Summary:

- There is no shortage of challenges facing Ford Motor Company. Ever since I invested in the company, Ford has suffered one major setback after another.

- The 25% tariffs on Mexican imports proposed by President-elect Trump will force Ford to pass costs to consumers, potentially reducing demand for its vehicles.

- Wolfe Research predicts new car prices will rise by up to $3,000, exacerbating already high average prices and deterring buyers.

- Despite short-term setbacks, Ford’s long-term outlook remains positive, but caution is warranted because of a few major risks facing the company’s market position.

Neme Jimenez/iStock Editorial via Getty Images

There is no shortage of challenges facing Ford Motor Company (NYSE:F). Whenever things started to look promising in the last three years, Ford faced a new challenge. Donald Trump’s thumping victory in the 2024 Presidential election seems to have unlocked a new challenge for Ford in the form of possible new tariffs against Mexico. As a long-term-oriented investor who continues to believe in Ford’s long-term potential to capture a meaningful share of the U.S. EV market, I wanted to evaluate the short and long-term impact of these tariffs.

New Tariffs Will Raise Auto Prices, Impacting Demand

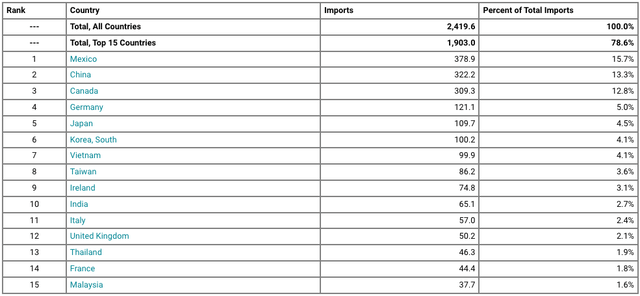

One of the biggest promises given by President-elect Donald Trump during his campaigns was to crack down on illegal immigration and drugs and to establish the nation’s presence as a global manufacturing hub. As part of his strategy to achieve this objective, Donald Trump has proposed a hefty 25% tax on imports from Mexico and Canada while levying an additional 10% in taxes on Chinese imports. These three nations represent the largest importers to the U.S., which suggests Americans should prepare for a notable rise in expenditure as a result of these proposed taxes.

Exhibit 1: YTD imports by country

Census Bureau

Following up on his campaign promises, Donald Trump published the below post on Truth Social last Monday, emphasizing the need to limit imports from Mexico and Canada.

On January 20th, as one of my many first Executive Orders, I will sign all necessary documents to charge Mexico and Canada a 25% Tariff on ALL products coming into the United States.

According to President-elect Trump, these new tariffs will be in place until the two nations address drugs and illegal immigration.

A closer look at Ford’s ties with Mexico suggests the automaker would be forced to pass on the impact of these new tariffs to consumers. Ford owns several manufacturing and assembly plants in Mexico, and the company even announced a $273 million investment in Mexico last September to accelerate the production of EVs. The below list provides a summary of Ford’s presence in Mexico.

- Cuautitlan Stamping and Assembly Plant which manufactures the Ford Mustang Mach-E.

- Hermosillo Stamping and Assembly Plant which manufactures the Ford Bronco Sport and Ford Maverick.

- Irapuato Electric Powertrain Center which manufactures electric vehicle drive units.

- Chihuahua Engine Plant which manufactures different types of engines used in popular vehicle models.

According to Cox Automotive, Ford imports approximately 25% of the vehicles it sells in the U.S. from Mexico, highlighting the massive impact newly proposed tariffs would have on the company.

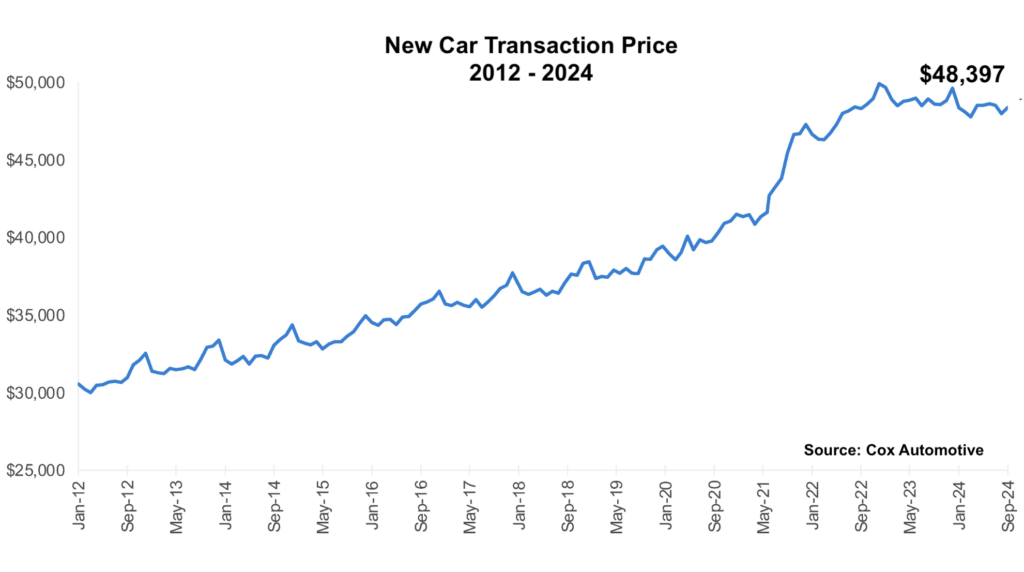

From a broad view, the auto industry will face a major setback when/if these tariffs come into play as price increases are likely to deter potential buyers from purchasing new vehicles. According to Wolfe Research, average new car prices in the U.S. will rise by as much as $3,000 because of these newly proposed tariffs. New car prices are already at elevated levels with the average surpassing $48,000 in September. A further increase in average prices as expected by Wolfe Research will have a detrimental effect on demand.

Exhibit 2: Average new car prices in the U.S.

CarEdge/Cox Automotive

According to Wells Fargo analysts, Detroit automakers will see an EBIT impact of $5 billion to $9 billion as a result of new tariffs before considering any price hikes. This massive risk is likely to force Ford to increase prices as early as Q1 2025, impacting the demand for its vehicles at a time when the company is already reeling from EV losses.

The Long-Term Outlook Is Positive But Caution Warranted

My long-term projections for Ford remain valid today as I believe the company is well-positioned to emerge as a big winner in the EV sector with its focus on electrifying popular trucks and SUVs. Ford’s focus on electrifying commercial vans, pickup trucks, and SUVs will help the company remain true to its core while embracing a new business model, and I believe pure-play EV companies such as Tesla, Inc. (TSLA) will find it difficult to compete with the likes of the F-150 Lightning in the long term given Americans’ lasting love for trucks.

Ford is also planning to launch an economical electric vehicle platform by 2027 to cater to the growing demand for EVs that are competitively priced compared to fossil fuel-powered vehicles.

As I have discussed in my previous articles, there are a few more reasons behind my bullish stance on Ford.

- Cost reduction efforts by the company to achieve a more nimble, flexible manufacturing process.

- Redefining the battery sourcing strategy to qualify for higher tax incentives.

- Focus on profitable EV growth by striking a balance with fully electric and hybrid vehicle models.

- The focus on mitigating the threat posed by Chinese EV makers.

Although I am bullish on Ford stock, I am closely monitoring a few risks that may alter my thought process in the future. Some of the biggest risks facing the company include pricing challenges stemming from competitive pressures, slower-than-expected EV adoption in the U.S. due to a lack of affordable EV options, and the uncertain regulatory environment with President-elect Donald Trump’s pro stance on fossil fuels.

Takeaway

Proposed tariff hikes on Mexican imports will have a meaningful impact on the affordability of new vehicles, and Ford is likely to be a victim of reduced demand for new autos. The company will be forced to pass on some of the cost increases to consumers, and I’m closely monitoring the real-world impact of these expected price hikes at a time when Ford is still struggling to get its EV strategy right. Despite the threat posed by higher tariffs on imports, I continue to believe in Ford’s long-term potential to emerge as a big winner in the EV sector, and I find the company cheaply valued at a forward P/E of just 6.1, which, in my opinion, does not reflect Ford’s potential in the EV space.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of F either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.