Summary:

- New Oriental Education’s Q1FY25 revenue met expectations, but weaker-than-expected FYQ2 guidance led to a stock sell-off.

- Macro uncertainties and weak economic conditions in China are likely to weigh on EDU’s enrollment and spending growth.

- Management’s focus on expanding learning centers and branching into non-core businesses like tourism may not yield high-quality earnings.

- We are cautious about EDU’s growth prospects and believe the company should focus on enhancing its core education business.

LordHenriVoton/E+ via Getty Images

New Oriental Education (NYSE:EDU) reported Q1FY25 revenue of $1.44bn that matched the consensus estimate, while adjusted EPS of $1.60 beat the consensus of $1.46. The stock sold off post-print due to the weaker-than-expected FYQ2 guidance in which management guided 25% – 28% revenue growth, which was slightly below the consensus 30%.

EDU has been a consensus buy stock amongst both global and domestic Chinese investors, and amongst the sell-side analysts with 27 buys and 3 holds, per Bloomberg, but we are cautious about EDU’s growth prospects given the current macro uncertainties which will continue to weigh in on enrollment and spending growth. In addition, much of the growth guidance appears to be supply side-driven as EDU continues to expand its learning centers. We suspect that without a clear turn-around in the consumption environment, the ROI on the learning centers could come below investor expectations and the near-term investment could continue to weigh on margins. Finally, we believe that EDU management should be more focused on enhancing its core education business, rather than branching off to businesses that are irrelevant to education services. Most notably, we view the expansion into tourism is purely to drive profit, given that East Buy ecommerce streaming growth is likely to be handicapped in the wake of the star streamer’s exit. Although the tourism business could be a new source of earnings, we do not see such earnings to be of high quality.

Macro uncertainties to weigh on revenue growth

China’s current macro uncertainties are likely to weigh on EDU’s enrollment outlook. While we agree that education is a cornerstone of any Chinese family’s spending given its perceived investment value, we believe that such spending may not be justified amid a soft economic backdrop in which parents are cutting back on many discretionary spendings including education due to the uncertain prospect in income growth and declining wealth effect due to the deflationary housing environment.

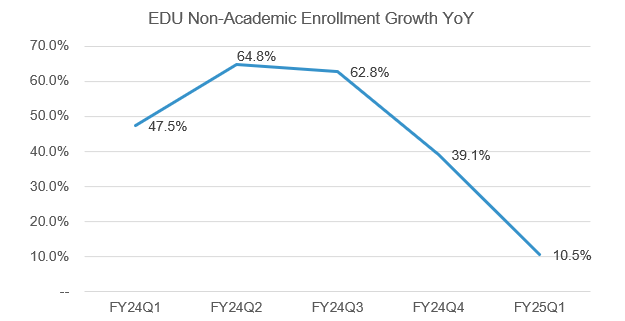

Most notably, non-academic enrollment growth of 10.5% is the slowest pace in recent quarters, implying that education spending within Chinese families is highly discretionary and that EDU’s defensive nature amid a weak macro backdrop may not be as strong as many investors perceive it to be.

Company reports, Astrada Advisors

China’s overall employment landscape remains challenging and is characterized by an elevated level of youth unemployment rate at 17.6%. Lack of promising employment prospects is likely to impact weigh on both parents’ and students’ willingness to invest in test preparation courses, given the less attractive return on investment profile. With close to 12 million university graduates seeking employment opportunities from domestic institutions alone, students who are looking to attend overseas schools may be discouraged to pursue an overseas degree given that such degree may not give them a clear advantage relative to the domestic graduates.

Management tried to rationalize the low enrollment growth by citing much of the enrollment was front-loaded in last quarter. If we were to combine Q4 and Q1’s numbers, then the YoY growth is around 25%. Even so, this is a sharp deceleration from the prior periods and underscores our view that enrollment deceleration is inevitable in the foreseeable future.

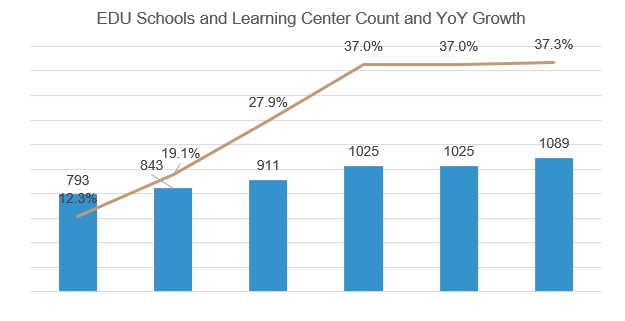

Another challenge worth flagging is that much of the growth in guidance appears to be driven by the supply side expansion of learning centers, rather than higher tuition fees and enrollment demand. Consensus appears to be perceiving this as concrete demand for schools and learning centers. However, we are skeptical given how much real demand is there in light of the constrained consumer spending and weak income and employment prospects. We are cautious on the quality behind this guidance as EDU could once again disappoint if enrollment metric continues to decelerate due to the macro challenges as we cited previously.

Company reports, Astrada Advisors

Greater management focus is needed to steer the ship

We believe management could be more focused in the wake of star streamer exit from its East Buy subsidiary. EDU operates a private label product and livestreaming ecommerce business through its subsidiary East Buy. This business has been an important profit driver for EDU during the regulatory crackdown on the education sector, but this business lacks clear synergy with EDU’s core education business. With the recent live streamer leaving East Buy, we believe the management could be more focused on enhancing the education business rather than branching into irrelevant businesses that lack synergy with the core business.

The recent entry into tourism on the surface appears to be a logical extension of the education business, but in reality, the service lacks clear differentiation from the existing tourism service providers such as Trip.com (TCOM). We listened to the rationale provided by the management at one of the recent investor meetings, and the rationale appears to be more political than business. Notably, management cited that it is beneficial to promote Chinese culture and history through educational tourism. While we have no doubt this would be one of the outcomes, the real agenda may be to enhance EDU’s corporate social responsibilities, so the regulators may be less punitive in their future regulations of the sector. Regardless, we would like EDU to be more focused on their strategic expansion that aligns with their core strength, rather than businesses that lack clear differentiation and synergy.

Consensus is currently modeling 20% revenue growth for FY25 at $5.1bn and $3.26 in EPS. Our revenue is 10% below consensus, given that we assume 10% enrollment per school growth and 25% growth in the number of schools. This should translate to 36% growth in total enrollment and 45% growth in new business revenue growth, which includes non-academic tutoring and intelligent learning devices. Our EPS is also lower than consensus at $3.10.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.