Summary:

- NextEra Energy can realize significant growth through co-development projects for baseload capacity to power the hyperscalers’ AI factories.

- Management will likely need to invest more attention into nuclear and SMR development to cater to this growing demand.

- Data center capacity is forecast to grow at a 23% CAGR through 2030 with some data centers being as large as 1GW in capacity.

Justin Paget

NextEra Energy (NYSE:NEE) has a strong growth trajectory as it navigates through an environment of accelerating demand for power. Hyperscalers will likely provide significant capacity growth later in the decade, whether it’s through grid connections or with dedicated baseload capacity. Near-term demand may impact rates as industry competes to secure power and new capacity is being added. Given the accelerated growth trajectory and drive for decarbonization by the hyperscalers, I am reiterating my BUY rating for NEE shares with a price target of $93/share at 16x eFY25 EV/aEBITDA.

Be sure to read my initial coverage of NextEra Energy Here:

NextEra Energy Is The Slow Growth Green Utility To Own

NextEra Energy Operation

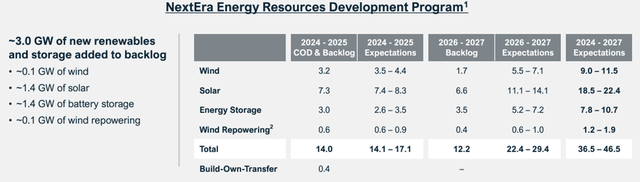

NextEra is finding itself in a strong position as demand for renewable energy generation and storage remains strong. Management reported adding 3GW on power to its backlog in q3’24, bringing the trailing twelve-month total to 11GW. This figure is exclusive of the agreements with two Fortune 50 companies outside of the technology sector. The agreements are for the development of 10.5GW of renewable power generation and storage projects through 2030. This will bring the total to 15GW of joint developments inclusive of the 4.5GW with Entergy announced in q2’24. The total backlog at NEER now sits at 24GW.

Much of the growth will be driven by the growing data center footprint, which is forecast to grow at a 23% CAGR through 2030. For example, Oracle Corp. (ORCL) is planning to construct 100 data centers, some of which will be 200MW in capacity and upwards of 1GW in capacity or about the size of a small city. Digital Realty (DLR), a data center REIT, is bringing 390MW of capacity online throughout eFY25.

Microsoft (MSFT) has earmarked some of its facilities to be powered by nuclear power as well as dedicated small modular reactors (“SMRs”) through its partnership with Helion Energy. Given that the hyperscalers are hyper-focused on managing down their carbon footprint, I’m anticipating many of these facilities to follow suit. I have reason to believe that many, if not most, of these large-scale data centers will also seek dedicated power sources given the current power constraints faced. Though this is an exciting development for the utility space, new capacity will likely not hit the market until 2030-2035 and beyond.

Management at NextEra anticipates power and storage demand to grow by 150GW through 2030 as a result of the data center build-out. They also suggested that nuclear capacity will grow by 900GW on a national level by 2040. Management is currently evaluating the recommissioning of their Duane Arnold nuclear plant in Iowa to cater to this demand.

Given the growing demand and scarcity of power, NextEra may be in a prime position to cater to this need. Assessing the verbiage in the q3’24 earnings call, I believe that NextEra might be in a position to lock in power supply at a premium to market for dedicated usage. This can potentially play into the growing demand from the hyperscalers as these data centers are central to their operations and require zero downtime. Depending on how deals are worked out, I believe that constructing dedicated baseload capacity can be an accretive to NextEra’s financial position.

Looking at solar, wind, and storage, NextEra added 3GW of capacity to its backlog in q3’24. Management anticipates new renewables capacity will be an impactful solution when compared to new gas capacity and suggests that wind and solar are upwards of 60% and 40% cheaper than new gas capacity. Management suggested that renewables growth will increase by 3x in the next 7 years when compared to the growth seen in the last 7 years. In terms of storage, management expects 50GW of co-located capacity to be needed through 2027.

As a result of the 2024 hurricane season, management anticipates that FPL will recover $1.2b from customers through a surcharge while allocating $150mm of the surcharge to the storm reserve.

NextEra Financial Position

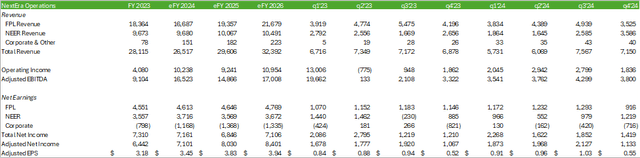

Looking to NextEra’s financial position, the firm realized significant margin improvement across its earning assets, resulting in an adjusted net margin of 28% and an adjusted EPS of $1.03/share. Looking out to eq4’24, I’m forecasting NextEra to generate $7,150mm in total revenue with an adjusted EPS of $0.55/share. This should bring eFY24 revenue to $26.5b and its adjusted EPS to $3.45/share. Given the strong demand for securing power as well as the growing demand by the hyperscalers, I have reason to believe NextEra will be in a strong position and may have the capacity to grow beyond its guided growth trajectory of 6-8% compounded growth from 2024 through 2027.

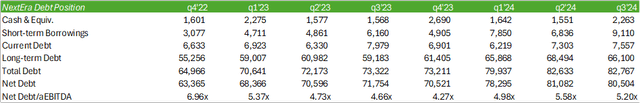

NextEra’s debt position is running relatively high; however, I do not believe this will pose any headwinds. The firm has no maturities coming due until 2026.

Risks Related To NextEra Energy

Bull Case

Electricity is growing in demand is AI factories are rolled out around the world. This has resulted in the recommissioning of nuclear power plants as well as discussions between hyperscalers and utilities for co-development projects for dedicated baseload capacity. Given that the hyperscalers are seeking low-carbon sources, NextEra is well positioned to cater to this demand.

If the Federal Reserve were to continue cutting rates going forward, NextEra may benefit in terms of refinancing debt or deploying new capital for new projects.

Bear Case

Many of the potential large-scale co-development projects will likely not hit NextEra’s operating statements until later in the decade or in the mid-2030s as SMR technology has yet to be utilized in the US. NextEra is also running up its debt load relative to adjusted EBITDA; however, the firm does not have any maturities through 2026 that will need to be refinanced or paid down. If the Fed maintains the current key rate, the cost of capital may impact the firm’s average interest rate if the need to raise capital were to arise.

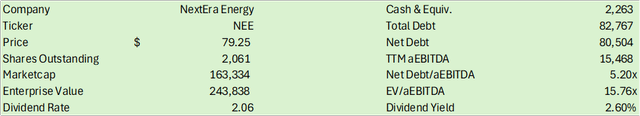

Valuation & Shareholder Value

NEE shares provide investors a strong investment opportunity for both its dividend and growth opportunity. The shares currently yield 2.60% on a forward basis, providing investors with a durable source of income. Management anticipates growing the dividend rate by 10% per year through at least 2026.

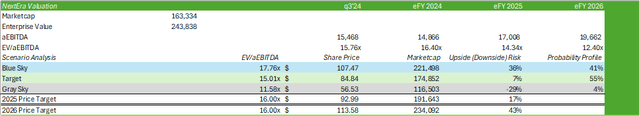

Looking to NEE’s valuation, shares are currently trading just above the midpoint of its 1-year trading range at 15.76x EV/aEBITDA. Taking into consideration my growth forecast as well as its historical trading range, I am reiterating my BUY rating for NEE shares with a price target of $93/share at 16x eFY25 EV/aEBITDA.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ORCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.