Summary:

- NextEra Energy beat analyst estimates with non-GAAP EPS of $0.94.

- The company’s Florida Power & Light business has a robust growth outlook, while the Energy Resources division achieved record renewables power generation.

- An historic break in the stock’s price vs. operating income has been formed in 2023.

sturti

Gotta Have It

Utilities are, almost by design, relatively stodgy, sleepy enterprises. When your business is ensuring that the basic necessities of staying alive are available 24/7, boring is good. Even the way utilities raise prices – by typically going through voter approvals and rounds of discussion with elected officials – is boring.

With this in mind, it’s always a pleasant surprise to see a utility surprise to the upside, which is just what NextEra Energy, Inc. (NYSE:NEE) did today, posting sales of $7.17 billion (a slight miss on estimates by -0.11%) and non-GAAP EPS of $0.94, handily beating the high analyst estimate of $0.91 per share.

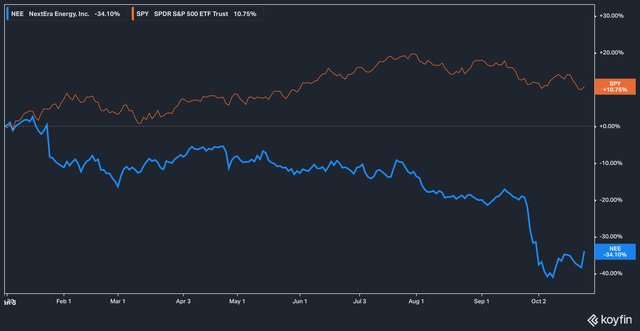

The stock, which has taken a bath most of the year, reacted positively on the news, surging more than 7% on the day.

NEE YTD Performance Vs. SPY (Koyfin)

Given that the company actually whiffed slightly on top line revenue, investors can be forgiven for scratching their heads as to why the stock has reacted so positively.

The Earnings

To start, let’s do a quick review of NextEra’s business.

The company operates in two main segments – Florida Power & Light [FPL] and Energy Resources [NEER]. FPL essentially does what’s in its name: providing power to a large swath of Florida. NEER comprises the company’s renewable energy segment and has a nationwide footprint.

For FPL itself, the outlook remains bright as Terrell Crews, NextEra’s CFO noted on the earnings call:

Key indicators show that the Florida economy remains healthy and Florida continues to be one of the fastest-growing states in the country. FPL’s third quarter retail sales increased 3% from the prior year’s comparable period due to warmer weather, which had a positive year-over-year impact on usage per customer of approximately 2%. As a result, FPL observed solid underlying growth in third quarter retail sales of roughly 1% and on a weather-normalized basis.

NEER, however, posted a solid set of results for the quarter. Speaking to this, Crews remarked:

Energy Resources had a record quarter of new renewables and storage origination adding approximately 3,245 megawatts to the backlog, which is the first time we have exceeded 3 gigawatts in a single quarter. Although we will remind you that signings can be lumpy quarter-to-quarter, we do believe this is a terrific sign of strong underlying demand for new renewable generation.

Less talked about but still vitally important for the company is the fact that NEER is no longer an anchor on the company’s neck from a cash flow perspective.

For example, in 2022, NEER generated operating cash flow of $3.3 billion. With Q1 2023’s operating cash flow of $231 million, Q2’s $1.07 billion, and Q3’s $2.1 billion, the business already has surpassed the full prior year’s operating cash flow – even in the face of dwindling wind generation.

The earnings, however, were not the only star of the show – after all, the estimate-beating EPS numbers were presented on an adjusted basis. What the market seemed to appreciate from NextEra instead seems to be the robust guidance provided by the company.

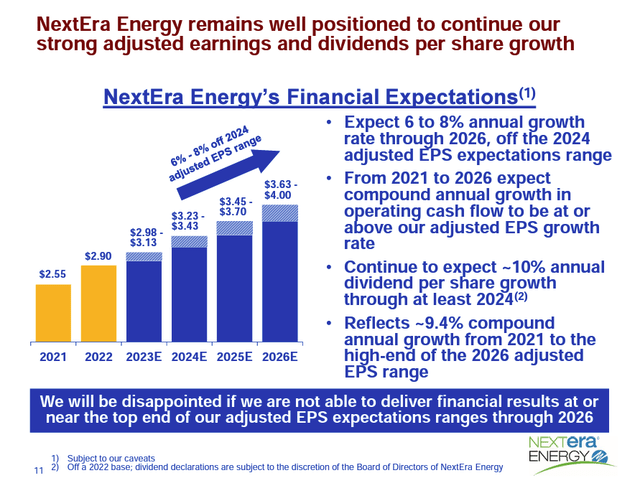

Stoking the fire of investor enthusiasm is the bottom banner of the slide, which seems to set an expectation that the high end of adjusted EPS expectations is the true target of management. It’s also a testament to the confidence of the management team that they’re comfortable enough to provide projections looking out to 2026.

Another bit of positive news was an update from CEO John Ketchum that the company expected to be able to provide an update (whether or not that means “sale” is anyone’s guess) on the company’s efforts to divest its Texas Pipeline Portfolio, the shopping around of which was announced in the second quarter of this year.

A Price Dislocation?

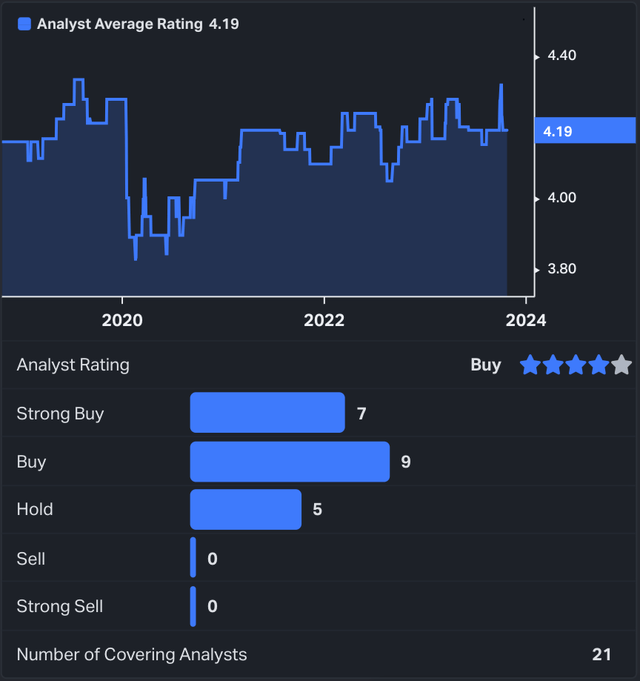

Given the fact that NextEra has a remarkably strong balance sheet for a utility company, it’s perhaps not surprising that the drop in price has attracted attention from investors and analysts alike. Of the 21 analysts who cover NextEra, seven rate the stock a strong buy, nine rate it a buy, and five rate the company a hold with no sell or strong sell ratings.

With a current price of roughly $55, the stock sits 35% below the average analyst target price of $74.

There are other signs as well that the stock’s drop may have gotten too far out ahead of its skis.

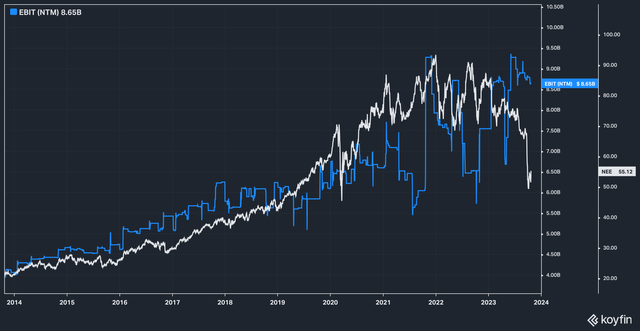

NEE Price vs. EBIT Estimates (Koyfin)

Prior to the end of 2020, NextEra’s stock price had a fairly steady relationship with its forward operating income estimates (operating income being a company’s revenues minus gross expenses). Things got a little whacky in 2023, with estimates dropping while the stock’s price surged, and the stock then traded roughly sideways until 2023, when things went south.

It appears, then, that this historic relationship has wholly broken down, resulting in a stock price last seen at the start of 2020. At that time, the company had forward EBIT estimates of $6.5 billion – today, next year’s estimates stand at $8.65 billion.

This is, we think, part of a wider knee-jerk reaction in the market to punish companies in interest-rate sensitive and capex-heavy industries, such as utilities. It’s also a move that may present a compelling opportunity for recover in the mid-term.

The Bottom Line

While NextEra has had an undeniably rough year, there are green shoots forming in the company’s renewables business and a robust growth outlook for its Florida utility operation. Management appears confident in their ability to deliver on a strong, multi-year outlook as well. Risks to our thesis include recurring or abnormally frequent severe weather events in Florida, which could result in higher repair and replacement costs and capex.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The information contained herein is opinion and for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist, and while they will be corrected if identified the author is under no obligation to do so. Author Is also under to obligation to update changes of view. The opinion of the author may change at any time and the author is under no obligation to disclose said change. Nothing in this article should be construed as personalized or tailored investment advice. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.