Summary:

- Netflix is expanding into physical entertainment venues, offering immersive experiences based on popular shows to increase user engagement and revenue streams.

- Financially, Netflix is strong with a large gain in subscribers in Q1 and jump in revenue, leading to an increased price target from Evercore.

- The company’s move into in-person entertainment spaces positions them to compete with Disney and diversify revenue streams, with significant growth potential and undervaluation.

- Given this, I think the stock is a strong buy.

hapabapa

Investment Thesis

Netflix (NASDAQ:NFLX), has traditionally been known as a streaming giant. However, recently the company has been trying to expand their service beyond this. Netflix is venturing into the physical entertainment market, a move that aligns themselves with major competitors like Disney (DIS), who have long capitalized on physical theme parks and entertainment venues. I think this is an important move.

This expansion is highlighted by the introduction of Netflix House, with the first locations set to open in Pennsylvania and Texas by 2025. These venues will offer immersive experiences based on popular Netflix shows, exclusive merchandise, and eateries, effectively blending the digital and physical entertainment worlds. I think this is a great idea. Not only will these locations likely increase user engagement for their digital platform, but they will also add an additional revenue stream for Netflix, allowing them to reduce dependency on subscription-based income.

Financially, I believe Netflix is positioned stronger than ever, as noted by Evercore, which emphasized the company’s robust financial health and increased their price target to $700 up from $650. The recent success of Netflix’s password-sharing crackdown has likely contributed to his success, as this initiative has led to a substantial increase in subscribers and revenue. The company reported a record gain of 13.1 million subscribers in Q4 2023 and about 9.33 million in Q1 2024, a testament to the effectiveness of their new policies and technological investments in AI-driven security measures.

Netflix’s financial metrics reinforce its growth potential. The company’s PEG ratio is currently below the sector median, yet their growth rates significantly surpass industry averages. This suggests that the market is undervaluing Netflix’s growth prospects. Given these factors, I think Netflix is still a strong buy.

Why I Am Doing Follow Up Coverage

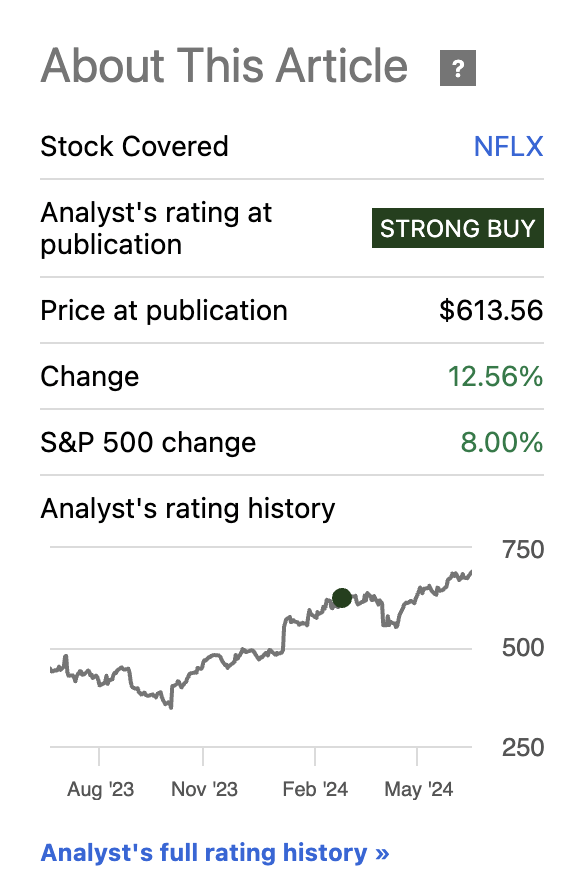

In my previous coverage of Netflix from March, I rated Netflix as a strong buy. My main reasoning for this was due to their technology advancements in cracking down on password sharing. So far, their stock has shown strong results, with revenue and subscriber count increasing since then and shares beating the market.

Netflix Stock Performance (Seeking Alpha)

Recently, the company’s stock is coming up on breaking out of a multi-year range. I think with the new entertainment venues discussed above, Netflix has plenty of room to grow. I continue to hold the same position but for additional reasons which I discuss throughout this article. Therefore I believe this follow-up coverage is warranted. As we see the stock break out of this range we could see more room to the upside.

Deep Dive on In-Person Entertainment

As I mentioned above, Netflix is exploring the in person entertainment industry which houses some of their streaming competitors like Disney. This initiative will be centered around their Netflix House, with the first locations slated to open in Pennsylvania and Texas by 2025. These venues will offer immersive experiences based on popular Netflix shows like “Stranger Things”,“Bridgerton”, and “Squid Game”. Visitors will be able to solve puzzles from “Stranger Things” and even attend a Regency-era ball, such as the one in “Bridgerton”. In addition to this, visitors will have access to exclusive merchandise and food options. This project allows Netflix to move beyond digital streaming to create a physical presence that can deepen consumer engagement and loyalty.

When asked about their live experience, Spencer Neumann (CFO) stated during a Morgan Stanley Technology, Media & Telecom Conference:

Well, the biggest thing it does for now is it’s driving more fandom. So when we talked about it before that kind of great virtuous cycle for our business is if we deliver more and more entertainment value, if we make it easier and easier for folks to discover what they want to watch next and if we wrap that together with making it more and more relevant in people’s lives through that kind of things like consumer products experience, et cetera, that’s just kind of it’s all additive -Morgan Stanley Conference

I mentioned previously that this entertainment avenue will help diversify revenue streams in addition to drawing more traffic to their streaming service. His quote explains in greater detail just how these live entertainment experiences will allow consumers to find more content to watch.

I believe this move into physical entertainment spaces allows Netflix to compete more directly with Disney, offering consumers an alternative to the high prices associated with Disney theme parks and shows. For example a Disney World day pass can range from $109 to $224 for people ages 10 and up. Netflix has already launched some live experiences, such as a live-action play of “Stranger Things”. Tickets for this show in July of 2024 cost roughly $38, already considerably less than Disney Tickets (and you don’t have to travel as far). While this is only one ticket, prices at Disney World are continuing to rise leaving consumers unhappy. I think for Netflix to maintain a competitive edge against Disney, we will see their experience offer cheaper options than Disney with experiences closer to where the consumers live (vs. consumers traveling to Disneyland in California in the US or DisneyWorld in Florida).

As I mentioned above, Netflix has already opened some entertainment experiences. Netflix’s Chief Marketing Officer, Marian Lee, stated:

…[the company has] launched more than 50 experiences in 25 cities, and Netflix House represents the next generation of our distinctive offerings. The venues will bring our beloved stories to life in new, ever-changing, and unexpected ways -CMO Lee.

As Netflix continues to build on their live experiences, I think the results will be promising. This diversification of revenue streams is crucial as it reduces Netflix’s reliance on subscription fees and ad-supported models, providing a buffer against market fluctuations. It also diversifies their brand beyond just a streaming company. They are an entertainment company now, not a streaming company, much like Disney.

On top of the strategic benefits, Netflix House venues are designed to be year-round attractions, unlike seasonal theme parks, which could attract repeat visitors and maintain a steady flow of revenue. The immersive nature of these experiences, combined with the popularity of Netflix’s original content, ensures a unique offering that can draw fans multiple times a year.

Valuation

Diving into Netflix’s valuation, I believe it’s clear that they have a large potential for growth when compared to their peers, especially with entertainment. Their forward revenue growth is 11.01%, which is 310.04% higher than the sector median of 2.69%. Their forward price to Sales ratio is 7.58, which is 540.53% higher than the sector median of 1.18.

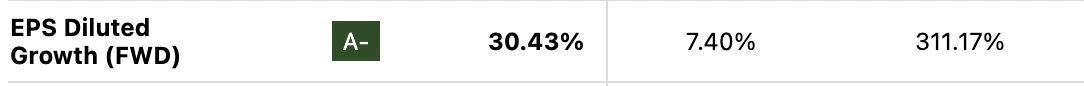

For me, the most notable growth metrics is Netflix’s earnings per share growth. Below is a table of Netflix’s EPS forward growth.

Netflix Forward EPS Growth (Seeking Alpha)

Netflix’s EPS growth is significantly higher than the sector median. Despite the company surpassing their peers in the categories listed above, their forward PEG Non-GAAP ratio, currently stands below the sector median. This is very interesting to me considering Netflix’s robust growth rates that significantly outpace the industry average. Netflix’s PEG is 1.29 which is currently 5.33% below the sector median of 1.37. Based on their growth prospects I think Netflix deserves to trade at a PEG ratio that is 50% above the current sector median (1.37). By multiplying the current sector median of 1.37 by 1.5, the result is 2.055. Then dividing this number by Netflix’s current PEG ratio and subtracting one, results in an upside potential of roughly 59.3%.

Looking forward, Netflix’s EPS growth projections reinforce this narrative. The company’s EPS for the fiscal year ending December 2024 is estimated at $18.34/share, representing a 52.45% year-over-year growth. This trend continues with EPS estimates of $22.13 for 2025 and $26.74 for 2026, highlighting the company’s strong earnings momentum. This trajectory is supported by a significant number of upward revisions in earnings estimates over the past three months, with 39 revisions for EPS and 23 for revenue.

Given these earnings estimates continuing to increase, I believe the odds that the market is underpricing future EPS beats is high. I do not think people fully understand the potential in Netflix’s plan and the long term potential it has. I think there is plenty of upside for this stock.

Risks

While Netflix’s growth prospects are promising, several risks could impact their future performance. Personally, a significant concern is the weakening US consumer market. As pandemic savings deplete, consumers are increasingly cautious about discretionary spending. With the cost of household essentials still high, it’s likely that consumers will be more tight with their budget especially considering most consumers have burned through their pandemic savings. There is clearly less room for them to spend money on non essential things such as a live entertainment experience from Netflix compared to 3-5 years ago. Although entertainment experiences somewhat resilient during economic downturns, there is obviously a risk that Netflix’s in-person entertainment ventures may not perform as expected if consumer spending declines sharply.

Adding to this competitive landscape. While Netflix has a strong portfolio of original content, competitors like Disney will still continue to invest heavily in their own streaming services and physical entertainment offerings (they pioneered the model and they of course will try to defend it). Disney has absolutely dominated the physical entertainment experience through their theme parks and poses a formidable challenge historically. However, I think if Netflix is able to offer cheaper prices compared to Disney, they have the potential to capture some of this market share. I believe there is clear consumer fatigue due to Disney’s high prices. Netflix has an opportunity.

Bottom Line

Netflix’s expansion into in-person entertainment, combined with the success of their password-sharing crackdown, positions the company for long-term success. Considering their financial health, reflected in their strong revenue and subscriber growth, I think their future is promising. Despite the current consumer trends, Netflix appears to bucking this trend and continuing their success.

The company’s current undervaluation, particularly their PEG ratio below the sector median despite higher growth rates, suggests significant upside potential. I think Netflix remains a strong buy. I am optimistic for their performance in the second half of 2024.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.