Summary:

- We’re upgrading Netflix stock to a buy.

- We think the company is better positioned to outperform the peer group as it holds pricing power in the streaming industry.

- We expect the recent price hikes, coupled with the better-than-expected subscriber growth, to support top-line growth in 1H24.

- Additionally, we now expect more traction from original content after the resolution of the WGA and SAG-AFTRA negotiations.

- We expect the stock to outperform through 1H24.

Giuliano Benzin

We’re upgrading Netflix (NASDAQ:NFLX) back to a buy. We now think the company is better positioned to outperform through 1H24 due to its pricing power in the streaming industry. We were neutral on Netflix, waiting for evidence that the stock can outperform driven by fundamentals. We were less optimistic due to our expectation of a longer growth runway for the company’s ad tier, softer margins, and challenges to top-line growth. We’re upgrading the stock now as we think Netflix is uniquely positioned to boost top-line growth after the announcement of price cuts this quarter and as content spend should now reaccelerate.

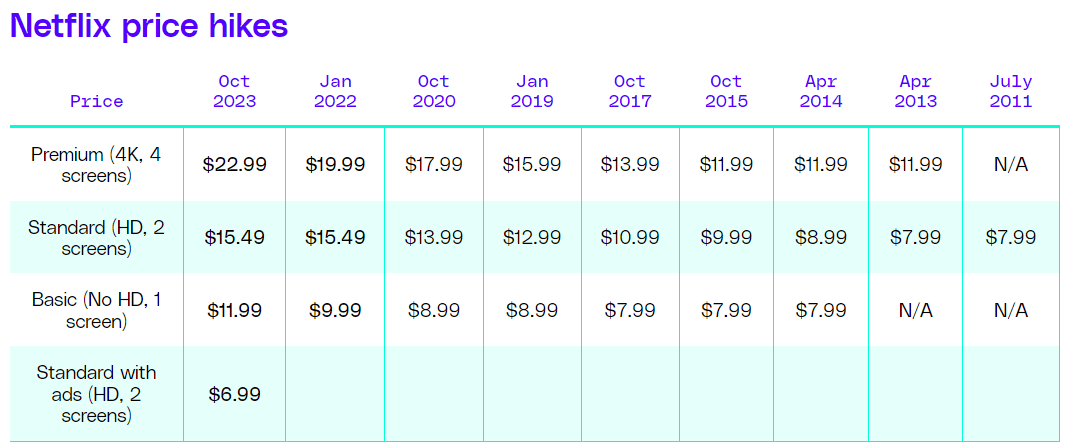

The company announced another price increase as part of third quarter earnings results, increasing the price on their Basic and Premium plans to $11.99 and $22.99 per month, respectively. This is Netflix’s second price hike this year; looking at competition, Amazon Prime (AMZN), Disney+ and Hulu (DIS), Warner Bros. Discovery (WBD), and Apple TV (AAPL) all raised prices this October in their U.S. market. Across those tiers, the monthly price rose an average of 23%, notably above the 3.7% 12-month inflation rate in September. We believe Netflix’s competitive advantage of pricing power is evident from its recent price hikes amid a higher growth in added subscribers.

The following outlines Netflix’s price hike history since 2011.

The Verge

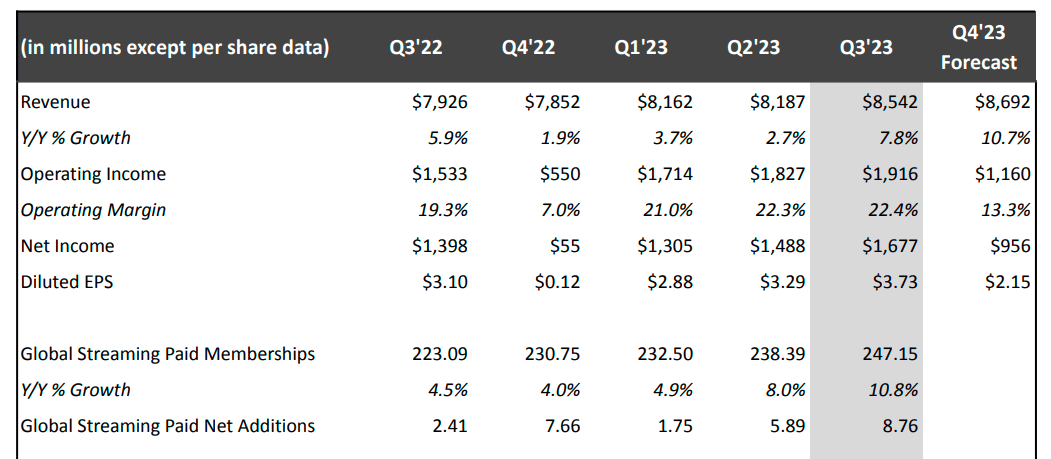

Netflix reported a surprise boost in subscriber growth this quarter, with total memberships at 247.15M versus expectations of 243.88M. We think Netflix’s pricing power is communicated not only by the company’s above-sector-average results this quarter but also by the fact that the company has kept its ad tier plan priced the same despite a challenging ad spend environment. We think this is a tactic by management to reel more customers into the ad tier plan. Management emphasized that ad tier memberships grew 70% QoQ in 3Q23. We think higher prices and subscriber growth recovery will support Netflix’s top-line growth through 1H24.

We understand investor concerns over Netflix’s ability to sustain better subscriber growth given macro uncertainty; we previously shared this concern. While we continue to believe macro uncertainty and the potential looming recession could weigh on the streaming peer group due to its exposure to consumer spending, we think Netflix will fare better than the peer group in a market downturn due to its sticky original content and pricing power. The following chart outlines Netflix’s global streaming paid membership growth up until 3Q23.

NFLX 3Q23 earning results

We also think the now resolved SAG-AFTRA negotiations will allow more room for the company to reaccelerate spend on fan original favorites. While CEO Ted Sarandos reaffirmed that the strikes did not cause any significant interruptions to content for subscribers, we think the impact of the strikes was definitely felt. Management was eager to resolve the strikes and was forced to reduce spending so much during the strikes that the company now expects a free cash flow of $6.5B. We see more room for Netflix to reaccelerate subscriber growth with original content.

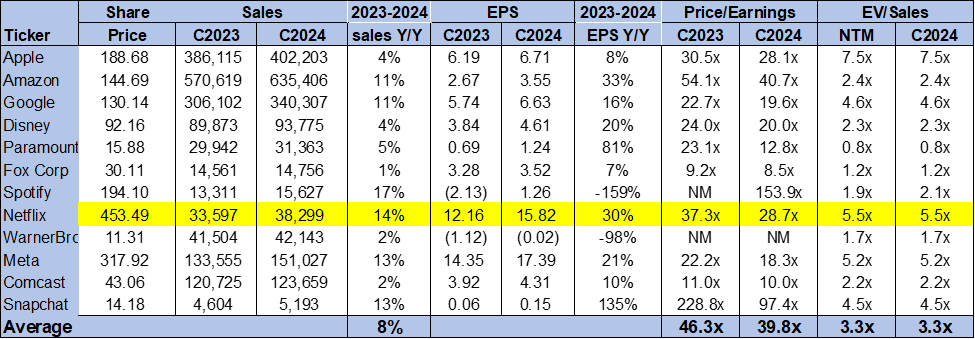

Valuation

The stock is trading above the peer group average; we think Netflix is a growth stock at current levels. The stock is trading at 5.5x EVC2024 Sales versus the peer group average of 3.3x. On a P/E basis, the stock is trading at 28.7x C2024 EPS $15.82 compared to the peer group average of 39.8x. We understand investors’ concern over Netflix’s higher multiple. Still, we think the higher valuation is justified given Netflix’s pricing power and position in the streaming industry after this quarter’s surprise subscriber growth. We recommend investors explore entry points into the stock in the near-term.

The following outlines Netflix’s valuation against the peer group.

TSP

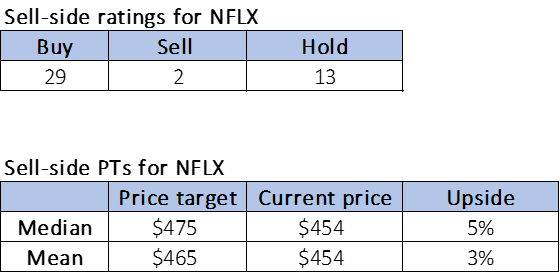

Word on Wall Street

Wall Street shares our bullish sentiment on the stock for the first time in a while; we were neutral on Netflix for the past several weeks. Of the 44 analysts covering the stock, 29 are buy-rated, 13 are hold-rated, and the remaining are sell-rated. The stock is currently priced at $454 per share. The median sell-side price target is $475, while the mean is $465, with a potential 3-5% upside.

The following charts outline Netflix’s sell-side ratings and price-targets.

TSP

What to do with the stock

We’re upgrading the stock back to our buy list. We think Netflix provides a more favorable risk-reward profile now and is better positioned to outperform the peer group as it holds pricing power in the streaming industry. We expect the recent price hikes and better-than-expected subscriber growth to support top-line growth in 1H24. We see the stock outperforming through 1H24 and recommend investors explore entry points into the stock opportunistically.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Our investing group, Tech Contrarians, discussed this idea in more depth alongside the broader industry and macro trends. We cover the tech industry from the industry-first approach, sifting through market noise to capture outperformers.

Feel free to test the service on a free two-week trial today.