Summary:

- Netflix has a leading position in the streaming industry, even though competition is quite fierce.

- Its recent growth has clearly decelerated as the company shifted its business strategy from growth to monetization of its platform.

- Its financial profile has clearly improved in recent years as the business matures, justifying a lower valuation multiple ahead.

wutwhanfoto

Netflix (NASDAQ:NFLX) has changed its business strategy from growth to profitability in recent quarters, a sensible move that however justifies a lower valuation multiple in the future.

Company Overview

Netflix is the largest content service streaming company in the world, operating across major markets globally. It has more than 230 million subscribers worldwide, of which about 156 million come from international markets (outside the U.S. and Canada). It offers a variety of TV shows, movies, and documentaries on internet-connected devices. It has a market value of about $150 billion and trades on the NASDAQ stock exchange.

Geographically, some 45% of its revenue is generated in the U.S. and Canada, while the rest comes from international markets, with Europe, the Middle East, and Africa generating some 31% of annual revenue, 13% in Latin America, and the rest comes from Asia-Pacific. Over the past decade, Netflix has grown immensely abroad, considering that only about 5% of its revenues were generated in international markets in 2012, while nowadays it’s more than half.

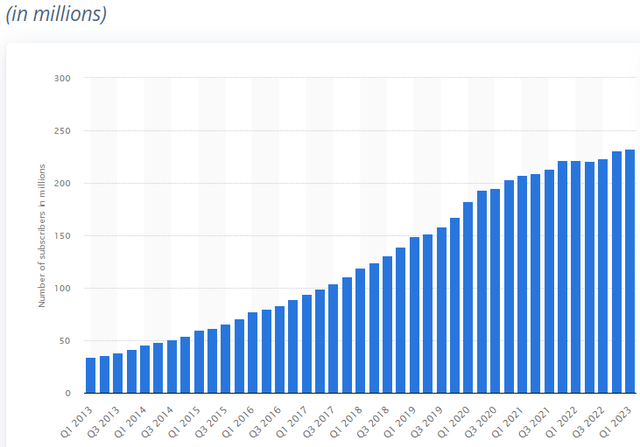

Its subscriber base has increased steadily until 2022, when it was negatively affected by the war in Ukraine (and its exit from Russia), the password sharing initiative, and price hikes, which led to a temporary reduction in total subscribers during the first semester of 2022. However, Netflix was able to return to subscriber growth in the past few quarters, reaching some 232 million subscribers at the end of Q1 2023.

For the company to maintain a solid growth path, both domestically and abroad, it’s important to continue building its content library, plus further improving the quality of its local original product offerings in international markets. This strategy has been successful in recent years and is not likely to change much in the near future, thus Netflix is likely to continue to invest in growing its compelling content offerings, to remain competitive against most of its competition.

Competition

While Netflix is a global leader in the streaming industry, competition has increased a lot in recent years from well-funded companies, including the Walt Disney Company (DIS), Comcast (CMCSA), and Apple (AAPL).

From a subscriber point of view, Disney has been Netflix’s most successful competitor, given that it has reached Netflix’s scale in a much more rapid pace (combining Disney+, Hulu, and ESPN) due to a lower pricing strategy and strong content, being nowadays one of its major competitors. Netflix took far more time to reach the same number of subscribers that Disney has nowadays, showing that its competitor’s strategy has been quite successful, even though from a profitability perspective the results aren’t great.

Indeed, Disney+ is a success story for Disney, considering that the streaming service has a great subscriber growth history since its launch in 2018, even though it still loses money and reaching breakeven may not be easy in the current macroeconomic environment.

While an aggressive pricing strategy has been great for subscriber growth, its average revenue per user (ARPU) is much lower than that of Netflix. The market wasn’t worried about this until last year, when changing market conditions and an economic slowdown led investors to worry more about the company’s profitability rather than growth. This changing investor sentiment is also valid for Netflix and other streaming services, which explains why Netflix’s strategy has shifted from growth to profitability in recent quarters.

Netflix had for many years committed to an ad-free platform and said many times that this would be its strategy over the long haul, but decided to change to an ad-supported platform last year. Netflix launched its ‘basic with ads’ plan at a monthly cost of $6.99, or $3 lower than its more expensive ad-free plan, targeting directly Disney+ which has a lower pricing plan.

This should also help to reduce customer churn, as a lower pricing plan is more attractive among cost-conscious customers, who have now less incentive to switch to other cheaper streaming options. This also makes its offering more attractive considering the current challenging economic environment and the general rise in the cost of living across the globe due to inflation and higher energy costs, which could lead to reduced consumer spending in entertainment and higher customer churn for Netflix.

Given that competition in the streaming space is fierce, and this landscape is not likely to change much in the foreseeable future, investing in content is key for Netflix to maintain its leadership position in the industry. The company is investing some $17-$20 billion annually in content, and has thus far been able to maintain a high-quality product offering and aims to continue to offer exclusive premium content. Moreover, Netflix is also increasingly including local content across its geographies, which should help to differentiate against other services and lead to higher customer engagement and lower churn over the long term.

Financial Overview

Regarding its financial performance, Netflix has a positive track record given that it has reported strong revenue growth over the past few years, and has been able to improve its profitability at the same time, enjoying nowadays strong business margins and positive free cash flow generation.

In 2022, Netflix’s total revenues amounted to more than $31.6 billion, an increase of 6.5% YoY, due to higher paying membership, while the price effect was only responsible for a 1% increase in total revenue as price changes were offset to a large extent by a stronger U.S. dollar. Its operating income was $5.6 billion, a decline of 9.1% YoY, justified by higher content cost amortization that was higher than revenue growth.

Amortization of content assets is the most important cost of revenue, amounting to more than $19 billion in 2022 or 61% of Netflix’s revenues, which is expected to remain the most important cost in the future as the company continues to invest significantly in new content over the next few years. Regarding other costs, Netflix was able to have good cost control related to marketing and interest expenses, but technology costs and personnel expenses increased at double-digit rates, also explaining why its operating income declined by 300 basis points (bps) to 17.8% in the last year.

Its net income for the year amounted to more than $4.3 billion (net profit margin of 13.7%), a decline of 11.5% YoY. Its free cash flow was above $1.6 billion, which is not a fantastic cash conversion rate, but much better than some of its competitors that are still burning cash, such as Disney+, while its net debt position was about $8.3 billion at the end of the year.

During the first quarter of 2023, Netflix launched paid sharing in some countries, as part of its strategy to improve the monetization of its platform and customer base, helping it to achieve quarterly revenue in excess of $8 billion (+3.7% YoY). While its growth rate has been much softer in recent quarters, the company’s focus has clearly shifted from growth to profitability and cash generation, showing that its business has now reached a maturity phase and growth rates going forward should be much lower than compared to its history.

Reflecting this strategy, its operating income improved to $1.7 billion in Q1, representing an operating margin of 21% (vs. only 7% in Q4 2022), while its net income was above $1.3 billion in the quarter. Its guidance for 2023, is to achieve an operating margin between 18-20% and improve free cash flow to at least $3.5 billion, which is a significant improvement compared to the previous year.

Going forward, Netflix maintained its business targets, aiming to achieve double-digit revenue growth, expand its operating margin, and deliver growing positive free cash flow. According to analysts estimates, Netflix should maintain a solid growth path in the coming years, given that revenue is expected to be above $42 billion by 2025, and its net income is estimated to be about $7.9 billion (profit margin of 18.9%).

Regarding its balance sheet, Netflix has a very comfortable position due to higher free cash flow than expected in Q1, leading to a net debt position of only $6.7 billion at the end of last March. This represented 1.1x net debt-to-EBITDA (last twelve months), which is a very acceptable level of financial leverage and a great support for a sustainable investment-grade credit rating. Moreover, as the company’s financial position is quite good, I think a dividend is possible in the next few years, as Netflix is clearly generating enough cash to invest in content and reduce financial leverage, thus it’s now also in a position to start rewarding shareholders through dividends or share buybacks.

Conclusion

Netflix has a great position in the streaming industry that isn’t easy to challenge, even though competition is quite fierce, and is also investing aggressively in new content. Its recent strategy to shift from growth to profitability seems to be sensible given the current macroeconomic environment, also showing that its business is now mature and more important than growing its subscriber base is to have a profitable and cash generative business.

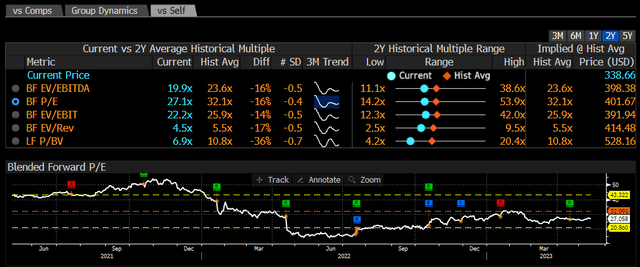

Regarding its valuation, Netflix is currently trading at some 27x forward earnings, which is not particularly cheap even though it’s below its own historical average over the past two and five years. However, as the company’s growth rate has declined significantly in recent quarters and its strategy has shifted from growth to profitability, I think a lower multiple may be warranted in the future.

Therefore, a valuation of about 20x earnings may be more appealing to long-term investors, thus investors should wait for a lower share price to enter a position or to buy more shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.