Summary:

- Netflix will stop reporting quarterly membership and average revenue per membership in Q1 2025.

- Autoplay has increased user engagement, with shorter countdowns resulting in more hours watched.

- Netflix’s valuation range is estimated to be between $240 billion and $290 billion.

Marvin Samuel Tolentino Pineda

Introduction

Per my January article, Netflix (NASDAQ:NFLX) shines with global distribution. This is one of the reasons why their economics are solid and the 1Q24 letter says revenue and operating margin have been the key financial metrics over the years, while engagement has been a nice estimate of customer satisfaction. Membership growth was important when Netflix was subscale, but they are a mature company now. The 1Q24 letter says they will stop reporting quarterly membership and average revenue per membership (“ARM”) in the first quarter of 2025 (emphasis added):

Now we’re generating very substantial profit and free cash flow (FCF). We are also developing new revenue streams like advertising and our extra member feature, so memberships are just one component of our growth. In addition, as we’ve evolved our pricing and plans from a single to multiple tiers with different price points depending on the country, each incremental paid membership has a very different business impact. It’s why we stopped providing quarterly paid membership guidance in 2023 and, starting next year with our Q1’25 earnings, we will stop reporting quarterly membership numbers and ARM.

Analysts and advertisers want to know the reach by geographic area. My thesis is that Netflix is doing the right thing by focusing on engagement, but they are also making a mistake by abandoning the quarterly membership updates in 2025.

The Numbers

One of the tools Netflix uses to increase engagement is autoplay. @JyotbirLamba recently posted about how the importance of autoplay was revealed by a former programmer back in 2019. It appears A/B tests have shown users now prefer shorter countdowns as they have become more accustomed to autoplay (emphasis added):

As part of the autoplay test, we tested how long the countdown should be between episodes. 5 seconds, 10 seconds or 15 seconds. 10 seconds caused the biggest increase in hours watched. We thought that it gave people time to digest what they had just watched, but wasn’t too fast (5 seconds) where it became jarring. Interestingly, Netflix recently changed the countdown between episodes to 5 seconds. That means they tested it out and found that people watch more if with a shorter countdown. This didn’t used to be the case. Netflix users have become conditioned to expect autoplay.

This and other testing techniques mean the Netflix ecosystem is now optimized such that users are likely to stay engaged and finish a series once it is started. The January to June 2023 viewing report confirms this as series are well represented with respect to titles having over 200 million viewing hours:

|

Title |

Global |

Release Date |

Hours Viewed |

|

The Night Agent: Season 1 |

Yes |

2023-03-23 |

812,100,000 |

|

Ginny & Georgia: Season 2 |

Yes |

2023-01-05 |

665,100,000 |

|

The Glory: Season 1 // 더 글로리: 시즌 1 |

Yes |

2022-12-30 |

622,800,000 |

|

Wednesday: Season 1 |

Yes |

2022-11-23 |

507,700,000 |

|

Queen Charlotte: A Bridgerton Story |

Yes |

2023-05-04 |

503,000,000 |

|

You: Season 4 |

Yes |

2023-02-09 |

440,600,000 |

|

La Reina del Sur: Season 3 |

No |

2022-12-30 |

429,600,000 |

|

Outer Banks: Season 3 |

Yes |

2023-02-23 |

402,500,000 |

|

Ginny & Georgia: Season 1 |

Yes |

2021-02-24 |

302,100,000 |

|

FUBAR: Season 1 |

Yes |

2023-05-25 |

266,200,000 |

|

Manifest: Season 4 |

Yes |

2022-11-04 |

262,600,000 |

|

Kaleidoscope: Limited Series |

Yes |

2023-01-01 |

252,500,000 |

|

Firefly Lane: Season 2 |

Yes |

2022-12-02 |

251,500,000 |

|

The Mother |

Yes |

2023-05-12 |

249,900,000 |

|

Physical: 100: Season 1 // 피지컬: 100: 시즌 1 |

Yes |

2023-01-24 |

235,000,000 |

|

Crash Course in Romance: Limited Series |

Yes |

2023-01-14 |

234,800,000 |

|

Love Is Blind: Season 4 |

Yes |

2023-03-24 |

229,700,000 |

|

BEEF: Season 1 |

Yes |

2023-04-06 |

221,100,000 |

|

The Diplomat: Season 1 |

Yes |

2023-04-20 |

214,100,000 |

|

Luther: The Fallen Sun |

Yes |

2023-03-10 |

209,700,000 |

|

Fake Profile: Season 1 // Perfil falso: Temporada 1 |

No |

2023-05-31 |

206,500,000 |

|

Vikings: Valhalla: Season 2 |

Yes |

2023-01-12 |

205,500,000 |

|

Extraction 2 |

Yes |

2023-06-16 |

201,800,000 |

|

XO, Kitty: Season 1 |

Yes |

2023-05-18 |

200,700,000 |

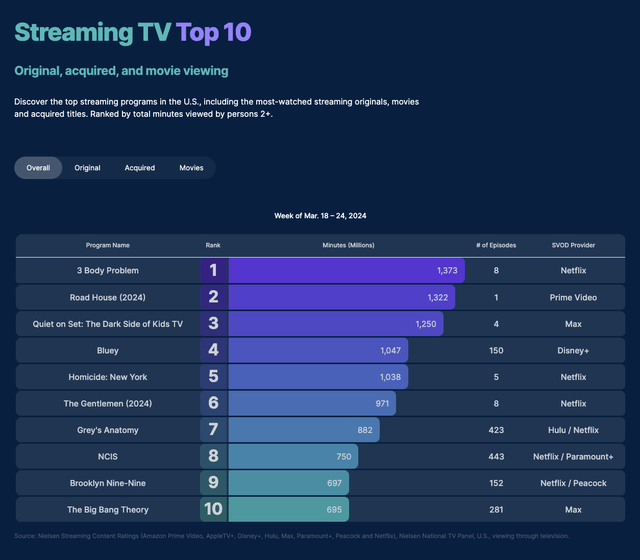

The length of titles and/or the number of episodes above should be given in order to think about how many times something was viewed. In other words, if I watch a 2-hour movie like The Mother once and a 10-hour series once, then I think the above shows 2 hours for The Mother and 10 hours for the series. Despite this caveat, series they key for Netflix with respect to engagement. One of the new series which has come out for Netflix since the titles through June above is 3 Body Problem, and it is getting high engagement. Per Nielsen, it was the top streaming program in the US the week of March 18th to March 24th:

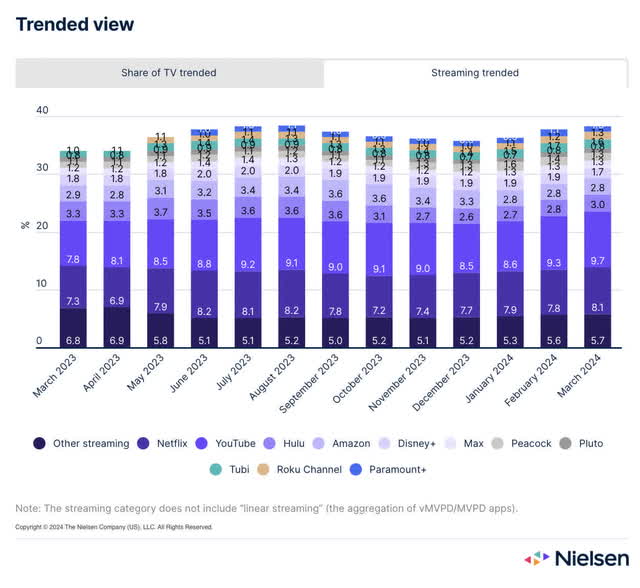

US viewership for Netflix went up over the last year as investments in engagement paid off. Per Nielsen, streaming as a percentage of overall viewing in the US went from 34.1% in March 2023 to 38.5% in March 2024. Netflix climbed from 7.3% to 8.1% of overall viewing during that time:

YouTube was responsible for 43% of the overall streaming increase in the US over the last year, but they’re a different beast as they rely on user-generated content. Leading conventional streamers, Netflix accounted for 18% of the overall streaming increase above.

Valuation

Capital allocation is an important part of valuation. Looking at the 1Q24 10-Q relative to the 1Q23 10-Q, we see Netflix returned capital to long-term shareholders by doing buybacks such that the share count decreased more than 3% from 444,536,878 on March 31, 2023 down to 430,964,991 on March 31, 2024.

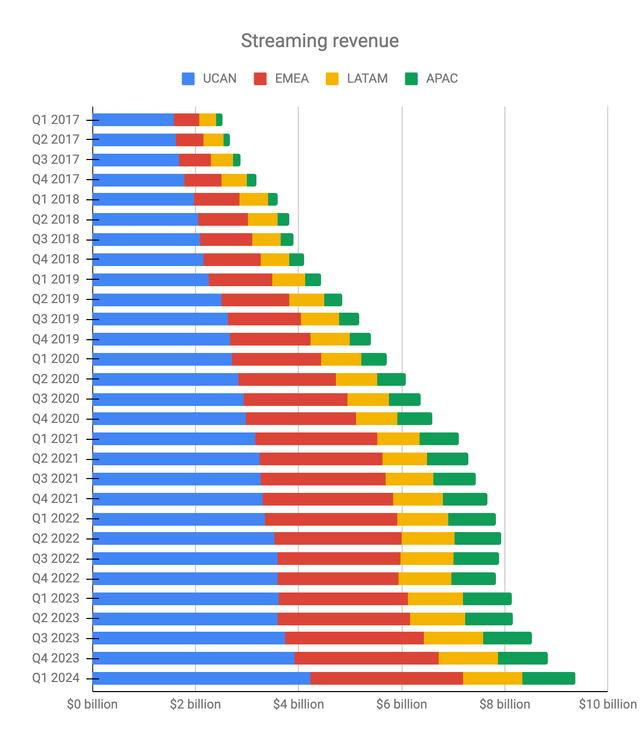

I am sanguine about global revenue growth and the 1Q24 letter says the reporting on this will continue to be broken out by geography:

We’ll continue to provide a breakout of revenue by region each quarter and the F/X impact to complement our financials.

Y/Y, streaming revenue increased over 17% in UCAN and EMEA while the increase was close to 10% in LATAM and APAC:

Streaming revenue (Author’s spreadsheet)

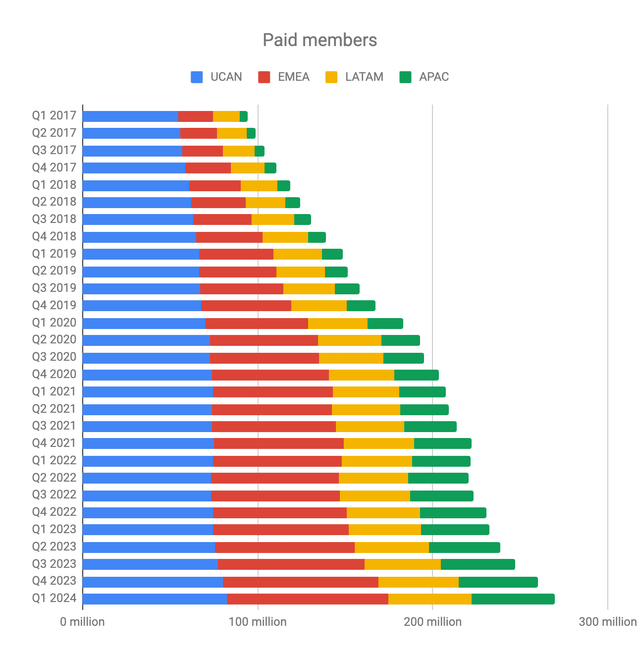

We now have about 270 million paid members, and it is helpful to see how they have grown in different regions over the years. Unfortunately, Netflix won’t be breaking this down every quarter starting in 2025. I think this is a mistake, as it shouldn’t distract from engagement if they reveal these numbers in footnotes:

Paid members (Author’s spreadsheet)

The 1Q24 letter says the following (emphasis added):

For the full year 2024, we expect healthy revenue growth of 13% to 15%, based on F/X rates at the end of Q1’24. We now expect FY24 operating margin of 25%, based on F/X rates as of January 1, 2024, up from our prior forecast of 24%.

Revenue for 2023 was $33.7 billion and if it grows 14% in 2024, then it will be about $38.4 billion. An operating margin of 25% implies operating income of $9.6 billion. If we apply a multiple of 25 to 30x, then we have a valuation range of $240 to $290 billion when rounded to the nearest $5 billion.

The market cap is $249 billion from the April 22nd share price of $577.75 times 430,964,991 shares. Seeing as the market cap is near the lower end of my valuation range, I think the stock is a hold.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX, AAPL, AMZN, DIS, GOOG, GOOGL, LBRDK, PARA, WBD, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.