Summary:

- NextEra Energy has two main businesses: FPL, the largest electric utility in Florida, and NEER, the world’s largest generator of renewable energy.

- FPL has strong tailwinds arising from positive regulatory environment and as Florida sees strong GDP and population growth.

- NEER’s revenues mainly comes from long-term PPAs, with 93% of revenues coming from long-term contracts.

- NEER’s prospects continue to improve given increasing power demand and higher renewables and storage additions in the next few years.

- FPL is executing well with low bills and high reliability for customers, setting itself well for the rate case filing in 2025.

Justin Paget

NextEra Energy (NYSE:NEE) is a very unique company, which has both a utility business and a renewables business.

Both businesses complement each other well and provide NextEra Energy with two very strong, high visibility businesses in which it is considered a market leader in.

In this article, I will go into the business model, fundamentals, competitive advantages, financials and valuation of the business. On top of that, I will provide some updates about the 2Q24 results, which showed strength in its renewables business with the second largest origination quarter, while FPL continues to deliver reliability and low costs to its customers, setting it up nicely for the next rate case filing in 2025.

Introduction

NextEra Energy has two main businesses.

The first main business of NextEra Energy is Florida Power & Light (“FPL”), which is the largest electric utility in the state of Florida and also one of the largest electric power utilities in the US.

The FPL business is really quite simple: Through investing in generation, transmission and distribution facilities, FPL is then able to deliver its customers with lower bills, better reliability, customer service and clean energy.

The second main business of NextEra Energy is NextEra Energy Resources (“NEER”).

NEER is the world’s largest generator of renewable energy from the wind and the sun, and it is a global leader in battery storage as well. The focus of the NEER business is to develop, construct and operate long-term contracted assets in both the United States and Canada. These assets are mainly clean energy assets like renewable generation facilities, battery storage projects, and electric transmission facilities.

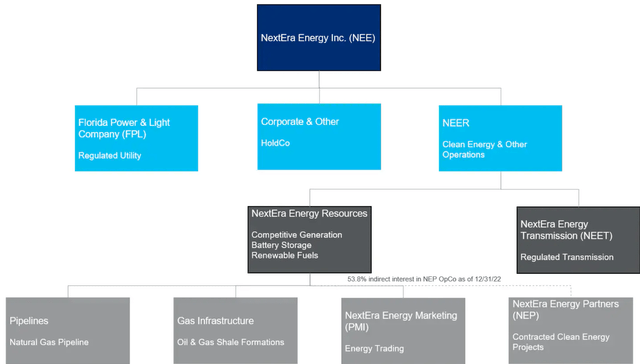

I compiled the organization chart for NextEra Energy below, and it really is not that complicated, and you just need to think of NextEra Energy as comprising of two parts, which is FPL and NEER. Within NEER, it includes NextEra Energy Resources, along with NextEra Energy Transmission, which is its regulated transmission business. The company also has a 53.8% interest in NextEra Energy Partners, which acquires, manages and owns contracted clean energy projects with stable, long-term cash flows.

Organization chart (Author generated)

Business mix

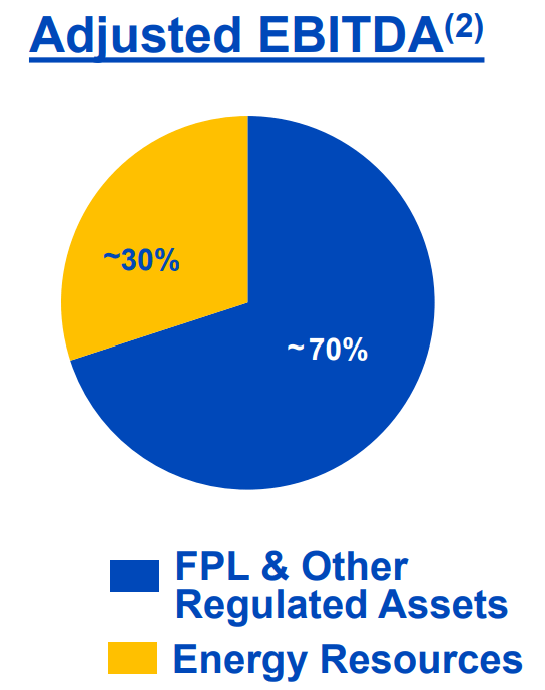

As can be seen below, from an adjusted EBITDA basis, FPL & other regulated assets make up 70% of the business, while NEER makes up 30% of the business.

Business mix (NextEra Energy)

While the above adjusted EBITDA mix shows the current mix, we can see below where NextEra Energy is investing in for the future.

It is clear that the overwhelming capital expenditures for NEER and FPL will be into renewables and transmission and distribution.

Capital expenditures (NextEra Energy)

FPL

Those of you residing in the state of Florida might already be familiar with FPL.

FPL, as mentioned earlier, is the largest electric utility in the state of Florida, and it is also one of the largest electric utilities in the United States.

To highlight the scale and size of FPL, as of the end of 2022, FPL has 32,100 MW of net generating capacity, about 88,000 circuit miles of transmission and distribution lines and 871 substations. Also, FPL serves more than 12 million people through 5.8 million customer accounts.

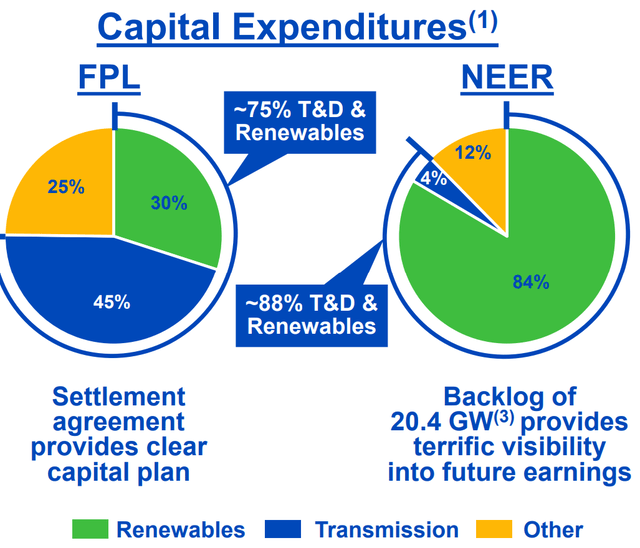

As can be seen below, as of February 2023, FPL’s service areas and plant locations mostly over northwest Florida, the east and west coasts of Florida.

Areas Served by FPL (NextEra Energy)

FPL can only service retail customers only if it is granted a franchise agreement with the municipalities or counties. These franchise agreements typically lasts 30 years and as of end of 2022, FPL has 225 of such franchise agreements that covers the large majority of FPL’s customer base in Florida. These franchise agreements have varying expiration dates through 2052.

FPL revenue mix

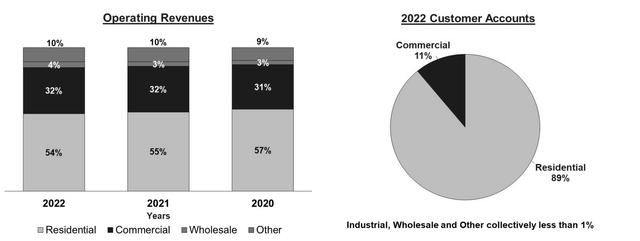

From a revenue mix perspective, the residential customer base forms the largest part of the company’s operating revenues for FPL, with residential making up 54% of FPL’s operating revenues and commercial making up 32% of FPL’s operating revenues.

By customer accounts, residential makes up 89% of customer accounts while commercial makes up the remaining 11%.

FPL mix (NextEra Energy)

The superior utility: High quality utility supported by strong growth and regulation

If I were to invest in only one utility, it would be NextEra Energy’s FPL.

Why is this so?

For most utilities out there, they are not as in a favorable position as FPL either because of a weak customer growth or weak regulation.

For FPL, Florida’s higher population and GDP growth will translate to higher utility customer growth rates than other utilities in other states.

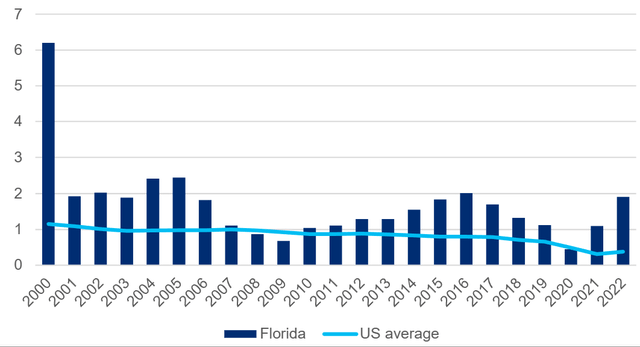

Since 2000, Florida has grown its population by 1.7% on average, higher than the national average population growth of 0.85%. This excess population growth is what has supported and will continue to support FPL’s customer growth.

In fact, we can see the widening of the Florida’s population growth rate compared to the national average in starting 2020.

Florida Population Growth Vs National Average (Statista)

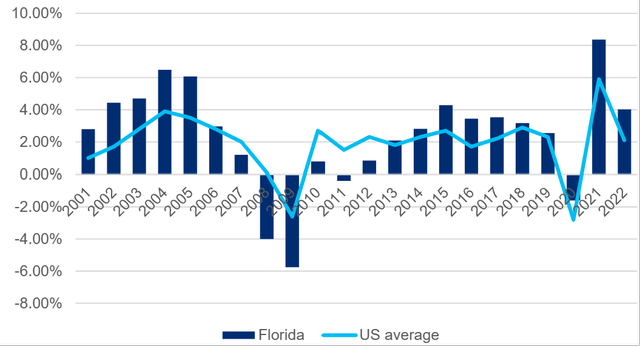

From a GDP perspective, relative to the US average GDP growth of 1.9% since 2000, Florida’s GDP also performed better than that, growing 2.4% on average since 2000.

Florida GDP Growth Vs National Average (Statista)

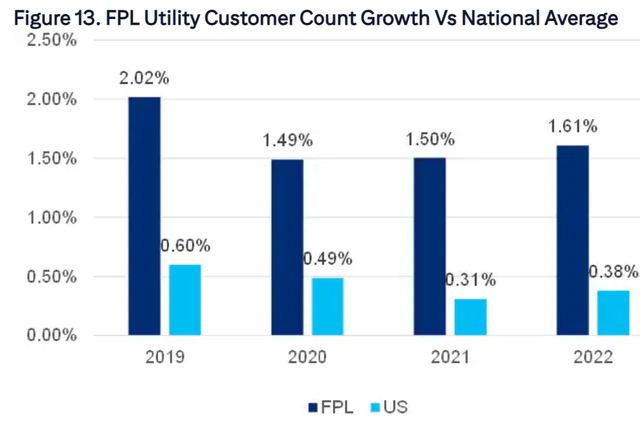

Both the higher population growth and GDP growth in Florida has drive the FPL customer count by 1.66% since 2019 while the national average growth was just 0.45%.

FPL Utility Customer Count Growth Vs National Average (S&P Global)

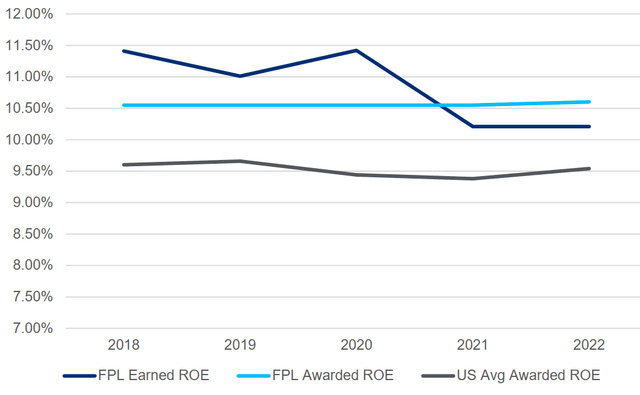

On top of that, FPL has historically been executing well in the ROE front.

FPL historically has been outperforming the national average ROE.

RPL was authorized a ROE band of 9.6% to 11.6% between 2022 and 2025 and it also has a 20-basis point cost of capital adder to be implemented pending order at Florida Supreme Court.

FPL has a strong track record of earned ROE in the higher range of its allowed band.

In the last five years, FPL has generated ROE of more than 10%, significantly higher than the US average authorized ROE of 9.5% during the period.

FPL vs US Average Utility ROE (FactSet)

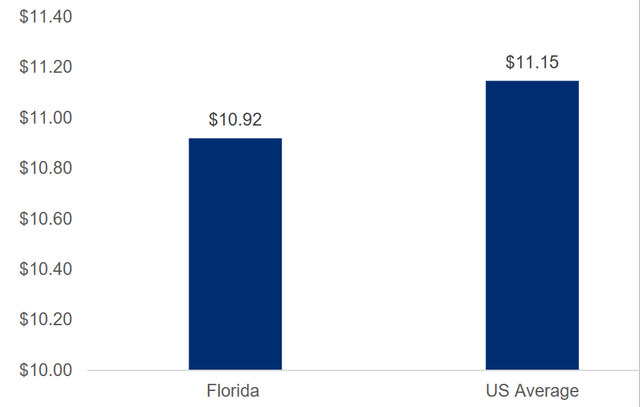

Lastly, as I will highlight again below, FPL benefits from a positive and strong regulatory environment in Florida. This is a result of the lower customer bills in Florida relative to the US average.

In Florida, the average customer utility bills are 2% lower than the US average in the past four years, which is the length of the rate case cycle in Florida.

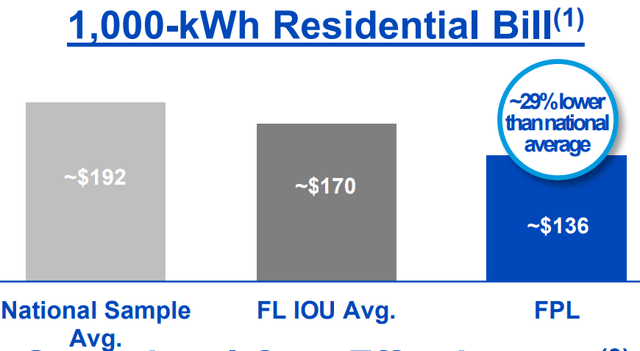

As a result, this creates an environment where there is less political pushback against increases in customer bill, and in turn, benefits FPL in the next rate case cycle given FPL’s customer bill is 29% lower than the US average, and also 20% lower than its Florida peers, as I will highlight next.

Florida vs US Average Utility Customer Bills, Trailing 4Y ($/MWh) (EIIA)

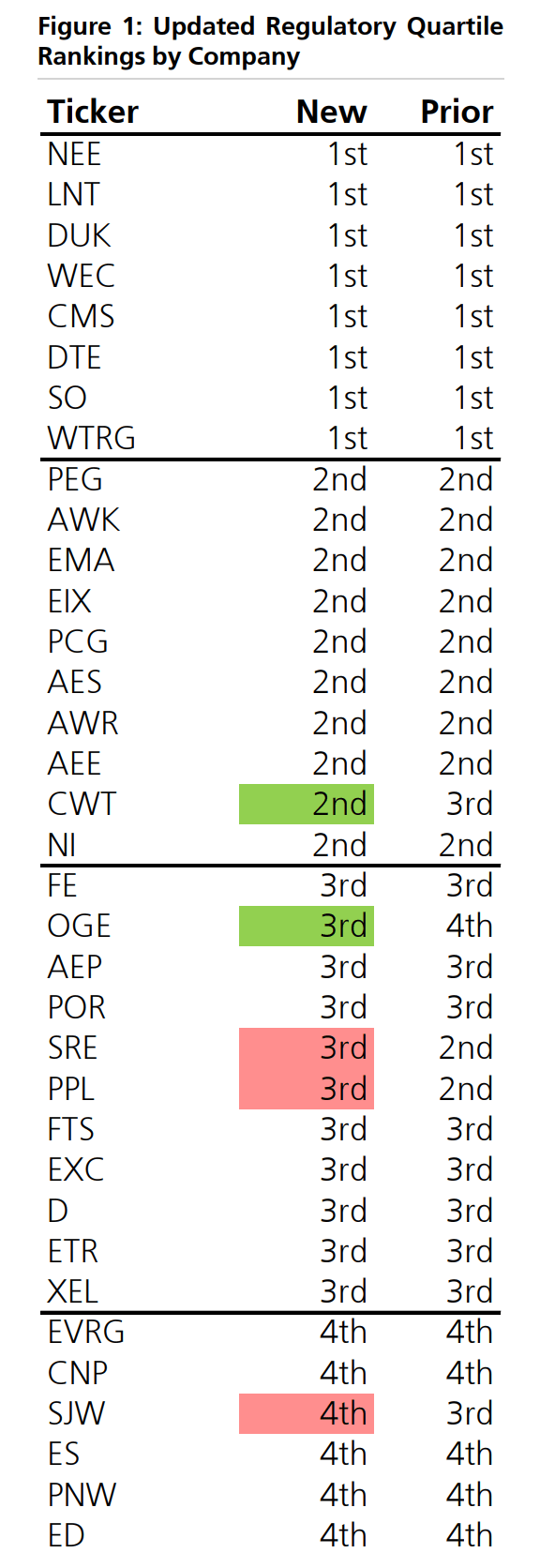

I cannot emphasize enough how positive and supportive the regulatory environment is in Florida for NextEra Energy.

UBS has done some research to quantify the regulatory environment across different states in the United States, and then labelled them from into four quartiles, with the 1st quartile being the most constructive tier.

As can be seen below, NextEra Energy is on the top of the list and has been there since one year ago.

Regulatory rankings (UBS)

In early 2025, FPL plans to file for new rates for the next period from 2026 to 2029. Given the strong population and GDP growth, positive regulatory environment and strong value proposition of FPL (which I will highlight next), I am optimistic about it.

As a result, for the next FPL rate case. I expect that FPL will continue to be supported for material capital expenditures increase and continue to enjoy strong ROEs.

How does this all relate to FPL’s customer value proposition?

As mentioned above, one of FPL’s value propositions is to offer lower bills to customers. This makes for happy customers, but more importantly, it creates a positive regulatory environment which allows for more positive outcome in the next rate case cycle for FPL.

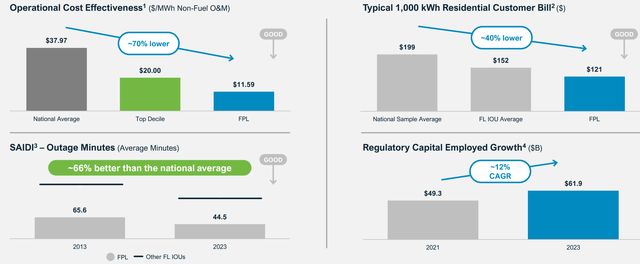

This is evident from the graph below, where FPL offers its customers cheaper bills, 29% lower than the national average when we are considering a 1,000-kWh residential bill.

When compared to other Florida peers, FPL’s customer bills are also 20% lower.

Lower bills (NextEra Energy)

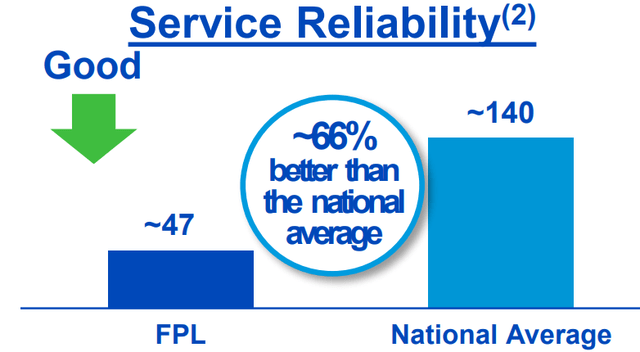

In addition, as evident by the next graph, FPL is able to not only achieve cheaper bills, but also, more importantly, better service reliability.

When compared to the national average, FPL is 66% better based on service reliability.

Service Reliability (NextEra Energy)

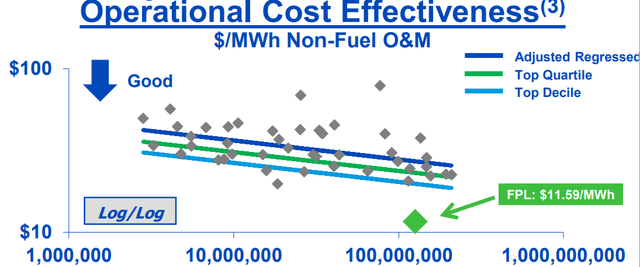

From an operational cost effectiveness standpoint, FPL is also leading the industry. Its $11.59 per MWh non-fuel operations and maintenance metric far exceeds the top quartile and top decile within the industry.

Operational cost effectiveness (NextEra Energy)

NEER

As mentioned earlier, NextEra Energy’s NEER segment includes NextEra Energy Resources and NextEra Energy Transmission, which is its rate-regulated transmission business.

The NEER segment develops, constructs and operates long-term contracted assets and focuses heavily on clean energy, like battery storage and renewable energy.

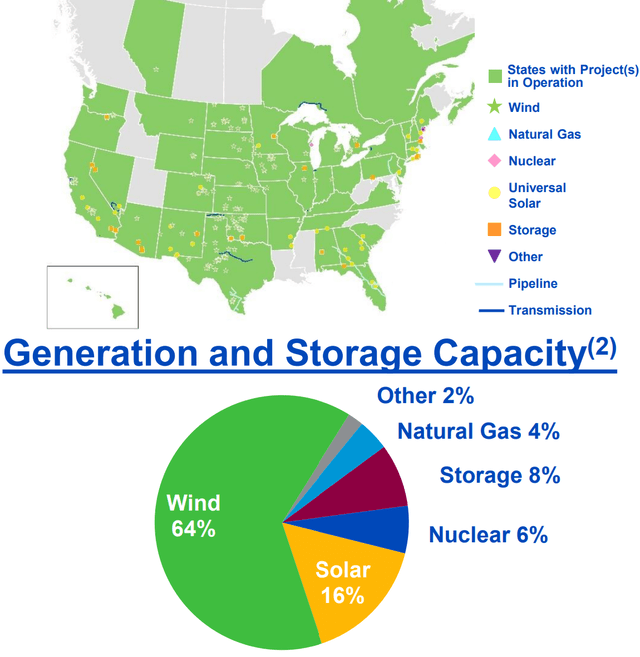

As of September 2023, NEER has 34 GW of clean energy in operation, 68% of which is in wind and 18% of which is in solar. In addition, it has more than 21 GW of backlog in wind, solar and storage contracts.

NEER generation and storage capacity (NextEra Energy)

Thus, NEER is considered the world’s largest generator of renewable energy from the wind and sun and also a world leader in battery storage.

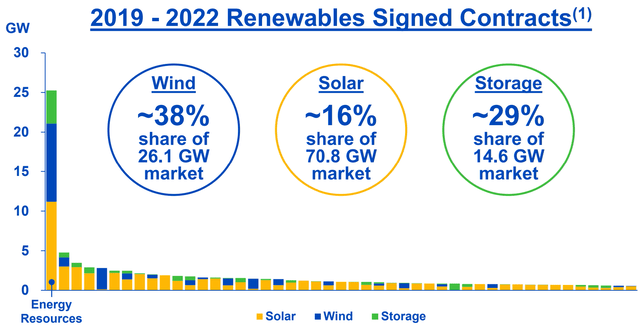

To put things into perspective, from the 2019 to 2022 period, NEER made up 38% market share, 29% market share and 16% market share in the wind, storage and solar markets respectively.

In 2022, NEER actually captured 56% market share in the wind market.

Renewables contracts of NEER (NextEra Energy)

NEER’s other segment is the developing, owning and operating of rate-regulated transmission facilities in North America.

As of end 2022, NEER’s rate-regulated transmission facilities, along with the transmission lines that connect its electric generation facilities to the electric grid are made up of about 290 substations and 3,420 circuit miles of transmission lines.

There are other smaller businesses within NEER, which includes the energy marketing business, and its gas infrastructure business where it constructs, manages or operates in natural gas pipeline construction projects.

NEER owns NextEra Energy Partners through a 54% indirect interest in the company. NextEra Energy Partners acquires and manages contracted clean energy projects. These projects typically have stable and long-term cash flows.

NextEra Energy Partners can acquire projects from NEER or from other third part interests.

NEER actually operates essentially all the energy projects in the portfolio of NextEra Energy Partners.

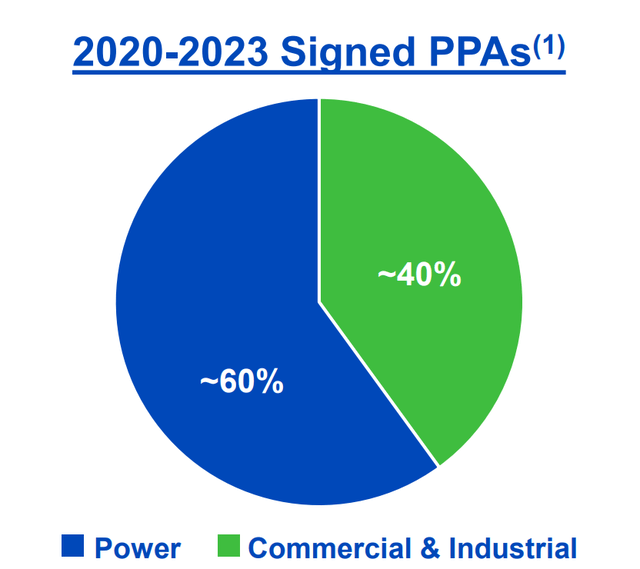

As can be seen below, NEER’s customers are mainly power, commercial and industrial customers.

NEER customer focus (NextEra Energy)

One of NEER’s competitive advantage in the space and why it is one of the strongest competitors in the space is because of its track record.

The company has been developing and operating renewables for more than 20 years, and that kind of experience brings learnings and efficiencies that few others can compare to.

Market opportunity

If you have seen my writings and research, you will know that there is lots of money to be earned in the decarbonization of the economy.

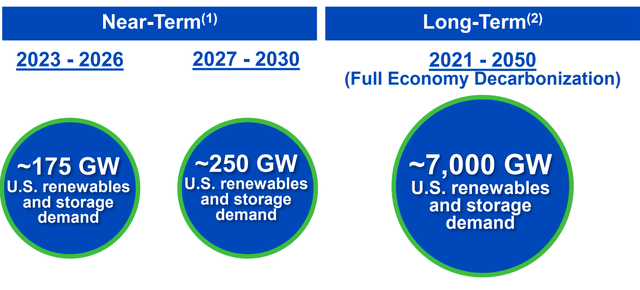

For NEER, this is also the case. The company stated that from 2023 to 2026, there is about 175 GW of US renewables and storage demand, and by 2027 to 2030, this will increase to 250 GW. Also, when thinking about it for the long-term until 2050, full economy decarbonization is expected to lead to 7,000 GW of US renewables and storage demand.

US renewable and storage opportunity (NextEra Energy)

Competition for NEER

NEER’s revenues mainly comes from long-term PPAs to customers in the wholesale electricity markets. The wholesale power generation market is a commodity driven and capital-intensive industry with several players.

For NEER, it competes mainly on price and from the company’s focus on clean and renewable energy, along with its track record, creditworthiness and reliability.

For NEER, the goal is to enter into long-term bilateral contracts for the full output of its generation facilities. This ensures the long-term stability of the revenue stream and also brings about a high utilization rate of its generation facilities.

About 93% of NEER’s net generating capacity was committed under long-term contracts as of end 2022. The remainder 7% that are not under such long-term contracts will usually involve shorter term bilateral contracts of less than three years.

As such, because the business is a highly competitive one, NEER has distinct competitive advantages that enables it to secure long-term contracts for the vast majority of its net generating capacity, thereby creating a durable business model built on its competitive moat.

2Q24 results

NextEra Energy reported 2Q24 adjusted EPS of $0.96, +1% higher than consensus, growing +9% from the prior year.

NEER reported adjusted earnings growth of 10.8% and adjusted EPS grew by $0.03 from the prior year, which was slightly below expectations.

The positive part of the equation for NEER was the contributions from new investments and its existing clean energy portfolio contributed to $0.12 per share and $0.06 per share increase in adjusted EPS respectively. The strong new investments were a result of the growth in its renewables portfolio. The strong existing clean energy portfolio contribution was a result of an increase in wind resources in 2Q24. In 2Q24, wind resources was 104% of the long-term average, compared to 88% in the prior year.

The drag to NEER came from the customer supply business, gas infrastructure business, and other impacts, resulting in adjusted EPS being reduced by $0.03 per share, $0.07 per share and $0.05 per share respectively. The customer supply business was impacted from the strong earnings from the prior year, while the gas infrastructure business had negative impact from lower production estimates and the sale of the Texas pipelines by NextEra Energy Partners.

While I expect that the gas infrastructure earnings growth to be relatively flat going forward, this is largely due to capital allocation as NEER invests more capital to renewables, storage and transmission.

Moving forward, I expect to continue to see this dynamic where the strength of NEER’s renewable development program will be more than enough to offset its gas infrastructure business weakness.

FPL adjusted EPS came in slightly below expectations.

FPL saw strong and accelerated growth since the most recent rate settlement at the start of 2022, where FPL’s regulatory capital employed grew at a 12% CAGR, compared to the 9% growth rate that was initially expected for the four-year settlement period.

During this period, FPL has absorbed the cost for the capital investments in its service area without increasing customer bills in the meantime. As a result, while this has led to stronger customer growth and better customer satisfaction, FPL utilized its reserve amortization mechanism faster than expected.

While the increased capital expenditures will likely be recovered fully in the next rate case filing in 2025, the elevated reserve amortization resulted in a small headwind in FPL EPS.

With the faster than expected utilization of FPL’s reserve amortization mechanism, FPL expects 11.4% regulatory ROE for 2024 and 2025 and a $0.06 EPS impact on both 2024 and 2025 EPS, both of which has already been included in the guidance.

Guidance for 2024 adjusted EPS was reiterated to be in the range of $3.23 to $3.43, and management expects 6% to 8% EPS CAGR through 2027. The 10% dividend per share CAGR was also reiterated.

With regards to the outlook, I think it’s important to state that it has been prudently set. For example, if we get one or two rate cuts in 2024, this will bring financing tailwinds for the company, but if they do not materialize at all, the outlook assumes zero rate cuts, so there is no risk to the outlook in that sense.

Management reiterated that they will be disappointed if they are not able to deliver financial results at or near the top-end of their adjusted EPS expectations range in 2024, 2025, 2026 and 2027.

Inflecting demand for NEER

NEER is in one of the best position it has ever been.

It is benefitting from two types of demand.

The first is demand from the replacement cycle, which NEER has always been a beneficiary to given that less efficient and higher cost generation has been replaced by lower cost renewables and battery storage. This theme will likely continue.

The second is something that is just getting started, and that is growth cycle demand. This growth cycle demand is new as power demand across many states in the US is finally starting to grow after staying static for some time. In fact, power demand is expected to grow four times faster in the next two decades compared to the last two, driven by multiple sectors, including data centers and the technology sector.

The majority of the growth demand will likely be met by demand for both new renewables and battery storage.

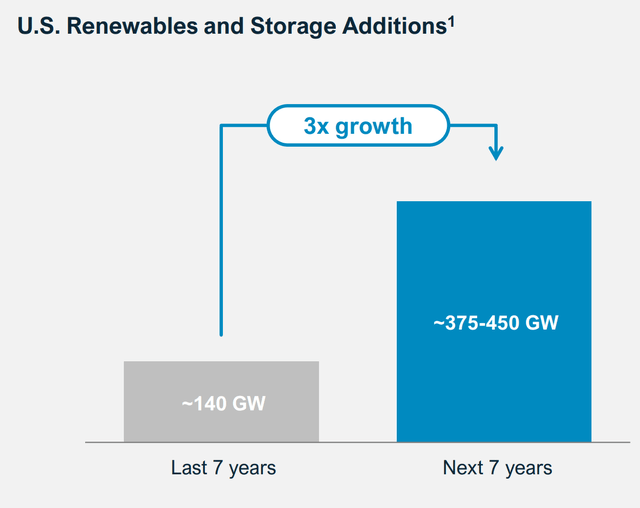

NextEra Energy highlighted that they expect the new renewables demand to triple in the next seven years relative to the prior seven years to meet this growing demand.

US renewable and storage outlook (NextEra Energy)

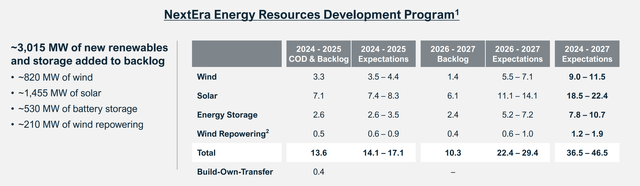

It is important to highlight that one of the big positives from the 2Q24 quarter was that it was a strong quarter of new renewables and storage origination for NEER, adding 3,000 megawatts to the backlog.

This means that the backlog has grown to 22.6 gigawatts today, after excluding the 1,600 megawatts of new projects brought into service since the last earnings call.

This is the second largest origination quarter by NEER.

The implication here is very significant for NextEra Energy.

For the 2024 to 2025 period, the backlog now accounts for almost 90% of the expectation for the period.

Looking further out, the current backlog for 2026 and 2027 now accounts for about 40% of the expectation for the period.

This creates very good visibility three to four years out and thus, makes it easier for NEER to meet its expectations for its development program

Backlog of NEER (NextEra Energy)

That said, origination can be lumpy, which is what NextEra Energy management has been consistently mentioning.

NEER remains very optimistic in the long-term given the very bright outlook brought about by the combination of the replacement cycle and the growth cycle, along with the strong execution and value proposition of NEER.

In total, NEER has a 300-gigawatt pipeline and scale, and this scale provides strong competitive advantages in addressing supply chain considerations and has attracted the largest customers to the company. NEER has the ability to meet customer demand as a result of its strong relationships with utilities,

In fact, half of the 300-gigawatt pipeline is already either interconnection read of in the interconnection queue process, which significantly decreases the time needed for customers to deploy. This is so important because interconnection timelines for new sites are now stretching towards three to seven years and even more. As such, customers are more likely to come to NEER due to their speed to market.

Of the 3,000 megawatts of new renewables and storage projects for 2Q24, 860 megawatts came from Google, which needs to meet their data center power demand.

In fact, NEER now has a total renewables portfolio of 7-gigawatts with data center and technology customers, which includes assets in operation and those in the backlog.

Given that investors have been increasingly interested in how the growing power demand from data centers and technology companies as a result of AI is impacting renewable demand, this growth from this group of clients demonstrates that the demand is real and big.

Another example is NEER’s collaboration with Entergy. To meet their new increased load demand and energy transition goals, NEER is targeting to build 4.5 gigawatts of renewable storage solutions for Entergy.

Supply chain strength

I will touch on political risk next, but with some talks about tariffs and dumping within the renewables space, particularly when it relates to China, management has shared that NextEra Energy is best positioned within the industry to whether any possible impact.

The main reason for this is that NextEra Energy has the scale and is the number one developer in the US. This creates leverage over its suppliers given that all the vendors and suppliers in the industry would want to work with NextEra Energy.

As a result, NextEra Energy has structured its relationships to ensure that there is some form of risk transfer and incentive for suppliers to perform.

As such, if there are tariffs imposed, these risks will be transferred to its suppliers as a result of the scale at which NextEra Energy is operating at, since all suppliers will want to do business with the company.

While smaller developers may face troubles when such supply chain risks appear, NextEra Energy has somewhat insulated itself from such risks through many years of risk management embedded in its agreements.

As such, from a supply chain perspective, management stated that they feel better than ever after putting to use what they have learned over the past many years.

FPL strength continues

FPL’s business is very straightforward: Make the necessary investments to make customers happy through low bills and reliable service, and the growing economy and customers in Florida helps as well.

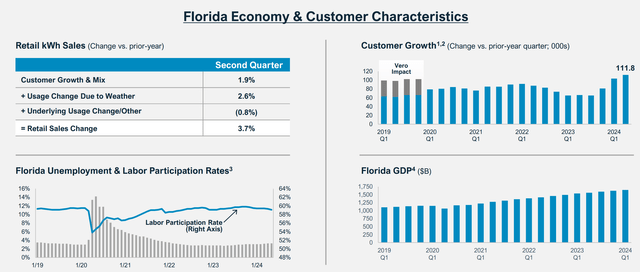

Customer growth was clearly one of the growth factors for FPL in 2Q24, which was in turn supported by strong employment and GDP figures in Florida.

Florida economy and customer characteristics (NextEra Energy)

As usual, FPL remains one of the best operating utilities in all of the US.

From a cost effectiveness perspective, RPL spends 70% less than the national average and even 41% less than the top decile competitors in its field.

FPL has been operating more reliably than competitors in Florida, and it is 66% better than the national average in terms of outage minutes.

FPL continues to invest in renewables and infrastructure within Florida, but it has done so profitably, with the regulatory capital employed growth continuing to grow strongly.

Lastly, the lower operational costs, continued investments in new low-cost technologies has led to 40% lower customer bills for its end users.

FPL operational metrics (NextEra Energy)

With a lower customer bill and higher reliability than the national average and other competitors in FPL, this brings a strong case for an increase in rates in the next rate case filing in 2025.

Election risk

There were multiple questions on political risk in the US given recent election headlines.

When asked about the US election landscape and risks to the IRA as well as the company’s renewable development plans, NextEra Energy gave investors’ confidence in this regard.

The company has been able to operate in both political spectrums in the last 22 years given its hundreds of billions in investment in energy infrastructure in the US in almost every state.

Management did state that the tax laws are very difficult to overturn, and that there has been a number of republican lawmakers that are embracing clean energy credits within the IRA as these benefits their own republican states.

Of course, NextEra Energy’s business not only creates jobs, brings taxes to the government, but also contributes to energy independence through renewable energy which is low cost.

Management reiterated that despite the fact that there will be heated rhetoric in the coming months, they feel good about where things currently stand.

NextEra Energy did mention that the election risk neither affect its ability to sign contracts nor is it keeping customers away from signing contacts in the future. Management does not see this risk as reducing demand, and in fact if customers saw this risk, the only change would be that there could be acceleration in demand.

While I do think that election news does provide some source of uncertainty, given that almost two-thirds of IRA funding flows to red states or districts does suggest to me that even if Trump becomes President that there will be congressional Republicans that would oppose a full repeal of the IRA.

Valuation

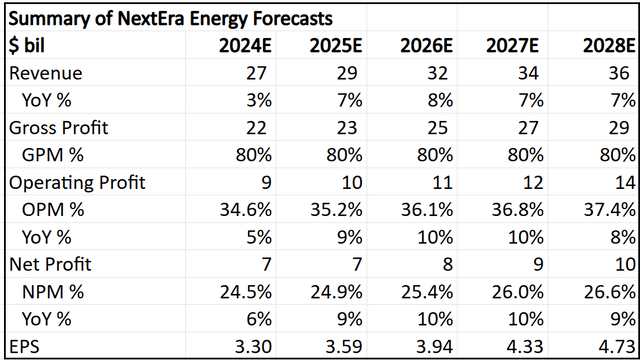

NextEra Energy is one of the financial model forecasts that I have done where I think there is a higher degree of confidence.

This comes from two things.

Firstly, the visibility we have into the NEER business through 2027 helps give us some assurance about where it is heading four to five years out.

Secondly, management has the most visibility into the business and they are all confident in their ability to meet their targets through 2027.

With that, my forecasts are all at the high end of their guidance range through 2027.

The revenue CAGR comes to about 6% in the next five-year period, while the EPS CAGR is about 9%.

Summary of 5-year financial forecasts for NextEra Energy (Author generated)

My intrinsic value for NextEra Energy is $91, which is based on the discounted cash flow model after I discount the terminal value and free cash flow to equity of NextEra Energy to the present value. I assumed 25x terminal multiple and 8.5% cost of equity.

The relatively low discount rate for NextEra Energy is due to its investment grade status and strong balance sheet, while the terminal multiple is justified because the company trades at 31x P/E on average in the 5-year period and 26x P/E on average in the longer 10-year period.

My 1-year and 3-year price target for NextEra Energy is $89 and $108 respectively.

My 1-year and 3-year price targets both imply 25x P/E.

Conclusion

I think NextEra Energy is a core holding because of its leadership in both FPL and NEER, both of which are great businesses.

Within FPL, there is no other utility that has better operational capabilities and demographical tailwinds with supportive regulations other than FPL. With the next rate case filing coming up in 2025, this will bring another upside to FPL which has been doing well for its customers in this past four-year period.

Within NEER, this business is seeing strong tailwinds from growing power demand as a result of technology and data center customers. The agreement with Google is one example, but this will be a long-term trend that takes time to play out given how long these cycles can be. The most important thing here is the backlog which gives visibility into 2027 and is very useful for investors to have confidence and assurance in the business model.

All in all, 2Q24 proved that NextEra Energy is seeing some upside in NEER as a result of growing power needs across the US and there is no other player better to meet that demand than NEER, while FPL continues to do well and have a nice set up going into 2025.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NEE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, the AI deep dive report, and access to The Barbell Portfolio.

The Barbell Portfolio outperformed the S&P 500 by 50% in the past year through owning high conviction growth and contrarian stocks.

Apart from providing bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join Outperforming the Market before the 20% price hike next month.