Summary:

- There are polarizing opinions regarding the future growth prospects for Netflix.

- A snapshot look at the current fundamentals does not reveal a compelling bullish story in the near term.

- Let’s look at how the structure of price on the chart can speak to what may be the most likely path going forward.

razihusin

by Levi at Elliott Wave Trader; produced with Avi Gilburt

Netflix is one of those stocks that just seems to evoke strong opinions one way or the other. It has a nearly cult-ish type of following. This is the same with many other “Tech” stocks that we cover, one namely is Tesla (TSLA), in fact just recently here. With ‘disruptors’ of industry such as these, how are we to arrive at a correct valuation? We could also add to that query, when have they ever traded in line with a reasonable valuation? The answer to the last is, well, never. Why is this?

If there is one main point that we can all agree on, it may be that companies like Netflix and Tesla, among others, are disruptors. They have changed the way we see certain main areas of our life, like entertainment choices and their availability, as well as how we move around. When a company and a compelling concept come onto the scene, the marketplace will apparently struggle to arrive at a valuation that makes sense.

This is simply because the stock is valued via crowd behavior. What if you had a trading/investing system that would allow you to track this type of behavior, i.e. sentiment, and then project the next likely move going forward? That’s what we do every day for our members across the entire marketplace. Today we feature Netflix (NASDAQ:NFLX) for the readership here. Our own Lyn Alden recently commented on the stock.

The Fundamentals

When we queried Lyn regarding her current view on NFLX, this was her reply:

“I don’t currently follow NFLX very closely. Years ago I analyzed it deeply and became publicly bearish on it. After such dismal stock performance over the past several years, I’m no longer acutely bearish on it but also still don’t see a compelling bullish thesis, so I am agnostic toward it.”

And frankly, the technicals support the view. This is one of the preeminent fundamental analysts in the world telling us that at the moment there is not a ‘compelling bullish thesis’ for NFLX. This is after NFLX had just completed a raucous run from $7, yes $7 (split-adjusted), in 2012 to $700 at its peak in 2021. Some pretty easy math there to see that it was a hundred-fold return for those that held the entire way. Overheated massively and stratospherically beyond any valuation known to the universe, price fell to $163 in mid-2022.

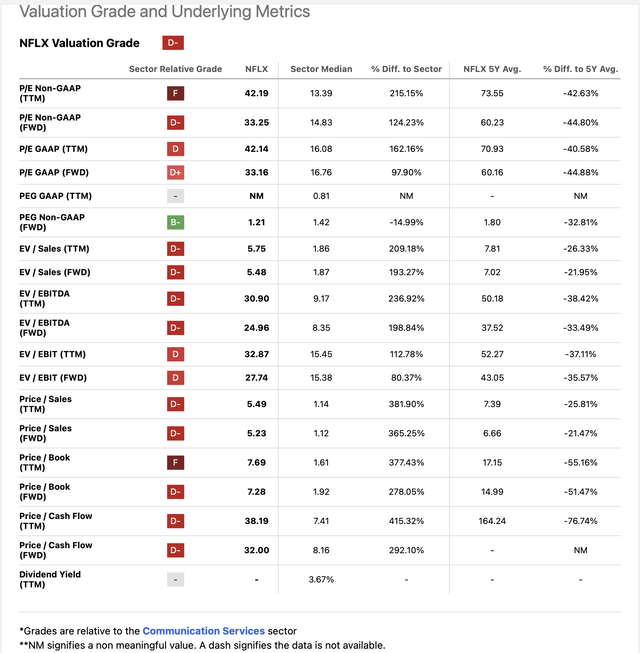

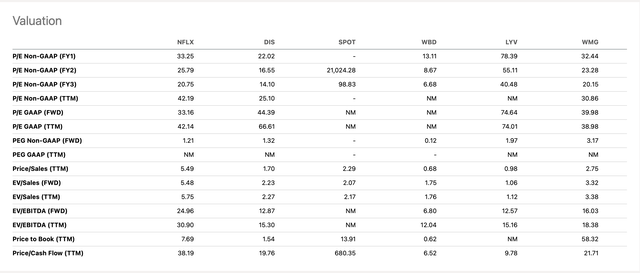

Take a look at the current snapshot valuation via Seeking Alpha:

One may just observe this via benign neglect, glancing every now and again, and let it find a base before revisiting a potential position in the stock and that could be the end of it. However, we also can view this issue from a behavioral point of view. Follow along as we dig in a different spot with Zac Mannes and Garrett Patten.

Sentiment And The Structure Of Price

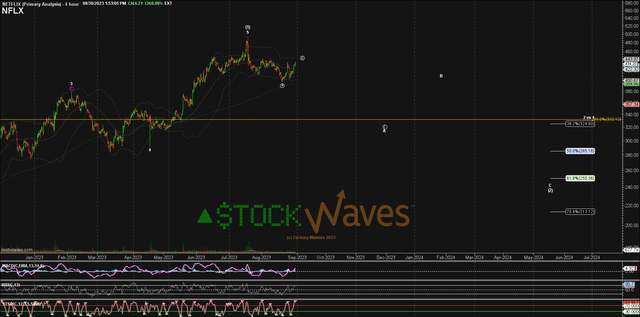

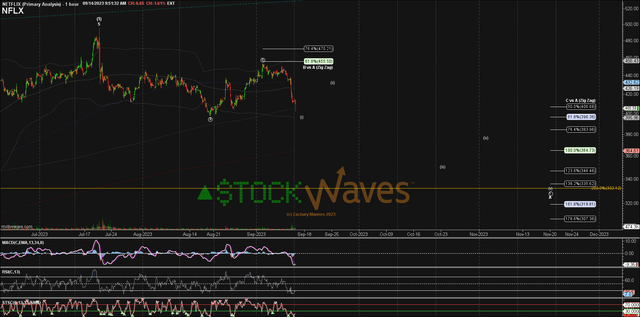

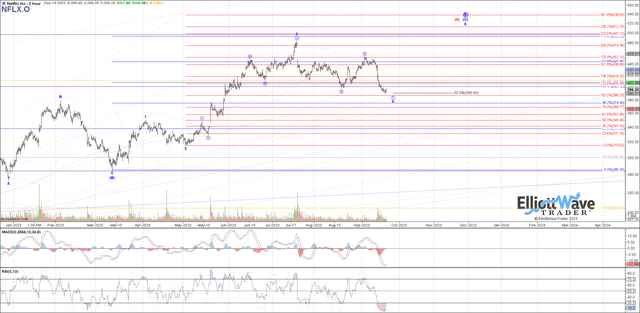

Take a look at the recent charts from both Zac and Garrett.

by Zac Mannes – StockWaves by Zac Mannes – StockWaves by Garrett Patten – StockWaves

At first glance, your initial response may be, “wait, are they split in their opinion?” Actually, I asked the same thing. Here’s some snippets from a conversation with Zac just the other day:

Zac: “Are we really ‘split’? So off the 390 region Garrett is looking for one more high to 500-520. While I favor a top being struck at 500 in July and staying under the 450s now.

I am actually more bullish long term counting this as the same [1] of a larger Primary Wave 5 like (TSLA) & (ALGN), but 5 waves up for [1] as a leading diagonal.

I think Garrett’s red [A] is a Primary Wave 5 though. So [B] would be same as my [2] and [C] pretty much same as [3].”

Whoa! What is that, Zac? Like some sort of Windtalkers winsome words? Code to confuse us? Not at all. Once you understand the basics of Elliott Wave, it all makes sense. Zac is telling us that he and Garrett are actually very much in alignment when it comes to NFLX stock.

Garrett & Zac each maintain their own independent charts, and while they tend to count things VERY similar and confer on most things, occasionally there are some nuanced differences in their Elliott Wave counts. There is a subjective “look” component to EW, not just the strict application of rules. There are many “Wave Slappers” out there that will technically apply the rules in a valid way but resulting in an entirely wrong “look”.

Many times when there is a nuanced difference between Zac & Garrett, it will be in the short term at a smaller degree such as here in NFLX, where Garrett favors one more high off recent support while Zac is only looking for a corrective bounce to stay under resistance.

This is where we are able to identify the risk to the path illustrated by Zac in the above charts.

Risk: should price break above the 450s, then the path shown by Garrett may be playing out and could target another swing high in the 500 to 520 range before a larger pullback.

Conclusion

NFLX may have struck an important high back in November of 2021. That high in the 700 range is likely to hold for some time. In the near term, the most probable path we should take is a pullback, to perhaps as low as 320.

Continuing Education

We have an extensive Education library available at Elliott Wave Trader. As well, we want to teach others this methodology. Three times a week we have beginner and intermediate-level videos where we show the exact way we count the waves and give in-depth analysis techniques. This methodology, if you give it the chance, will change the way you invest forever. More on that can be found here.

There are many ways to analyze and track stocks and the market they form. Some are more consistent than others. For us, this method has proved the most reliable and keeps us on the right side of the trade much more often than not. Nothing is perfect in this world, but for those looking to open their eyes to a new universe of trading and investing, why not consider studying this further? It may just be one of the most illuminating projects you undertake.

(Housekeeping Matters)

If you would like notifications as to when our new articles are published, please hit the button at the bottom of the page to “Follow” us.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.