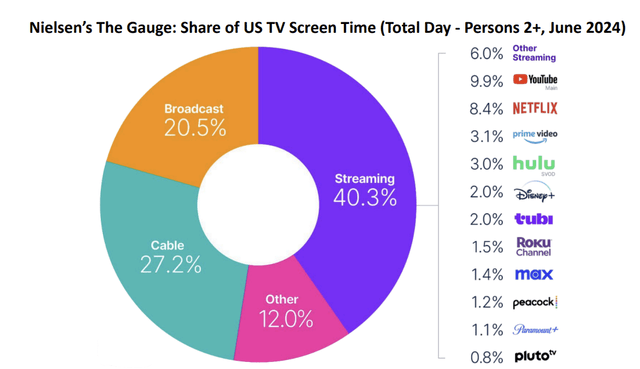

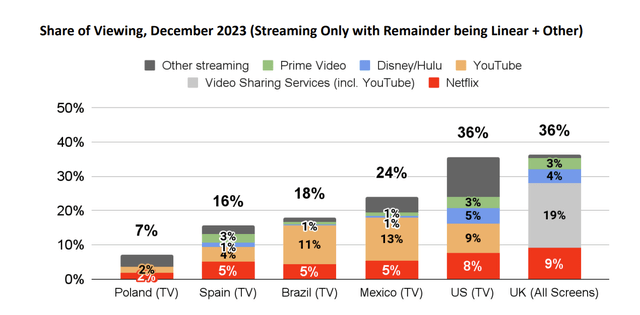

Netflix claims to hold a 25% share of the US streaming market (see the below chart), slightly lower than YouTube. Although management noted that only 80% of TV viewing time is spent on streaming, this still represents a significant opportunity to grow market share. The management reported that while TV timeshare decreased in June, streaming services continued to gain market share.

View share (Netflix)

Netflix has a larger subscriber base than YouTube (100 million). In addition, Netflix has a business model advantage over YouTube in this environment, as consumer spending is starting to slow down, which could potentially reduce YouTubers’ motivation to create content.

Disney

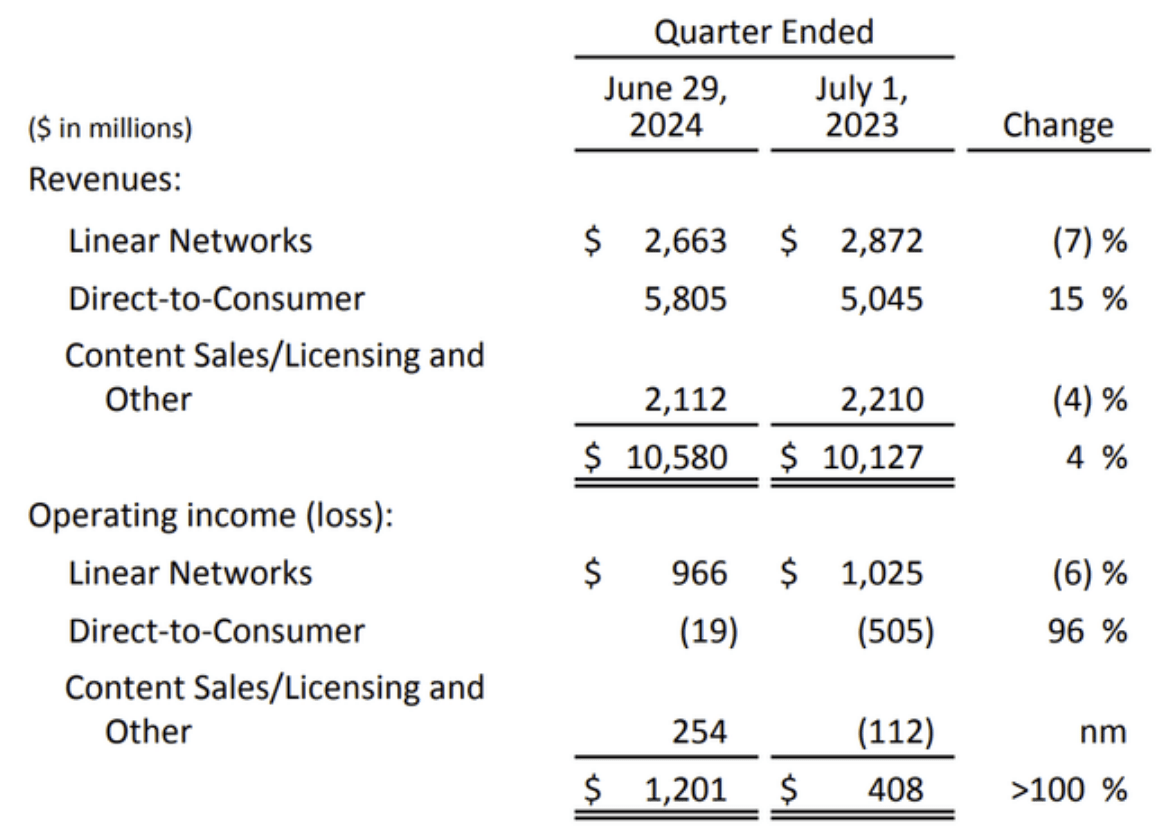

Compared to Disney, Netflix has a scale advantage, and compared to Disney, it enjoys a profitability advantage. (see the below exhibit)

Disney financials (Disney)

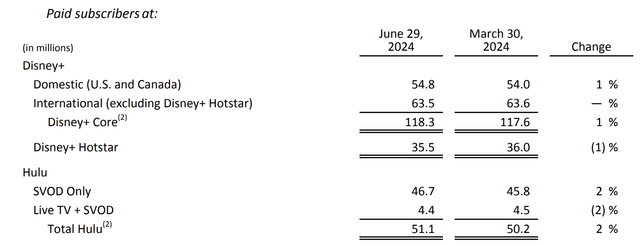

Although Disney significantly improved its profit margins this quarter, its viewing timeshare dropped to 2% (see above and below chart), and user base growth slowed to 1% (see below exhibit).

View share (Netflix) Disney operating metrics (Disney)

While Disney has been relying on other more profitable businesses to support the development of Disney+, it is now facing challenges with the decline of its cable business.

Valuation

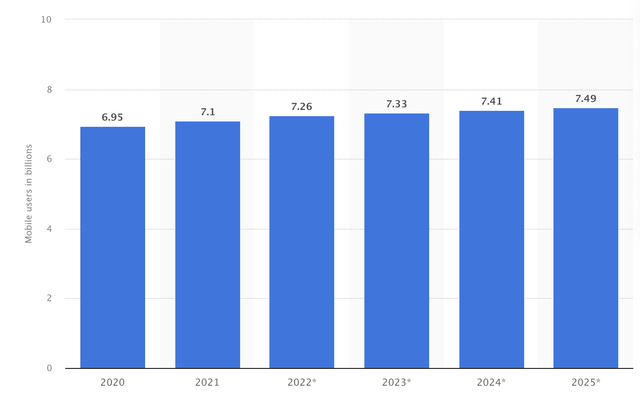

There are currently over 7 billion mobile users worldwide (see below chart).

Mobile user count (Statista)

Netflix’s penetration in this area outside UCAN is still rather low. (see the below exhibit) Thus, the company’s collaboration with telecom players in APAC and EMEA will be a very successful tactic to boost penetration in those areas.

Penetration estimation (From Wiki and Netflix and edited by LEL)

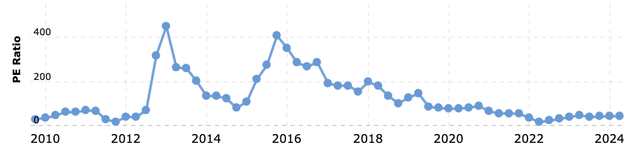

The company’s price-to-earnings ratio (see below chart) fluctuated over its expansion stage and bottomed in 2022 at almost 15 times the company’s subscriber base, which had dropped to single digits. Its 2024 forward P/E ratio increased to 31x recently, indicating the continuation of expansion.

PE ratio (Macrotrend)

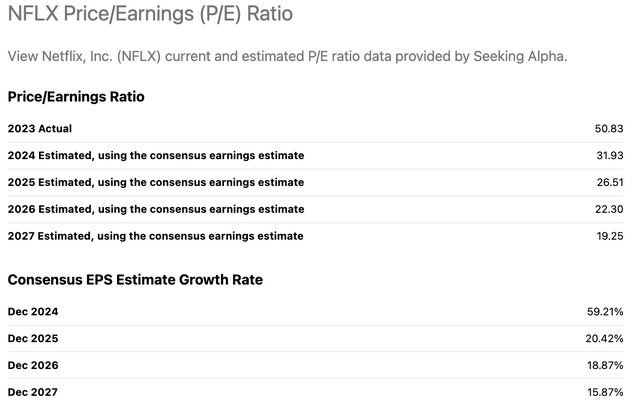

Because of these partnerships, the company was able to maintain double-digit growth in revenues in 2023 and increase its operating leverage. As a result, its EPS growth reached 59%.

The management mentioned that the full-year operating margin target for 2024 has been raised to 26%, up from the previous expectation of 25%. They indicated that content spending will grow at a slower pace than revenue, which will support margin expansion.

For the next three years, the analysts projected an EPS growth of 20% to 15%. (see the below exhibit)

PE and EPS estimate (Seeking Alpha)

In our opinion, the company may shift from a content-driven growth model to one focused on telecom partnerships, and considering the current low penetration rate, we believe that the projected growth rate of 15-20% is likely conservative. From this perspective, the stock still appears undervalued.

Conclusion

In terms of view time and membership base, Netflix remained the industry leader in streaming. Due to this, Netflix is better positioned to grow its alliance with international telecom providers and penetrate markets where its brand recognition is still relatively low. Additionally, this increases investor visibility into the company’s growth trajectory. As a result, even if the market expects Netflix to grow rapidly, we believe the valuation supports a sound growth strategy. With enormous potential, the company keeps breaking into the current TV industry. We believe the stock still has room to rise as a result. Furthermore, the stock performance is more stable as a result of the business model paradigm shift. We therefore continue to rate it as a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.