Summary:

- Review of a virus-inspired model to predict subscriber growth.

- The article shows an unorthodox valuation considering lower FCFE and greater capital expenditures.

- Three critical catalysts for the stock explored – gaming, competitive environment, and market sentiment.

wildpixel/iStock via Getty Images

In 2018, I began modeling Netflix (NASDAQ:NFLX) subscriber growth using the equations used to predict pandemics and the spread of diseases. The model has had interesting results and is relatively accurate.

I will explain how the model’s predictions compare to Netflix’s past results and prospects and the three catalysts that make it a much better stock than it was three years ago when it traded at the same price.

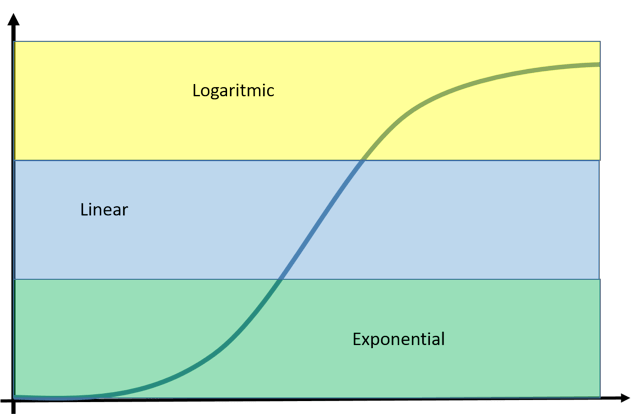

The Sick Model

The model, which I named “Sick Model,” used the S-shaped behavior of a disease spreading into a population to predict subscriber growth. This behavior can be segmented into three stages: exponential, linear, and logarithmic. The saturation of the population causes the spread to decelerate. Suppose one subscriber interacts with ten friends who do not have Netflix. In that case, there are potentially ten new subscribers; that is the behavior of the exponential phase. In the logarithmic phase, one subscriber would have to interact with 100 friends before finding one who does not use Netflix.

% Of a population affected vs. Time (My Charts – Netflix Is Contagious, And The Cure Is Coming)

The model predicted that Netflix would have 371 million subscribers by 2025, which is in line with current optimistic valuations, and that its subscriber growth rate would be about 4.8% in 2030, which is the assumption of the current valuation. Ironically, the model stopped functioning to predict short-term results during the pandemic as Netflix subscribers jumped and stabilized.

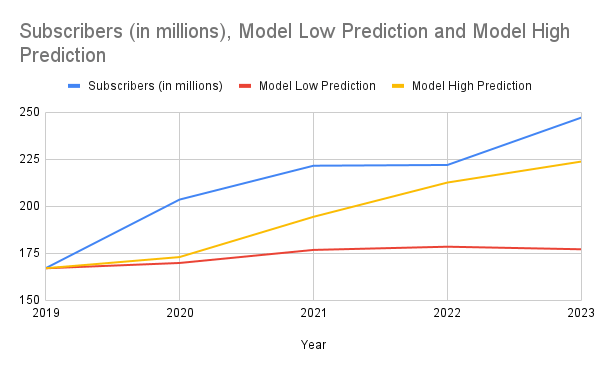

Subscribers actual Vs. Sick Model prediction (My charts)

The subscriber growth Netflix has experienced in the past years is consistent with linear growth, and it will naturally transition to logarithmic growth as saturation increases. This is considered in the valuation.

However, Netflix has changed its business model enough for subscriptions not to be a meaningful proxy for its value. Netflix now has various pricing options to segment its plans by the number of users, quality, and ad-supported plans.

This segmentation has allowed Netflix to reach more people and expand its subscribers, which explains why it substantially outperformed the model’s expected subscribers for 2023 of 180-230 million to the last reported 247 million while only delivering on the low range of the model on revenue.

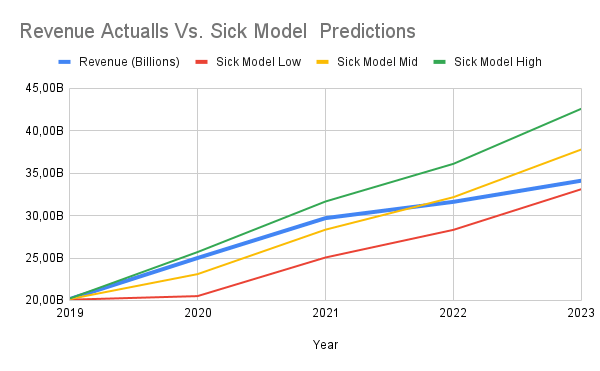

Revenue actuals & 2023 estimate Vs. Sick Model Prediction (My Charts)

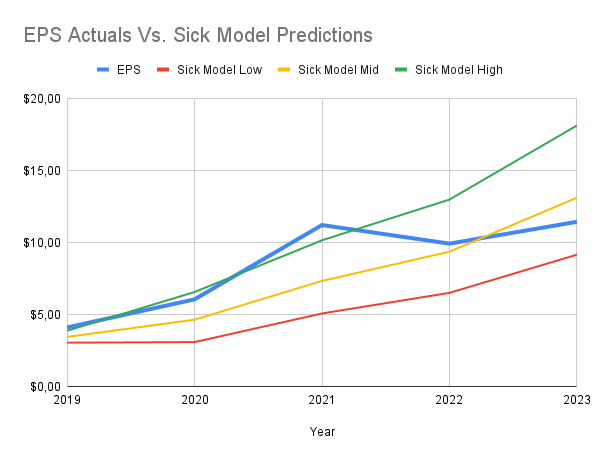

Overall, earnings per share are on track to deliver within the model’s predicted medium range.

EPS Actuals & 2023 estimate Vs. Sick model predictions (My Charts)

While analyzing the model’s accuracy and results is entertaining, the story that the numbers tell is the crucial part. In the past, subscriber growth was a good proxy for the stock as Netflix licensed most of its content, creating a rigid cost structure and linear relationship between its subscribers, revenue, and margins.

The company’s objective then was to maximize the arbitrage between the licensed content and the number of subscriptions it could obtain for that content. The objective now is to maximize the value it can get for its produced content. This might seem like a semantic difference, but it is a structural difference in its business model.

A good example of this mechanic is Netflix’s behavior in emerging markets, where Netflix can create ad-supported plans and lower pricing models to maximize revenue generation and increase market penetration and subscriber growth. In the past, licensing the content would have been more expensive than the revenue from this plan, making it unprofitable.

This acquired ability now allows Netflix to modify its pricing structure more extensively. By adjusting its pricing strategy and seemingly sacrificing revenue growth, Netflix surpassed the sick model´s wildest expectations on the number of subscribers. However, low revenue did not translate into lower earnings because of the structural change in its content, which delivered margin expansion and earnings in line with the model.

The benefit of this is that the model predicted a saturation of the number of people that could pay Netflix’s full subscription fee worldwide much sooner than the market anticipated, with the successful implementation of its reduced price options and a more significant proportion of self-produced content, this limitation vanishes, almost eliminating one of Netflix´s most significant risks.

The Three Key Catalysts for the Future

1. Overblown competitive environment

The model’s most significant deviation, shown in the low scenario, considered that other streaming platforms, especially Disney+(DIS), would hinder Netflix’s revenue growth and pricing power. But Netflix has proven its moat and enhanced its ability to manage its pricing models. It seems to maintain its growth and remain the king of streaming by a noticeable margin.

While in 2019, it was an unknown risk how much streaming services would hamper Netflix’s growth, now this risk is not only known but looking at the growth it has had, the risks were overblown.

It is clear now that the space has room for more than one player, and Netflix is harder to cut than the model expected back in 2020.

2. Gaming

Netflix has been slowly turning into gaming. From its casual remarks in Q4 of 2018 about Fortnite being a comparable threat to other streaming services to the last earnings call, where games were mentioned about 15 times.

Well, let’s start with the big prize. I think that’s the better way to look at it, which is games is a huge entertainment opportunity. So we’re talking about $140 billion worth of consumer spend on games outside of China and outside of Russia. Greg Peters – Co-Chief Executive Officer 2023 Q3 Earnings call

Games and movies have had an almost paradoxical relationship. The most prominent intellectual properties in movies have had poor-performing videogames, and likewise, movie adaptations of videogames have been fewer and even less successful. For example, while there are relatively few video games based on movies, the list of video games notable for negative reception of about 50 video games, more than 10% of the list consists of video games based on movies or studio IPs. Netflix’s tech background might help it better understand the video game business than its counterparts.

But the main challenge ahead of us to get to your mid-term is that our current scale and frankly, our current investment level are both very, very, very small relative to our overall content spend and engagement. So now our job is to incrementally scale to the place where games have a material impact on the business. We’ve got ambitious plans there. We want to really grow our engagement by many multiples of where it is today over the next handful of years. Greg Peters – Co-Chief Executive Officer 2023 Q3 Earnings call

While the ambition to create console games based on their IP might be further into the future, the initial expansion to mobile games is promising for experimentation and requires relatively low expenses. Their IP can be a substantial differentiator and almost immediately made it a significant player in the environment.

3. Market sentiment

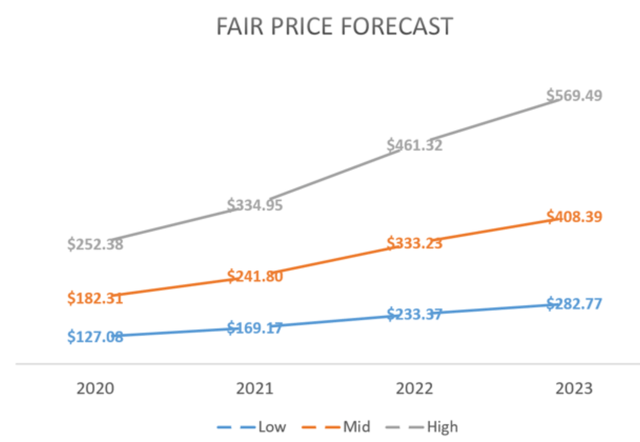

Netflix had been valued at overly optimistic valuations. The fair price forecast of January 2020 seems to have been reasonably accurate, predicting a mid scenario around $410; however, at the time, the stock was priced at $326, about 30% above the most optimistic scenario.

Netflix 2020 predictions (My Charts )

While the market was overly optimistic about the stock and the issues it would face back then, it would seem that the market is overly pessimistic about the stock’s prospects today despite it proving it can withstand competitive pressure better than expected, being in a much more favorable strategic position regarding content creation, having greater flexibility on its pricing strategies, starting to explore new avenues of revenue like gaming, and some rumors on physical location.

Valuation

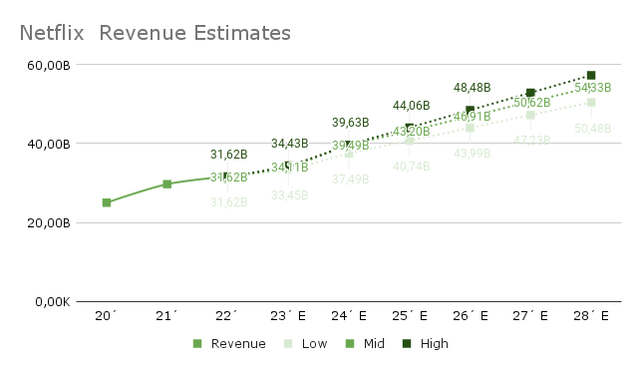

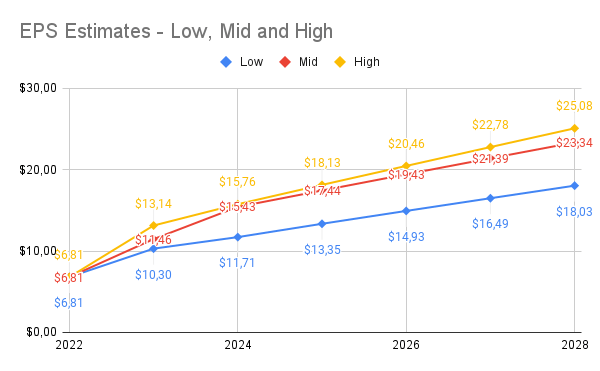

We have already discussed many valuation assumptions, from revenue growth to margins and pricing. Based on these assumptions, we have the following revenue and earnings forecast. The model does not consider Netflix incursions in games and physical locations in any meaningful way for the low and mid scenarios and only slightly in the high scenario.

Netflix Revenue Estimates (My Charts) Netflix EPS estimates (My Charts)

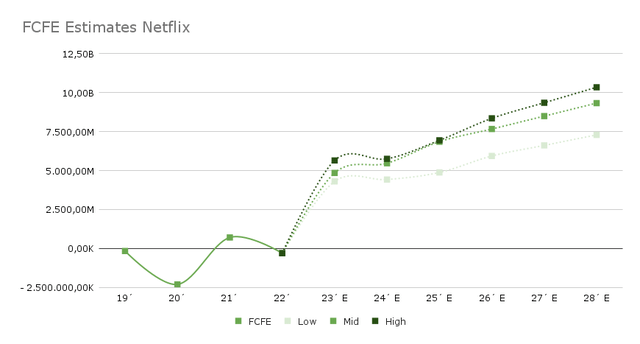

However, I took two unorthodox cash-flow measures to adjust Netflix’s valuation and free cash flow to equity. First, I consider their content investments as capex, which reduces FCFE. This adjustment reflects the actual free cash flow to equity, as content investments are essential to continuing operations. Second, I adjusted depreciation and amortization to match earnings convention, adjusting the assumptions on how the assets would depreciate.

Adjusted FCFE Estimates Netflix (My Charts)

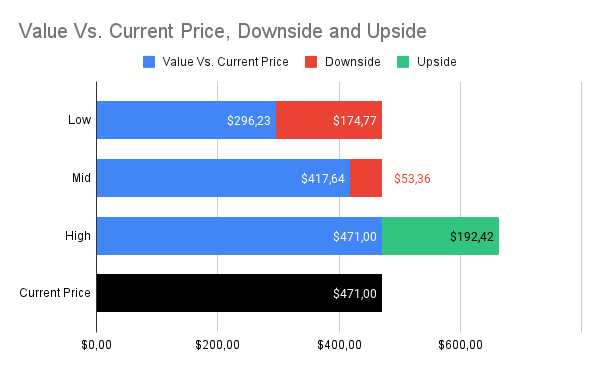

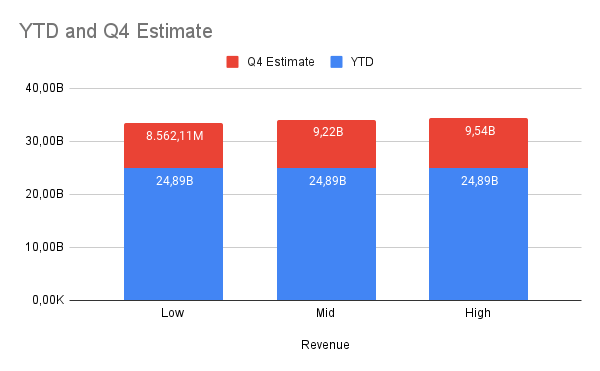

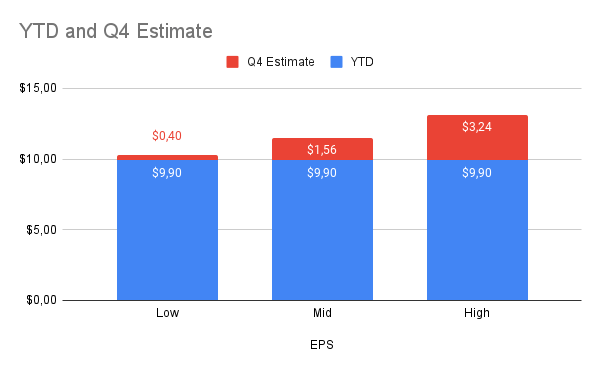

The most generous jump would seem to be 2023, which consists of the results of the past three quarters and the model´s estimates for Q4 2023. With these numbers, we have the following estimates of fair value for the stock.

Fair Value Estimates vs. Current Price Netflix (My Charts)

Netflix reached the expected earnings per share and is projecting similar growth to that forecasted by the sick model. It is not surprising that the fair value is in line with past expectations. However, the price now is within the model´s range. While the current price is above the mid-fair price, the high price range would put Netflix above $600.

To better gauge the level of optimism and pessimism of the model, these are the resulting expectations for Q4 earnings.

Q4 Revenue estimates (My Charts)

Revenue is in line with market expectations, so the low scenario seems unlikely if Netflix maintains its subscriber momentum.

Q3 EPS estimates (My Charts)

On EPS, the market consensus would be higher than the mid-scenario, but I believe the high scenario is a better approximation of the upcoming earnings.

Conclusions

Netflix is reasonably priced for its prospects. The stock has certain risks that could make the price drop almost 40% and catalysts that could make it jump proportionally higher. The slight overprice of the mid-scenario reflects that the market is forecasting its success as more likely than its possible failure.

Its position is substantially better than it was in 2020. There are fewer risks, and the remaining ones are easier to forecast. The catalysts may be substantial if the entire plan for their development is well crafted. While I agree that it is better for management to fully develop a plan and experiment slowly with games and physical locations until the plan is more clearly laid out, it should not be included in the valuation or the price. Much depends on how this unfolds and whether Netflix can reinvent itself or will only marginally improve its prospects.

The Tortoise and the Cat Portfolios

Since returning to writing, I have created animalistic portfolios to reflect better the risk evaluation process and how portfolio goals and time horizons may affect the decision to include stocks.

The Tortoise Portfolio

This portfolio, concerned about protecting downside exposure without ambitious return expectations, is more risk-averse. Despite its long-term horizon, it would not be included in the stock in the portfolio as the value of a stock going 40% down is more heavily weighted than if it increases by 40%. Not only is the risk profile incompatible with the portfolio at the moment, but it does not provide a meaningful hedge or exposure to the trends that the portfolio seeks, nor does it have an ESG angle that is especially attractive. For these reasons, the stock would not be included in the portfolio.

The Cat Portfolio

The cat portfolio is quite aggressive, and the risk profile does not deter its inclusion in the portfolio. The upside is significant, but the catalysts are unlikely to reflect suddenly in the price; they will slowly grow, which is not in line with the relatively short time horizon of the portfolio. Because of this, it would only include half a position responding to some FOMO and some idea of managing the position as the trend becomes more apparent.

As for me, I entered Netflix last year, and it represents a small portion of my portfolio. It has some exposure to two of what I believe are the seven most important trends of the century – the technological convergence across sectors and the integration of physical and virtual realms. As the investment thesis remains the same, it is not priced sufficiently high for me to exit nor low enough to add more; I will maintain this small position.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.