Summary:

- NextEra is well positioned to benefit from rising electricity demand thanks to data centers (AI) and reshoring activities.

- The company delivered a strong quarter marked by renewables bookings with a critical win from Google.

- NextEra has a solid asset base and offers downside protection. Recycling activities demonstrate this.

- NextEra’s historical P/E and a sum-of-the-part valuation support our buy rating target.

Cindy Shebley/iStock Editorial via Getty Images

In our last NextEra (NYSE:NEE) review, we asked ourselves how sustainable the company earnings growth story trajectory was. We reported risks on inflationary costs and higher interest rates vs. NextEra’s stock price performance. Our assessment clearly selected more discounted EU renewable players, such as Enel. Looking at the stock price performance, the US player was flat, while Enel grew by more than 40%, also outperforming the S&P change. This is not a comps analysis between two leading clean energy providers; however, they shared key peculiarities. Both companies have nuclear generation and a leading market share in the renewable space.

For our new readers, the company operates with Florida Power & Light (FPL) and Energy Resources (NEER). The former is a regulated electric player serving approximately 5.9 million regional clients. The latter is one of the largest renewable developers worldwide. The company also owns a majority equity stake in NextEra Energy Partners, which is a publicly traded yield-co. Looking at Enel’s information, as of today, the Italian player is the largest listed renewable power developer worldwide, “with a capacity of 53.6 GW across hydro, wind, solar, and thermal generation”.

That said, the company has a clear competitive advantage in renewable development in its home country and an attractive valuation. Here at the Lab, we now anticipate that NextEra might outperform the sector over the next twelve months.

Why are we positive?

-

(Data centers and AI growth). Taking advantage of the Q1 results and the recent Q2 update, the company posted a solid quarter marked by a sizeable hyper scaler contract for data center power and renewables bookings. Like Enel, here at the Lab, we believe that utility companies are well-positioned to benefit from rising electricity demand associated with AI consumption and new data centers. Looking at the details, the data center clients now represent 3GW of the company’s renewables in service and 4GW in the backlog. In Q2, NextEra signed an 860MW deal with Google to power its data centers. This is a noteworthy proof point of the company’s value proposition for this customer set. We anticipate incremental demand in the 2026-2028 timeframe and think data center deals will offer recurring earnings growth projections, driving up the overall return level of NextEra portfolio MIX as the mix shifts toward these new projects. Compared to our last analysis, we also see greater management transparency in the renewables business division. Another key upside is related to the USA reshoring activities and higher needs for electrification;

-

(Recycling activity upside). The company recently entered into a $900 million financing agreement with Blackstone. This aims to sell a partial renewable energy project interest with a total production capacity of 1.6 GW. This is part of the company’s asset recycling activity outline for June Investor Day. In number, NextEra will likely dispose of between $5 and $6 billion worth of assets. Here at the Lab, we believe this is an encouraging sign and demonstrates NextEra’s solid asset base and offers new investors solid downside protection;

-

(Renewable origination improvements). There is a higher backlog compared to Q1 2024. Q1 was also the second-largest origination quarter the company has had, and Q2 was a positive confirmation. In number, the backlog totals 22.6GW, up from 21.5GW last quarter. Today, with the current NextEra backlog update, we believe the company will be able to achieve its ~40GW of renewable energy target for the 2024-2027 timeframe. Therefore, any material pullbacks are attractive buying opportunities;

- (No impact expected from solar or battery tariffs). Regarding downside protection, the CEO anticipates that NextEra’s operations scale and tight contractual provisions will likely help insulate the company from the potential negative impacts of tariffs. This is based on any possible implications of the solar panel AD/CVD investigations and the battery storage from China (section 301 tariffs announced recently).

New Estimates and Valuation

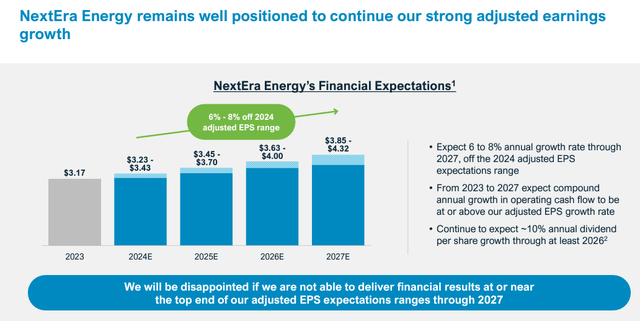

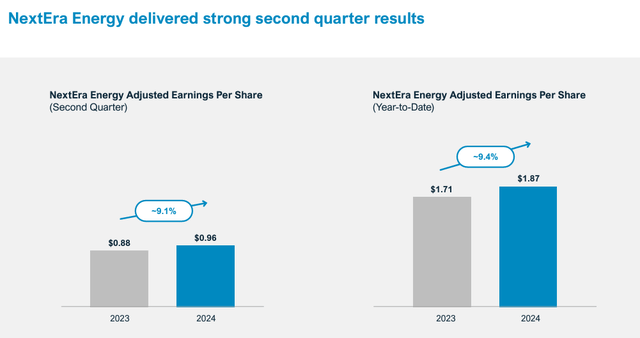

The company had a positive quarter and reiterated its 2024 EPS guidance of between $3.23 and $3.43 (Fig 1). In Q2, the company delivered an adjusted Q2 EPS of $0.96 compared to a Q1 EPS of $0.88 (Fig 2). Following the H1 results, we anticipate NextEra sales in the $27/28 billion range. Florida Power & Light’s regulated rate revenue base has grown 12% CAGR since 2022. That said, the company recorded a reserve amortization of $66 million in Q2. With a $586 million remaining reserve, we anticipate a lower EPS evolution. This is already included in NextEra’s EPS growth outlook of 6-8% in the next three years, with a positive confirmation of the business plan presented on 11 June 2024. On a positive note, NEER delivered an EPS of $0.42 in the quarter thanks to the growth of the renewable portfolio, which was partially outweighed by higher depletion expenses.

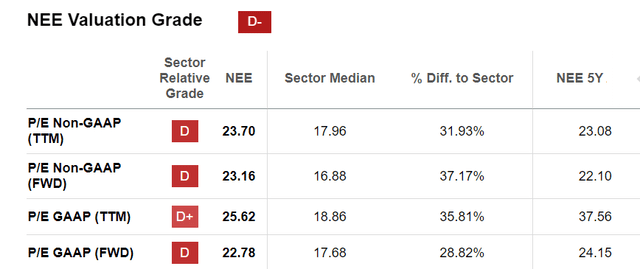

Here at the Lab, following a solid Q2 EPS print and the company’s updated commentary on FPL’s surplus amortization mechanism usage, we forecast a 2024 and 2025 EPS of $3.37 and $3.70. Regarding the valuation, we raised our target price from $85 to $87 per share, derived from a sum-of-the-part valuation considering Florida Power & Light and Energy Resources. Favorable demographic trends and strong execution support a best-in-class P/E valuation. Our 2025 valuation is derived by valued FP&L at $46, based on a P/E of 20x and an EPS of $2.3. The MSCI USA Utilities Index supports our P/E estimate (Fig 3). Related to the Energy Resources valuation, we see this entity as a pure infrastructure player related to the energy transition. Looking at the Damodoran P/E data on the Green & Renewable Energy, we see an average current P/E of 27.5x. In our divisional estimates, we used this multiple on a $1.4 EPS to reach a value of $40 per share. In addition, we should also include a $1 for the market valuation of the ownership in NextEra Energy Partners. This leads our target price to $87 per share, moving our rating to a buy recommendation. Looking at the aggregate and considering our 2025 EPS of $3.7, NextEra’s valuation is backed by its historical P/E. Indeed, valuing the company with a forward P/E of 24.15x on our forecasted numbers (Fig 4), we reach $89 per share. This is aligned with our new target price.

In addition, the company continues to expect earnings at the top end of its guidance during the forecasted period. This solid reiteration of the company’s record is vital to our target price changes. Our team believes the company is independently well positioned on the November election outcome. Also, to support our downside protection, NextEra announced a quarterly distribution of $0.9050 (corresponding to an annualized rate of $3.62). This represents a DPS increase of approximately 6% from last year.

Fig 1

Fig 2

Fig 3

Fig 4

Risk

Here at the Lab, we identify several risks. Higher interest rates impact the company’s net profit and change the investor appetite for renewable assets. This might impact NextEra’s recycling disposal activities and could inflate the company’s capital cost. NextEra is also exposed to regulatory and policy risks. In detail, the company expects the earned ROE in Florida to trend down from 11.8% to 11.4% in 2025. This has a negative impact of $0.06 EPS.

NextEra has a massive backlog, and we recognized the risks of poor project execution. These risks also include construction and procurement failure. In addition, we report cybersecurity risks to the transmission grid and extreme weather events. On a positive note, NextEra Q2 EPS benefited from favorable wind weather.

Conclusion

NextEra is a high-quality regulated and renewables business with a decade of electric power growth. Our team is bullish on renewables’ upside potential and data center power demand. We also suggest our NextEra readers look to our recent Enel follow-up note.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.