Summary:

- We maintain our hold rating on Netflix (NFLX).

- Consistent with our upgrade just a month ago, we think expectations were conservative enough to support Netflix’s outperformance in the near term.

- We are, however, not convinced that the company can continue to surprise on the upside into 2024.

- We expect price hikes to only boost revenues for the short term, and we now don’t see more catalysts into 2024 amid increased macro uncertainty.

Mario Tama/Getty Images News

We maintain our hold rating on Netflix (NASDAQ:NFLX) in spite of the company’s earnings beat this week. Consistent with our upgrade a month ago, we think expectations for the streaming and entertainment industries were conservative enough to support Netflix’s outperformance in the near-term. The company reported revenue of $8.54B, in-line with consensus, up 7.8% Y/Y and 4% sequentially, and GAAP EPS of $3.73, beating by $0.23. Netflix’s star of the show, however, was the 8.8M paid net additions, accounting for a 9% Y/Y increase in average paid memberships and significantly higher than the 2.4M added in 3Q22. We think management rolling out paid sharing and focusing on profitable growth did help support growth this quarter, but we also believe expectations were low enough for the beat.

Our bearish sentiment is based on our belief that the company won’t be able to continue showing upside surprises into 2024. While we understand management is attempting to use password sharing and ad tier to reaccelerate pandemic-like growth levels, we don’t think investors will see material financial outperformance into 2024 due to the longer growth runway of these catalysts and the macro weakness. We see more attractive entry points into the stock down the line.

We see positive signs from Netflix and continue to expect the company to be uniquely positioned to outperform in the mid-to-long term. Netflix has shown its leverage over pricing power this quarter, with management increasing the pricing of its basic and premium services from $9.99 to $11.99 for basic and $19.99 to $22.99 for premium, respectively. Netflix’s ad and standard plans will remain at the same price of $6.99 and $15.49 a month, respectively. We think the price hike will help support financial outperformance in the near-term but don’t see it as a sustainable growth driver. We expect Netflix will continue to struggle to boost top-line growth meaningfully in the near-term, and we don’t see attractive entry points at current levels as the market has priced in the expectation of recovery.

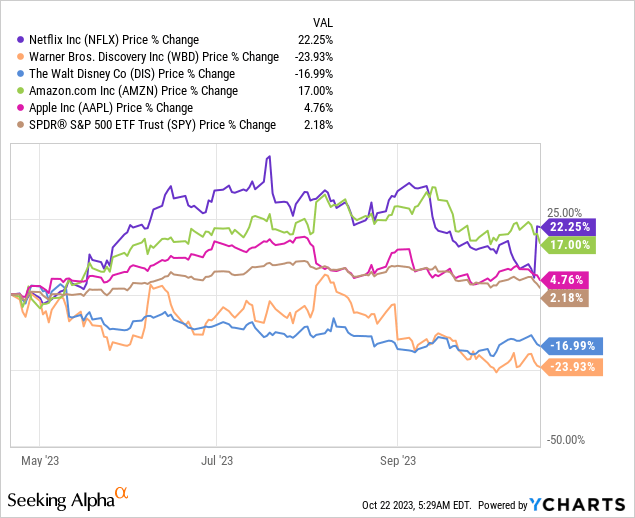

The following graph outlines Netflix’s performance versus the peer group, including Warner Bros Discovery (WBD), Disney (DIS), Amazon (AMZN), Apple (AAPL) and S&P 500 over the past six months – keeping in mind the exposure to the streaming industry differs across the peer group.

TSP

Investors reacted positively to the price hikes and the advertising business growth trajectory, reporting a 70% QoQ growth in ad plan membership, with the stock running up +14% after earnings. We’re more constructive on the ad tier growth and price hikes, but we don’t expect the new tier will add a substantial contribution to fourth-quarter results. Management guidance for next quarter confirms our expectations, forecasting similar results to 3Q23 in terms of paid net additions +/- a few million. Global ARM is expected to remain flat Y/Y, and we think this is due to the limited price increases over the past year. We think management is on the right track to monetize subscriber growth but still see a longer growth runway, especially given the exposure to UCAN and EMEA revenues amid the current macro backdrop. We recommend investors stay on the sidelines in the near-term.

Valuation

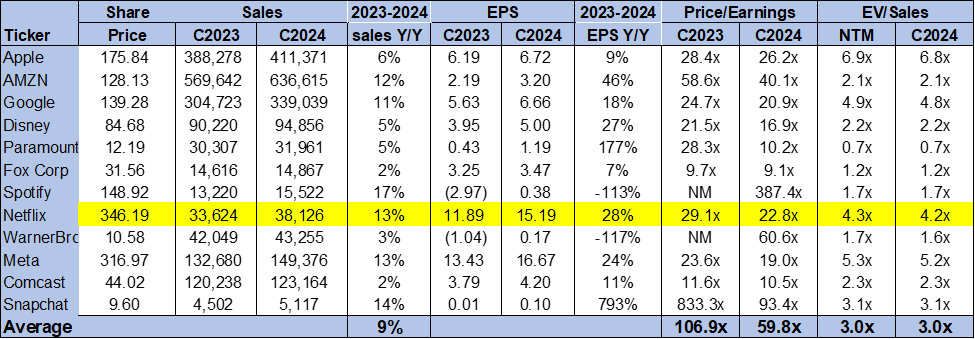

Netflix continues to trade above the peer group average. The stock is trading at 4.2x EV/C2024 Sales versus the peer group average of 3.0x. On a P/E basis, the stock is trading at 22.8x C2024 EPS $15.19 compared to the peer group average of 59.8x. We’re more positive on Netflix now but don’t see attractive entry points at current levels. We think the longer growth story will continue to play out. The following chart outlines Netflix’s valuation against the peer group average.

TSP

Word on Wall Street

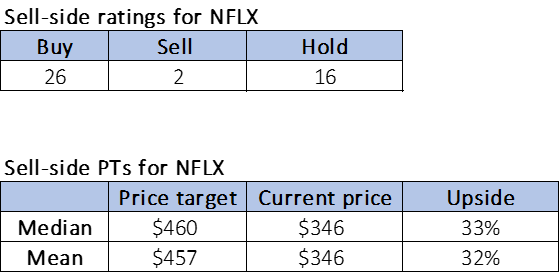

Wall Street is leaning towards a bullish sentiment on the stock. Of the 44 analysts covering the stock, 26 are buy-rated, 16 are hold-rated, and the remaining are sell-rated. We think Wall Street is caught between a hold and buy on the stock due to optimism around the company’s password sharing and ad-tier offset with limited visibility on top-line growth and the macro environment. The stock is currently priced at $346 per share. The median sell-side price target is $460, while the mean is $457, with a potential upside of 32-33%.

The following charts outline sell-side ratings and price-targets for the stock.

TSP

What to do with the stock

We continue to be hold-rated on Netflix. We’re more constructive on signs of password sharing supporting top-line growth, but we continue to believe revenue growth will be challenging in the near-term. We’re not convinced that the company continue to show surprise on the upside into 2024 and management’s expectation of flat ARM for next quarter. We expect investors will see more attractive entry points towards the end of the year.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Our investing group, Tech Contrarians, discussed this idea in more depth alongside the broader industry and macro trends. We cover the tech industry from the industry-first approach, sifting through market noise to capture outperformers.

Feel free to test the service on a free two-week trial today.