Summary:

- Netflix once again saw strong subscriber growth. However, most of the new users have paid sharing accounts.

- We’ve slightly raised our EBITDA forecasts due to a reduction in other gross cash expenses and minor changes in revenue forecasts.

- The Company will stop disclosing the number of paid accounts in FY2025. We believe the company is reaching the upper limit of TAM penetration in developed markets.

- Cloud gaming could potentially benefit Netflix, adding $23 per share to our price target. However, current gaming efforts remain financially immaterial.

- We’re neutral on NFLX after the latest earnings release and on current market valuations, and we maintain our Hold rating.

stockcam

Investment Thesis

Despite these positive results, we expect growth to slow due to high penetration in developed regions, particularly North America, where Netflix (NASDAQ:NFLX) has almost reached a plateau. The company’s decision to stop disclosing paid subscriber numbers in FY2025 signals its recognition of this saturation. In addition, Netflix’s potential entry into the cloud gaming market, while an upside opportunity, remains speculative without a clear go-to-market strategy. Given these factors, we believe that Netflix’s current market valuation reflects a fair assessment of its growth prospects and challenges.

Q2 FY2024 earnings summary, revenue forecast update

We’ve been covering Netflix in Seeking Alpha since 2022. Our previous article can be found here. The 2Q 2024 report is generally in line with our expectations, with EBITDA slightly ahead of the forecast and FCF below due to elevated content spending.

- Revenue amounted to $9 559 mln (+16.8% YoY) vs. our forecast of $9 504 mln and consensus of $9 530 mln which was slightly above our expectations.

- The company’s adjusted EBITDA amounted to $6 454 mln (+21.2% YoY) vs. our forecast of $6 123 mln, which also met our estimates. Advertising and development expenses are growing at a lower rate than we expected, which caused a 5% deviation.

- Free cash flow for the period totaled $1 213 mln versus our forecast of $1 503 mln due to deviation in the forecast of content investments for the period from actual figures.

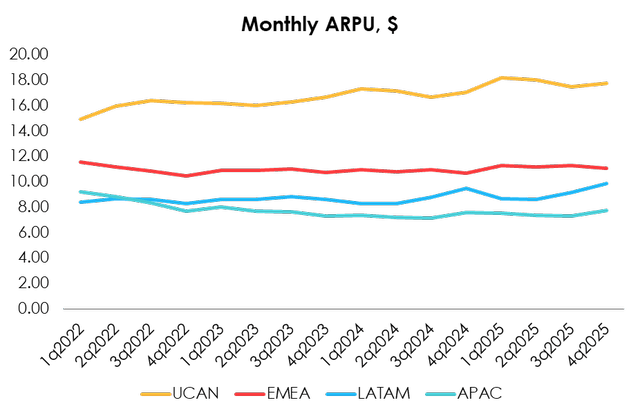

The company continued to boost the number of subscribers (net inflow amounted to 8.04 mln accounts), while ARPU dynamics continue to be mixed:

- In North America, the figure climbed to $17.17 (+7.3% YoY). Ad-supported subscription versions remain a strong driver of financial results amid a strong recovery in marketing budgets.

- On the global market, the indicator amounted to $9.22 (-2.6% YoY). The strengthening of the dollar against global currencies and especially the devaluation of the Argentine peso put pressure on the average subscription price. Nevertheless, we see Netflix considering currency exchange rates in pricing and assume that the indicator will return to a healthy growth rate in the coming year.

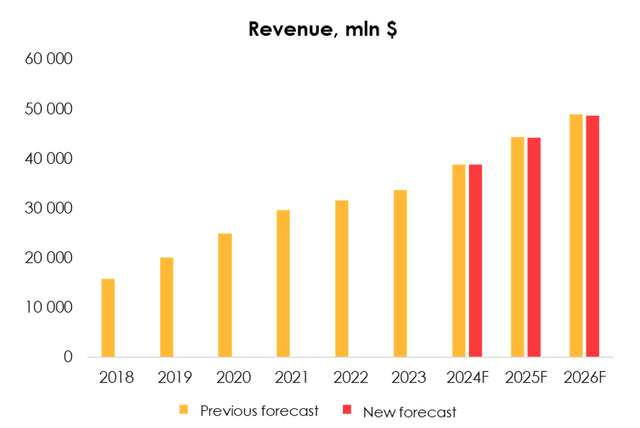

We have made minor adjustments to the revenue forecast to reflect the more significant effect of currency exchange rates, as well as subscriber and ARPU dynamics in the regions. We almost unchanged our revenue forecast in 2024, revising it upwards from $38 836 mln (+15.2% YoY) to $38 844 mln (+15.2% YoY), but slightly revised it downwards in 2025, from $44 287 mln (+14.0% YoY) to $44 210 mln (+13.8% YoY).

The management has shared its guidance for Q3 2024. The company sees next quarter’s revenue at $9 727 mln (+13.9% y/y) and operating margin of 28.1%. The company’s projections are generally consistent with our forecasts.

OPEX Outlook & EBITDA projections

From a cost perspective, we have made a few changes to the forecast:

- We have revised downwards our forecast for other gross cash costs from $6 222mln (+13% YoY) to $6 100mln (+11% YoY) for 2024 and from $8 201mln (+32% YoY) to $7 501mln (+23% YoY) in 2025. We see that despite the expansion of the target audience, content library and available regions, the cost growth rate remains below expectations.

- We have revised upwards our content investment forecast from $16 497 mln (+31.4% YoY) to $17 035 mln (+35.7% YoY) for 2024 and from $17 049 mln (+3.3% YoY) to $17 383 mln (+2.0% YoY) in 2025, in line with management’s expectations. Although the business has already entered the value stage, Netflix plans to maintain the target level for the amount of content it produces.

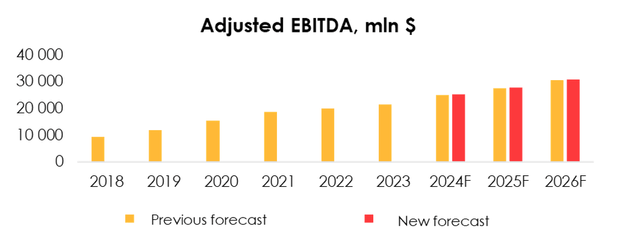

We have therefore revised upwards our forecast for adjusted EBITDA from $24 892 mln (+15.7% YoY) to $25 113 mln (+16.8% YoY) for 2024 and from $27 503 mln (+10.5% YoY) to $27 877 mln (+11.0% YoY) for 2025.

Due to the downward revision of forecast for other gross costs, we have revised downwards our forecast for adjusted EBITDA from $24 202 mln (+12.5% YoY) to $24 892 mln (+15.7% YoY) for 2024 and from $27 052 mln (+11.8% YoY) to $27 503 mln (+10.5% YoY) for 2025.

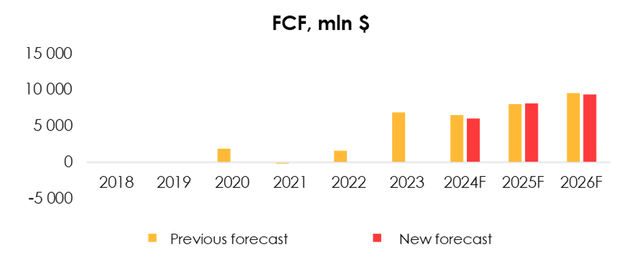

As a result of the increase in the content investment forecast, the free cash flow forecast was revised downwards from $6 544 mln (-6% YoY) to $6 048 mln (-13% YoY) for 2024, but upwards from $8 053 mln (+23% YoY) to $8 096 mln (+34% YoY) for 2025.

Penetration rates are coming to ceiling levels. What’s next?

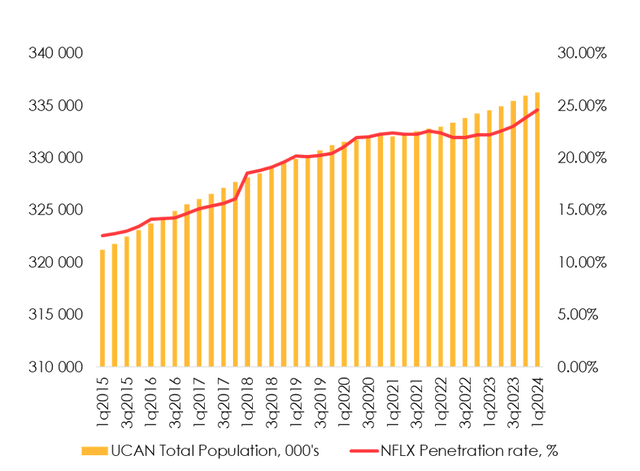

As mentioned in the Q1 FY2024 shareholder letter, Netflix will stop reporting paid subscribers in FY2025 and will only report regional revenue streams. We believe that the main reason why the company wants to stop reporting is the slowdown in growth in developed markets. In particular, in North America, NFLX has reached a total penetration rate of almost 25%. And when Netflix started to monetise sharing accounts, the penetration rate increased after a period of stagnation.

We believe that the company will still be able to maintain customer growth in developed markets, but has almost reached a plateau in developed UCAN & EMEA, as most of the sharing audience has already been converted into subscribers.

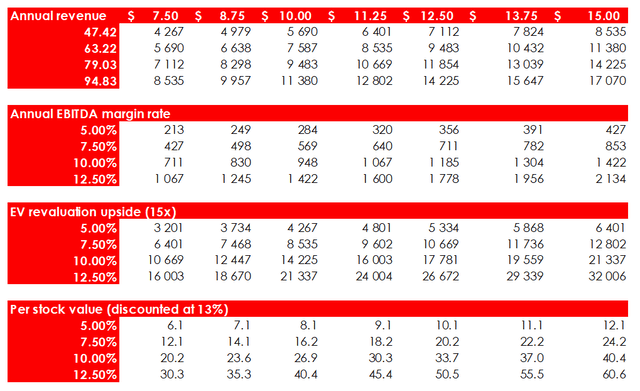

However, Netflix is considering entering the cloud gaming market in the future. We’ve made a rough estimate of the potential financial upside from the gaming division, depending on the ARPU ($7.50 – $15/month) and the cross-selling rate of paid subscribers (15% – 30% of total). On average, the gaming division adds $23/share to the current price target.

Currently, Netflix only uses gaming as a user retention feature (free downloads from the Apple Store, mobile games, etc.), so the segment remains immaterial to the company’s financials. The projected upside should only be considered as an option, as there’s no clear path in terms of go-to-market strategy and monetization.

Valuation

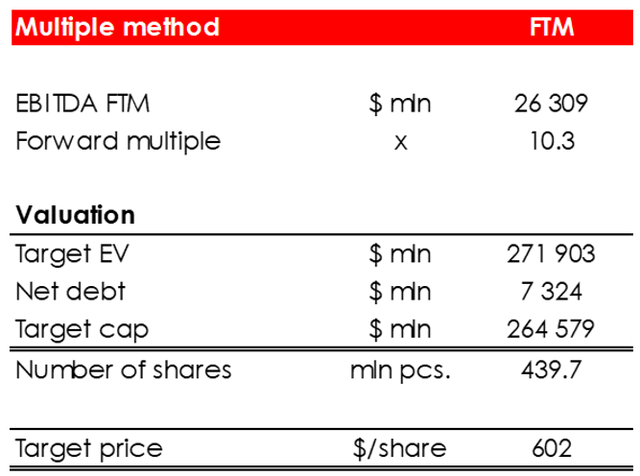

We’re evaluating NFLX target share price based on FTM EV/EBITDA multiple.

We set the target price of the shares at $602 due to:

- upward revision of the forecast for adjusted EBITDA in 2024-2025;

- shift in FTM estimate (previously we included EBITDA guidance for the next 12 months, from Q2 2024 to Q1 2025, now the forecast period shifts to Q3 2024-Q2 2025).

Based on the new assumptions, we are maintaining the rating for the company at HOLD.

Conclusion

Despite several healthy earnings reports in a row and dominating the global streaming market, we believe Netflix has almost reached its full potential. Although there is still room for growth in emerging markets, it may be difficult for Netflix to grow in developed markets after the shift to paid sharing. Current share prices are fair, and we believe investors could focus on other market opportunities.

To manage your position, we suggest keeping an eye on Netflix’s financial statements and industry research (JustWatch, Nielsen, Parrot).

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.