Summary:

- NextEra Energy investors are likely more concerned with a possible Trump return.

- NEE must navigate a potential partial repeal of the IRA, but a full repeal is not expected.

- NEE’s Investor Day assures investors about long-term growth prospects powered by several industry growth vectors.

- NextEra Energy is also a key player benefiting from the AI gold rush, lifting investor confidence.

- I argue why NEE investors should consider capitalizing on the recent pullback to buy more shares. Read on.

Anna Moneymaker/Getty Images News

NextEra Energy: Uncertainties Attributed To Trump

NextEra Energy (NYSE:NEE) investors are likely heading into NEE’s Q2 earnings release on July 24 with higher uncertainty. NEE topped out in late May 2024 under the $80 level as investors likely took profit. NEE fell quickly toward its mid-June lows, just under the $70 level, before dip-buyers returned to support the stock.

NEE has struggled to regain upward momentum as the market has likely started to price in the possible return of a second Trump administration. My last bullish NEE article underscores my belief that NEE is still early in its recovery process. Notwithstanding the recent volatility, NEE’s growth prospects have remained intact, suggesting a dip-buying opportunity could be apt.

New energy stocks have suffered a de-rating as investors reassessed the prospects of at least a “partial repeal” of the Inflation Reduction Act. However, a full repeal of the IRA is not anticipated. Accordingly, the credits allocated to “domestic manufacturing, nuclear power, and wind and solar tax credits are expected to enjoy bipartisan support.” As a result, meaningful and well-supported dips in clean energy leaders like NEE are expected to attract growth and income investors.

NEE: Investor Day Assures Long-Term Growth Prospects

The Florida-based NEE has also assured investors that the campaign finance issues that plagued its Florida Power & Light Company are likely over. FPL is “the largest electric utility,” underscoring its scale and criticality to NextEra Energy’s business model. In Q1, FPL accounted for over 50% of NextEra Energy’s GAAP net income, demonstrating its importance to NEE.

In NEE’s recent Investor Day in June, NextEra Energy indicated that it “plans to file a rate case in March” 2025, bolstering investor confidence in FPL’s earnings prospects. Consequently, I’ve assessed that NEE’s confidence in filing a rate case in the near term underscores a more favorable regulatory outlook for FPL. Therefore, it should mitigate the previous regulatory headwinds that buffeted NEE. A constructive regulatory outlook is pivotal in assuring investors that it can continue to earn above-average returns, as FPL is expected to invest “$34B to $37B” through 2027.

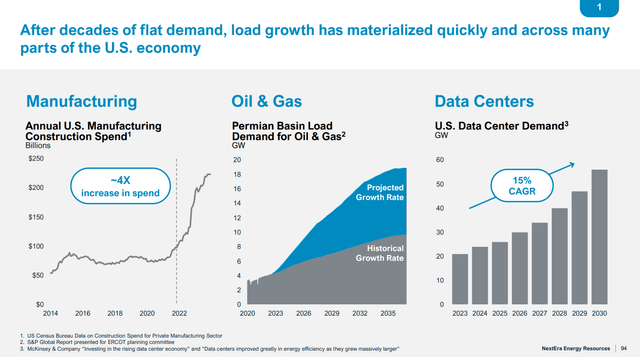

NextEra’s load growth projections (NextEra Energy filings)

NextEra Energy’s scale in expanding the scale of FPL is predicated on the secular growth vectors in load growth in the long term. The localization of US manufacturing attributed to increased reshoring initiatives has led to a surge in construction spending.

In addition, the ability to capitalize on the Permian Basin’s robust supply dynamics has also boosted the growth prospects of the US oil and gas industries. The AI gold rush is also expected to spur an incredible 15% CAGR in data center electricity demand. Consequently, NEE seems well-positioned to capitalize on these opportunities, allowing it to invest further and scale its new energy portfolio.

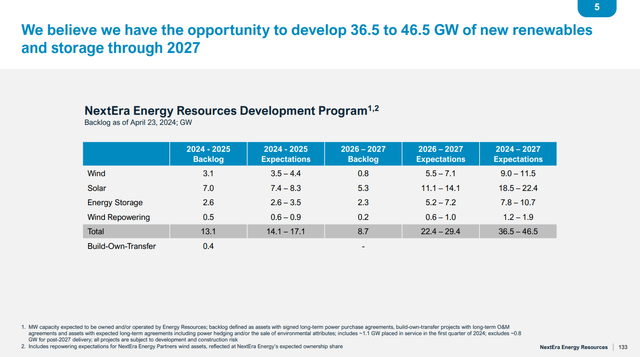

NEE Renewable energy portfolio outlook (NextEra Energy)

As seen above, NEE has raised its outlook for new renewables and storage projects to between 36.5 GW and 46.5 GW. I assess improved clarity provided by the earlier growth prospects, a discernible increase from its previous guidance of 32.7 GW to 41.8 GW. As a result, I have higher confidence that management is better positioned to meet its medium-term earnings outlook, supported by secular growth drivers across several industry verticals.

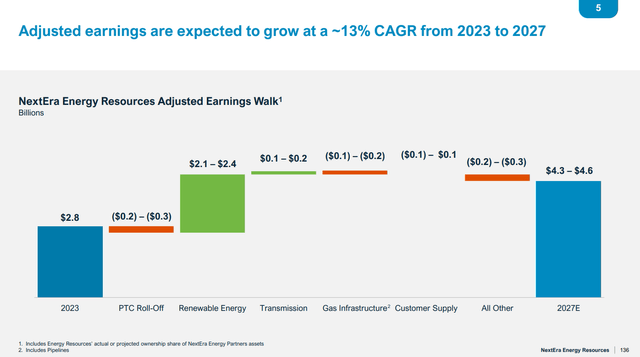

NEE adjusted EPS outlook (NextEra filings)

Management’s ability to deliver a multi-year adjusted earnings growth outlook through 2027 likely assures investors about NEE’s renewable energy growth prospects. As a result, I believe it provides a firm foundation for investors to assess NEE’s robust “A-” growth grade, underpinning NEE’s premium valuation.

Is NEE Stock A Buy, Sell, Or Hold?

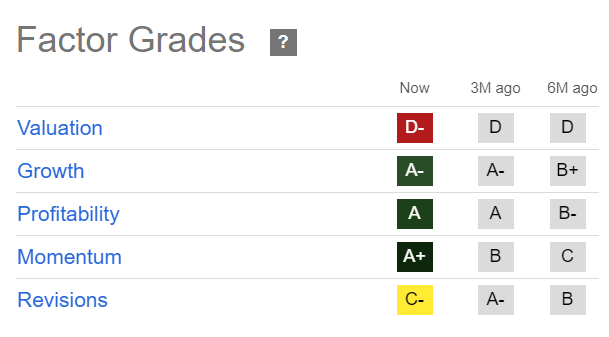

NEE Quant Grades (Seeking Alpha)

NEE isn’t assessed to be undervalued, although bullish investors might argue that its solid growth outlook justifies it. Furthermore, NEE’s adjusted EBITDA multiple of 12.6x is still below its 10Y average of 13.9x. Hence, it’s arguable that the market hasn’t fully revalued NEE’s secular growth opportunities, given the high interest rate environment and potential IRA partial repeal headwinds.

Despite that, NEE’s best-in-class “A+” momentum underpins my conviction in NEE’s buying thesis, bolstering confidence in its solidly profitable business model. In addition, income investors should turn more constructive as they potentially rotate out of cash into leaders like NEE. Therefore, NEE’s forward dividend yield of 2.7% should receive support from income investors reallocating their portfolios.

Investors considering an investment in NEE must be mindful about not chasing NEE in sharp upward spikes, as seen in May. Given the inherent volatility assessed in NEE, buying on well-supported pullbacks seems to be a wiser decision.

NEE holders must also consider the developments heading into the November presidential election. The market will likely attempt to price in the winner ahead of the results. Therefore, higher volatility must be anticipated if Trump’s probability of winning increases further.

In addition, I assess that the market has likely priced in a less hawkish Fed moving ahead. Given the high level of CapEx anticipated through 2027, unanticipated delays and reduced cadence in the Fed’s interest rate cuts might curtail investor confidence in NEE.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!