Summary:

- NFLX continues to post double beat FQ1’24 earnings call, with the recent over-reaction only attributed to the management’s pivot in subscriber reporting from FQ1’25 onwards.

- Considering that it has already become a standard reporting method and is now being adopted by other legacy players, the sudden pivot is strange indeed.

- Even so, we agree with the management’s stance in which profitable growth matters most, with its next opportunity being in the advertising market, against the maturing subscriber growth.

- NFLX’s inherent profitability, growing market share, healthy balance sheet, and robust shareholder returns continue to demonstrate its long-term investment thesis.

- With the market correction still occurring, interested investors may want to monitor the stock’s movement before adding at its previous support levels of $480s for an improved margin of safety.

DNY59

We previously covered Netflix, Inc. (NASDAQ:NFLX) in January 2024, discussing why its streaming prospects might remain robust as the macroeconomic outlook lifted, significantly aided by the robust labor market as discretionary spending grew.

Combined with the excellent FQ4’23 performance and impressive FQ1’24 guidance, the stock had also pulled forward part of its upside potential, with interested investors better off waiting for more attractive entry points despite the streaming company’s (prospective) long-term success.

By now, NFLX has already drastically pulled back by -12.7% from its recent peak, as the market overreacts to the new subscriber reporting standard and the overall tech market declines nearing the Q1’24 earnings season.

Despite the maturing streaming business, its inherent profitability, growing market share, and robust shareholder returns continue to demonstrate NFLX’s long-term investment thesis, with market leaders rarely coming cheap.

This pullback only triggers an opportunistic entry point for investors looking to add nearer to its fair value. We shall discuss further.

NFLX Continues To Be The King Of Streaming – Reporting Pivot Likely Signals A Maturing Business Profile

Before we get to the crux of the matter, NFLX’s sudden pivot in subscriber reporting, we shall briefly discuss its double-beat FQ1’24 earnings call, which further demonstrates why it remains the king of streaming thus far.

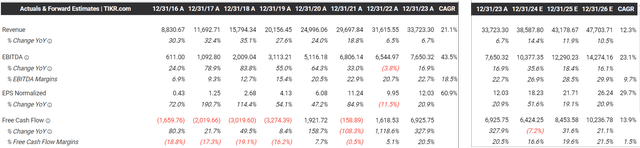

For now, the streaming leader reported FQ1’24 revenues of $9.37B (+6.1% QoQ/ +14.8% YoY), operating margins of 28.1% (+11.2 points QoQ/ +7.1 YoY), and adj EPS of $5.28 (+150.2% QoQ/ +83.3% YoY).

The FQ1’24 subscriber growth to 269.6M (+9.32M QoQ/ +37.1M YoY) and the relatively stable Average monthly Revenue per Membership [ARM] of $11.58 (+2.3% QoQ/ -1% YoY) by the latest quarter also demonstrates the highly sticky streaming platform, despite the elevated inflationary and interest rate environment.

Moving forward, NFLX’s sudden pivot is odd indeed, given that it has already become the gold standard in the streaming reporting method and similarly adopted by other legacy players, including The Walt Disney Company (DIS), Warner Bros. Discovery, Inc. (WBD), and Paramount Global (PARA), amongst others.

With the NFLX management opting to do away with the subscriber reporting, it is akin to Costco Wholesale Corporation (COST) not reporting their membership fee growth and Amazon.com, Inc. (AMZN) not reporting the AWS operating income, with these key operating metrics typically being synonymous to its top/ bottom line performances thus far.

Growth In Streaming Share

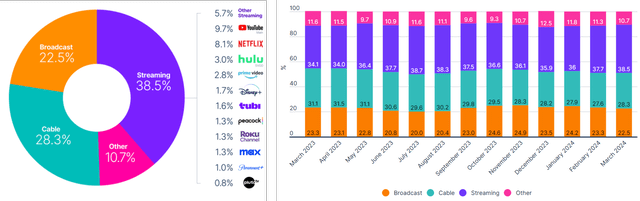

Even so, NFLX remains a clear leader with 8.1% in market share as of March 2024 (+0.3 points MoM/ +0.8 YoY), as the overall streaming industry also gains to 38.5% (+0.8 MoM/ +4.4 YoY), further highlighting the secular transition in consumer habits.

As a result, while we may not agree with the sudden pivot in the reporting standard from Q1’25 onwards, we believe that the company may continue on its profitable growth path ahead.

If anything, we believe that the NFLX management recognizes that its next growth opportunity lies in the advertising market, as opposed to the maturing subscriber growth.

For example, part of the bottom line tailwinds are attributed to the double-digit growth observed in the ad-supported tier at +65% QoQ in FQ1’24, building upon the two quarters of +70% QoQ growth and +100% prior to that.

While NFLX’s ad-supported tier at $6.99 per month has yet to achieve the same ARM as the standard tier at $15.49 per month as of FQ1’24, with “FY2023 averaging at approximately $8.50 excluding subscription fee,” we believe that things are likely to gradually improve.

eMarketer has already projected a sustained growth in digital ad spending at a CAGR of +9.6% to $870.85B through 2027, as more advertisers increasingly “shift their investment towards the ‘pure play’ internet channels.”

As a result of the secular trend, it is unsurprising that NFLX has already offered a very promising FY2024 revenue guidance of +14% YoY, while raising its operating margin guidance to 25% (+4 points YoY), up from the original midpoint of 22.5% (+1.5 points YoY).

These numbers further underscore the management’s confidence in generating robust profitable growth ahead, while maintaining a healthy balance sheet with a net-debt-to-EBITDA ratio of 0.58x in the latest quarter.

This is compared to its direct competitors, such as The Walt Disney Company (DIS) at 2.42x, Warner Bros. Discovery, Inc. (WBD) at 4.66x, and Paramount Global (PARA) at 6.17x in FQ4’23.

Readers must also note that the NFLX management will be announcing major subscriber milestones on an ad hoc basis while continuing to provide a geographical breakout on a quarterly basis.

If anything, we believe this move may be potentially mirrored by its competitors, especially given the drastic fall in NFLX’s stock prices by -21% after the FQ1’22 loss in subscribers.

For so long as the streaming company continues to record healthy top/ bottom line growth, as discussed above, we believe that the change in its reporting standard will not be material to its overall performance.

So, Is NFLX Stock A Buy, Sell, or Hold?

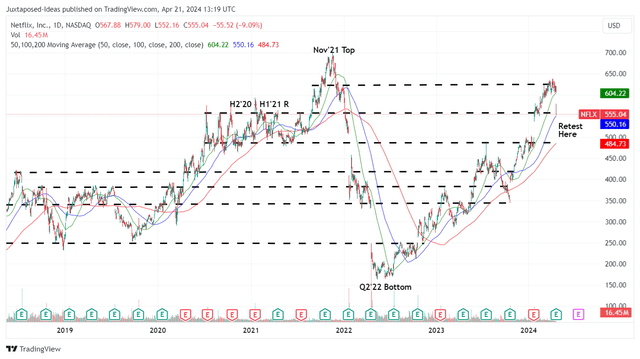

NFLX 5Y Stock Price

For now, NFLX has drastically lost much of its recent gains, as the market overreacts to the new reporting standard and the overall tech market declines nearing the Q1’24 earnings season.

The Consensus Forward Estimates

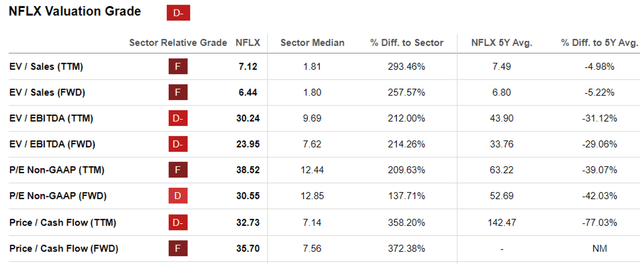

At the same time, as NFLX’s streaming business matures from the high-double digit growth during the pre-pandemic period to low double-digits thus far, we believe that the moderation observed in its FWD EV/ EBITDA of 23.95x and FWD P/E of 30.55x are warranted indeed.

This is compared to the 5Y historical average of 33.76x and 52.69x, respectively.

NFLX Valuations

Then again, NFLX’s premium over the sector median of 7.62x and 12.85x is justified as well, due to the inherent profitability of its streaming business compared to its legacy peers, further aided by the projected expansion in the former’s adj EBITDA and net income margins through FY2026.

For now, based on the LTM adj EPS estimates of $14.41 and the 1Y P/E mean of 31.79x, it is apparent that the stock is still trading way above our fair value estimate of $458, with a notable +21.1% premium to current levels.

Then again, based on the consensus raised FY2026 adj EPS to $26.24, there seems to be an excellent upside potential of +50.2% to our long-term price target of $834.10.

Thanks to the previous SAG/ WGA strikes and delayed productions, NFLX has also utilized part of the robust Free Cash Flows to retire $8.04B, or the equivalent of 10.7M of its shares over the past five quarters, returning much value to existing shareholders.

As a result of the attractive long-term risk/ reward ratio, we are upgrading NFLX as a Buy, though with no specific entry point since it depends on individual investors’ dollar cost average and portfolio allocation.

With the market correction still occurring and likely to continue over the next few weeks, interested investors may want to monitor the stock’s movement before adding at its previous support levels of $480s for an improved margin of safety, with those levels also nearing our fair value estimates.

Maintain long NFLX.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX, COST either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.