Summary:

- After executing a stellar turnaround, New Oriental Education’s stock has risen over 90% over the past year.

- The company’s prospects are cautiously optimistic with non-K-9 educational programs anticipated to support growth.

- Prospects appear baked into the stock price.

Andy Feng

Since covering New Oriental Education (NYSE:EDU) earlier this year and late last year, the stock has risen over 30% and 90% respectively. The company’s prospects are cautiously optimistic, but it appears to be baked into its stock price at this point.

Company Overview

New Oriental Education is a Chinese education services provider. Their operating segments are as follows:

-

Educational Programs and Services provides educational services, test preparation courses, and online education programs among other services. This is their biggest segment accounting for the vast majority of revenues, as much as 90% of as of FY2022 (their latest annual report has not been released). Within this segment, educational services and test preparation courses account for the majority of revenues (over 90% of the segment’s revenues and 80% of total revenues) and online education and other services accounts for the rest.

-

Books and Other Services sells and distributes books and other educational materials developed or licensed by the company, and provides services such as overseas study consulting services and study tours. Within this segment, overseas study consulting accounts for the majority of revenues (around 7% of total revenues) while revenues from sales of books and educational materials account for the remainder.

The government’s crackdown on the country’s education sector compelled education services companies like New Oriental Education to cease their lucrative K-9 after-school tutoring programs in 2021.

Following the shutdown, New Oriental’s strategy has focused on two key areas:

-

Expand existing non-K-9 education programs such as overseas test preparation, overseas study consulting, and domestic test preparation for adults and university students. These educational service programs generally fall under their Education Programs and Services business segment except for overseas study consulting which falls under their Books and Other Services business segment,

-

Develop new business initiatives, which currently include non-academic tutoring (such as extracurricular programs and courses), intelligent learning systems and devices, study tours and research camps, smart learning devices, and university exam preparation courses. The segment also includes their eCommerce platform which sells agricultural products, a business operated by their subsidiary East Buy Holdings (formerly known as Koolearn). Among all their new business initiatives, management noted in their Q3 2023 earnings call that non-academic tutoring is currently their biggest revenue driver and smart learning systems is the second biggest. Together these two initiatives contribute the vast majority of the company’s new initiatives.

Background: top-line growth driven by educational services, margins on the rise

FY2023 revenues declined 3.5% YoY to $2.99 billion, improving from last year’s 27.4% YoY decline. Gross margins improved to 53% and the company swung to a profit with an operating margin of 6.4%

For Q4 2023, revenues rose 64% YoY to $860.6 million helped by strong post-covid demand recovery. As in the previous quarter, growth was driven by their educational programs; overseas test prep and overseas study consulting businesses saw revenues increase 52% YoY and 6% YoY respectively while domestic test preparation for adults and university students grew 34% YoY. Non-academic tutoring courses delivered robust performance as well with a total of 629,000 student enrollments recorded during the quarter compared with 218,000 the previous quarter. The total number of schools continued to increase as well, rising to 748 at the end of the May 2023 quarter, up from 712 the previous quarter and 744 the same quarter a year earlier.

Intelligent learning systems and devices however appeared to be decelerating, recording 99,000 active paid users in the quarter, down from 108,000 the in Q3 and Q2, and 131,000 in Q1 2023.

Near term, management anticipates Q1 2024 revenues in the range of $983.2 million and $1 billion, a 32%-35% YoY growth. Education programs are expected to remain as growth drivers in the coming quarter helped by a favorable post-COVID demand environment, notably from overseas study consulting and overseas test prep courses as China’s border reopening encourages students to explore overseas education opportunities.

In addition, the company’s capacity expansion efforts which are expected to help capture market share could drive growth (management expects to increase classroom capacity by 15%-20% the coming quarter). Seasonality factors present a further tailwind since test preparation courses tend to have the highest demand between summer vacation periods June and August each year.

Riding on improving business conditions, after swinging to the black in FY2023, a strong start is expected for FY2024 in terms of profitability with operating margins expected to expand in Q1 2024.

Leaning on non-K-9 educational programs for growth, East Buy a question mark

Looking ahead, the company’s focus is on expanding their non-K-9 education programs – their core and biggest business. Demand for extracurricular subjects as part of an all-round education remains strong and demand for overseas study consulting and overseas test prep programs stands to benefit from growing demand for international education driven by China’s growing affluence as well as general perceptions that overseas education offers better career prospects.

In addition, management is making efforts to capture market share leveraging on their competitive strengths of a longstanding history and brand name as China’s largest private educational services provider founded by one of China’s top private tutors. Management noted in their Q4 2023 earnings call a changing competitive landscape with smaller players increasingly exiting the market. Management believes that a 15%-20% expansion in classroom capacity over the next 2-3 years is feasible.

Among new initiatives, New Oriental’s eCommerce business East Buy (OTCPK:KLTHF), in which New Oriental is the largest shareholder with a 55% stake, continues to show some promise as a potential growth engine, however, long-term success is still far from assured. For the fiscal year ended May 2023, revenues rose 650% YoY and the company swung to the black after years of losses. However, revenue growth appears to be slowing; for the six months ended May 2023, East Buy’s revenues rose just 16% QoQ. Margins also appear to be on a downward trajectory; gross margins for the six months ended May 2023 stood at around 40%, down from 47% notched the previous six months i.e., for the six months ended November 2022. Operating margins performed even worse, dropping from 30% to 17.5% during those periods. Nevertheless, East Buy has been investing into the business, including expanding its private label assortment, expanding sales channels (the vast majority of GMV were generated from their collection of Douyin channels, but they now have their own app and are exploring other eCommerce channels), and supply chain capabilities. Given the early stage of the business, the investments required to scale it up, and anticipated cost increases due to intense competition, further margin deterioration is possible in my view.

Risks

Potential waning of interest for overseas education

The number of Chinese students studying overseas has increased consistently over the past several years and the share of university students studying overseas is roughly the same as the U.S. at around 2% (nearly 1 million out of a total 46 million plus Chinese university students studied overseas, whilst in the U.S. around 350,000 students studied overseas out of a roughly 18 million university student population). With China’s per capita incomes still a fraction of the U.S., the proportion of Chinese students studying overseas could potentially grow, provided perceptions remain unchanged. However, the Chinese government is aiming to turn China into an education powerhouse by 2035, and is heavily investing in their own education system, an effort already delivering results with the country’s universities increasingly climbing up the rankings. Some surveys have found that students of China’s top universities are increasingly opting to remain in China to pursue postgraduate studies. If consumer perceptions change and domestic universities gain favor among Chinese students, New Oriental could be affected by reduced demand for overseas study consulting and test prep courses. A corresponding increase in domestic test prep demand may only partly help offset decline as overseas test prep courses tend to have higher prices.

Conclusion

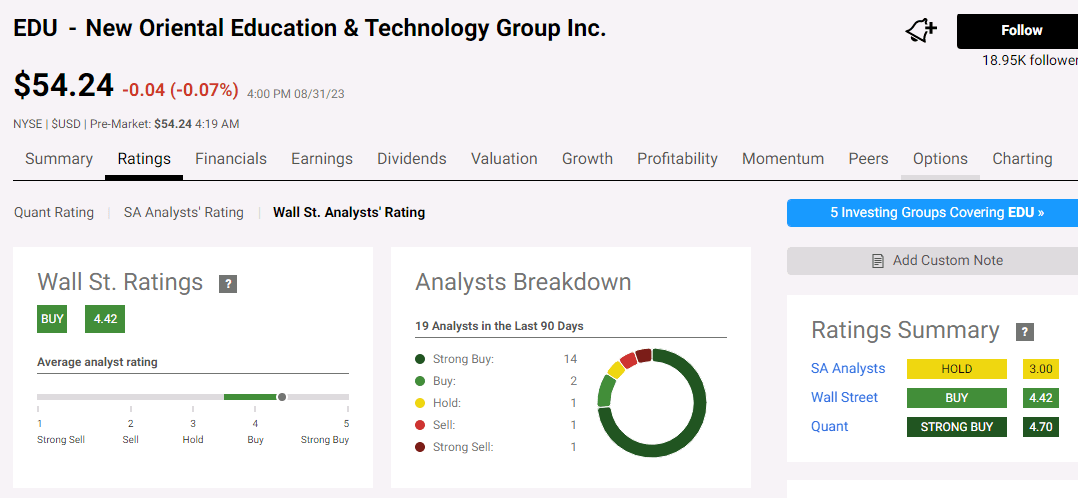

New Oriental Education has a buy analyst consensus rating.

Seeking Alpha

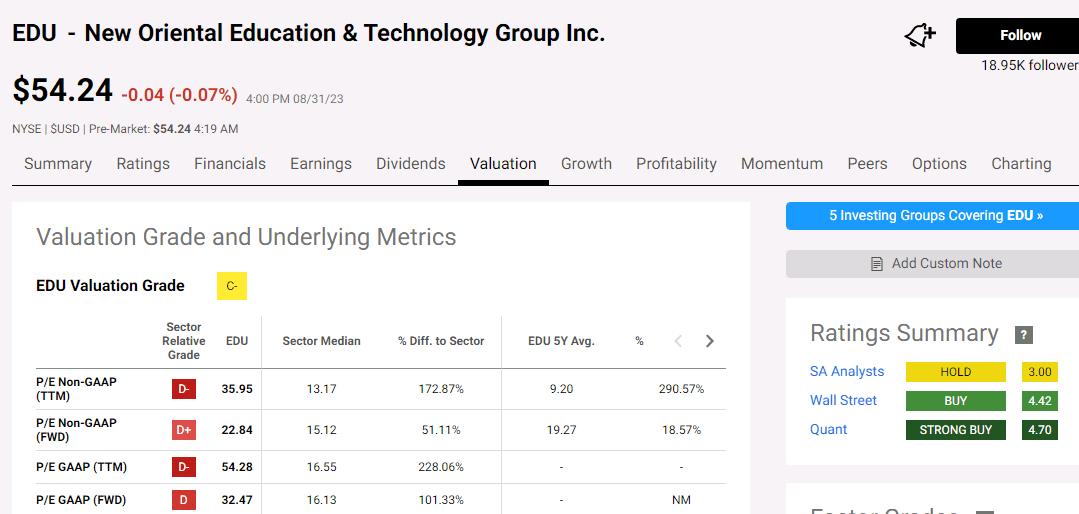

New Oriental’s stock has climbed 90% over the past year and is currently trading at a forward P/E of 22, higher than the sector median and higher than their five-year average.

Seeking Alpha

Applying the following fairly aggressive assumptions over the next five years suggest New Oriental Education is worth roughly $8.3 billion, considerably lower than their $9.2 billion market value currently. The stock could be viewed as a hold.

|

Revenue growth YoY % |

25% |

|

Net margin % |

11% |

|

Terminal growth rate YoY % |

3% |

|

CAPEX (% of revenues) |

5% |

|

Discount rate % |

10% |

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not a recommendation to buy or sell any stock mentioned. Please consult with a professional investment advisor prior to making any decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.