Summary:

- NextEra Energy, Inc.’s share price has been incredibly weak recently, despite its massive size and scale.

- The company’s shift to renewables is not only environmentally friendly, it enables the company to reduce its costs for customers substantially.

- We expect the company to continue generating a strong dividend while growing earnings, making it a valuable investment.

ArtistGNDphotography

NextEra Energy, Inc. (NYSE:NEE) is one of the largest utility companies in the world. The company has a $150 billion valuation, but has seen growth struggle as interest rates have gone up. The company’s share price is 20% below its late-2021 highs pushing its dividend to 2.5%. As we’ll see throughout this article, NextEra Energy, at its current valuation, is a strong investment.

NextEra Energy Overview

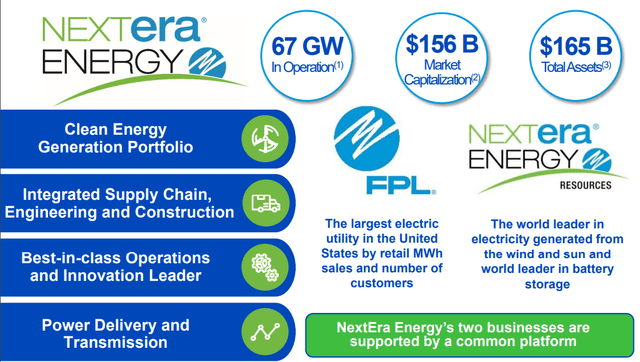

NextEra is the largest publicly traded utility company with its impressive portfolio of assets.

NextEra Energy Investor Presentation

The company is a leader in renewable energy and also the largest electric utility company in the United States. It has 67 gigawatts in operated power, more than 50% of the total operated power of Spain. The company’s massive size and scale, with power delivery and transmission assets, gives it unique opportunity and asset replacement opportunities.

The company’s size and scale are unparalleled.

NextEra Energy 1Q 2023 Results

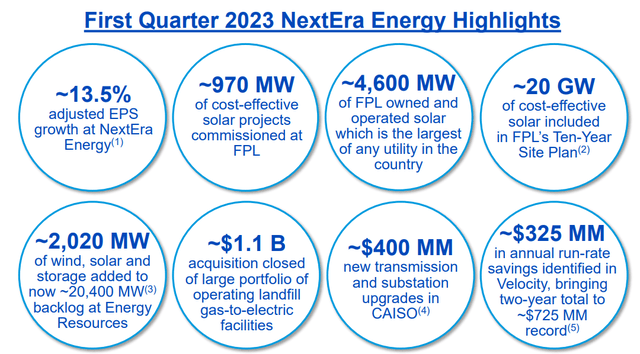

The company had 13.5% adjusted YoY EPS growth at NextEra Energy, with an incredibly strong first quarter.

NextEra Energy Investor Presentation

The company commissioned 970 megawatts of cost-effective solar projects in the quarter and is the largest solar operator in the country at 4.6 gigawatts. However, it plans to substantially expand that in its 10-year plan with 20 gigawatts of solar. Overall, the company’s active backlog in renewables / storage is more than 20 gigawatts.

The company has continued to grow to acquisitions ($1.1 billion in landfill gas to electric) while continuing to expand transmission and other assets. Lastly, the company’s in the midst of a major cost cutting program that we expect to continue and help with savings.

The Renewable Cost Advantage

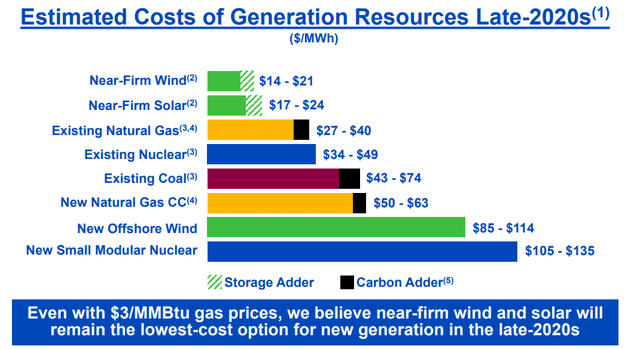

At the present time, non-renewables have one consistent benefit, which is energy density, along with a lack of ties to weather.

NextEra Energy Investor Presentation

However, unfortunately they’ve already been heavily perfected and invested in. Renewables haven’t been. And they’re still being invested in substantially to reduce costs. Offshore wind is the next segment that’s currently expensive; however, even there we expect costs to be returned substantially. Near-firm wind and solar remain impossible to compete with.

We expect, due to pollution and cost, coal will be primarily wiped out from the market. Major coal operators such as Berkshire Hathaway Energy are effectively shutting down coal production as soon as they can, and the writing is on the wall. We do expect natural gas to remain substantial, especially to handle the volatility of renewable production.

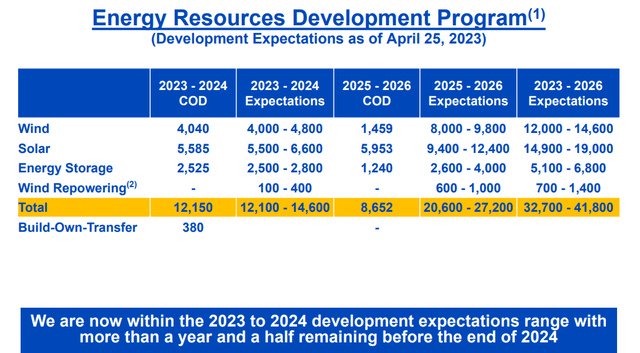

NextEra Energy Development Program

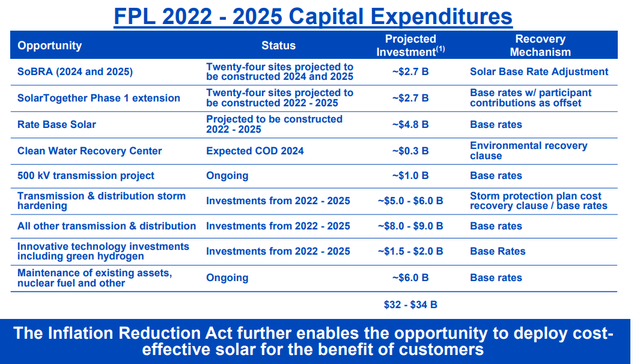

The company has a massive development program across its assets.

NextEra Energy Investor Presentation NextEra Energy Investor Presentation

FPL has $8.5 billion annualized project investment per year through 2025. The company’s Energy Resources development program, as the company’s renewable arm, is the largest renewable company in the world. The company is building gigawatts of capacity here, and that’s expected to ramp up substantially from 2023-2024 to 2025-2026.

The company’s massive growth in operations here will make it the premier renewable operator in the world. By 2026, the company expects Energy Resources to be the largest electricity supplier regardless of type of electricity, which shows the hefty strength of its renewable program. The company is right that decarbonization is a multi-trillion dollar opportunity.

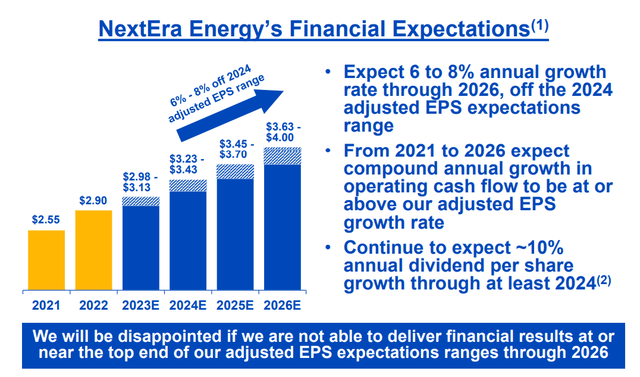

NextEra Energy Financial Guidance

Putting this all together, the company’s financial guidance should enable substantial future shareholder returns.

NextEra Energy Investor Presentation

The company expects roughly 7% adjusted EPS growth, and expects to move near the top-end of its guidance. The company’s 2026E guidance is for roughly $3.8 / share, with continued operating cash flow growth in-line or above EPS. Additionally, the company expects to generate ~10% annual dividend per share through at least 2024.

Assuming NextEra Energy can continue through 2026 with that, that’s a yield on cost of more than 3.3%. That’s strong for a utility company that’s continuing to rapidly grow earnings. That guidance for double-digit overall returns shows the company’s strength.

Thesis Risk

The largest risk to our thesis is NextEra Energy, Inc.’s ability to meet its growth expectations in EPS. That requires the company to not only reduce its costs, it also requires the company to continue its growth. That can be a tough challenge in a volatile market, and it’s worth paying close attention to as an interested investor.

Conclusion

NextEra Energy, Inc. is the largest utility company in the United States. The company has a valuation of more than $150 billion and a dividend of more than 2.5%. The company is continuing to guide for aggressive dividend growth, something that it can comfortably afford, especially supported by its continued earnings growth guidance.

The company’s shift to renewables is incredibly valuable. Renewables, especially with storage assets, require massive scale to successfully operate for the company. They require many billions of dollars’ worth of investment. The company also has the scale to make its operations. Putting it all together, NextEra Energy, Inc. is a valuable investment. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NEE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.