Summary:

- New Oriental Education revived from 2 years of policy-induced downturn with a stronger competitive position to tap into China’s vast after-school tutoring market.

- Investors have yet to fully recognize the business potential of EDU’s large and loyal client base, which it has accumulated over 3 decades.

- EDU is undervalued at 21x FY25, with EPS growing at over 40%. 3Q24 earnings, due on April 20th, can lead to another leg up.

- The recent price pullback for EDU is a healthy correction, easing pressures from profit-taking pressures from crowded long positions.

Andy Feng/iStock Editorial via Getty Images

Key Investment Thesis

I initiate New Oriental Education & Technology Group Inc. (NYSE:EDU) at Buy. Despite strong share price rally in 2023, I see that significant upside remains, driven by its robust earnings growth and its ability to generate new growth via monetizing its large client pool, whereas current valuation reflects consensus views that EDU’s revenue growth will decelerate rapidly as its existing businesses mature.

EDU is a leader in China’s After School Tutoring (AST) industry. The industry underwent a policy-induced downturn between 2H21-1H23, as the Chinese government banned educational institutions from offering academic AST programs to K9 students. These programs had been the industry’s main revenue sources. EDU recovered strongly from the downturn with an enhanced market position and reduced competition. I believe, by FY24, its profit will exceed its pre-ban levels. Trading at less than half of its previous peak, see the stock as a bargain.

The stock fits my stock pick criteria for long-term core holdings, which requires; 1) fast-growing demand; 2)sticky client base with less demand volatility; 3)asset-light business model; 4)limited competition and stable pricing, and; 5) reasonable valuation. I believe EDU fits most of those criteria.

Company Description

EDU is a Chinese firm specialized in After School Tutoring and English Language Education. The company was established in 1993 to cater to the strong tutoring demand for English tests required for university admissions, such as TOEFL and GRE. In early 2000, EDU expanded its business into the K12 AST, which at its peak contributed 76% of EDU’s revenue in FY2021. However, in FY22, due to the Chinese government’s ban, EDU’s revenue and profit were taken a hard hit and had to restructure its business lines to be compliant with new regulations.

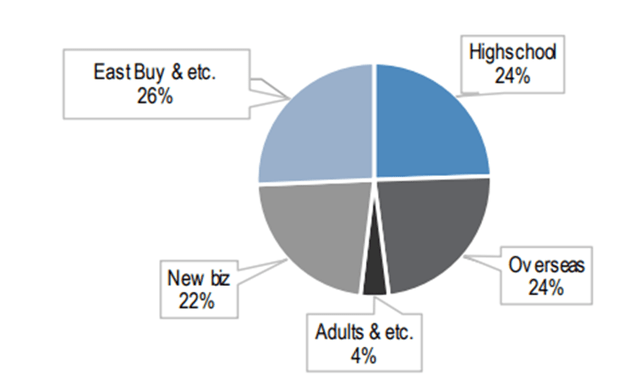

EDU currently operates four business segments.

- K12 AST (high school + New Biz). This segment will account for 46% of revenue in FY24E. Its main business includes high school academic AST, K9 non-academic trainings (such as painting, presentation skills, poem and literature) and intelligent learning devices (pad computers equipped with pre-recorded EDU courses).

- English test preparation and consulting service for study overseas. This segment will contribute 24% of revenue in FY24E.

- East Buy (1797 HK). A livestreaming e-commerce platform, selling mainly private label products. This segment will contribute 26% of revenue in FY24E.

- Domestic test preparation for adults and other businesses. This segment will contribute 4% of revenue in FY24, and offers preparation courses for admission tests of graduate school and professional certificate exams.

Figure 1 business breakdown of EDU in FY24E

China’s after-school tutoring is far from saturation

The after-school tutoring industry is a large and booming industry in East Asian countries, including Japan, Korea, China, etc. This can be attributable to the influence of Confucian culture, which emphasizes the importance of continuing education and self-improvement and sees education as a crucial pathway to higher social class. Additionally, those countries underwent rapid economic growth post World War II, where well-educated professionals were highly valued, further fueling the demand for quality education. As a result, parents and students in those countries are keen to excel academically in securing a place in renowned education institutions, which has led to an increasing demand for after school tutoring.

In Korea, nearly 80% of school students have attended at least 1 after school tutoring program, with an average time spent of 7.2 hours per week. The total spending on cram schools in Korea is estimated to be 1.2% of GDP and 17% of family income for South Korean families in the top 20% income group. Those numbers were considerably lower in China, where spending on after school tutoring were around CNY564bn in 2021, or 0.5% of GDP.

Figure 2: Chinese AST market

EDU resumed strong growth after a policy-induced downturn

In 2021, the rapid expansion of after-school tutoring drew government attention, as it contradicted the government’s long-standing policy of reducing educational burdens for young students and promoting a fair educational system. Consequently, in June 2021, the government has issued heavy-handed measures to ban all K9 AST programs for academic subjects, both in online and offline formats.

The policy had a severe negative impact on AST institutions, particularly the online focused institutions, as they were still burning cash to expand their business. Hence, many of these institutions had to undergo a substantial downsizing measures for survival. Offline focused EDU also experienced negative repercussions. But the impact was milder, thanks to its large cash pile, and diverse business mix. EDU has managed to keep nearly half of its training centers (1,669 training centers in FY4Q21, vs 748 in FY4Q23) and its teaching team (down from 54,200 in FY4Q21 to 26,600 in FY4Q23).

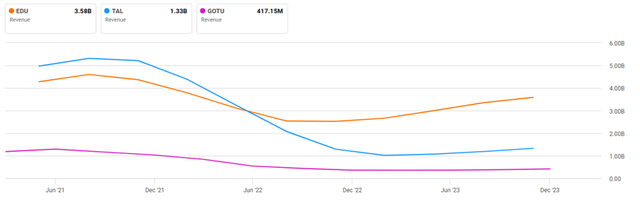

Figure 3: EDU’s revenue is only 22% lower than its peak in mid-2021, whereas TAL and GOTU were down to only 25% and 31% of their peak revenue before the ban.

After the ban, EDU has conducted several initiatives to resume growth. They were highly successful in my view. By FY23 (ended in May 2023), EDU has returned to nearly 80% of its peak sales, while its competitors were still at 25-30% of their pre-ban sales level. These initiatives include:

- Closed all its K9 AST courses for academic subjects in Oct. 2021, and redirected the resources to expand its POP Kids program. The POP Kids program is an education program focused on holistic development and offers training in areas such as computer programming, robotics, art, science, critical reasoning, presentation skills etc.

- Introduce learning devices to replace academic AST. Given students have discretion of how to engage with those devices, these devices are categorized as reference books by the government. Since FY23, EDU has expanded its learning device business to replace academic AST. The device has equipped with all of EDU’s pre-recorded learning courses and learning references. Users can access these materials by paying a regular subscription fee.

- Rebranded Koolearn into East Buy. Koolearn Technology Holdings (Koolearn) was one of EDU’s subsidiaries, specializing in online AST. Following the government ban, Koolearn transitioned to a livestreaming e-commerce platform. With a combination of English education and production introductions, it gained tremendous popularity in FY23 and later changed its name to East Buy.

Easing Competition Supports EDU’s Margin Recovery

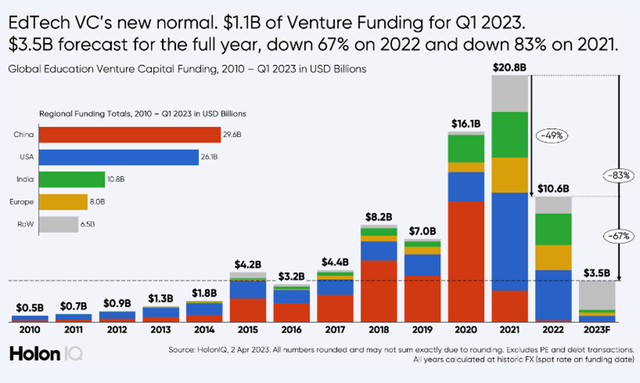

Before the government ban, EDU faced competition not only from prominent offline players such as TAL, but also from emerging online EdTech companies, such as Wobang and Fenbi. These EdTech companies were very aggressive in acquiring clients, backed by substantial funding from private equity investors. To defend its market, EDU was compelled to a more aggressive expansion of its offline network, which weighed on its net margin from 16% in FY17 to 12-14% before Covid-19.

After the ban, funding of Chinese EdTech companies declined from 70% of global EdTech financing in 2020 to only 1% after then ban in 2022. Many of those EdTech companies downsized their operations significantly. EDU has improved its competitive position and pricing power during the downturn. Therefore, as the market embarks on a recovery path since FY4Q23, I expect continued margin expansion for EDU over the next 3 years.

Figure 4: External funding for China EdTech sector were gone since the ban in 2022

EDU’s Strong FY3Q Guidance Reflects Sustained Demand Strength

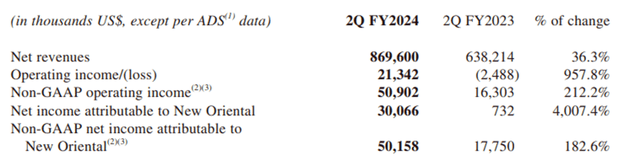

EDU’s revenue recovery gained traction since FY4Q23, with revenue up 64% yoy, driven by strong growth across all segments. The strong momentum carried through to FY1Q24 and FY2Q24, which saw revenue up 48% and 36% yoy respectively. Non-GAAP net margin has also seen a strong upward trend to 5.8% from 2.8% a year ago.

Figure 5: Financial results of 2QFY24 (ending in Nov. 23)

Management guided a 42-45% revenue growth for FY3Q24, and further margin improvement, which they characterized as quite conservative. I expected EDU to beat its guidance, given 3Q (from Dec. to Feb.) is a peak season for EDU’s offline AST, and overseas consulting business. Also, as a Merrill Lynch Analyst mentioned in the 2Q result briefing, there is very strong demand for EDU’s AST program. Many people trying to enroll in EDU’s learning centers have to join a waiting list for months, due to lack of capacity. Since supply is within EDU’s control, I believe they already have good visibility when issuing the guidance.

New Engines To Drive Growth

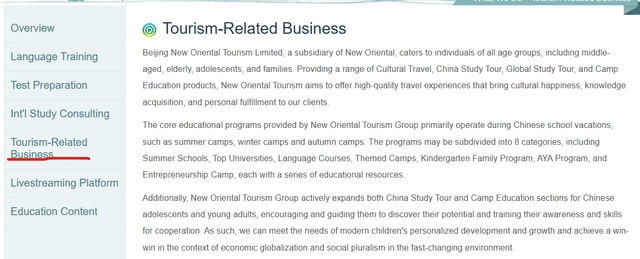

I expect “educational tourism” will become a next growth engine for EDU, as it has been proactively developing this business since June 2023. Educational tourism market has enormous potential, with annual sales of CNY140bn. By tapping into its large student pools and school network across the country, I believe EDU can swiftly grow its revenue from this new segment. Management stated that they will begin to disclose revenue of this business in the next fiscal year, once it reaches a meaningful size.

Figure 6: EDU has put tourism-related business as a separate unit in its home page

Source: New Oriental Education

Financial Forecast

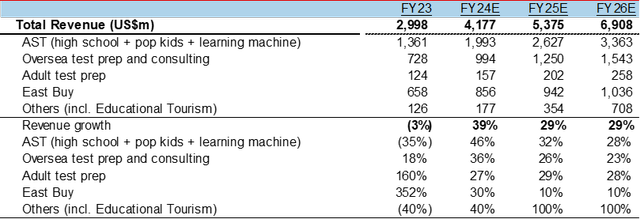

I expect EDU’s revenue growth to stay in the 30% trajectory for the FY24-FY26, driven by market growth, share gains from private tutors, and expansion of educational tourism.

By segment, I expect EDU’s AST programs, including high school, the POP Kids programs, and learning devices to continue to grow at a 35% FY24-26 CAGR. The forecast has factored in management guidance of 20% capacity increase, further improvement in utilization of existing facilities, as well as mild ASP improvement.

Its overseas test preparation and consulting business may slow down to a 28% CAGR, after pend-up demand during Covid-19 lockdown begins to fade. But I expect its growth to remain strong, as a challenging job market may compel college graduates to extend their studies overseas.

I expect East Buy growth to slow down to 16% 3-year CAGR as it enters into a mature stage, and competition for livestreaming platforms intensifies. But on the other hand, education tourism should deliver a stunning growth in FY25 and FY26 on strong demand and a low base.

Figure 7: Financial forecast

Source: Company data, My own estimates

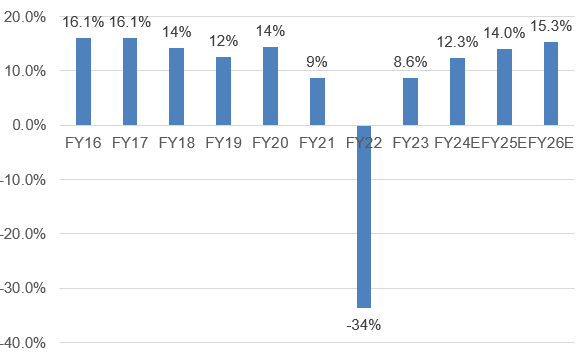

On the margin front, I expect EDU to reverse its previous margin downtrend, driven by the scale of the economy and benign competitive environment. Its Non-GAAP net profit margin should increase from 9% in FY23 to 12.3% in FY24. In FY25 and FY26, I forecast 1.7ppt and 1.3ppt net margin expansion, driven by the scale of the economy and easing competition.

Based on those, my estimates for Non-GAAP EPS are $3.0/$4.4/$6.2 for FY24/25/26, implying 96%,46% and 40% growth respectively.

Figure 8: EDU’s Non-GAAP net margin

Source: company data, My own estimates

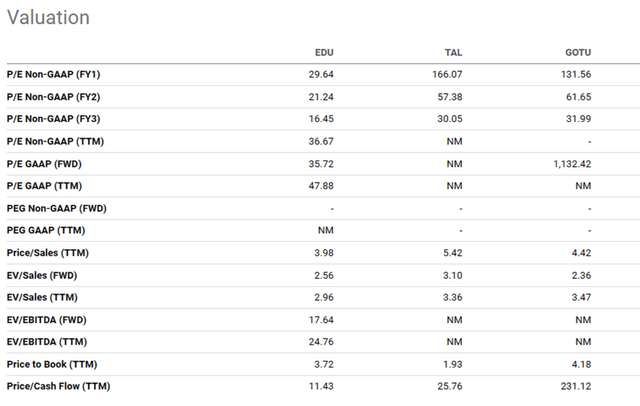

Valuation Analysis

EDU is trading at 29x FY5/24 P/E. I am comfortable with this level of valuation, as given we are already in 3QFY24. In May 2024, valuation will drop to 21x based on FY25 earnings. This is undervalued in my view, considering its 30% revenue CAGR in FY24-26. Compared to its peers, such as TAL and Gaotu, EDU is trading at a much lower P/E, price to sales ratio (P/S) and P/Cash Flow. Investors are cautious about EDU’s growth trajectory beyond 2024, after its revenue recovered back to its pre-ban peak level.

Figure 8: EDU’s valuation comparison table

Shareholder Return Policy

EDU does not have a regular dividend payout, given it was in a rapid growth phase before the ban. After the ban, it had invested heavily in restructuring its businesses and supporting its loss-making facilities. In July 2022, EDU announced a buyback program, worth $400mn. The program completed $194mn by the end of FY2Q24, and the remaining will be completed before May 2024. The $400mn buyback was small, considering its $15bn market cap, but it was a good start that EDU has begun to balance its growth and shareholder returns. EDU has near $1.5bn operating cash flow each year, according to my estimates. Hence, it has ample capacity to boost buybacks.

Risk To My Bullish Call

Key concerns from investors on the name could be on the policy front, given the surprising ban in 2021. With the mounting pressure on economic growth, Chinese regulators have started relaxing their strict policy on several sectors since late 2023, including reverting its policy on online game. I believe the risk of another round of a ban on EDU’s new businesses will be limited.

Crowded positioning. EDU share price staged a significant rally in 2023, and also outperformed China market YTD. Hence, we saw share price correct by over 10% since early March, as investors rotate from growth sector to cyclical sectors. I view the pullback as healthy, and rebound to new highs following the strong FY3Q24 result.

Figure 9: EDU’s share pulled back by 12% since Feb. 2024

Conclusion

I believe EDU is a long-term buy and hold investment for investors, given its leading position in China’s fast-growing after school tutoring market. I forecast a 30% revenue CAGR over the next 3 years, driven by industry growth, market share gains and expanding into new business such as educational tourism. Despite its strong share price rally, I view EDU as significantly undervalued, with its FY25 P/E at just 21x. I believe even an ex-growth consumer company with a quality business model and a deep moat may warrant a 15-20x P/E in my view. Moreover, EDU’s ability to continue to unlock value from its large and loyal client base is underestimated by investors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.