Summary:

- Netflix’s superior content, recommendations, and user interface give it a competitive edge in the streaming space, attracting and retaining subscribers.

- Growth opportunities lie in expanding ad revenue, entering live sports streaming, and increasing prices in LATAM and Asia-Pacific markets.

- Netflix’s strong balance sheet, rising ROIC, and undervalued stock price suggest significant upside potential.

Wachiwit

The Netflix Investment Thesis

One of my favorite things to do is to watch great movies and outstanding shows. My all-time favorites include all seasons of The Wire, as well as the first seasons of True Detective and Fargo. In the recent past, I also really liked some of the Netflix, Inc (NASDAQ:NFLX) shows like House of Cards, One Piece or the Korean show Bloodhounds. And the special thing for me is that I never thought before that I would like a show like One Piece, but the quality convinced me. And if it wasn’t for Netflix, I probably wouldn’t have been introduced to the show Bloodhounds.

All in all, I think Netflix has won and will continue to win the streaming war because their content, their recommendations, and even their user interface are way ahead of the competition. Some competing streaming sites still seem to lack a smooth, seamless experience and intuitive design.

What Is The Key To Winning The Streaming War?

I think the most important factor in the streaming market is having content that people want to watch, and everything else is just noise. Popular shows like Stranger Things, Wednesday and Bridgerton have probably brought in a lot of new customers for Netflix. And Netflix even acknowledges this in its annual report, writing that data such as costs and new subscription generation determine whether or not shows are continued.

And when it comes to shows, Netflix is ahead of the competition. Of course, the competition also has some franchises that work very well and create buzz, but Netflix has many more that are creating buzz on social media and in the real world. For example, I subscribed to Netflix about 10 years ago for Narcos, a branded Netflix original series produced by Gaumont International Television, and I am still a Netflix subscriber today.

If we take a look at the different streaming sites and their strong releases, Netflix’s repertoire is much larger and of higher quality. Of course, the following list is not exhaustive and you may want to make some changes, but you’ll probably come up with more popular Netflix shows than popular shows from the competition.

Apple+ (AAPL): Ted Lasso, The Morning ShowPrime Video (AMZN): The Boys, The Lord of the Rings, Reacher, Fallout, Jack RyanDisney+ (DIS): The Mandalorian, Loki, WandaVisionNetflix: House of Cards, Stranger Things, Narcos, One Piece, Cobra Kai, Wednesday, Black Mirror, The Witcher, Squid Game, Money Heist, Dark, You, Sex Education, 13 Reasons Why, Outer Banks, Bridgerton

And the list is just what popped into my head, but a quick search on IMDB showed that the shows with the most ratings – which is also a good indicator of views – show that Netflix is leading the way here. Stranger Things in particular stands out with 1.4 million ratings. That’s why I think Netflix’s original series, whether branded or owned, are a huge differentiator and competitive advantage. The competition simply cannot match the volume of high-quality series. And in addition, Netflix can monetize the IP of the original series with merchandise or in its games portfolio.

Of the top 10 most-streamed original series in 2023, seven came from Netflix and one each from Prime Video, Disney+, and Apple TV+. Plus, the acquired market is also dominated by Netflix, where they again have 7 of the top 10 series, with the likes of Suits, NCIS and Grey’s Anatomy. And there was the same dominance in 2022, where Stranger Things, Ozark and Wednesday were the clear winners, with only Prime’s The Boys and Ring of Power coming close.

But when it comes to movies, Netflix is not the number one, at least not in terms of minutes watched in 2022 and 2023. That space is dominated by Disney+ with movies like Encanto, Moana, Frozen or even Elemental. Disney has 6 movies in the top 10 and Netflix the remaining 4. However, the number of minutes watched is significantly lower than for series. This means that series account for a much larger share of time spent on streaming platforms. But there also seems to be a trend that Disney and Prime are offering less original content in the series space because it seems hard to compete with Netflix there. And on the movie side, Netflix is trying to do a better job with its partnerships with Sony and Universal.

In the U.S., the typical adult spends an average of ~ 4-5 hours per day watching TV, and currently Netflix users only engage for an average of 2 hours per day, so there is still upside to capture more of the ~33 hours of TV time per week. This could be especially important for ads, because the more ads you show and the more people you reach, the more leverage you have with Trade Desk (TTD) and Google (GOOGL). And when, as we currently see, 50% of new sign-ups in ads countries are on the ad plan, and those are growing 35% quarter over quarter, ad revenue could be an important driver in the future.

What Else Sets Netflix Apart From The Competition?

I think Netflix’s recommendation algorithm is superior because it has often shown me shows that I really liked. This is partly due to the huge amount of content, but also because the quality is often good. In addition, the local content offers me personally the opportunity to learn new languages, as I am currently learning Spanish and the local Spanish series with subtitles help me a lot. And for many small production companies, Netflix is a blessing, because Netflix takes the financial risk and the filmmakers can focus on making the best product. Here I can especially recommend Scandinavian thrillers or Korean gangster shows.

And just the fact that the phrase Netflix and Chill exists should tell you what a powerful brand they have built. And the more data Netflix has, the better they can estimate how successful something might be, how customers have responded in the past, what caused them to cancel shows, and so on.

What Are The Growth Opportunities?

The upcoming Mike Tyson vs. Jake Paul boxing event and the live NFL sports events in December could be the start of a new era if all goes well. Personally, I am not a big fan of Mike Tyson getting back in the ring, but Jake Paul and his brother have a lot of reach and that could translate into a large audience and new subscribers. And his brother Logan Paul will also be on Netflix in 2025 along with the WWE. But I think the sports market is difficult because the rights are very expensive and there are a lot of companies competing. But the same thing was said before Netflix entered the regular streaming market. So Netflix’s execution speaks for itself.

I see additional growth opportunities in the LATAM and ASIA PACIFIC markets, which have significantly lower monthly revenue per paying user, and I believe Netflix has the ability to raise prices there in the coming years. Especially when there are local movies and series that create a hype there.

Are Management And Shareholders Aligned?

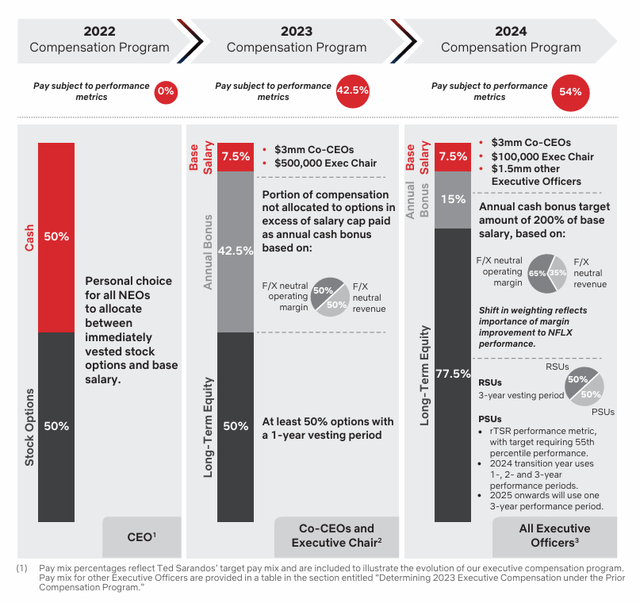

Proxy Statement Netflix

When shareholders and management are aligned, it often leads to outperformance, so I like to look at the proxy statement to see if I find anything I like. And Netflix has improved its compensation program in recent years, with 54% of pay now performance-based, up from 0% in 2022. And the annual cash bonus is tied to two metrics, operating margin and revenue, which I think is a good thing. What I find less positive is that the threshold to get 50% payout is 12.5% operating margin, which is far below the current ~25%.

So I think the metrics are good, but I would like to see targets that are more engaging and payouts that are only guaranteed for good performance.

NFLX’s Balance Sheet

On one side of the balance sheet is $7.4 billion in cash and $1.7 billion in short-term investments, and on the other side is $1.8 billion in ST debt and $14 billion in LT debt, for a total of $6.8 billion in net debt. And FCF for FY24 is likely to be between $6 billion and $6.5 billion, which leads me to conclude that Netflix’s liquidity is secure, as annual FCF is almost as high as net debt.

What Has The Market Priced In?

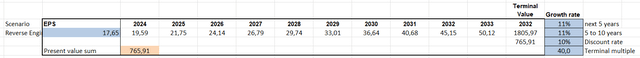

Author

One of my favourite ways to see if a company is fairly valued is to do a bit of reverse engineering to see what the market has priced into the shares. And for Netflix, the market has priced in an EPS growth rate of 11% over the next 10 years, based on TTM diluted EPS of $17.65. Historically, however, EPS has increased 41.91% per year over the past 10 years and 41.42% per year over the past 5 years. I do not think they can maintain that growth rate, but I do think they will beat the 11% that is priced in, which is why I think the stock is undervalued.

Where Could EPS Be In December 2027?

Seeking Alpha

Analysts estimate EPS of $33.32 in December 2027, which at a multiple of 40x would imply a stock price of $1332. This would represent an upside of nearly 67% from the current share price of $796. And I think the EPS could be even higher depending on how the live streaming events, the advertising, and the games go. So I would not be surprised if Netflix even ends up between $35 and $40 EPS.

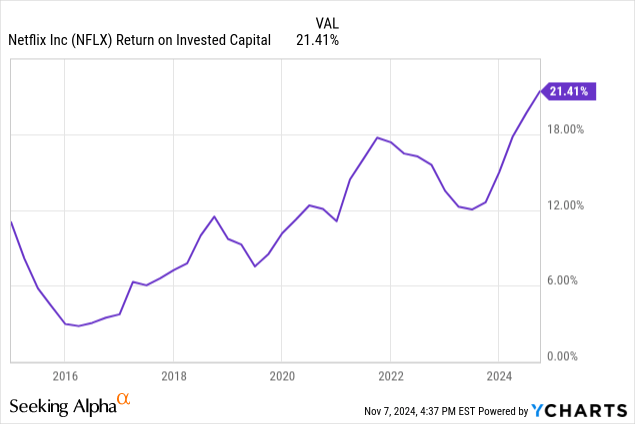

Netflix’s Capital Allocation

Netflix’s ROIC is on the rise, showing that its focus on original content is paying off. It is important to note that the cost of original content begins during the content creation process, sometimes years before release, and the cost of licensed content is incurred during delivery and the window of availability. Nevertheless, the ROIC-WACC spread is positive, demonstrating that all investments create value for shareholders.

ROIC: 21.41% – WACC: 7.9% = ROIC-WACC Spread: 13.51%

Conclusion

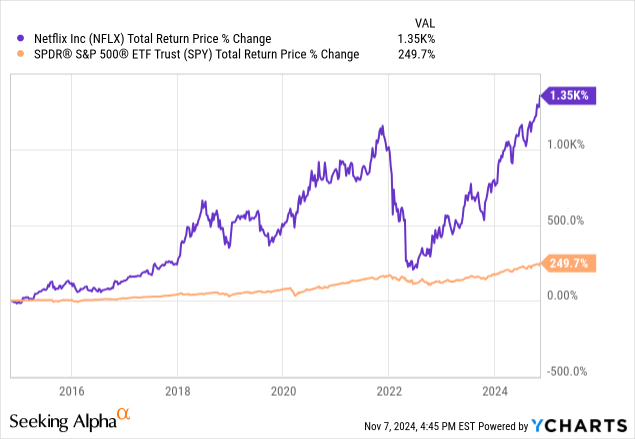

Netflix’s strong performance is also reflected in its overall performance versus the S&P 500 (SPY), and the chart also shows the gift to those brave investors who refused to be intimidated by the temporary uncertainties that occurred nearly two years ago. But even now, at an all-time high, I still think the stock is attractive because I firmly believe that Netflix has the best content in the streaming space, and secondly, it has a lot of growth potential. After all, with its original content that is better than the competition’s, Netflix has won the streaming war.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TTD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.