Summary:

- Demonstrated profitability and stability reinforce its reputation as a reliable investment.

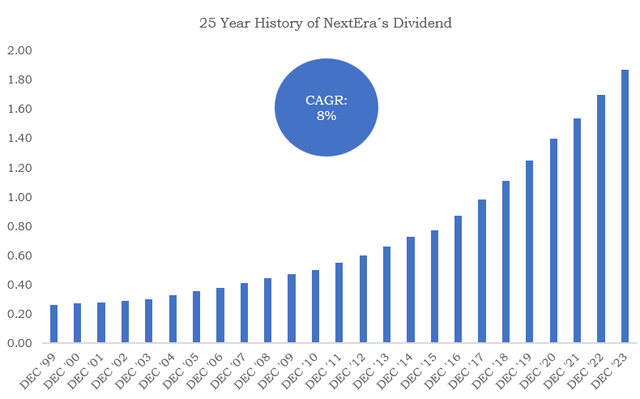

- Over the past 25 years, NextEra Energy has increased its dividend annually at a remarkable compound annual growth rate of over 8%.

- Qualitative and quantitative analysis supports the opportunity to take the journey on an undervalued stock by more than 15%.

agnormark/iStock via Getty Images

Investment Thesis

While utilities are often perceived as a mundane business model with modest returns largely derived from dividend payments, this perception does not apply to all companies in the sector. NextEra Energy (NYSE:NEE) stands out as a prime example, demonstrating that investment in utilities can be dynamic and profitable.

As a Dividend Aristocrat, NextEra Energy showcases a resilient business model bolstered by consistent capital expenditures in sustainable clean energy. These key factors make it an attractive option for a buy-and-hold investment strategy.

Resilient Business Model

As highlighted earlier, NextEra Energy’s status as a Dividend Aristocrat reflects one undeniable truth: the company has a proven business model. Throughout various business cycles, it has consistently demonstrated profitability and stability, reinforcing its reputation as a reliable investment.

The company owns the largest utility in the United States, located in Florida, serving over 5 million customers. Additionally, NextEra operates the world’s largest generator of renewable energy with a 30,600 MW of total net generation capacity, which has seen its contribution to total operating revenues rise significantly, growing from 17% two years ago to an impressive 34% today.

Let’s return to basics and discuss inflation, a concept that refers to the decreasing value of money over time. When inflation rises, it means that goods and services become more expensive, leading to a reduction in consumers’ purchasing power. In the United States, personal consumption accounts for nearly 70% of GDP, so when people have less disposable income, the economy can contract, potentially leading to a recession. During such times, consumers tend to prioritize essential goods and services, which means companies providing these necessities can remain profitable, regardless of the business cycle.

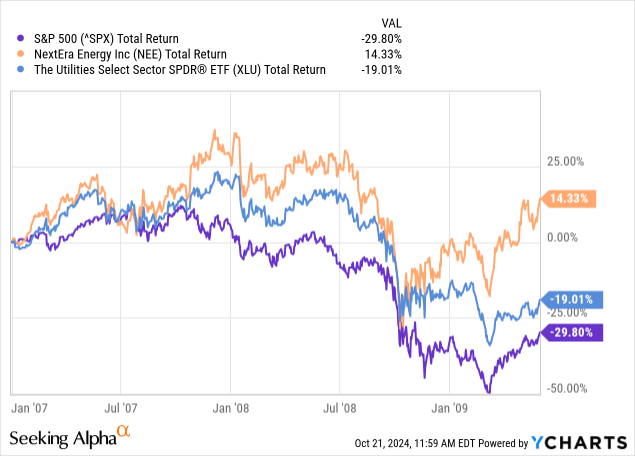

The chart above compares the total returns of the S&P 500 (SPX), the Utilities Select Sector SPDR Fund (XLU), and NextEra Energy during the Global Financial Crisis. It highlights the impact of the crisis on various assets over a two-year period. While the S&P 500 experienced a decline of over 29% and the utilities benchmark fell by 19%, NextEra Energy achieved a 14% return, defying market fears. This underscores the earlier point made in the article: NextEra’s business model enabled it to deliver better returns than its peers.

I’ve illustrated the sector’s resilience from a market return perspective, showing how the company outperformed its peers. However, it’s also crucial to examine the company’s internal numbers to determine if, regardless of economic downturns or rising inflation, it can maintain profitability. NextEra Energy provides an essential service to consumers that cannot be replaced or interrupted, ensuring its continued relevance and financial stability.

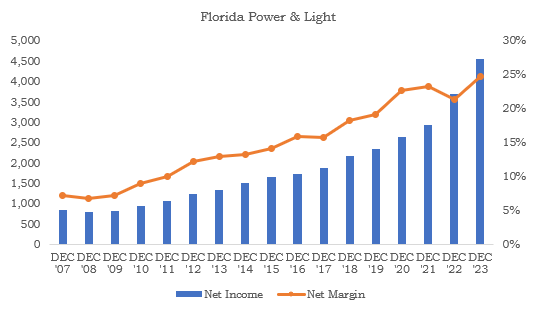

Florida Power & Light, the average utility segment of NextEra Energy, represents a five-year average of 70% of total sales. As shown below, over the past seventeen years, it has only experienced a decline in net income during 2008 due to lower retail customer usage and higher interest expenses according to the company’s financial release.

FactSet

To grasp the resilience of a utility, it’s essential to understand how they operate and generate revenue. These companies are typically governed by rate regulations. Utilities are often considered monopolistic because of high entry barriers due to the capital-intensive resources and infrastructure required. To address this, governments have implemented a series of regulations that enable utilities to collect revenue from both retail and wholesale markets. This revenue, known as revenue requirements, is designed to cover the cost of providing services while allowing for a reasonable rate of return.

We now understand why a utility can remain stable despite fluctuations in the business cycle. But what value does the company provide to investors that allows it to be more profitable than its peers? This can be explained in two parts.

First, Florida Power & Light has demonstrated that, even within a regulated rate environment, it can enhance profitability by making operations more efficient, increasing its margin from 10% to over 25%.

Second, NextEra Energy Resources, currently a secondary segment accounting for less than a third of total sales, is expected to become the company’s primary segment in the future. This shift aligns with current trends toward clean energy, which are projected to peak around 2030 and beyond.

Dividend Aristocrat

Over the past 25 years, NextEra Energy has not only maintained its dividend payments but has also increased them annually at a remarkable compound annual growth rate (CAGR) of over 8%. This consistent growth in dividends reflects the strength of its business model, showcasing exceptional stability and strong visibility of future cash flows. Few companies can boast such a track record, underscoring NextEra’s solid position in the market.

The Model

Usually, I like to perform a Discounted Free Cash Flow to value a fair price for a company and make different scenarios that help me understand under what premises the company is valued as undervalued or overvalued, however, under my point of view, this type of model does not apply to every company. As mentioned, Utilities are a business model characterized as intensive in capital expenditures, as the infrastructure needed to be able to supply the service is extensive. Therefore, if a discounted free cash flow model is used, the value of the company would not reflect the reality as past and future flows are expected to be low due to the intensive capital expenditures.

For this sector, in particular, I should evaluate what could show me a better fair price for the company, and as dividend payments are one of the main drivers for utilities to offer value for shareholders, I prefer to use the Dividend Discount Model (DDM). For this model, in particular, several inputs are needed:

Expected Dividend Per Share (EDS)

According to the company information, NextEra declared a dividend payment of $0.515 for this quarter. Over the last four quarters, in order to annualize this information, the total payout has been $2.06 per share ($0.515 x 4). According to FactSet, the expected Dividend Payment for the next year is at $2.26 per share, which translates to an almost 10% increase from a year earlier.

Cost of Capital (CC)

Risk Free Rate – 10-Year Treasury

Beta = 3Y Beta from FactSet

Equity Risk Premium = Implied Equity Risk Premium for November 2024

NextEra’s Cost of Capital = 4.29% + 0.56 * 3.90% = 7.2%

Dividend Growth Rate (DGR)

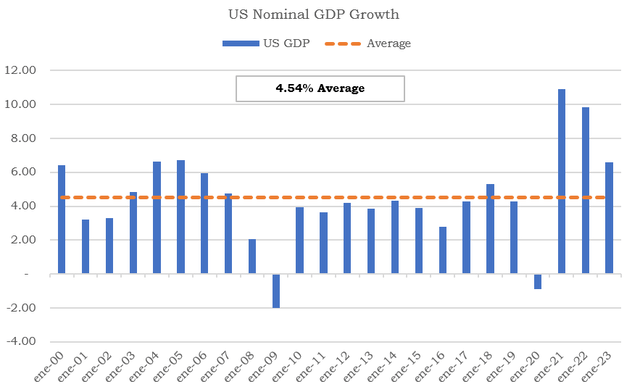

As shown in the chart above, the company has grown its dividend payment over the last 25 years at an 8% compound growth rate annually. However, from my point of view, growing in perpetuity at that growth rate could not be very realistic. On this case, I would prefer to use the nominal GDP Growth as the minimum growth rate needed by a company.

Federal Reserve Bank of St. Louis

Fair Price

Once we have gathered the key inputs for our model, we will proceed to calculate the fair value of the company to determine whether it is overpriced or underpriced according to this model.

Value of the Stock = EDS / (CC – DGR)

Value of the Stock = $2.26 / (7.29% – 4.54%)

Fair Value of the Stock = $82.21

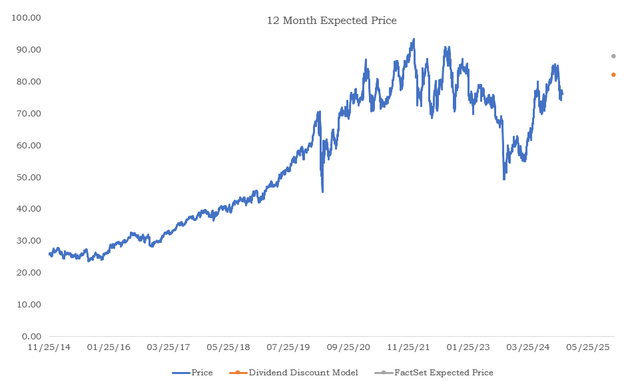

The chart below shows the evolution of NextEra’s stock price over the past five years, along with two key data points on the right. The gray dot represents the expected price from FactSet over the next 12 months, while the orange dot reflects the price derived from our dividend discount model calculation. Both indicate a similar expected price, with potential capital appreciation ranging from 8% to 15%. Additionally, as a dividend play, it’s important to consider the current dividend yield for the company, which contributes an extra 2.71% to the total potential return.

Main Risks

Dear readers, it is important to remember that there is no such thing as a completely safe investment in the capital markets. While the opportunities presented above may seem appealing, it’s crucial to understand both the sweet and the bitter aspects. To recap, NextEra’s business model primarily revolves around delivering energy as a utility company, which can be seen as the most resilient segment of the business. However, as mentioned earlier, the second segment – which could potentially become the primary one in the coming years – focuses on the development and operation of long-term contracted assets. This segment is more susceptible to volatility, such as fluctuation in energy prices, as well as political risks in the short term.

On November 5th, Donald Trump defeated his rival, Kamala Harris, with a decisive overall victory. This event triggered a sell-off in solar and wind stocks, despite the broader market experiencing one of the best days in years. Notably, the iShares Global Clean Energy ETF (ICLN) dropped more than 7% in a single day and NextEra in particular lost more than 5%.

Trump has vowed to combat inflation by reducing energy costs, promising increased fossil fuel production. In contrast, his defeated opponent strongly supported clean energy investments, particularly through the Inflation Reduction Act – one of the largest investments in the U.S. economy, focusing on climate change and clean energy initiatives, among other priorities. However, as I mentioned, these concerns may only persist in the short term. The transition to clean energy and alternative sources is inevitable, and those who can navigate the current turbulence will be best positioned to unlock the hidden value of these stocks. The International Energy Agency says that fossil fuel demand will peak by 2030 and renewables will overtake coal as the leading source of electricity by 2025.

Conclusion

NextEra remains one of my top picks for 2025 and beyond, thanks to its proven management and business model. It offers investors the stability needed during turbulent markets, along with the potential for the appreciation sought by all shareholders.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NEE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.