Summary:

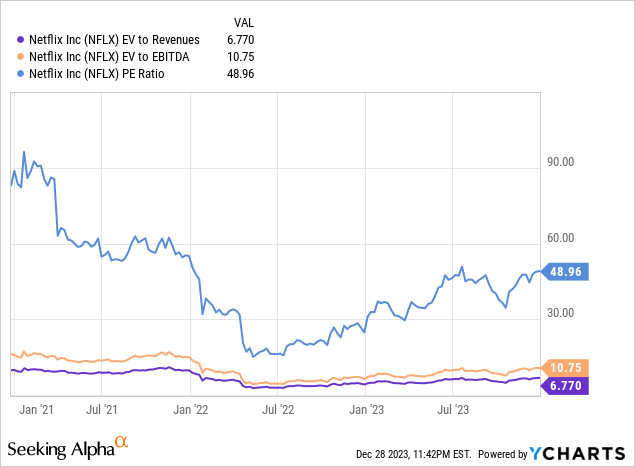

- The bullish case for Netflix is less clear now that its stock price has seen a strong rebound in the past 18 months and valuation measures are higher.

- However, profitability-boosting measures like paid sharing and the ad-supported tier are still in their early days.

- Netflix is likely to remain the market leader for quite a while and will continue to benefit from price hikes and margin expansion over the long term.

- Nevertheless, it could take a long-term horizon to revisit the all-time high of ~$700/share. The path beyond 300M subscribers is unclear, and competition is more intense than before.

simpson33

Investment Thesis

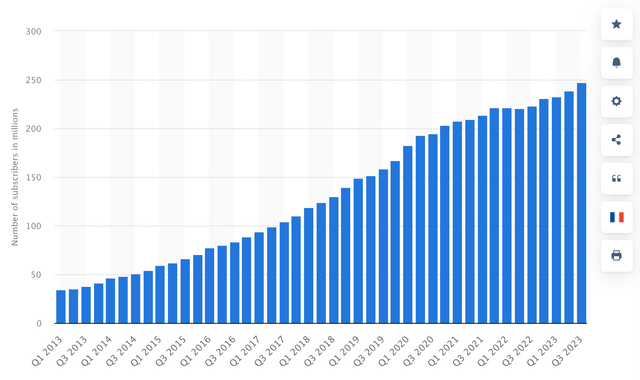

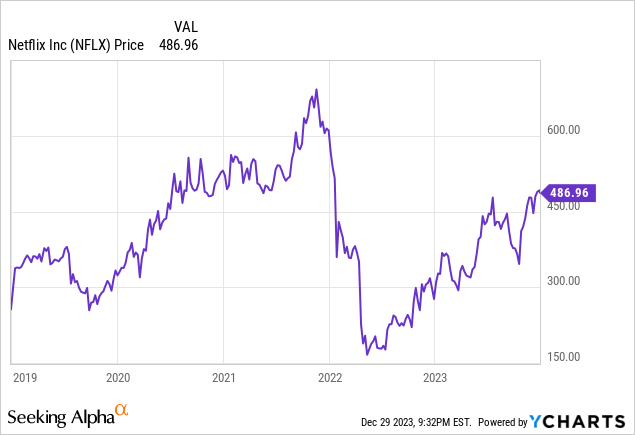

Since the last time I wrote about Netflix, Inc. (NASDAQ:NFLX), in June 2022, the stock is up over 150%. Apart from the general market rally, the latest enthusiasm for Netflix comes from the company gaining traction on its profitability-boosting efforts following a pause in growth in early 2022. Netflix’s crackdown on password sharing initially faced some skepticism, but 24M additional subscribers in the past year have clearly helped the market overlook concerns that the crackdown would only provide a one-off uplift. An expansion in operating margins has no doubt also helped as consumers have mostly taken price hikes in stride.

Still, the crackdown isn’t a factor that can continue to boost growth indefinitely. Management expects it to provide a benefit over the next several quarters. Whether this is fully priced in or not is unclear, given Netflix’s now-loftier valuation metrics. The writers’ and actors’ strikes also provided a boost to cash flow from temporarily reduced content spending, and competition in the industry has increased.

I initially started drafting this article with a hold rating in mind. But Netflix is the market leader and a well-regarded, innovative company, with room for growth and further price hikes over the long term, as the industry consolidates. While I don’t currently own it, I expect that there’s a good chance that it can regain a $700/share level within the next 2-3 years.

Notable Upswing in Free Cash Flow (Helped by the Strikes)

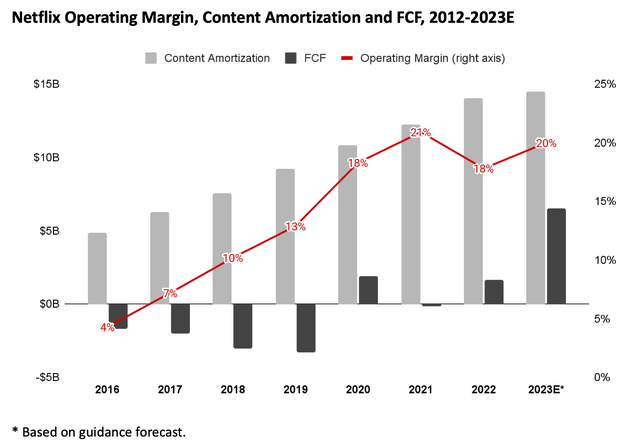

The long thesis behind Netflix was always that it is the streaming leader, with pricing power and ability to grow margins over the long term as the subscriber base continued to grow. This story has largely continued to unfold, with the company’s operating margin lately hovering around 20%, notwithstanding the setback of stalled growth in 2022. Netflix’s share price has recovered accordingly, regaining a large part of what it lost after November 2021, when it nudged above $700/share.

Netflix 2023 Q3 Shareholder Letter.

Netflix had originally been expecting around $3.5B of free cash flow (FCF) in 2023, although it has since revised this number upwards to $6.5B for FY2023, as the strikes reduced content spend and paid sharing has gained success. Nevertheless, for the sake of argument, if Netflix’s normalized level of FCF (minus the strikes) is roughly ~$5B, then Netflix still trades at a lofty ~42x multiple of FCF.

The Undisputed Streaming Leader But Won’t Be Impervious to Competition

Netflix is the clear leader in streaming and will probably remain so well into the future. But I’m not as sure that they will remain as unaffected by the competition as many assume. Competitor services have relatively recently made large strides, adding tens of millions of subscribers each, in the last few years. At the very least, the now-more-crowded market should eventually help to erode the growth available to all individual market participants, including Netflix.

Much has been made of competitor streaming services bleeding cash. But in most cases, they’ve moved beyond peak losses – Disney expects to be breakeven in 2024. In Warner Bros. Discovery’s (WBD) case, it stated that it reached breakeven in 2023H1. It has been preoccupied with working through its merger in 2022 and wasn’t at the point of prioritizing growth. Amazon Prime Video hasn’t seemed like the best content producer to me, but it has the obvious benefit of being bundled with Amazon Prime.

However, Netflix’s first-mover advantage will likely last for a long time – they mostly just have to keep doing what they’re doing. Consumer habit formation means a certain degree of tolerance to whatever fare Netflix cranks out, regardless of what competitors offer. And there is also a virtuous circle resulting from people wanting to watch the same things that they hear others talking about. This benefits Netflix the most from the simple fact that it’s the largest streaming service, i.e., with the most scale and distribution, even if they are relatively more saturated in certain key markets.

Uplift From Password-Sharing Crackdown Not Indefinite But Should Last a Few Quarters

Netflix had estimated that over 100M non-paying households worldwide were using its service with borrowed passwords. Since the crackdown rolled out to the U.S. in May 2023, Netflix has added about 15M subscribers in the last two quarters. While we don’t know how many of these resulted from the crackdown, it’s probably a pretty good chunk of them (though management stated that paid-sharing adds were “on top of also very healthy organic, meaning not driven by paid sharing growth”). Their growth had pretty much flat-lined in early 2022, dipping into negative territory in 2022Q2, following the pull-forward of the pandemic.

Even if Netflix can capture just half of these non-paying households, then it makes sense to believe that a similar level of subscriber adds could happen over the next few quarters, getting Netflix close to 300M subs. Much like a price increase, some households will initially resist paid sharing, only to later sign up or upgrade over time as they accept that streaming is one of the most affordable entertainment options that’s out there. Presumably, competitors could pick up some of these households, as well, though peer subscriber adds have been uneven in 2023. On the 2023Q2 and 2023Q3 calls, Netflix management stated that they expect the benefits to occur over the next several quarters.

Ambitious Valuation But For a Company That Keeps Delivering

Netflix has rallied back to a level where its valuation metrics make a bullish case less obvious, but it’s still about 30% off of its high at a time when the market is closing in on record levels.

Admittedly, a bunch of things are different from when NFLX was near $700/share in late 2021:

- There will be less low-hanging fruit as paid sharing and the ad-supported tier continue to gain traction.

- Competitors now have more coherent offerings and will continue expanding into new geographies.

- Consumers now face higher interest rates and a higher cost of living, in general.

- The total addressable market is probably not as large as it was once thought to be. While 300M subscribers look well within reach, the path is less clear going to 500M and beyond.

- Netflix’s stock price tumble in 2022 is still in recent memory.

And yet, initiatives to boost profitability are still in the relatively early days. If industry consolidation continues, there may also be less pressure for content spend to keep up with revenue and subscriber growth. For investors with a long-term horizon (e.g., 2-5 years), the industry is likely to emerge from its somewhat dark days of streaming armageddon, with Netflix near its helm.

(In terms of price hikes, we’ll only see the limits once subscriber churn starts to offset a larger part of the revenue benefits of higher average revenue per user. I don’t think we’ve seen any clear indication of that happening, yet.)

Final Words

I would expect Netflix to eventually regain its previous high of ~$700/share, on the basis of it being a high-quality market leader that will benefit from further price hikes and improved operating leverage over the long term. Relative to the 180%+ gain from the 2022 stock price low, though, this will likely occur at a much less impressive annualized growth rate than the last 18 months. It will also depend on the sustainability of the boost from paid sharing.

As always, it will be interesting to see how this plays out. I was tempted to call it a day on this stock, with a hold rating, after the large rebound following my previous NFLX article. It’s arguably not the best market-beating opportunity out there. But on revisiting the situation, I expect that there will still be decent stock price appreciation over the long term, from the current level. I look forward to hearing your comments on NFLX.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WBD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not a financial adviser/advisor, and this article is only intended to express my own perspective. I could have overlooked key facts and/or risks, and my views could change at any time, not least because of new information that might become available. The suitability of an investment depends on your own personal circumstances and risk tolerance. You are responsible for your own due diligence and investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.