Summary:

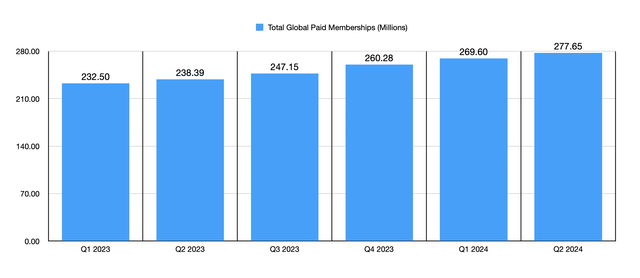

- Netflix’s financial results for the second quarter of 2024 showed record revenue and growth in paid memberships across all regions.

- Despite some declines in average revenue per membership, Netflix’s net income, operating cash flow, and EBITDA all saw significant increases.

- Management expects revenue for the third quarter of 2024 to be 14% higher than last year, and for the full year to be between 14% and 15% higher, showing continued.

- The firm continues to create stellar content and it has maintained robust market share in a competitive market.

- But this doesn’t make it a compelling opportunity at this point in time.

AzmanJaka

Had you asked many investors a year ago what the streaming industry would come to look like, many likely would have been pessimistic about a few of the firms. After all, streaming can only become so large. And with several entertainment giants over the last few years launching their own services, the threat of an oversaturated market seemed very real. When it comes to Netflix (NASDAQ:NFLX) specifically, you need not look any further than yours truly.

In past articles published, mostly in 2022, I mentioned how worried I was about the streaming giant. Even though it was one of the two largest streaming companies on the planet, the other being The Walt Disney Company (DIS) with Disney+, Hulu, and ESPN+, what concerned me were a couple of things. For starters, Netflix was priced near the higher end of the scale compared to the major entertainment companies. And second, those firms boasted massive libraries of content that had been built up over decades. Frankly, I did not have much hope that Netflix would remain relevant.

I ended up admitting my fault back in October 2023 when I ultimately upgraded the stock from a ‘hold’ to a ‘buy’. By April of this year, after seeing the stock skyrocket 50.9% at a time when the S&P 500 was up 16%, I ended up pulling back and downgrading it to a ‘hold’ once again. Looking at the newest data provided by management, data that came out for the second quarter of the 2024 fiscal year, I do not think that now is the time to become bullish on the firm. However, I would also be lying if I said that management was not continuing to prove my original fears wrong. And at some point, if the company keeps on delivering like this, an upgrade could occur once again.

A great show

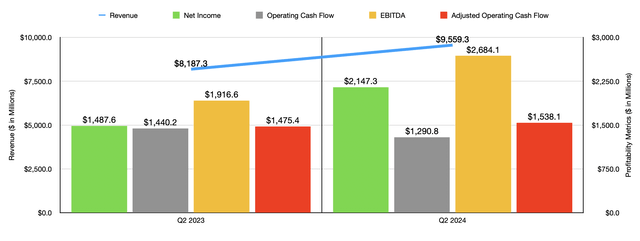

Fundamentally speaking, things are going really well for Netflix right now. To understand how well, we only need to look at the financial results for the second quarter of the company’s 2024 fiscal year. During that time, revenue for the business came in at $9.56 billion. In addition to being an all-time high for the company, it represented a 16.8% improvement over the $8.19 billion generated just one year earlier.

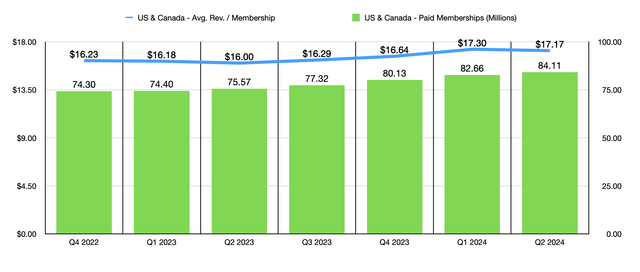

By far, the biggest driver behind this increase was a growth in the number of paid memberships. In the US and Canada, which is responsible for 44.9% of the company’s overall sales, paid memberships grew to 84.11 million. That is 1.45 million above the 82.66 million reported in the first quarter of 2024. And it’s also a whopping 8.54 million above the 75.57 million that the company had one year ago. This is not to say that everything has been great. While average revenue per membership per month of $17.17 is comfortably higher than the $16.00 reported one year earlier, the reading reported for the second quarter of the year was down from the $17.30 reported in the first quarter.

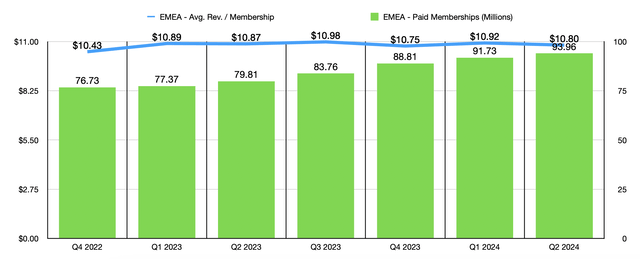

This has not been the only source of growth for the firm. In fact, it has seen membership growth in every single region on a quarter over quarter and year over year basis. In the EMEA (Europe, Middle East, and Africa) regions, membership expanded from 91.73 million in the first quarter of this year to 93.96 million in the second quarter. Year over year, membership is up 17.7%, or 14.15 million. Year over year, average revenue per member did manage to fall from $10.87 to $10.80. This may not seem like much of a decline. But when applied to the number of paid memberships that the company had at the end of the second quarter, this difference would translate to about $78.9 million in reduced revenue on an annualized basis.

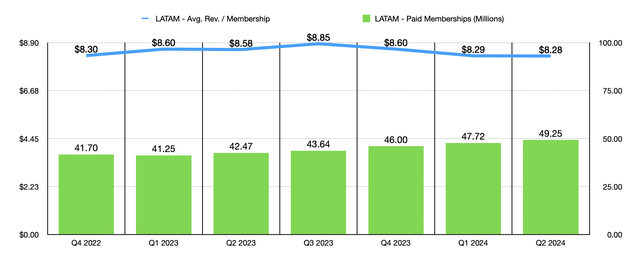

In Latin America, the 49.25 million members that the company had was comfortably above the 42.47 million reported one year ago. But as was the case in the EMEA markets, average revenue per membership did fall, dropping from $8.58 per member per month to $8.28. As disappointing as this is, this drop was actually driven by foreign currency fluctuations. If we use a constant currency framework instead, we would actually get year over year growth in average revenue per membership per month of 24%.

Author – SEC EDGAR Data Author – SEC EDGAR Data

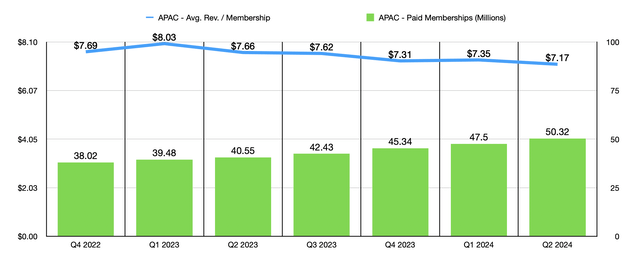

A similar trend can be seen when looking at the Asia Pacific region. For the first time ever, Netflix hit over 50 million paid members there, with the number totaling 50.32 million at the end of the most recent quarter. That’s a whopping 24.1% surge over the 40.55 million reported just one year earlier. But over that window of time, average revenue per membership per month dropped from $7.66 to $7.17. In this case, a constant currency approach cuts this decline by half.

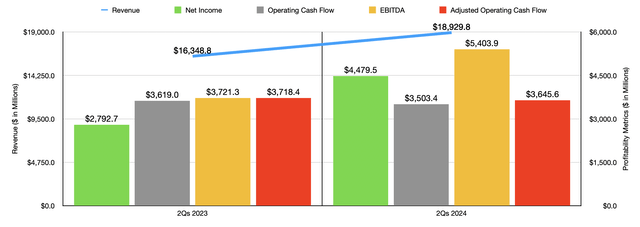

Shares are pricey

You might think that lower pricing might mean lower margins. But at the end of the day, overall profits for the company moved up rather significantly. Net income jumped from $1.49 billion to $2.15 billion. Operating cash flow did contract from $1.44 billion to $1.29 billion. But if we adjust for changes in working capital, we get a slight improvement from $1.48 billion to $1.54 billion. And lastly, EBITDA for the company jumped from $1.92 billion to $2.68 billion. In the chart above, you can also see financial performance for the first half of 2024 relative to the first half of 2023. Year over year, revenue, profits, and EBITDA all rose nicely. But there was weakness when it came to operating cash flow and adjusted operating cash flow.

Management does not offer much in the way of guidance. But they did say that, on a constant currency basis, they expect revenue for the third quarter of this year to be roughly 14% higher than it was last year. And for 2024 in its entirety, they said that revenue should now be between 14% and 15% above what it was last year. That’s up from a previous range of between 13% and 15%. We don’t really know what to expect for the bottom line for the year. But if we simply annualize the results seen so far, it would translate to net income of $8.67 billion, adjusted operating cash flow of $7.25 billion, and EBITDA of $10.62 billion.

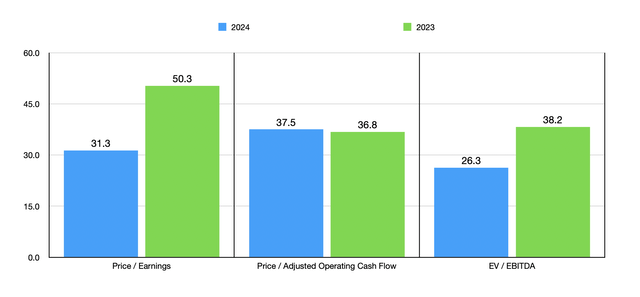

Using these figures, we can see how shares of the company are valued in the chart below. This includes the use of historical figures for last year and the forward estimates for 2024. Even on a forward basis, shares of the business do look very pricey. They are certainly more expensive than what I am typically comfortable with. But of course, the market is assigning a high value to these growth prospects. So even though I would generally be bearish about a business like this, at these multiples at least, I think a more neutral stance makes more sense.

Growth opportunities remain

Outside valuation, it’s important to note some other important data points that help make me comfortable with keeping Netflix a ‘hold’. The fact of the matter is that, even though streaming is a fairly mature industry, and a highly competitive space, management continues to push out high-quality content. In fact, just before second quarter earnings data came out, the company stated that it was the most nominated brand for the 76th annual Primetime Emmy Awards. During that event, it gained 107 nominations across 35 different series. The company’s content continues to draw in hundreds of millions of people every quarter. For instance, in the second quarter of the year, the Bridgerton library of content that the company has was responsible for 172 million views in all. This comes from roughly 278 million member households, with an estimated audience of 600 million. Season 3 of Bridgerton locked in 98.5 million views on its own. But there are plenty of other shows as well. For instance, Under Paris is now the third most popular non-English film in the company’s library, with a total of 90.9 million views. Atlas was responsible for 79.3 million views. The British drama Baby Reindeer was responsible for 88.4 million views. The list goes on. Furthermore, in May of this year, Netflix announced that it would be the home for both Christmas Day NFL games this year. It will also have exclusive rights to the Christmas games for the league next year and the year after.

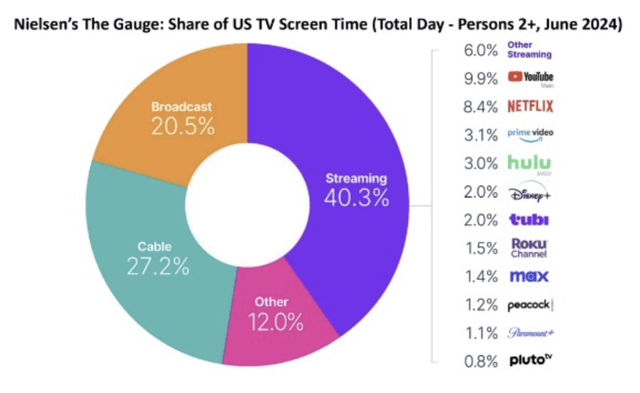

The company continues to invest in video games, which is a massive market opportunity. This includes third-party games like Grand Theft Auto, as well as games based on its own intellectual property. Management is also very optimistic about the role that advertising can play in boosting revenue and profitability. In the first 18 months since launching its ad-supported tiers, these have come to be responsible for 45% of all signups in the markets in which they are available. The company continues to invest in other technologies on its platform in order to boost the value of advertising on it. And that should continue for the foreseeable future. And of course, there’s still plenty of room to grow. For the US alone, only 40.3% of all TV screen time is dedicated to streaming. And with a market share of 8.4%, Netflix is currently number two in the space, just behind YouTube.

Takeaway

All things considered, Netflix is doing quite well for itself. Growth has been impressive as of late and I expect that trend to continue for the foreseeable future. I think the company is doing really well and additional content creation, not to mention other innovations like I mentioned, will propel it higher. I don’t think that this makes the company a great investment opportunity at this time. The market understands how valuable this platform is and is pricing it accordingly. But if shares do pull back or if fundamentals improve even more, my mindset on the matter could easily change.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!