Summary:

- Netflix’s singular focus on streaming has allowed the company to pull ahead of competitors.

- Netflix is successfully leveraging its large user base for licensing deals.

- The recent consolidation in the streaming industry presents a major risk to Netflix.

Giuliano Benzin

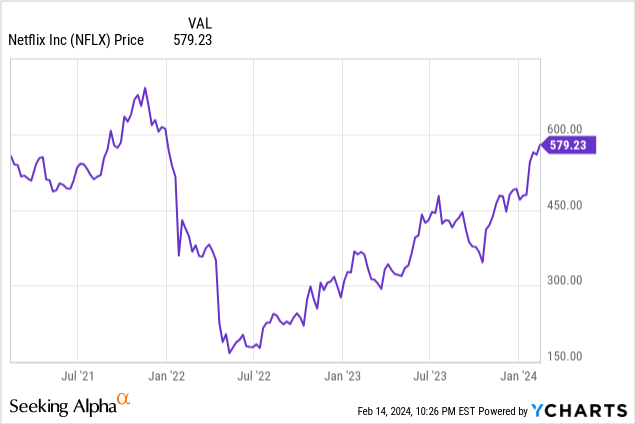

Approximately 2 years ago, I wrote an article that discussed why Netflix (NASDAQ:NFLX) would pull ahead of competitors. While the timing of that article could not have been worse, as the company soon plummeted after witnessing unprecedented subscriber growth slowdowns, every major point in that article has eventually essentially been proven correct. Netflix is clearly starting to snowball its lead over competitors like Disney + and Max.

The premise of that article was that Netflix would snowball its lead as a result of a near-singular focus on streaming and its unrivaled user base. This premise remains more true today as competitors are unable to keep up with Netflix. Even media industry heavyweights like Disney (DIS) and Warner Bros. Discovery (WBD) are quickly falling behind.

Netflix has experienced a major resurgence over the past year.

Commitment to Streaming

Netflix has long made it known that it prioritizes streaming over everything else. In fact, the company remained so steadfast to its streaming commitment that the company consistently leaves money off the table by avoiding theatrical releases for its big budget films. Even “Glass Onion” was only kept in the theaters for one week, and the reason Netflix allowed it in the theater at all was so that “Glass Onion” would be qualified for award nominations.

Such a commitment to streaming is unheard of in the media landscape, which only makes sense as Netflix’s main competitors all have major businesses outside of streaming. In fact, Netflix’s largest competitors often view streaming as side businesses to complement their main businesses. Apple (AAPL) and Amazon (AMZN), for instance, view their Apple + and Amazon Prime Video streaming services as just another tool to attract individuals into their respective ecosystems, in which they will spend the majority of their money. Even Disney views streaming as a complementary business to their parks and theater businesses.

In sharp contrast, Netflix continues to focus nearly all of its attention on improving its site’s algorithms, user interface, and content. The fact that Netflix has been able to consistently outperform Amazon Prime Video in terms of viewership numbers is evidence that Netflix’s approach is working. This is despite the fact that Amazon started its streaming service first. What’s more, Amazon has more resources than Netflix and a large ecosystem of consumers to pull from.

Strong Feedback Loop from Unrivaled User Base

Netflix’s massive user base is one of the company’s largest assets. The company’s unrivaled user base gives it a major edge over competitors in that releases immediately have higher viewership numbers and a greater chance of going viral. This largely explains why Netflix consistently dominates the ratings charts over competitors like Disney + and even Amazon Prime Video.

The advantage of having the largest user base is no longer evident in Netflix’s ability to revive and transform moderately successful shows into viral sensations. The most recent example of this has been the resurgence of a legal drama called Suits, which broke records after appearing on Netflix, despite the fact that the show stopped airing on network TV years ago.

This built-in size advantage naturally attracts studios, as their projects will have a greater chance of success on Netflix. This gives Netflix an edge in terms of negotiation relative to the other major streaming players. As a result, Netflix is able to acquire/produce more streaming content, which only further increases its user base, thus creating a strong feedback loop.

Robust Lineup

Netflix has an incredibly strong lineup of releases in 2024, which should help Netflix pull even further ahead of the competition. The company is planning to release cultural blockbusters like Avatar: The Last Airbender and The Three Body Problem in just a few months, both of which are likely to break viewership records.

Squid Game season 2 is perhaps the most anticipated release in Netflix history, given the success of Squid Game season 1. This release alone could add many more millions of subscribers to Netflix, considering the subscriber growth experienced by Netflix after season 1 released. Given how large the Squid Game brand has grown and how many more subscribers Netflix has since season 1, it would not be surprising to see Netflix experience even greater viewership numbers from season 2.

There are simply no other streaming services that come close to the quality of releases that Netflix is planning in the near-term. The consistent release of such popular titles is likely a major reason why Netflix experiences one of the lowest churn rates in the industry. The company could experience even lower churn rates in 2024 given its strong slate of releases this year.

Strong Financials

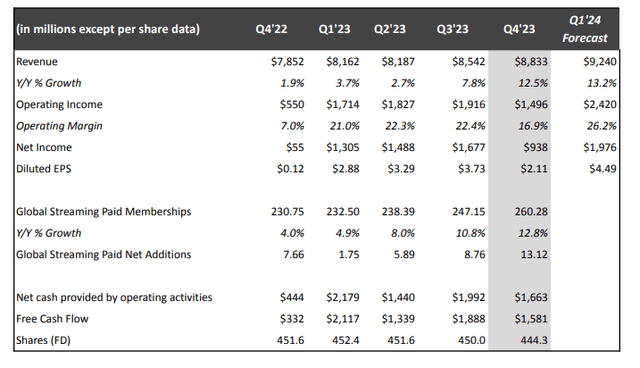

Netflix’s surprisingly strong Q4 results only bolster this article’s thesis on Netflix. The company’s paid memberships grew a staggering 13.12 million to reach a total of 260.28 million. The company also posted an impressive revenue growth of 12.5% to $8.83 billion. The strong top-line results translated to a net income of $938M.

While the company’s top-line growth did not translate into strong bottom-line growth, much of this can be attributed to Netflix growing investments into its business. For instance, Netflix has been implemented many new operational and strategic changes, like implementing new password sharing rules and incorporating ads. All of these major infrastructure changes negatively impact the company’s net income figure in the short term.

These major changes to the company’s infrastructure translate into additional operational costs, i.e., investments into new technologies, setting up an entirely new password monitoring system, hiring engineers to buildout the new ad platform, etc. However, many of these costs are short-term in nature as once these new technologies are implemented, they will only require maintenance in the long term.

Netflix’s increasingly large revenue stream will not only allow the company to produce more quality content, but also allow the company to invest more heavily in its gaming division. This puts Netflix at an even greater competitive advantage compared to other streamers. By expanding its ecosystem, Netflix has the opportunity to pull in entirely new audiences.

Risks

Many of Netflix’s competitors are starting to consolidate as a reaction to Netflix’s growing dominance. It was recently announced that Disney, Warner Bros. Discovery, and Fox (FOX) made an agreement to combine sports streaming rights and create a streaming platform. This combined sports streaming entity will be a serious threat to Netflix’s sports ambitions.

This consolidated streaming service will have more bargaining power when negotiating with organizations and leagues for broadcasting rights. The combined audience will make this new sports streaming service more attractive partners for sports leagues, thus limiting Netflix’s ability to secure competitive sports content. Moreover, any attention that Disney, Warner Bros, and Fox can attract to its streaming service will be attention that Netflix will not be able to capture.

Netflix’s more well-financed competitors, Amazon and Apple, are also starting to invest more heavily into their streaming services. Unlike lesser competitors like Disney+, Paramount+, or Max, these streaming services have billions of resources to pull from. After all, Amazon and Apple of some of the largest tech giants in the world. Moreover, they each have their own massive ecosystems in which they can pull in more viewers.

Peer Comparisons

As the closest point of comparison, Disney is valued at $204B, despite the fact that all of its major franchises are experiencing major dips in popularity. While Disney does have a major parks business, Netflix should still be valued far ahead of Disney. Netflix is pulling far ahead of Disney on the streaming front and is encroaching on Disney’s territory with its own real-life attractions.

Given that all of Netflix’s other major competitors only view streaming as a side business, it is harder to break out how their streaming businesses are valued. Amazon Prime Video and Apple+, for instance, only generate a small fraction of Amazon and Apple’s revenue. While such streaming services have an advantage over Netflix on the resource front, they are almost certainly not receiving the focus and attention needed to adequately compete with Netflix over the long term.

Conclusion

It is becoming increasingly clear that Netflix has won the streaming wars. Even rivals like Max have implicitly acknowledged this fact by licensing previously exclusive content to Netflix. Netflix still has more upside at its current valuation of ~$240B and forward P/E ratio of 32. Given recent trends of subscriber growth, Netflix could attain an annual subscriber growth rate of ~20% for the foreseeable future. In such a scenario, Netflix should be fairly priced at a market capitalization of ~$300B at a forward P/E ratio of 40.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.