Summary:

- Netflix is set to report second-quarter results, with a focus on transitioning to an advertising era.

- The company’s new growth algorithm includes expanding into ad-based streaming, with potential for significant revenue growth.

- Key factors to monitor in the upcoming release include subscriber numbers, advertising users, ARPU progress, and margin expansion.

hocus-focus

Netflix (NASDAQ:NFLX) is set to report its second-quarter results this Thursday, after market close.

Notwithstanding the company’s strong performance and exceptional execution, I believe 2024 is going to be looked back to as a ‘Transition Year’, with Netflix’s second stage of growth already in process.

Netflix has already won the streaming war 1.0 (aka subscription-based streaming), but will it win in its advertising era as well?

Let’s try to answer that question and discuss the key points to monitor in the upcoming release.

Introduction

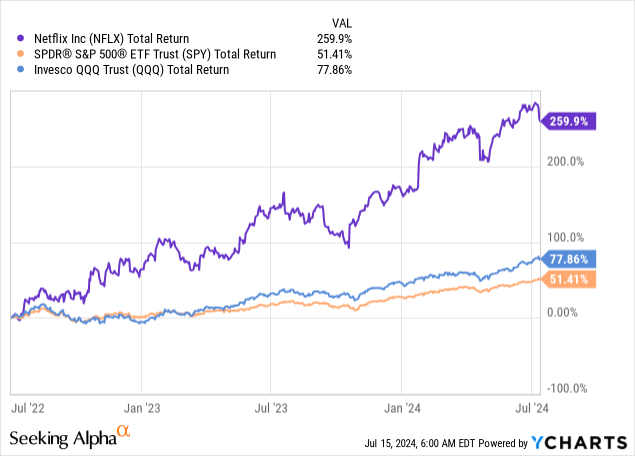

I started covering Netflix on Seeking Alpha back in June of last year, as the company’s extraordinary recovery was already underway.

In a series of four articles, I claimed time and time again that investors should ignore the surge in stock price and focus on the fundamentals, which clearly showed the stock is still undervalued.

This turned out to be especially relevant following the inexplicable post-earnings selloff in April, which came after one of the best quarters in Netflix’s history. Shares are already up nearly 18% from that short-lived fall.

Investors’ panic over the company stopping to report its subscriber numbers, paradoxically, was precisely the proof that Netflix’s management was very much correct in their decision to stop reporting the metric starting in 2025, as Netflix’s new growth drivers gain traction and become an increasingly important part of the business.

With that said, let’s revisit the old investment thesis before discussing the advertising-led era.

Revisiting The Old Netflix Investment Thesis

Until not long ago, there weren’t too many business models that investors liked more than subscriptions, especially in businesses that enjoy relatively low churn and benefit from economies of scale.

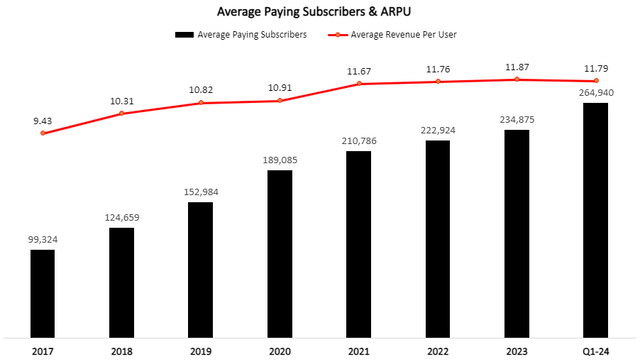

Created by the author using data from Netflix financial reports; Subscriber amounts in thousands.

Netflix fits into that description perfectly. It has by far the lowest churn among subscriber-based streamers. And, with its 270-million subscriber count, the largest in the industry, combined with its industry-leading ARPU, Netflix’s content investments generate a much higher return than that of its peers.

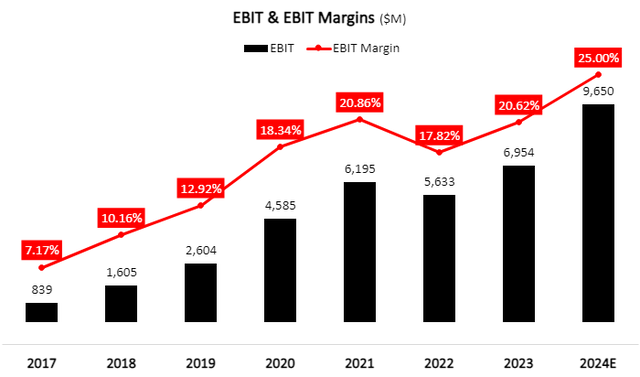

Created and calculated by the author using data from Netflix financial reports, the author’s projections, and management’s guidance.

With that, Netflix’s old-growth algorithm was quite simple to understand and to build an investment thesis around.

The company estimated its TAM at 500 million households with connected TVs. Through initiatives like the password crackdown, in addition to expanding the content slate, and waiting for cable customers to adjust to the new reality, Netflix captures a constantly growing portion of that TAM.

Subscriber growth, combined with price increases, leads to sustained top-line growth, and then the company’s operational leverage and economies of scale kick into gear.

The New Growth Algorithm

Netflix’s old model is still very much relevant and will remain the primary business of Netflix. Netflix undeniably won that market, and I expect it will remain the number one player for the foreseeable future.

However, the ad-based streaming market is still taking its way, shape, and form. Netflix launched its ad tier in November 2022, ten months after its legendary CEO left. This is no coincidence, as Reed Hastings was strongly against it. I think that in hindsight, he too will say it was a necessary move.

Not everyone wants to commit to a relatively costly ad-free subscription, and an ad option provides both a churn mitigating mechanism (people who want to might choose to stay if they pay less) and a customer acquisition platform (due to a more convenient entry price).

In addition, under an ad tier, revenue growth is not entirely predicated on subscriber growth or price increases, but rather, can be generated via internal improvements.

For instance, if ad-targeting improves, it will lead to better conversions, and therefore you can charge a higher price per ad. Also, there’s a direct alignment between user engagement and revenue. If an ad-free user watches more Netflix, they will pay the same amount. But, if an ad user watches more Netflix, they will see more ads and therefore lead to more revenue.

So, in addition to the simple old algorithm, we now have a new advertising arm that has many avenues to generate accelerating revenue growth.

I think it’s becoming increasingly clear that 2024 is a transition year, with management focus, as well as investor focus, shifting from the old already-proven model to the new, advertising business. This is best reflected by the company’s decision to stop reporting subscriber numbers starting in 2025.

To the contrary of many naysayers, I find that to be the right decision. Under the old model, subscriber numbers were indeed the most important metric to size up Netflix.

Under the new model, subscriber numbers will remain relevant, but they will be joined by metrics like the number of advertisers, CPMs, advertiser ROAS, and ad impressions.

With that in mind, management wants success in that direction to not be overshadowed by subscriber numbers, and that’s completely understandable.

Streaming War 2.0 – Netflix’s Advantages & Hurdles

The number one advantage Netflix has here, in my view, is the same advantage it has in streaming in general. Unlike its legacy media competitors, Netflix doesn’t need to worry about cannibalization. There’s a $150 billion prize in traditional TV advertising to go for, with essentially not much to lose. This is the low-hanging fruit for Netflix, which is, generally speaking, a replacement for traditional TV.

However, in digital advertising, the story is much more complicated. Netflix is no longer fighting old and less tech-oriented companies like Comcast (CMCSA) and Disney (DIS). It is now fighting companies like Amazon (AMZN), Google (GOOG), and Meta (META). Although Netflix has a very unique offering that is more similar to traditional TV, it will still need to show advertisers they should allocate budget to its platform over places like YouTube or Instagram.

Another hurdle would be a change in content strategy. Netflix is expanding from its core content identity to areas like sports entertainment with WWE and has reached an agreement to air NFL games as well. This is a crucial addition, as it appeals to traditional TV advertisers who are used to an ‘Event’ offering, rather than binges and on-demand watching.

Lastly, and by far the most significant hurdle, would be to build a strong in-house advertising platform. All those veteran digital advertisers I listed above have been in this business for a very long time and have thousands of the best engineers in the world working to constantly improve their platforms.

I estimate Netflix will be able to succeed without reaching capabilities that are even remotely close to those of Google or Meta, but it will definitely need to outplay the legacy players and competitors like Hulu, many of them with decades of experience in advertising.

Valuation & Preparing For Q2

Looking ahead to Thursday’s report, it won’t be a surprise that all the metrics we discussed so far will be key factors to monitor. A quick overview, that includes overall subscriber numbers and specifically advertising users, which amounted to 40 million as it was last reported. In addition, investors should focus on the ARPU progress, as well as continued momentum in margin expansion.

In general, I expect this to be an in-line quarter, with consensus only marginally above the company’s guidance. Management commentary about progress in advertising is most likely going to be the most important aspect.

With that, let’s transition to valuation.

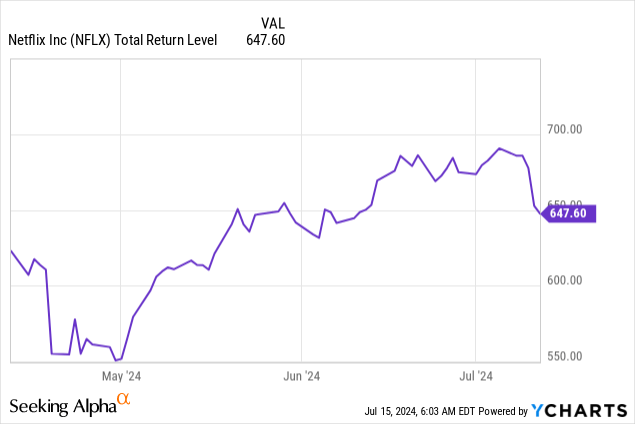

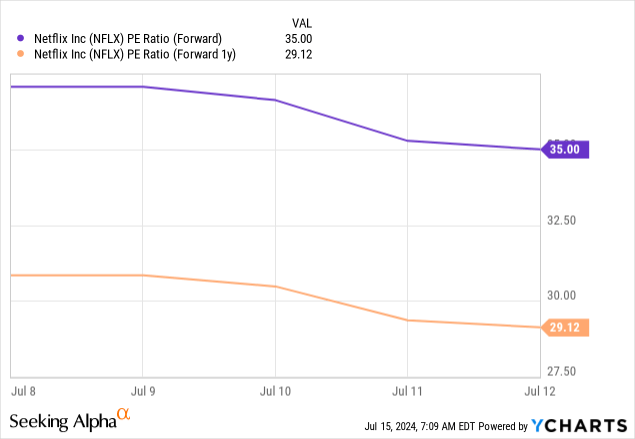

Netflix is trading at 35 times forward earnings and at 29 times 2025 earnings. That puts it slightly below a fair multiple for Netflix at this stage of the company, which I estimate at 32x.

At 32 times 2025 expectations, I estimate Netflix’s fair value at $710 per share.

Importantly, Netflix’s cash flow in 2024 is weighed down as a result of production delays caused by the strike. I expect it will surpass $9.5 billion in free cash flow next year, which would put it at around 25x free cash flow.

Conclusion

Netflix is entering its advertising era, with the company, and investors, shifting much of the focus towards this still relatively small part of the business.

While the new growth algorithm comes with risks and uncertainties, the advertising opportunity significantly expands Netflix’s long-term upside.

In the upcoming quarter, I expect a modest beat, and most of the discussion to revolve around progress in advertising users and the platform buildout.

I estimate near-term upside at approximately 10% and reiterate a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.