Summary:

- With Jake Paul Vs. Mike Tyson, pay-per-view events may now make a gradual shift to subscriber-based streaming.

- This article will examine just how much subscriber growth this new medium could possibly generate.

- I predict it will need to drive at least a 20% CAGR in subscriber growth for the next 3 years to make the price of Netflix make sense right here.

- I build some models to visualize what that might look like.

g01xm/iStock Editorial via Getty Images

A new paradigm in streaming

Netflix (NASDAQ:NFLX) is doing something that I could have never imagined, they’re bringing pay-per-view to a worldwide audience for merely the cost of a subscription. Having been a Mike Tyson fan myself as a kid, I remember vividly the pain we had to go through to watch a Mike Tyson fight. For instance, when our family got the Mike Tyson Vs Peter McNeeley fight on pay-per-view in 1995, this is what we had to go through:

- Go to the Comcast office to see if they have pay-per-view boxes available.

- Rent the box and put down a deposit.

- Call the fight payment hotline [my parents did this of course] to cough up the $50 for the fight, providing a unique box code identifier if I remember correctly.

- Screw the box into the back of our TV, unscrambling the fight channel.

- Enjoy the 89-second fight after arduous hours of un-interesting undercard fights.

- Return the box and my parents got their deposit back.

Now, we can simply find the fight on a streaming service on our smart TVs and press a button to pay. As if that were not already convenient enough, you’re telling me that getting prize fights as part of a streaming package is going to become a thing? If so, and this is a new marketing trend for the masses, this is going to attract a lot of subscriptions.

Some background on the fight for those who are not fans or follow the sport. Jake Paul is a YouTuber turned boxer who challenges a lot of retired MMA and professional boxers to exhibition matches. Some notable retired fighters he’s faced include:

- MMA legend Anderson Silva

- MMA legend Nate Diaz

- Tyson Fury’s [WBA Heavyweight Boxing champion] brother, Tommy Fury

Most of these have ended in a decision for Paul or a knockout. Many have speculated whether they were rigged. Regardless, they’re popular pay-pre-view fanfare as everyone awaits for Jake Paul to eat canvas and get knocked out himself. So, of course, seeing Paul fight Mike Tyson is going to be pretty popular.

However, I do have some skepticism over just how sticky these new subs will be. I fully expect next quarter data to incorporate a lot of signups for this event. Even though Mike Tyson is now 58, that almost makes it more intriguing.

Notes on video quality of the Tyson VS. Paul event

Please note, that I’m writing this as I’m watching the event. There’s a lot of pixelation and low-resolution moments. I don’t know how many people are watching worldwide, but the quality is not up to par with some other highly viewed sporting events like NFL playoff games on Amazon. Again, this could just be the sheer volume of viewers, or it could be that Netflix does not have the data-crunching capability for live event compression when there is an overload of viewership. Stay tuned for other commentary in days to come.

Year to date performance

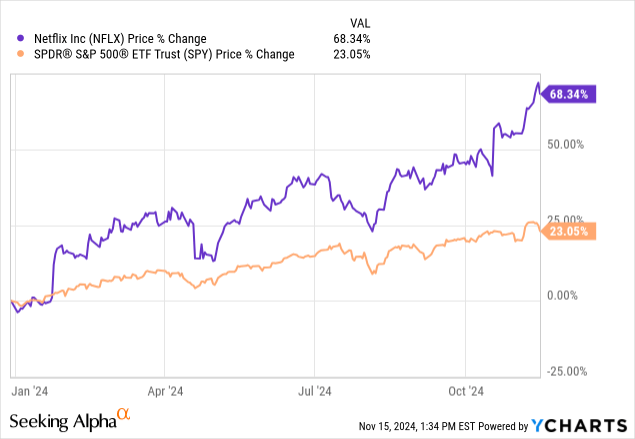

Netflix has been on a tear this year, more than doubling the price return of the S&P 500 (SPY). We would expect after such a run that the valuation levels on Netflix are also sky-high.

Sky-high valuations

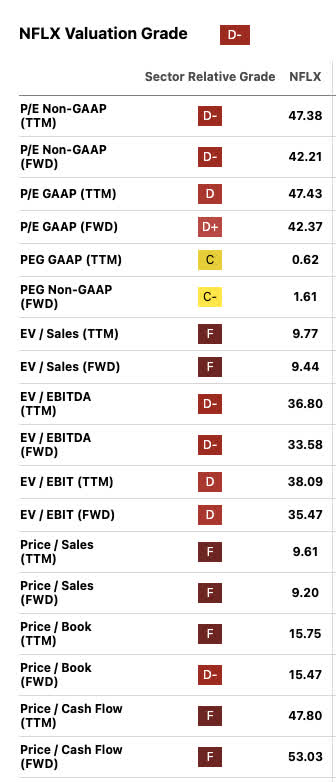

Seeking Alpha

A sea of red from the Seeking Alpha valuation tab for Netflix. Still, a blended average of around 40 X forward earnings for both GAAP and Non-GAAP [33.58 EV/EBITDA and 42.37 GAAP P/E] is not an unsurmountable valuation to be able to grow into. I personally still use the Peter Lynch rule of thumb never to assume more than 25% growth in profitability ongoing. Thus, if I was using a PEG ratio model where the price-to-earnings divided by the earnings growth rate should not exceed a value of 1, I’d only want to be paying 25 X earnings maximum.

I’m going to attempt to build a theoretical model of how Netflix can get there [based on your cost basis if buying in today]. Let’s first start with the latest subscriber data.

Q3 data for Netflix

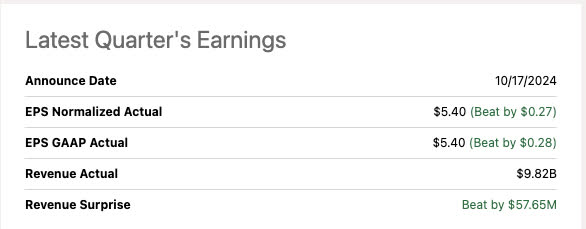

Seeking Alpha

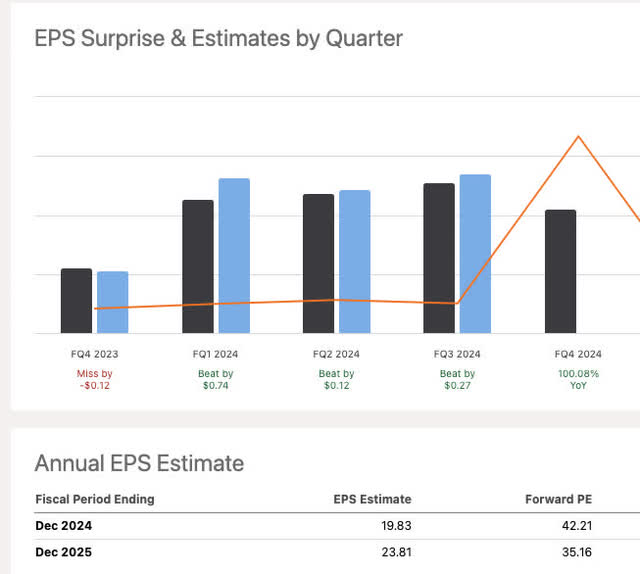

Another top and bottom line beat back in October sent the stock higher. This has been a consistent theme this year for Netflix, they are on a roll:

So far, every quarter this year, they have been able to beat the EPS estimates. With this upcoming quarter incorporating the Tyson VS. Paul fight data, it is something that I’m not sure will show up in the EPS data, but the new subscriber data should be very positive. The market has traded this up for a reason, they continue to grow earnings at a consistent rate.

The consensus analyst estimates between the full year 2024 and the full year 2025 is looking for nearly $4 a share in EPS growth, or 20% year over year. This is a great rate of growth, but the market is still overpaying for it in my opinion.

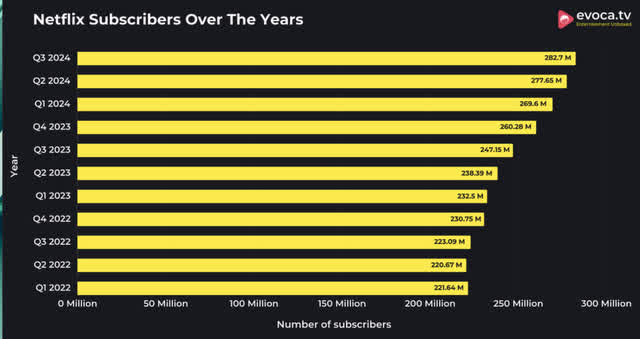

Subscriber growth quarter after quarter. At 282.7 million subscribers, Netflix was able to grow the subscriber base another 1.8% quarter over quarter. Looking at Q3 on a year-over-year basis, subscriber growth is up 14.3%. With so many subscribers already incorporated here where else can we expect growth?

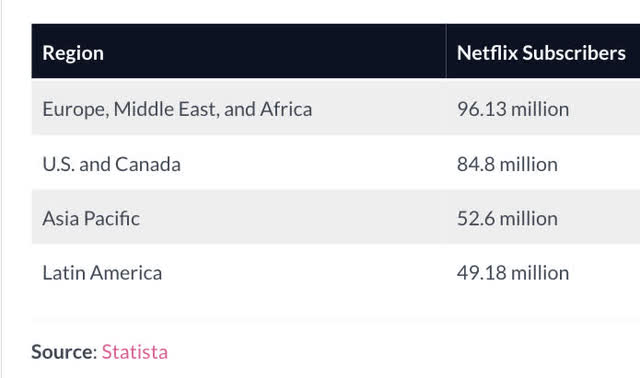

So here we can see that the US is already pretty saturated. I would like to look at this on a household-by-household basis, not anticipating more than one subscription available for Netflix to absorb per household to be conservative. In this model, I am going to assume that the number of people per household is consistent with other regions where the US has about 2.61 members per household. I will divide the regions of importance to this model by 2.61 to estimate the number of households to absorb into new subscriptions.

Here are my predicted household numbers by region:

- US: 46.2 million households left in the US [131 million households in the US minus 84.8]

- LATAM population, 616 million /2.61 = 236.92 million households minus 49.18 = 187.74 million households left.

- EU population 741 million/2.61 = 283 million households minus 96.13 million = 187.9 million households left.

- All households left ex Asia Pac region = 420.85 million.

Why am I excluding Asia Pac? In this thesis, I just want to drill down on the regions where I think previous pay-per-view paid combat sports content would drive subscriber growth. With most boxers and MMA fighters coming from the US, Latin America, and Europe, these are also the regions where the sport is most popular and a clear value add.

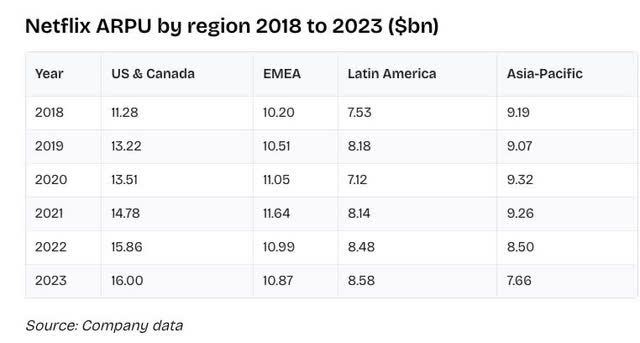

NETFLIX company data via businessofapps.com

Here, I am going to take an average rather than a weighted average along current revenue trends, of the all-region ARPU since there is more growth to be had outside of the US versus inside of the US. That would be $10.77 per user in revenue.

- All projected households left in 3 focus regions: 420.85 million.

- Times X $10.75 per user is $4.52 Billion in available monthly revenue.

- Times X 12 months is $54.28 Billion in annual available revenue.

- Divided by 2 to conservatively say half could be captured is $27.144 Billion in annual revenue available.

- Using Netflix’s current gross margin of 54.7% would get us $14.84 Billion in gross profit.

- From the gross, Netflix captures 45% of that to translate into a net income margin or an added $6.68 Billion in net income.

- Adding this straight into the existing TTM net income of $7.78 Billion gets us to $14.461 Billion in net potential future income.

I would say it would take at least until 2026 and a lot of combat sports investing to get to this net income number. Let’s run a future “owner earnings” discount model on that to see what it would be worth. Here, we define “owner earnings” as Net income + Depreciation and Amortization minus CAPEX discounted at the 10-year Treasury risk-free rate of return:

- $14.461 Billion + Projected 2026 Depreciation and Amortization of $500 million, minus $400 million in projected CAPEX equals = $14.56 Billion in owner earnings.

- $14.56 Billion discounted at 4.4% = $330.94 Billion fair market cap.

- Divided by 427.5 million shares outstanding = $774.14/ share fair price.

The above is obviously taking into account a lot of growth and no incorporation of further ad revenue growth, which, I think, would be offset by future R&D requirements to buy combat sports programming.

Using a PEG ratio analysis on this future growth would again use Peter Lynch’s upper limit assumption of 25% to find where a PEG 1 ratio would be demarcated. In this case, $14.61 Billion / 427.5 million shares outstanding gets us to $33.82/ share in GAAP income. Using 25 as the multiplier [25 X $33.82] would get us to $845.71 a share.

Also, keep in mind, my CAPEX projections are light

After checking in with all my friends watching the Tyson VS Paul fight live, my pixelated less than 720 P quality is actually pretty good being that it isn’t buffering. Others are experiencing a lot of buffering. There’s either going to have to be an acquisition of a better compression technology company or more CAPEX spent on data centers if they want to pull off live prize fights going forward.

So in this case, in the absolute perfect scenario based on forward numbers and a near doubling of subscribers in 2 years, I can only justify on the high end a price that is 2.7% higher than the price the stock trades at today in 2024.

Also, prize fighting needs to make a comeback

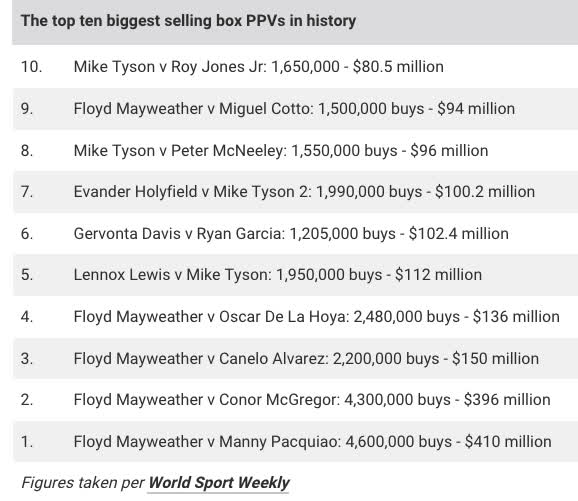

givemesport.com

Still, the biggest PPV prize fight of all time, Floyd Mayweather V Manny Pacquiao was in 2015. In all honesty, without Mike Tyson and without Floyd Mayweather Jr., boxing has faded and has now been usurped by demand for MMA. UFC consistently pumps out new stars and puts on a plethora of pay-per-view events throughout the year. Making a deal with Dana White for a full year of UFC bouts would be exactly what Netflix or other streaming contenders would need to catapult subscriptions using this thesis.

With the WWE about to premier on Netflix in a $5 Billion 10-year deal, it could possibly open the door to discussing UFC in the future with Dana White now owning both of those organizations.

Live sports and streamers

Here lies the issue with this, all the streamers are chasing sports to drive subscriber growth now that data centers are abundant enough to provide unlimited live broadcast data.

- Amazon Prime (AMZN): Major league baseball, NBA League pass, Thursday night NFL football.

- Google (GOOGL)(GOOG) NFL Sunday ticket.

- Disney (DIS) ESPN sports across all leagues.

- Apple TV (AAPL) Major League Soccer.

The above is just a highlight of some of the most known deals. You also have fuboTV (FUBO) and others. Everyone is chasing sports, so I think it is incorrect to believe Netflix has an inside track here. Investing in sports will eat up money that could have been invested in other content, so there may be some quality sacrifice in other areas in order to pursue this.

Casinos are everywhere

Here is the final problem. Casinos are everywhere and a lot of live sports is enjoyed in groups at bars and casinos. Did I pay for that Pacquiao Mayweather fight from 2015? No, I watched it at a Casino. Some of the potential expected revenue will undoubtedly be absorbed by group watch parties rather than in households.

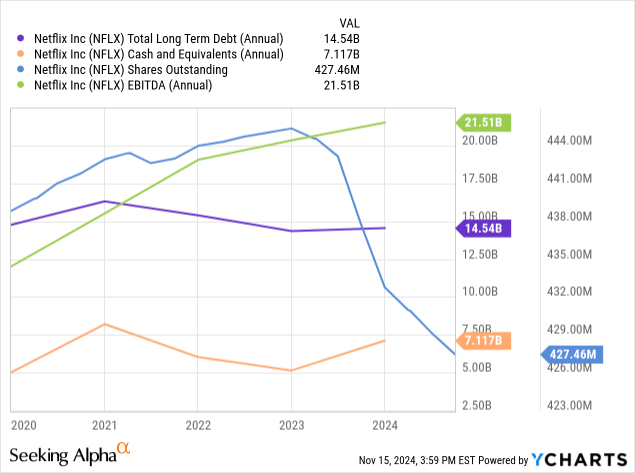

The balance sheet

Netflix is producing a lot of EBITDA, much more than its long-term debt. In this case, I could imagine Netflix can take on even twice the amount of debt they currently carry in pursuit of making live sports deals. Shares outstanding have recently been reduced, rewarding shareholders as a return of capital in lieu of a dividend.

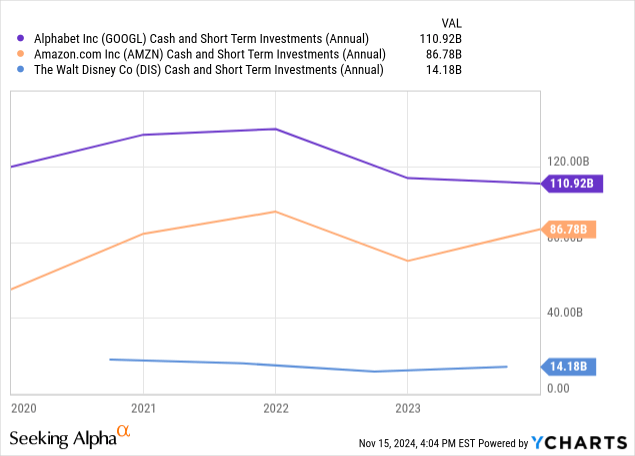

Cash and equivalents are ample, at about half of current long-term debt. The only issue I see is in the competition with Google and Amazon, they don’t have anywhere near the cash if these two companies want to invest heavily in their streaming services. In the end, money talks, whoever can sign the most deals will probably get the best subscriber growth rates if we believe live sports is the next frontier.

As we can see, the competition has substantially more resources but also less concentrated businesses. For now, Netflix has an edge because they are solely focused on streaming. That throne might not last forever.

Risks and summary

I can’t imagine bringing PPV to streaming will be cheap. Probably the most expensive per-showing sports category they can get into. Whether it works or not, we’ll know in the quarters to come with subscription data. For now, I believe it will take Netflix a near doubling in subscribers in a few years’ time to make the current price a buy right here, right now. That would be a 20-25% per annum subscriber growth rate CAGR for 3 years to hit that number. Trying to draw models longer than a few years into the future is not very worthwhile in my opinion.

That being said, subscriber-based models are probably the best companies to invest in [at the right price, of course]. There’s very little friction to customer acquisition, and we don’t have to worry about turnover ratios, inventory build, etc. I understand why investors are elated with the subscriber growth and EPS beats, that elation is already building in at least 3 years of growth in my opinion. If you own it, hold it, it’s a great stock.

The buffering during the fight should be a negative catalyst for a bit. I’m sure that Netflix will blame an insane amount of viewership as the issue [Jake Paul claimed 120 million live viewers at the post fight interview], but Netflix’s servers and compression technology will come into question now that they are pursuing live sports.

I just would not be a buyer here with all the competition at the castle gate and the need for perfection and then some from here on out. This is a hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS, AAPL, AMZN, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information provided in this article is for general informational purposes only and should not be considered as financial advice. The author is not a licensed financial advisor, Certified Public Accountant (CPA), or any other financial professional. The content presented in this article is based on the author's personal opinions, research, and experiences, and it may not be suitable for your specific financial situation or needs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.